Bianco: Central Banks Are The Biggest Risk To The Economy In 2020

Authored by Jim Bianco, op-ed via Bloomberg.com,

The Fed’s reaction to the disruption in repo markets shows how hard it will be for policy makers to reverse their ‘money printing’…

The U.S. economic recovery that began in June 2009 is now in its 127th month, which is a record. Even more impressive is that for the first time since the signing of the Declaration of Independence in 1776, the U.S. just completed the first calendar decade without even one day of a recession. There are a few key reasons why this is happening, and one clear risk that could bring the expansion to an end.

The natural trend for an economy is to grow. A recession only occurs when something “breaks.” So, this record expansion is happening because nothing has broken. The primary reason is new technology that gives businesses more flexibility to adapt to changing conditions.

Technology is also preventing faster inflation in the developed world, a major cause of recessions in the past. Pricing has become hyper-competitive (think of the “Amazon effect”) and the internet allows for product substitution at lighting speed. Unhappy with a Chinese supplier? A quick Google search or a Skype call will quickly help you find a Vietnam substitute at virtually no cost.

Breaking things, in the literal sense, is also at an all-time low. Major powers have been at war with each almost continuously for over 500 years. But starting in 2000, they have stopped fighting in an unprecedented period of peace in human history.

Another leading cause for breaking an economy has been rapidly rising energy prices. Crude oil at $147 a barrel was concurrent with the Great Recession in 2008. But this is changing. Abundant energy supplies due to new fracking technologies are reducing the threat of a supply shock. Bloomberg News reported that November was the first month in 70 years that the U.S. was a net petroleum exporter.

And note the muted response in energy markets to the drone attack on Saudi oil facilities in Abqaiq in September. Forecasts that the attack would cause oil prices to spike to $100 were not entirely unfounded, as that would have happened in the past, when supplies were not nearly as flexible. Instead, Brent crude is holding below $70 a barrel.

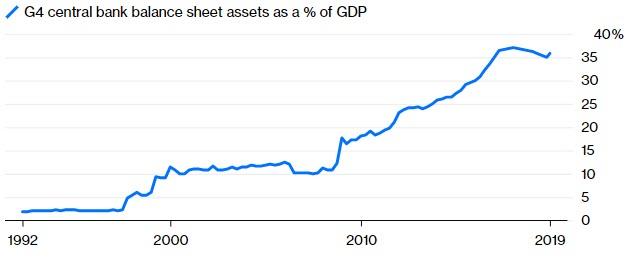

All of these are powerful, but standard, reasons for why the economy is stable. There is, however, an unconventional source of strength that emerged in the last decade that also doubles as its biggest risk: central banks. As of November, the collective balance-sheet assets of the Federal Reserve, European Central Bank, Bank of Japan and Bank of England stood at 35.9% of their countries’ total gross domestic product, up from about 10% in 2008, according to data compiled by Bloomberg.

Printing Press

The Fed, ECB, BOJ and BOE have pumped trillions of dollars into the global financial system in recent years

Source: Bloomberg

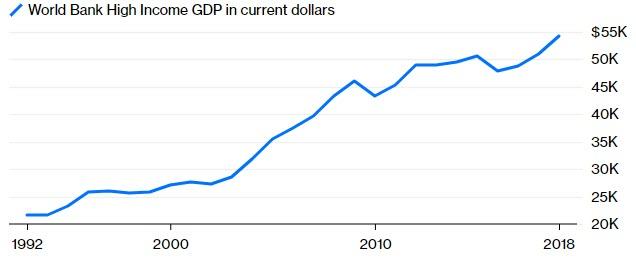

At the same time, the latest World Bank data show that developed country GDP expanded to $54.2 trillion at the end of 2018 from $46.1 trillion a decade earlier. Restated, central bank balance sheets grew at faster rate, by $9.9 trillion, than their underlying economies, which have expanded by $8.1 trillion, which is a big reversal from the 2001 to 2006 period.

Not Keeping Up

Major economies haven’t grown as fast as central bank balance sheets

Source: Bloomberg, World Bank (55K = $55 trillion)

It’s hard quantify just how much of this combined “money printing” by central banks contributed to GDP growth, but most would agree that it ranges anywhere from “some” to “much.”

