Authored by Jeffrey Snider via Alhambra Investment Partners,

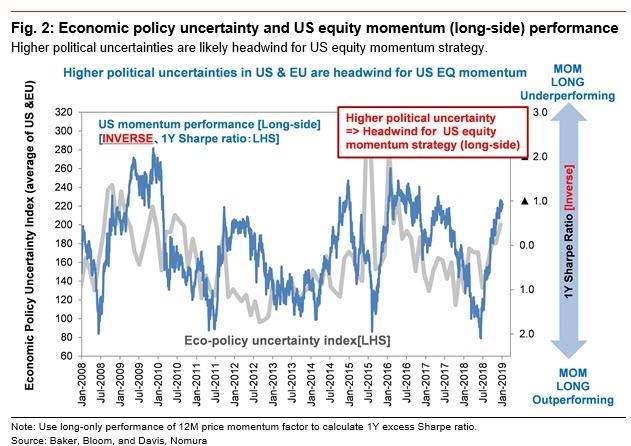

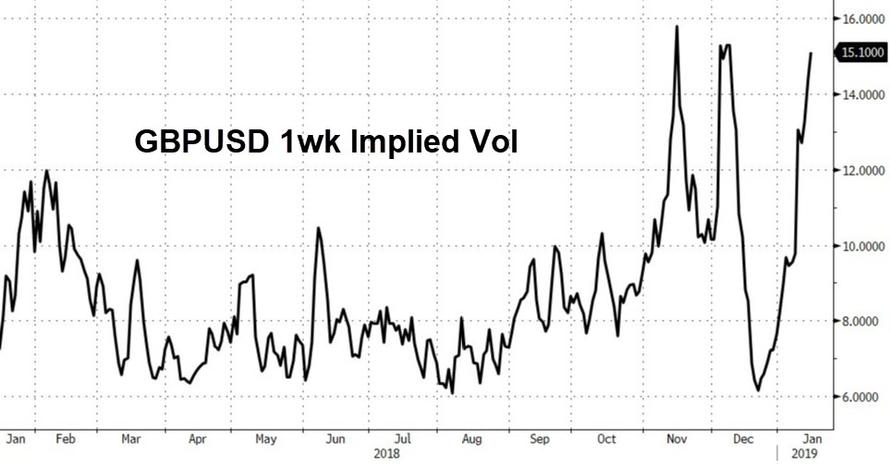

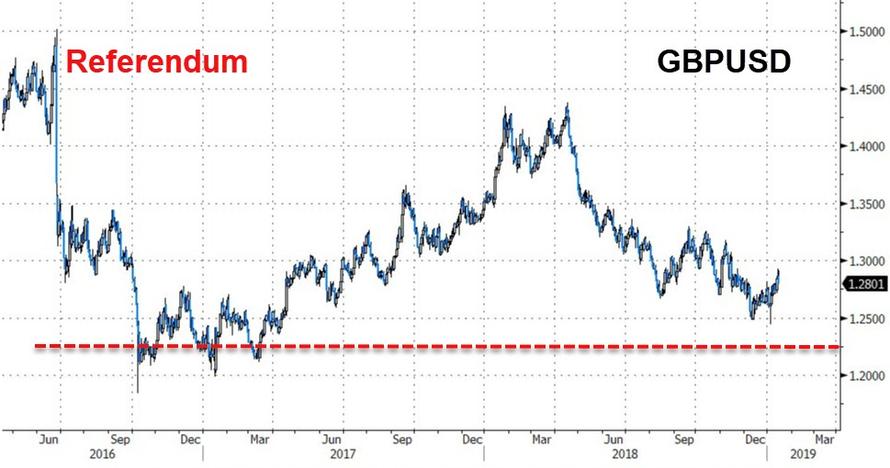

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve.

There are real economic processes underneath. The more fundamental the market, the closer it is actual economic transactions. These are influenced by the movement of real things, this real economy, not just the transposition of numbers on some detached Wall Street computer screens. Living in the financial services realm can make it seem like none of this is real.

