After Steamrolling Clients, JPMorgan Says Buy Some More (But Admits S&P May Crater To 2,300)

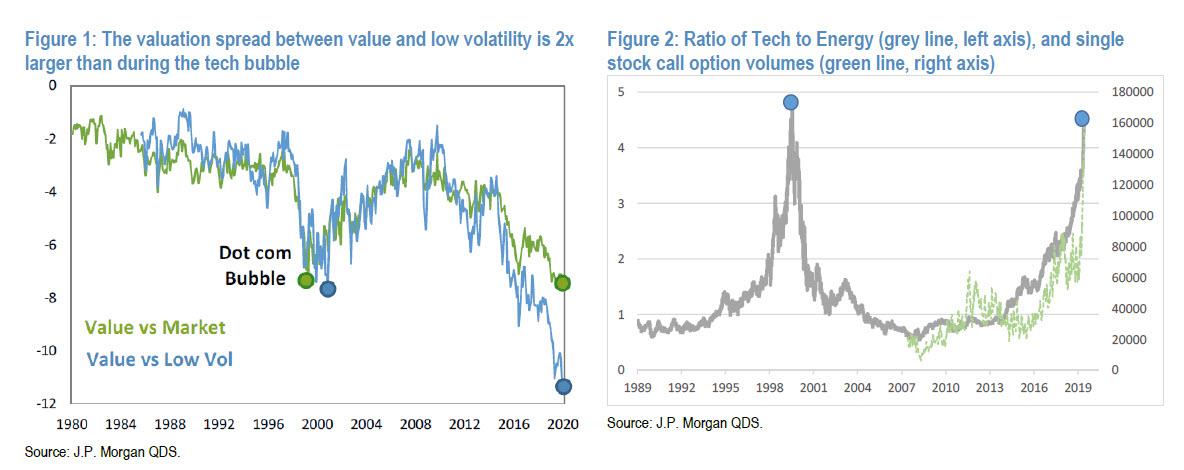

Exactly three weeks ago, we advised readers that JPM’s head quant, Marko Kolanovic had doubled down on his call to buy“once in a decade” cheap value stocks while shorting low-vol factor names. To justify his case, Kolanovic showed the following chart, which demonstrated just how overvalued the “low-vol bubble bubble” had become…

… with the embedded assumption that just because the spread was massive, it couldn’t get any bigger. And after all, after he first recommended rotating into low vol stocks and the trade imploded, odds were pretty good that he would get it right this time. Commenting on his recos, this is what we said: “so for all those who got crushed buying the “once in a decade” value-low vol convergence, Kolanovic has some words of encouragement: hang in there, cause he will eventually be right, even though as he himself admits, he has absolutely no better visibility into what is going on in China than anyone else, demonstrating just how great the dangers of getting wed to a given trade can be, especially when trading without a stop loss threshold:

We reiterate our call to sell out of defensive assets and rotate into cyclical assets such as value stocks, commodity stocks and EM. Risks to our base case include the potential for new epicenters of the disease and reacceleration of new cases. Most investors are not even trying to forecast various scenarios, but rather look to bond yields for an ‘all-clear’ signal for rotation and rerisking. In various discussions, clients indicated that 10Y bond yields reaching 1.75% would be a signal to sell momentum, sell tech (secular growth) and defensives, and rotate into cyclicals and value.

We concluded by saying that “we’ll check back in three weeks – when as JPM’s “base case” says predicts the Chinese chaos should be over – to see if maybe this time Kolanovic was finally correct.”

He was not.

Fast-forwarding to today, exactly three weeks later, we find that after this week’s crash in energy, i.e., deep value stocks, that anyone who was still long value got absolutely destroyed, while the ongoing surge in low vol stocks may have been the proverbial straw that broke the bagholder’s back.

Meanwhile value stocks (which these days are mostly banks, insurance companies and oil names) have continued to be an unmitigated disaster, and as Bloomberg’s Ye Xie writes, even as the S&P hurtles to a bear market, they continue to “underperform growth companies and there’s no end in sight. The ratio between S&P 500 Value Total Return Index and its growth counterpart tumbled to the lowest since the turn of the century. “

In other words, anyone who took advantage of the “once in a decade” decoupling between energy and value stocks last July, when Kolanovic first recommended it, was likely carted out this week.