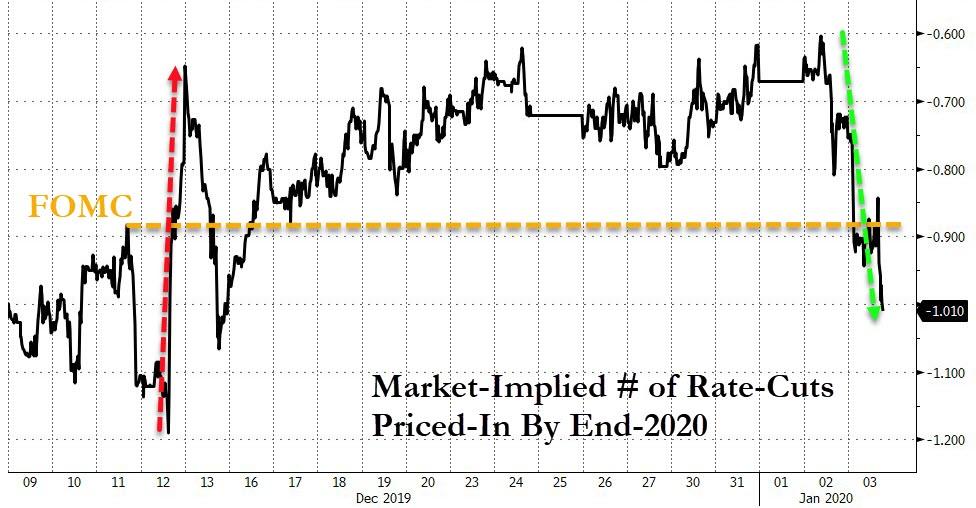

So, what happens when central banks pull back from this stimulus? When the Federal Reserve hinted in late 2018 that they were going to increase interest rates several more times in 2019, and the balance sheet reduction was on “automatic pilot,” the S&P 500 Index plunged almost 20% and recession fears became prevalent.

And when the Fed partly reversed its stance in early 2019, suggesting it wouldn’t increase rates, recession fears receded and stocks soared to post one of their best years ever in terms of returns.

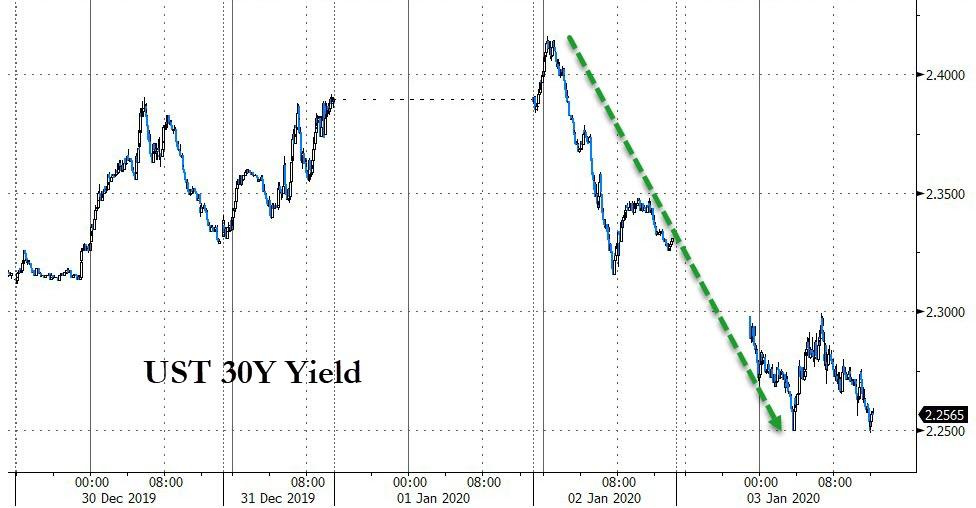

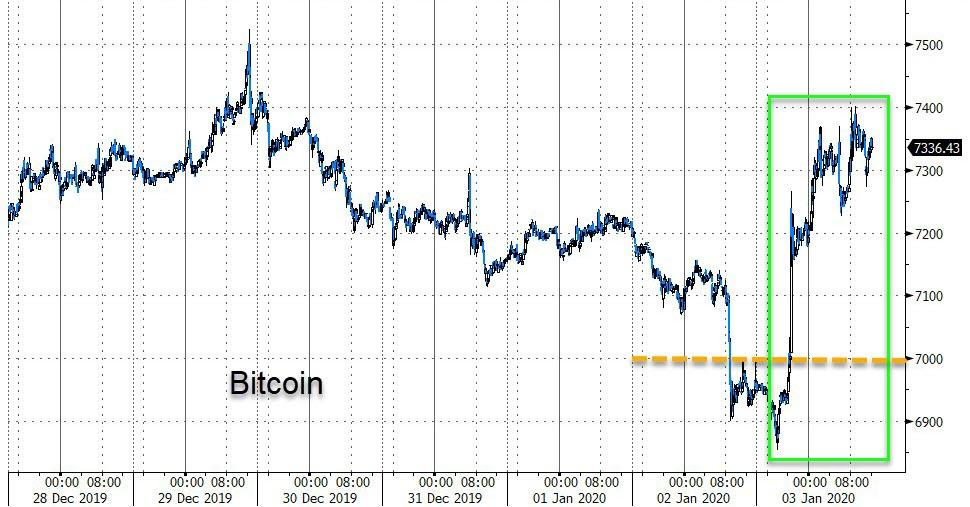

But the Fed kept shrinking its balance sheet, and by September the repo market ran into trouble. The central bank was forced to reverse here, too, and has boosted its assets by more than $400 billion, a move that coincided with the strong fourth-quarter rally in riskier assets such as equities. The takeaway here is that it will be extremely hard for central banks to reverse “money printing.”

With inflation doormat, though, there is no need for central banks to start tightening monetary policies anytime soon and “break” the economy. But should policy makers get their wish and some inflation returns, then it would be time to worry.

Central bankers try to operate under the Hippocratic Oath: “First, do no harm.” We will not know if they have caused any harm until they reverse their unprecedented balance sheet expansion without incident. The Fed’s recent experience is not encouraging.

Tyler Durden

Fri, 01/03/2020 – 16:25

via ZeroHedge News https://ift.tt/2MSFxMG Tyler Durden