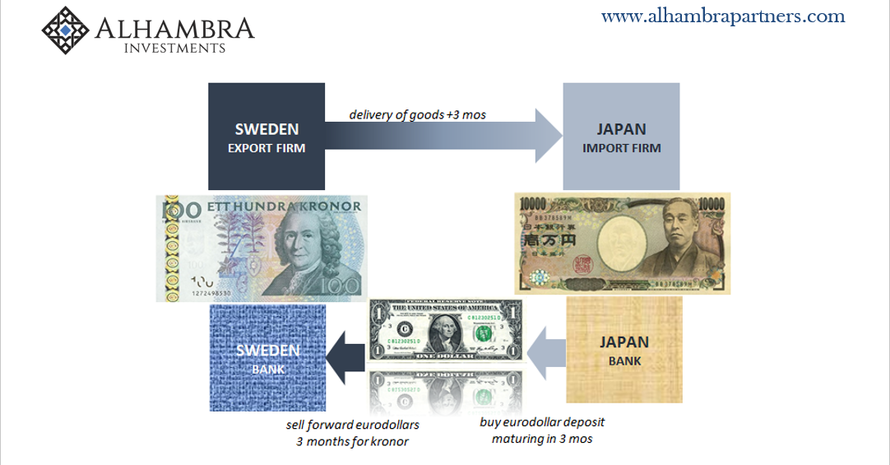

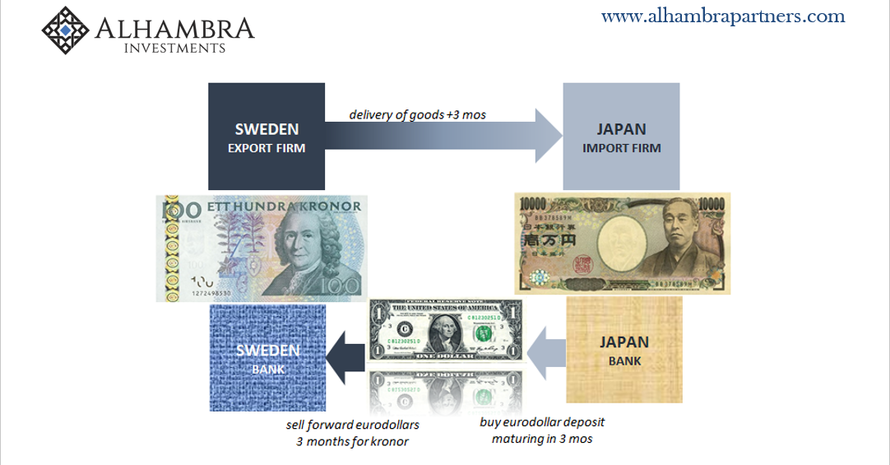

This is where the eurodollar attains its primacy. So many people talk about a reserve currency without ever once considering what it means to be one. It is the ultimate medium, standing in between others so as to facilitate real economy transactions from very far afield.

In the example I often use, a Swedish firm intends to export goods to a Japanese buyer. Trade is made efficient and flexible, therefore probable and manageable, by the eurodollar system in between; it mediates the different characteristics of each disparate system so as to standardize and harmonize the terms. The explosion of globalization and trade alongside the advent of the eurodollar system isn’t dumb luck.

This eurodollar requires banks to be in the middle offering them. But if those banks just happen to notice how Japanese firms suddenly aren’t much interested in Swedish goods, or any goods, that can be a problem for more than Sweden and Japan.

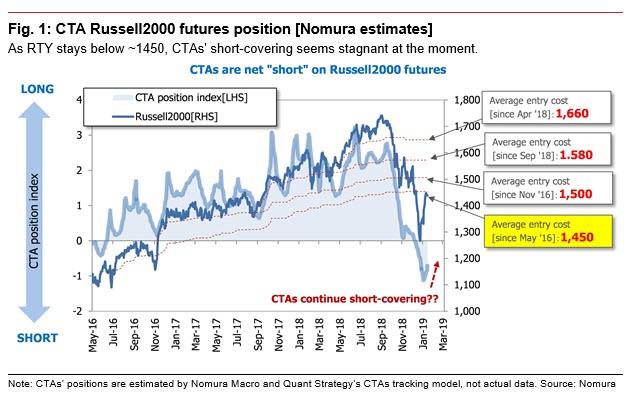

And if banks are already scaling back their eurodollar involvement to then find how it is having an effect on both Sweden and Japan, it isn’t surprising to learn they’d cut back on pretty much everything in between (and maybe do so at great speed, focusing squarely on the exits above all else). This would include purely financial transactions, so-called hot money, otherwise having less or little to do with the real economy transactions of trade.