It wasn’t just value stocks that Kolanovic was pitching: he was also once again bullish on the market, due to a rather bizarre assumption: that the economy would start improving despite the coronavirus pandemic, to wit:

Given the severity of the outbreak, the market may wait to see not just a decline in the absolute number of cases, but a significant pick up in datasets capturing real-time economic activity. Our base case is that this would happen within 1-2 weeks.

Not only has the coronavirus pandemic not improved with clusters now across Europe and various US states, but adding fuel to the flames was the plunge in oil, which crushed energy (i.e., value stocks) to a level not seen in decades. And while there is no way Kolanovic could have foreseen the breakdown in OPEC, as his clients’ risk manager he should have considered the risk of pushing everyone into value stocks which have now caused irreparable harm.

So where does this leave Marko and his merry JPMorgan men? Why tripling down, because after he was wrong once, and dead wrong the second time, today the JPM quant team led by Kolanovic and Lakos-Bujas is out with a paper addressing what little is left of JPM’s clients, and advising them that the “risk/reward is improving”… which is of course true after the biggest market crash since the financial crisis, a crash which none of JPM’s quants called correctly (or incorrectly) in advance.

Here’s how the JPM quants lay out the events of the past week:

The equity market has been coping with the COVID-19 outbreak across developed markets for the last two weeks, forcing investors to guesstimate the impact to demand, supply chain disruptions and credit. The Saudi/Russia oil price war that broke out over this weekend (oil collapsed by 25%, largest decline since ’91) turned an already fragile backdrop into a perfect storm for risky assets on Monday, March 9th—essentially a black swan event. S&P500 experienced an outright crash. The 8% one-day decline turned out to be the worst day for S&P500 since 2008 (19th worst day since 1928). While this sell-off has wiped out 2-years’ worth of gains for S&P500, history suggests that equal or worse single-day sell-offs were followed by median forward returns of +4% and +17% over the subsequent 1-week and 12-month periods, respectively.

What JPM fails to mention is that if indeed this is the start of a recession, the market is usually far lower over a 12-month period. But it’s not like the bank has biased, bullish agenda. Anyway, back to the shocked take by JPM which could not possibly have predicted anything that has happened in the past few days:

The speed and intensity of the sell-off has shaken investor confidence with many now modeling recession scenarios even though there is still significant lack of clarity on the actual fundamental impact. It is important to keep in mind that the sharp sell-off is also symptomatic of a fragile market structure that can amplify price both downside and upside—a volatility shock coinciding with a collapse in liquidity and significant forced selling by systematic portfolios (i.e. similar to Dec ’18 market crash).

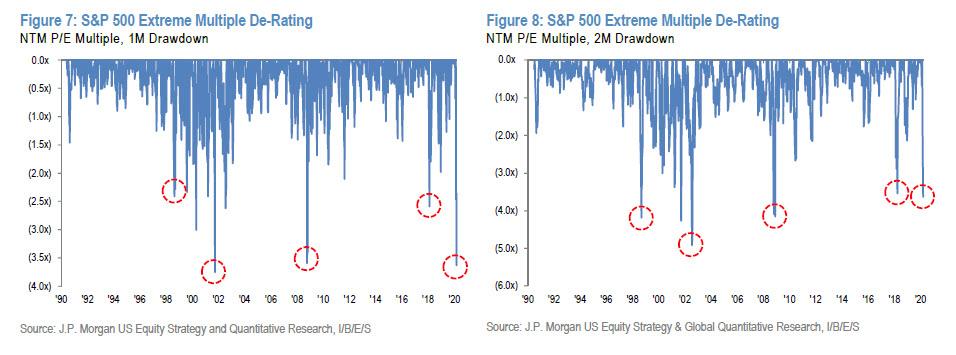

JPM next goes on to show just how unprecedented the market’s move has been in a historical context, perhaps because this will somehow absolve the bank of failing to prevent its clients getting slaughtered in value stocks:

