Authored by Sven Henrich via NorthmanTrader.com,

It’s all in the open now. Front and center. The new global easing cycle has begun before the last one ended…

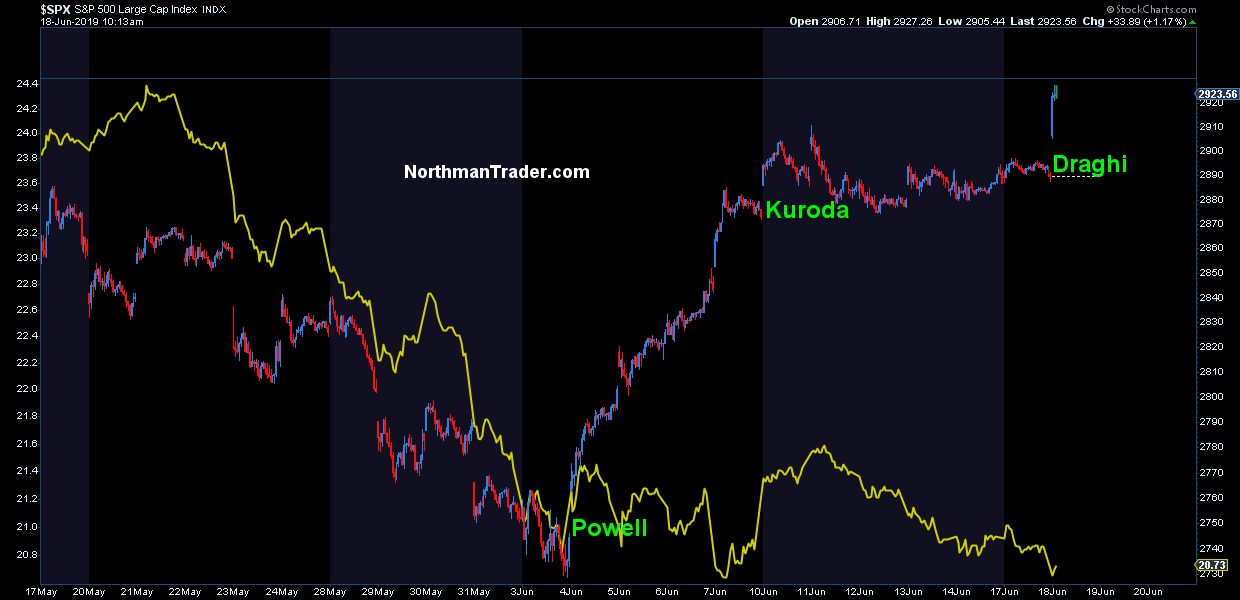

Jay Powell’s ready to act speech on June 4th. On June 10th the BOJ’s Kuroda indicated readiness to cut rates more and expand asset purchases and today June 18th Mario Draghi followed suit and has opened the door to more rate cuts (never having raised rates from negative once) and relaunching QE which was just ended 6 months ago.

Let’s call a spade a spade: Equity markets and capitalism are broken. Neither can function on any sort of growth trajectory without the helping hand of monetary stimulus. Global growth figures, expectations and projections are collapsing all around us and markets are held up with promises of more easy money, in fact are jumping from central bank speech to central bank speech while bond markets scream slowdown:

What is this all producing I ask?

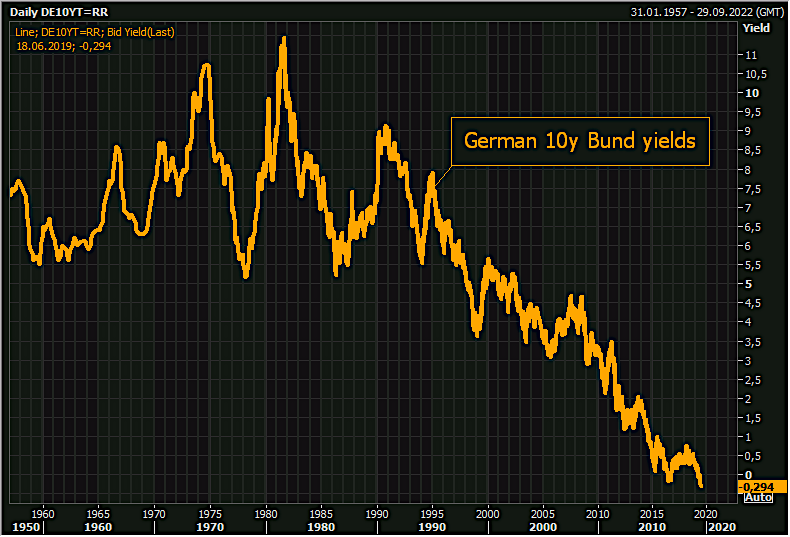

Well, Draghi managed to cause new all time lows on the German 10 year:

Cause nothing’s more confidence inspiring than collapsing yields.