That’s especially true if the one giving off weak signals for banks in the middle is China rather than just Sweden or Japan. If that one goes into reverse, the pullback from it can become much more generalized. Sweden goes sour, get out of Sweden; China goes sour, get out of everything.

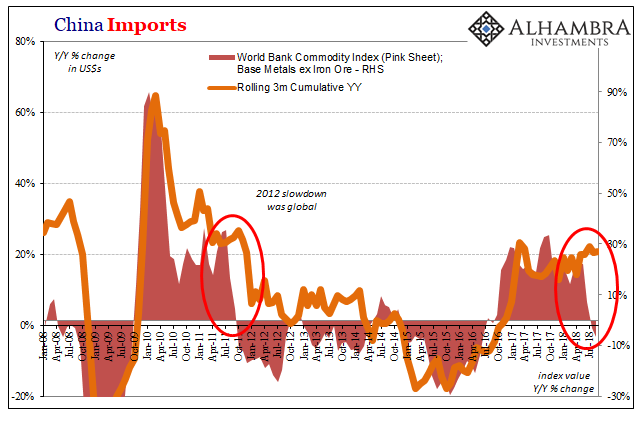

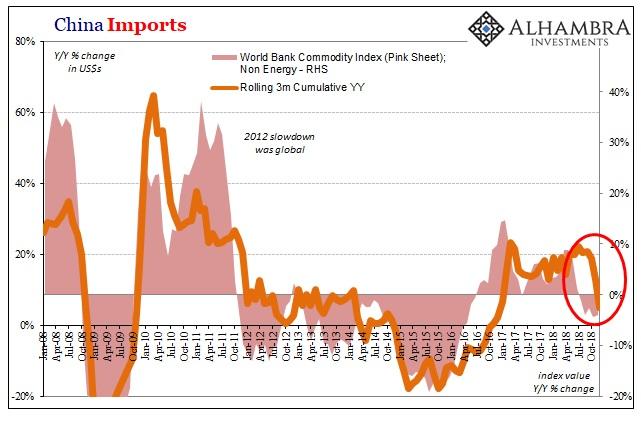

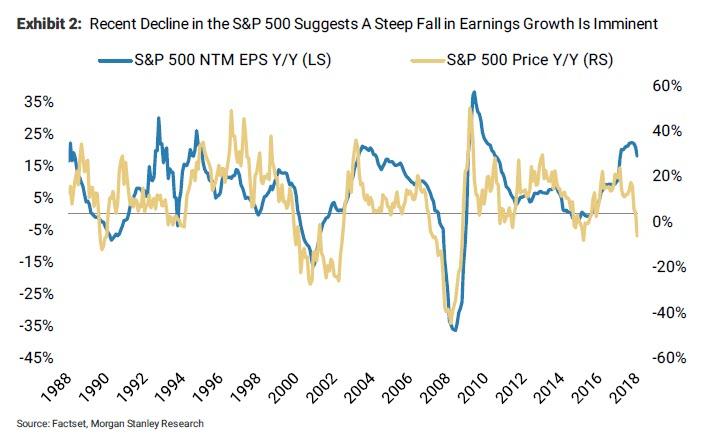

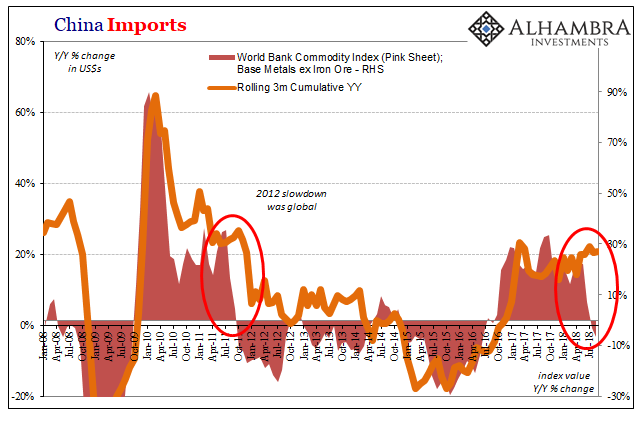

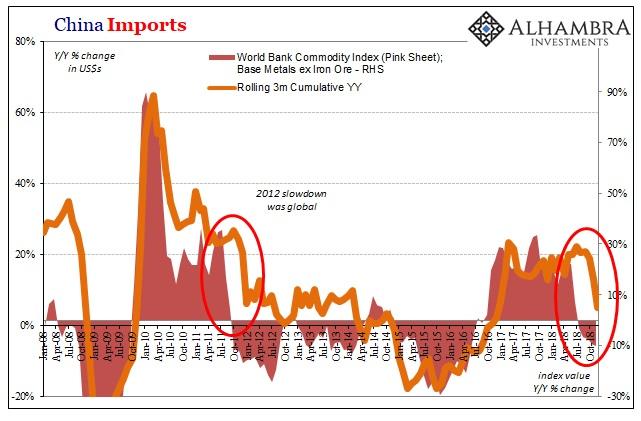

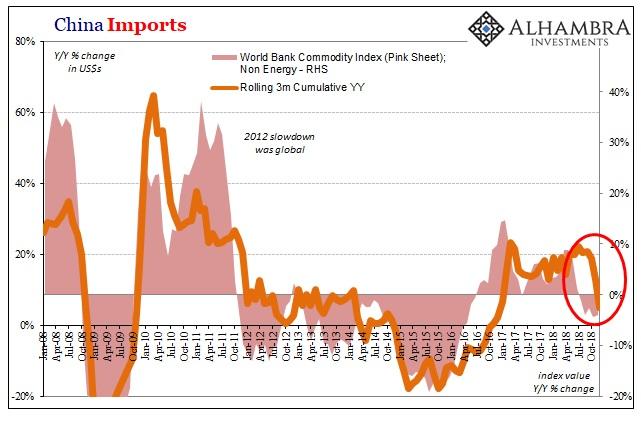

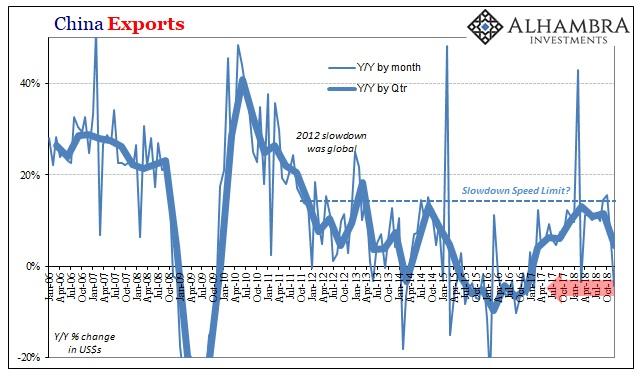

Chinese trade figures for December were bad. Again, this wasn’t unexpected since other markets had been signaling weakness ahead for months before; those obviously close to real fundamentals. Commodity