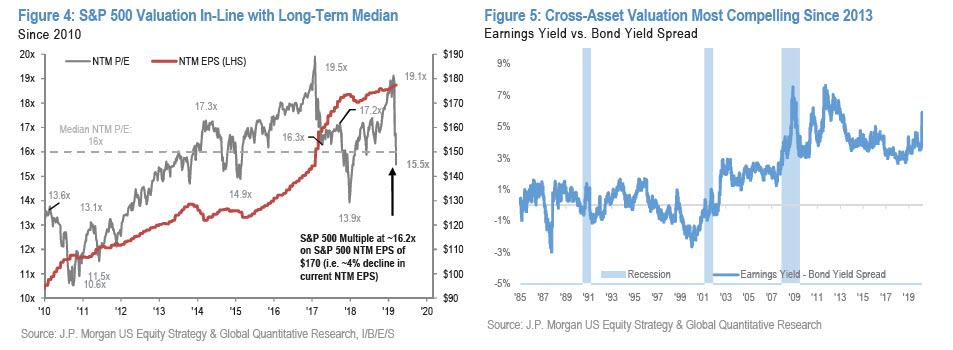

The S&P500 multiple just experienced one of the largest multiple de-ratings in the last 30-years. Over the last 1-month its multiple de-rated by ~3.5 turns, which is comparable to the TMT recession and the GFC. The index multiple is currently at 16x (assuming a conservative earnings growth of 3-4% in 2020)…

We interject briefly here to ask why on earth would anyone think that in a year in which China’s economy is now contracting any will take months if not quarters to get back to normal, will earnings groth be 3-4% with supply chains in tatters and company after company pulling guidance. But then we remember it’s JPMorgan and suddenly everything makes sense again. Anyway, continuing:

