Airpods Maker Races To Divest From China As Clients Push For India Expansion

Rising geopolitical tensions and Covid uncertainty has forced Apple to reevaluate its manufacturing supply chain of iPhones, AirPods, HomePods, and MacBooks in China. Momentum has been building behind the scenes as Apple suppliers shift production capacity out of the country to friendlier shores in Southeast Asia.

Apple suppliers rarely comment on supply chain shifts due to secrecy, but a new report via Bloomberg reveals AirPods maker GoerTek Inc.’s view of the shifting world and how it plans to diversify out of China.

GoerTek is one of Apple’s many suppliers and is exploring new production facilities outside China. The company assembles AirPods and other consumer electronic products, such as drones, speakers, Bluetooth products, 3D electronic glasses, and LED series products.

GoerTek Deputy Chairman Kazuyoshi Yoshinaga told Bloomberg the company is investing $280 million in a new production facility in Vietnam and considering an India expansion.

“Starting from last month, so many people from the client side are visiting us almost every day,” Yoshinaga said from his offices in Hanoi, Vietnam. He said the topic that dominates client discussions is “When can you move out” of China?

The uncertainty around China started around 2018 after President Trump launched a trade war. Then supply chain snarls at manufacturing facilities during Covid spooked many multinationals that had high exposure to the second largest economy in the world. And now, rising Sino-US tensions have fueled the fire to push companies to diversify out of China.

Readers have been well aware of this trend over the last year:

- “Friendshoring” Trend Sees Companies Moving Ops To Dodge Tensions And Trade Wars

- “Confidence Shaken:” US Firms In China Look Elsewhere As ‘Friendshoring’ Gathers Steam

From The Wall Street Journal to Bloomberg to other Western financial outlets, there have been countless stories about Apple exploring ways to shift production outside of China but never came from the company, instead from “sources” with direct knowledge. Chief Executive Officer Tim Cook has been very careful not to upset Beijing by announcing plans to divest from China because that could impact the company’s entire ecosystem centered in China, which employs millions.

Bloomberg Intelligence estimated it would take Apple nearly a decade to shift 10% of its manufacturing capacity out of China. However, the GoerTek executive said it would happen much quicker.

Yoshinaga said many Chinese tech manufacturers are experiencing the same discussions with clients as the need to divest from China.

“I would say currently 90% of them, they’re looking at that,” he added. “It’s the brand companies’ decisions.”

Yoshinaga said many clients had asked him to shift production to India:

“We get requests from our clients almost every month. ‘Do you have any plans to expand to India?'” he said. “If they decide to build up the production lines in India, we may have to think about it seriously. Currently we are focusing on developing our Vietnam production facilities.”

This interview is one of the first shared with the public that offers an insider point of view of the global economy fracturing and supply chains needing to be rejiggered.

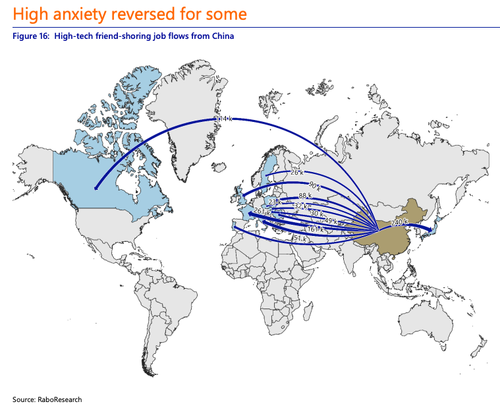

Michael Every, the global strategist at Rabobank, recently outlined in a note to clients which countries will benefit from friend-shoring…

Every expects a lot of low-tech manufacturing jobs will go to India.

France, Japan, Italy, and Canada could be the top beneficiaries of high-tech jobs.

This decade could be one of the greatest global supply chain resets ever.

Tyler Durden

Tue, 02/28/2023 – 15:10

via ZeroHedge News https://ift.tt/Z2xkDHK Tyler Durden