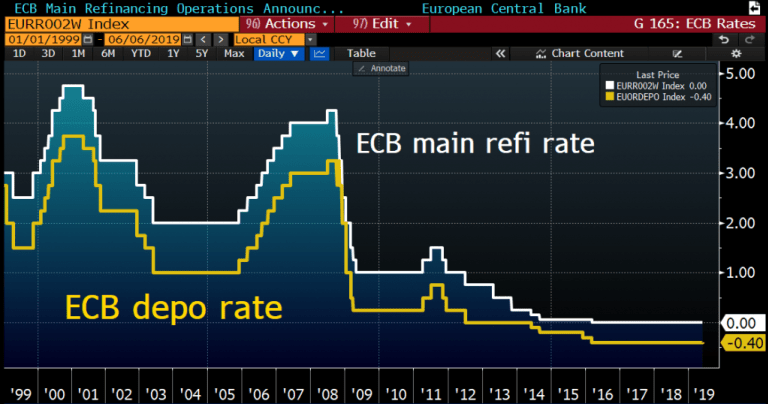

Yea by all means cut rates some more, it’s worked so well the last time:

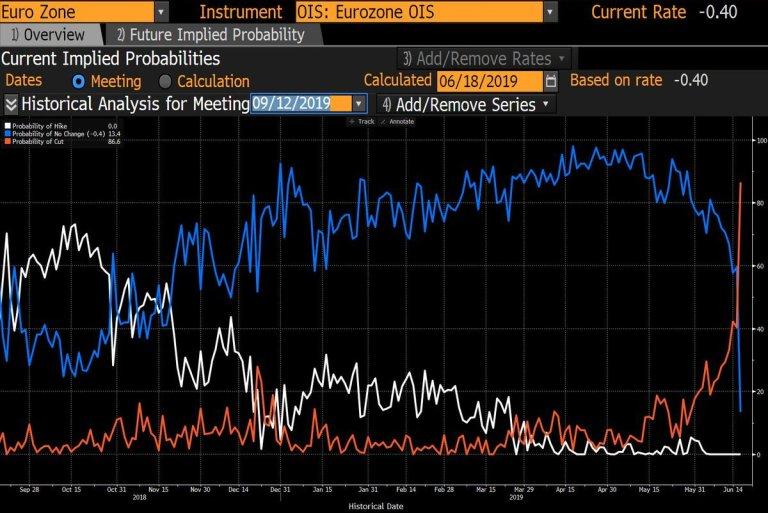

And of course Draghi produced a massive jump in rate cut expectations:

The art of the jawbone.

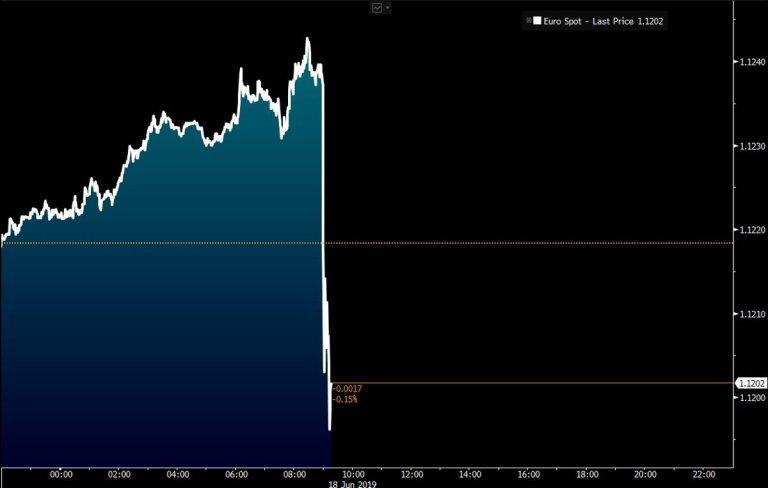

The other immediate feat of Draghi’s speech: A drop in the Euro:

Which prompted the ire of President Trump who already sees himself engaged in a battle with other global central banks, namely China, but apparently now also the ECB:

Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others.

— Donald J. Trump (@realDonaldTrump) June 18, 2019

European Markets rose on comments (unfair to U.S.) made today by Mario D!

— Donald J. Trump (@realDonaldTrump) June 18, 2019

Oh yea, this can’t miss. Welcome to the monetary wars, the ultimate race to the bottom which prompted me to ask:

Wouldn’t it be funny if Draghi, by promising more QE and rate cuts, inadvertently opened up a new trade war front by prompting Trump to issue tariffs on Europe in retaliation?

These are the times we live in after all.— Sven Henrich (@NorthmanTrader) June 18, 2019

Trump has long demanded that the US Fed cut rates by 100bp right here and now. Markets are now pricing in nearly 4 rate cuts within the next 12 months.

With the ECB and BOJ now firmly on the record of being ready to cut rates and engage in further asset purchases the Fed increasingly will look the odd man out. If they don’t give Trump and markets what they want there will be a hissy fit.

If they do indeed give in and cut rates, or signal rate cuts to come, they will have joined the global monetary war already declared.

For investors rejoicing the new found free money train heading their way keep in mind:

Central bankers acting like we’re in a global recession may just mean we are in a global recession.

— Sven Henrich (@NorthmanTrader) June 18, 2019

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2WSz6f7 Tyler Durden