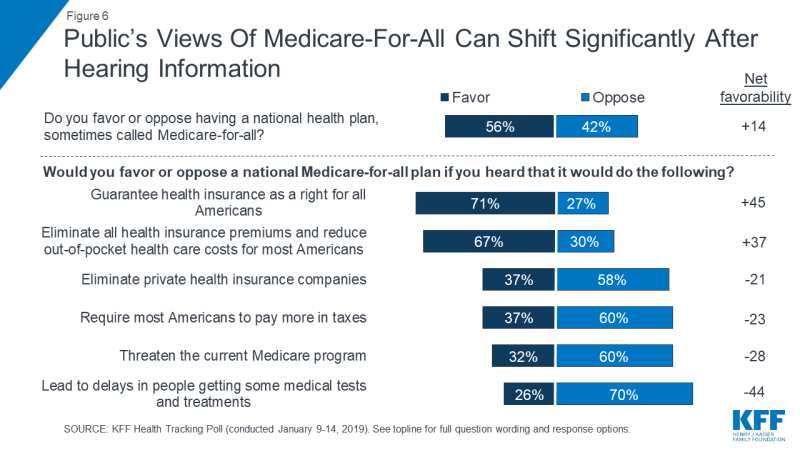

While “Medicare-for-all” is set to become a 2020 Democratic talking point, support for the universal healthcare scheme crumbles when people are asked if they’d be willing to pay higher taxes or put up with delays in treatment to get it, according to the Associated Press.

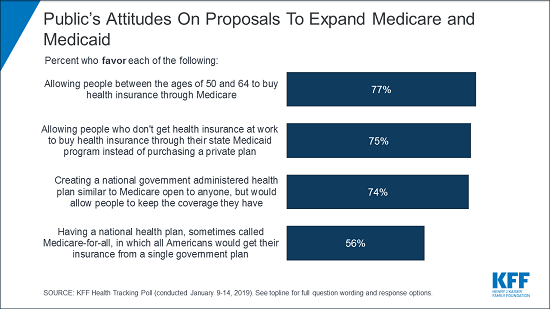

According to a survey released Wednesday by the nonpartisan Kaiser Family Foundation, initial support for the “Medicare-for-all” comes in at 56% – increasing to as much as 71% when people are told it would guarantee health insurance as a right, eliminate premiums and reduce out-of-pocket expenses.

When told that it would increase taxes or lead to delays in service, however, support for the program dropped to 37% and 26% respectively.

“The issue that will really be fundamental would be the tax issue,” says Harvard professor Robert Blendon of the T.H. Chan School of Public Health in response to the poll. Blendon noted that single-payer programs in Vermont and Colorado failed due to concerns over tax increases required to fund them.

There doesn’t seem to be much disagreement that a single-payer system would require tax increases, since the government would take over premiums now paid by employers and individuals as it replaces the private health insurance industry. The question is how much.

Several independent studies have estimated that government spending on health care would increase dramatically, in the range of about $25 trillion to $35 trillion or more over a 10-year period. But a recent estimate from the Political Economy Research Institute at the University of Massachusetts in Amherst suggests that it could be much lower. –Associated Press

In the first year of the program, the government would need to come up with around $1.1 trillion to fund the program, even with significant cost savings.

According to Mollyann Brodie who directed the Kaiser poll, the big swings in approval vs. disapproval suggest that the debate over “Medicare-for-all” will only heat up from here. “You immediately see that opinion is not set in stone on this issue,” she said.

“Any public debate about ‘Medicare-for-all’ will be a divisive issue for the country at large,” added Brodie.

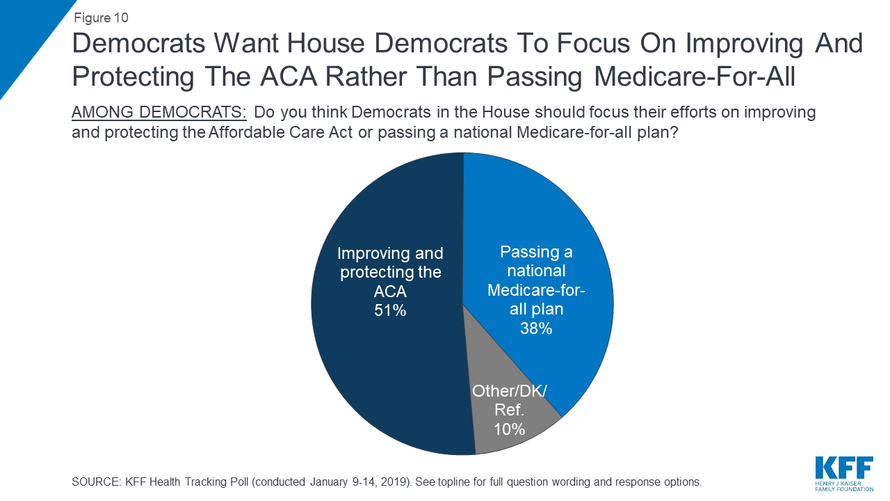

The poll also reveals that most Democrats want House Democrats to focus on improving the Affordable Care Act (ACA, a.k.a. Obamacare).

Two other Democratic healthcare alternatives received widespread support according to the poll.

Majorities across the political spectrum backed allowing people ages 50-64 to buy into Medicare, as well as allowing people who don’t have health insurance on the job to buy into their state’s Medicaid program.

Separately, another private survey out Wednesday finds the uninsured rate among US adults rose to 13.7% in the last three months of 2018. The Gallup National Health and Well-Being Index found an increase of 2.8 percentage points since 2016, the year Trump was elected promising to repeal “Obamacare.” That would translate to about 7 million more uninsured adults. –Associated Press

According to government surveys, the rate of uninsured has remained virtually unchanged under Trump.

via ZeroHedge News http://bit.ly/2FVk2YZ Tyler Durden

For families uninterested in whatever education public schools may provide, the most established alternatives continue to be independent schools run by private groups, religious organizations, and businesses. They recruit students by offering strong academics, religious and moral instruction, and different approaches ranging from firmer discipline to student-guided education.

For families uninterested in whatever education public schools may provide, the most established alternatives continue to be independent schools run by private groups, religious organizations, and businesses. They recruit students by offering strong academics, religious and moral instruction, and different approaches ranging from firmer discipline to student-guided education.

San Francisco politicians have a plan to attract tenants to the empty storefronts and apartments popping up around the city: tax the vacant units. On Tuesday, The San Francisco Chronicle

San Francisco politicians have a plan to attract tenants to the empty storefronts and apartments popping up around the city: tax the vacant units. On Tuesday, The San Francisco Chronicle