prices had turned to minus signs indicating that market participants were reading real economy softness for some time. This is one chart I showed back in October:

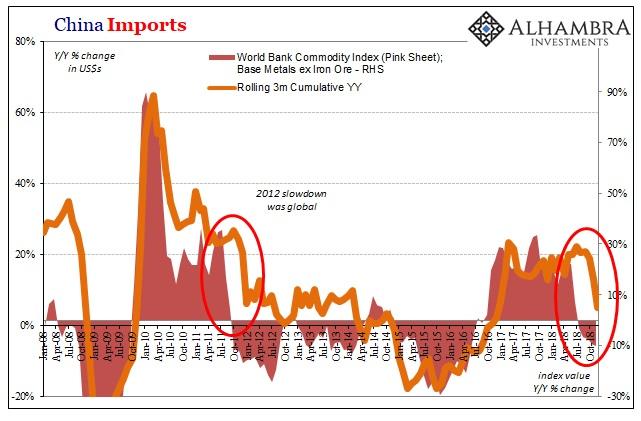

When commodity prices reverse, we should expect in this case real Chinese transactions (imports) to follow at some point in the near future. The near future was December, the chart below the updated version of the one above:

Imports into China, a primary measure of downstream economic strength in the world economy, fell by more than 7% year-over-year last month. This followed just 3% growth in November. It was the first contraction since October 2016. For Q4 as a whole, imports rose just 5% compared to Q4 2017, down sharply from a 20.7% gain in Q3.