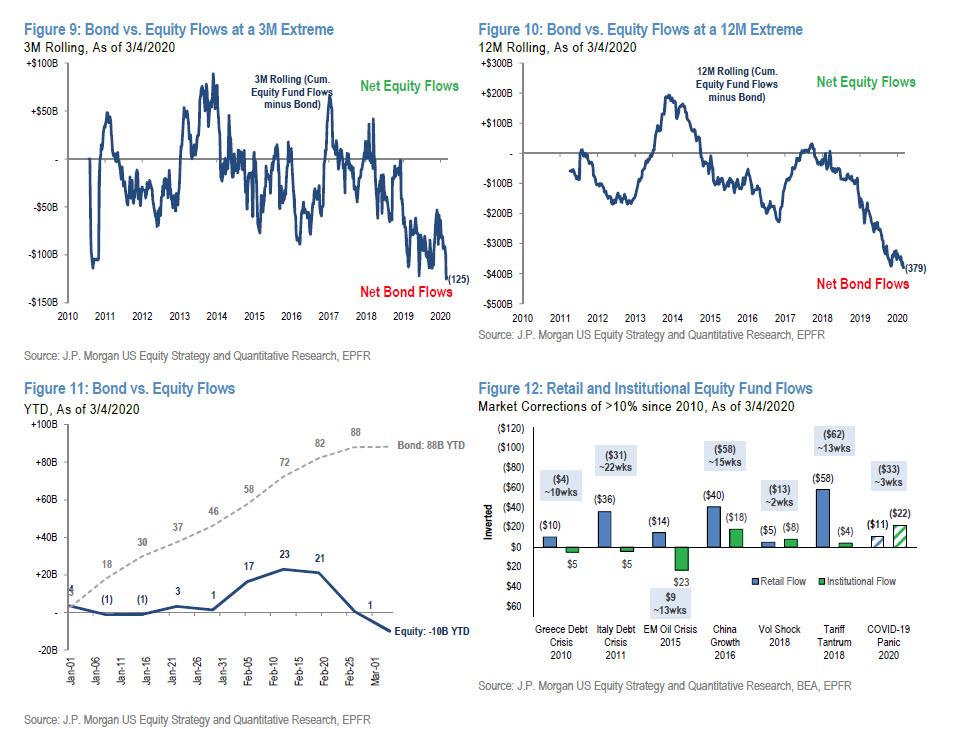

… putting it in-line with its long-term median. Additionally, in a world of near-zero rates and low nominal growth, US equities are one of the few remaining higher quality yielding assets, with a dividend income of ~2.3% and 4-6% long-term EPS growth. Currently, a record ~85% of S&P500 stocks have higher dividend and shareholder yields than US 10yr bond yield (see Figure 6). More so, equity positioning has significantly reduced. Fund flows from equities-to-bonds have reached extreme levels on a 3, 6, and 12-month rolling basis measured since the beginning of this cycle. Since the start of this sell-off, we estimate that retail and institutional equity fund flows have seen ~$40B in outflows (compared to ~$60B during the 4Q18 sell-off). Systematic strategies have sold ~$400B in equities and broadly their equity positioning currently sits at very low levels. All the key momentum signals have turned negative (e.g. including 12m) and 1-2 month realized volatility measures are at cycle highs. While buyback activity was slow at the start of the year with market reaching new highs, both discretionary and program-based buyback executions significantly picked up during the current market sell-off, recently running at ~$6-8B per day.

JPM’s next argument: the market is massively oversold so it can’t be any more oversold. Which is great in theory, just don’t show them the chart above of what happens when this is dear wrong:

The current equity sell-off reached bear market territory (~ -20% from peak) and is now almost in-line with the median market-sell off since 1928 that preceded an upcoming recession. Based on history, a market sell-off of this magnitude implies a 65-75% chance of a recession in the next 12 months…

So surely JPM will admit that, since the market is always right, a recession is imminent and clients should get out of stocks. Only… that’s not the case, and instead JPM thinks “the market has gone ahead and priced in too severe of an adverse scenario, assuming we get timely and strong counter-policy response and a COVID-19 outbreak that peaks in the coming weeks.” Amusingly, this is precisely what was behind JPM’s positive case just three weeks ago, and we all know what happened there. Luckily, there is always the Fed and US government to bailout any wrongrecommendation:

JPM Economics is now expecting the Fed to cut rates to 0% at the upcoming FOMC meeting or sooner, with the potential of providing dovish guidance and considering additional policy tools (i.e. asset purchases). The US administration is working on a potentially large stimulus plan targeting both individuals and businesses most impacted by COVID-19. For instance, we estimate that a combination of payroll tax reduction, refinancing of in-the-money residential mortgages and lower gasoline prices could cushion the average US household by providing ~$1,000 saving in the next twelve months. Most importantly, the spread of COVID-19 in Europe and in the US remains highly uncertain, however JPM research (see Report) is modeling cases to peak end of this month / beginning of next. In Asia, 3 of the largest markets are seeing relative improvement. New cases in South Korea appear to be peaking, China continues to deliver on a gradual normalization with limited new cases (factory capacity up to 90% for mid-large enterprises), and Taiwan has sidestepped the outbreak (see Report). Also, on the commodity front, the period of depressed oil prices could be short-lived as Saudi/Russia pain thresholds are surpassed.

So if anyone though that after all that, JPM would finally call time on its bizarre, pathological insistence that the bull market will continue (with 3-4% EPS growth no less) despite an ongoing viral pandemic which just shut down Italy and has crippled China’s economy indefinitely, coupled with an all out price war which was destroyed the energy sector, one would be wrong, to wit: “Given the above base case, we view the current level of S&P500 offering an attractive risk-reward, and maintain our 2020 S&P500 price target of 3,400.“

At least this time JPM’s quants have the decency to admit that their call is nothing more than a coin toss: “We do acknowledge the potentially extreme binary outcome as we work through the impact of COVID-19, but still hold the view that policy supports should ultimately outlast the outbreak.”

Oh, because printing money or offering tax breaks somehow cures viruses? Well that’s news to us. But what happens if that’s, gulp, not the case and the coin lands tails and JPM is wrong once again?

If COVID-19 intensifies and proliferates well beyond JPM base case scenario and the anticipated counter-policy responses turn out to be underwhelming, the S&P500 will most likely face further downside. Under this pessimistic scenario, the equity multiple may not find a bottom until it hits 14-15x and EPS growth turns negative—implying a recession case of ~2,300 level for S&P500.

To summarize: JPM thinks the S&P will hit 3,400 in a “binary” outcome where everything happens as priced to perection, but admits that in case it is wrong again, the downside case is a crippling bear market that sends the S&P down another 400 points to 2,300. We don’t know about JPM’s remaining clients, but we will take the latter.

Tyler Durden

Tue, 03/10/2020 – 13:30

via ZeroHedge News https://ift.tt/2wICLoc Tyler Durden