5x Leverage Is Too Much Says The SEC

Wall Street’s financial engineers thought they had found yet another way to turn financial markets into casinos.

The gimmick this time is with 3x, 4x, and even 5x leveraged ETFs tied to individual stocks and cryptocurrencies.

But, as RealInvestmentAdvice.com reports, the SEC just ruled against these new proposals, apparently drawing the line at 2x leverage as the rules state.

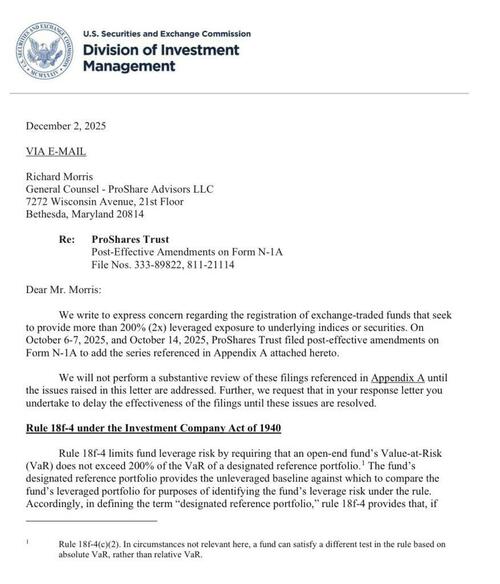

“We write to express concern regarding the registration of ETFs that seek to provide more than 200% (2x) leveraged exposure to underlying indices or securities”

Nine issuers filed with the SEC for 3x, 4x, and 5x ETFs, betting that the new leadership at the SEC would be more open to speculation and be willing to ignore the significant risk entailed in these securities.

Their strategy hinged on gaming the SEC’s derivatives rule – Rule 18f-4 – by changing how “risk” is measured.

Under Rule 18f-4, a leveraged or inverse ETF must run a Value-at-Risk test using the actual asset it tracks as its benchmark.

For example, if your proposed 5x ETF is based on Apple’s stock price, the risk test is anchored to Apple’s stock price.

Once you apply an apples-to-apples, no pun intended, analysis, 5x and other ETFs levered more than 2x fail the SEC test.

The issuers tried to redefine the “designated reference portfolio” (benchmark) to an asset that is less risky than the actual underlying asset.

Doing so effectively lowers the apparent risk, thus, using their logic, allowing 3x, 4x, and even 5x leverage.

The SEC’s latest comment letter shut that door. They didn’t mince words in their ruling:

Did we just reach ‘peak speculation’?

Tyler Durden

Fri, 12/05/2025 – 09:05

via ZeroHedge News https://ift.tt/j0vROU8 Tyler Durden