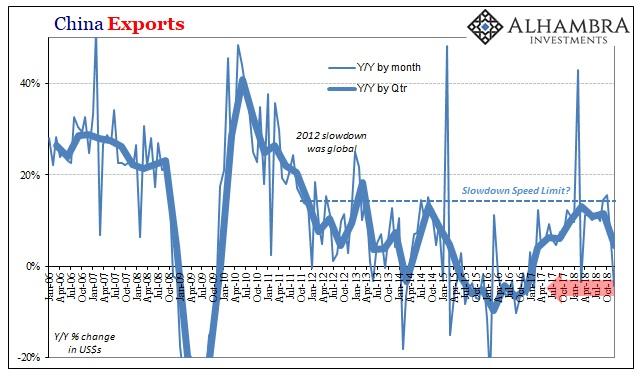

It was no better on the other side. China’s export growth turned negative, too. In December, total exports were down 4.4%, the worst month also since 2016. For the quarter, outbound trade was up just 4.5% compared to Q4 2017, the lowest quarterly gain by far since Q1 2017.

The direction of the global economy is pretty clear from these Chinese figures. As I wrote several times in 2014, Federal Reserve officials can keep on claiming the economy is strong but China once more begs to differ.

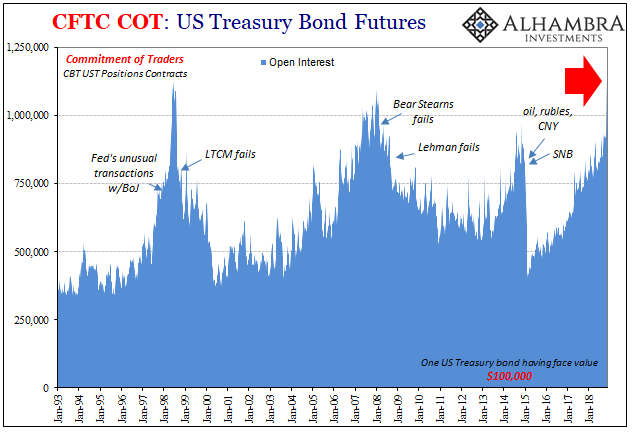

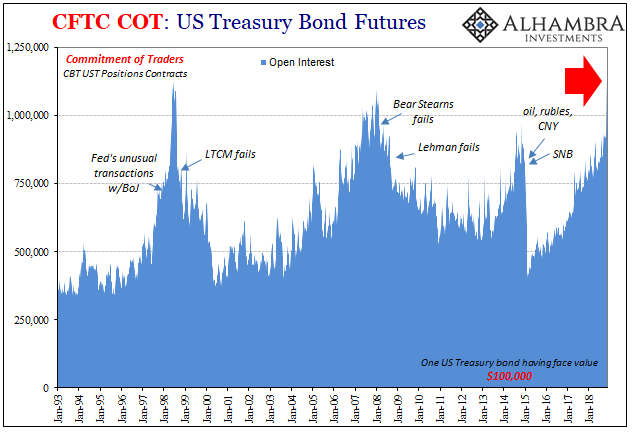

You better believe that as intermediary eurodollar banks were made privy to fewer goods being moved, and therefore financed, into and out of China they were adjusting themselves for the pretty clear consequences of what that would mean more broadly. There was very likely this fundamental emphasis for the purely financial warning of UST futures right at the end of November.

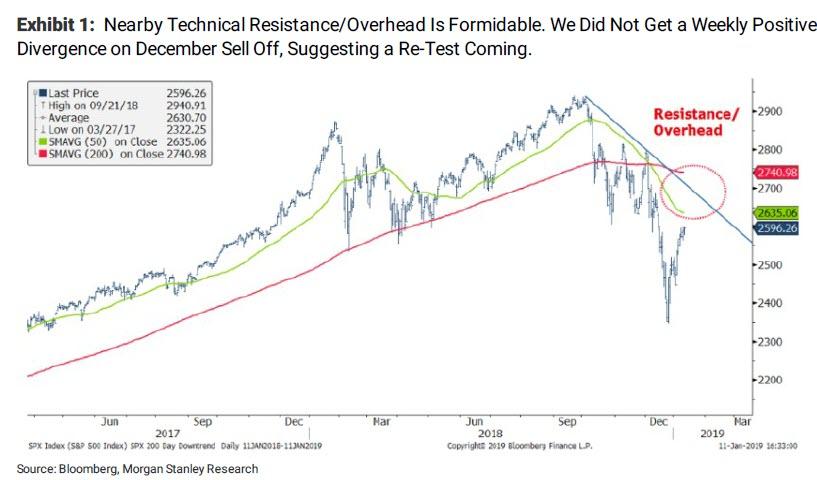

Markets were pulled lower not by emotion, not at first, fears over Jay Powell being too hawkish which might at some point in the future catch up with the real economy, they were dragged down starting in the real global economy where it was already taking place.

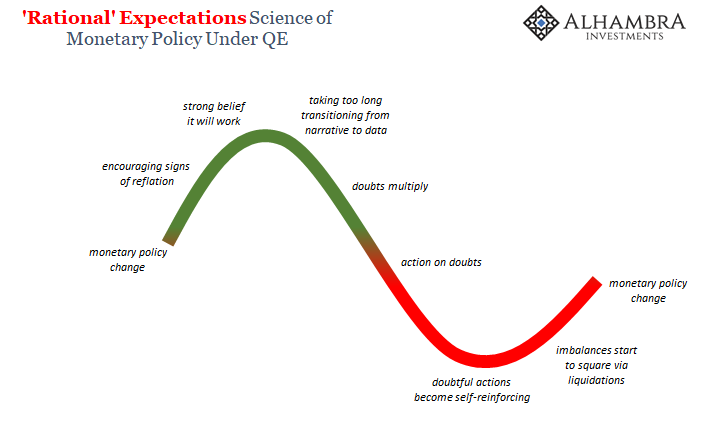

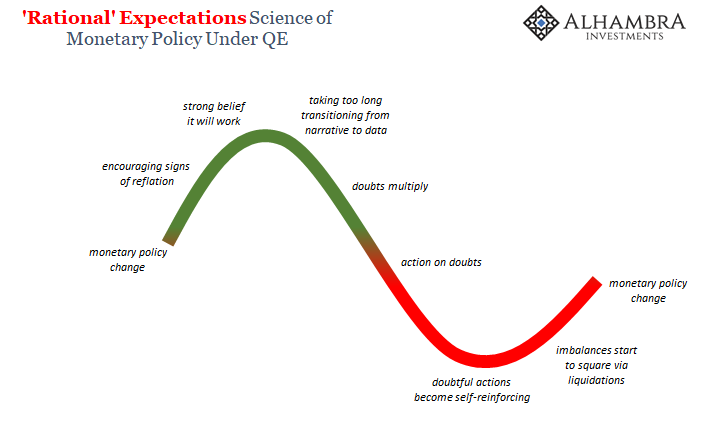

Since eurodollar banks don’t run matched books, no matter what the textbooks say, they act as contagion spreading first doubt then confirmed weakness into what becomes the self-reinforcing spiral: dealers grow wary, pull back monetary resources, then the real economy grows weak confirming to dealers the prudence of their caution. Round and round it goes.

What we don’t yet know is how many “cycles” may be completed in this game of downturn; just how much economic damage will be visited before something starts to go right again (enough liquidations to square positions, enough deflationary prices to spur new demand in real trade). The speed at which these negative, self-reinforcing processes developed in December does not suggest a very favorable probability spectrum going forward.

All this is the predictable outcome of the flat yield curve, especially around or now under 3% nominal. UST’s and eurodollar futures had been saying all along throughout the entire run of Reflation #3 that the chances the global economy was going to soar were nowhere near the chances it was going to sour. Curves are not just about inversion and recession; in fact, the curves are far more interesting outside of those contexts.

December was extraordinarily sour, with eurodollar banks getting to taste it first and spread it around.

via RSS http://bit.ly/2QPgQAa Tyler Durden

The Trump administration’s protectionist trade policies were supposed to reduce America’s trade deficit with China—or, at least, that’s what President Donald Trump has repeatedly claimed—but new data shows that the gap between how much America imports from China and how much it exports to China hit a new record high at the end of 2018.

The Trump administration’s protectionist trade policies were supposed to reduce America’s trade deficit with China—or, at least, that’s what President Donald Trump has repeatedly claimed—but new data shows that the gap between how much America imports from China and how much it exports to China hit a new record high at the end of 2018. Regardless of the final figures for 2018, it’s pretty clear that America’s trade deficit with China has jumped upwards in the two years since Trump has been president.

Regardless of the final figures for 2018, it’s pretty clear that America’s trade deficit with China has jumped upwards in the two years since Trump has been president.