China Rocked By “Unprecedented” Surge In Bank Runs

Tyler Durden

Wed, 07/15/2020 – 19:30

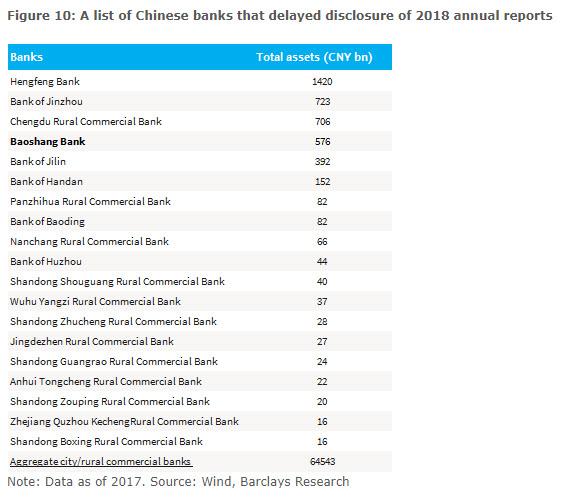

At first, it was an unthinkable taboo – after all with a banking system that’s twice as large as that of the US, the last thing Beijing wanted (or could afford) was doubts that the people’s trillions in savings were safe as the alternative was not just a collapse of the financial sector but a breach of China’s capital controls firewall as tens of millions of citizens scrambled to shift their savings abroad, in the process obliterating the yuan. Then, starting in early 2019 after several banks which previously refused to published 2018 annual reports either quietly failed or were not so quietly nationalized…

… most notably the inner-Mongolia-based Baoshang Bank which was seized in the first state takeover since 1998, domestic confidence in China’s banking system was suddenly – and perhaps irreparably – shaken, leading to scattered scenes such as these as bank runs erupted across several Chinese banks , forcing Beijing to unleash unprecedented damage control (and internet censorship) to keep the illusion that all is well.

Fast forward to today, when a confluence of the adverse trends that emerged in 2018 and 2019, coupled with the historic economic slowdown in China’s economy, and accelerated by social media-fueled rumors about collapsing banks have sparked what Bloomberg called an “unprecedented” surge of bank runs, forcing regulators and even the police to step in to calm depositors.

According to Bloomberg, in just the past few weeks, worried savers have descended on three banks to withdraw funds amid rumors of cash shortages that were later dismissed as false.

Over the weekend customers rushed to a bank in the northern Hebei province to take out money, prompting local regulators to publicly vouch for the soundness of its lenders as the police halted the run.

Indeed, as Bloomberg adds, “after several bailouts and the first bank seizure in more than two decades last year, the coronavirus outbreak and its economic fallout have exacerbated an already shaky situation in the world’s largest banking system” leading to a sharp erosion of confidence in the $43 trillion banking system among the nation’s more than 1 billion account holders, threatening a cornerstone of China’s rise into an economic powerhouse.

“The perception Chinese savers had of banks being risk free is changing even though in nearly all recent cases their deposits have been protected,” said China International Capital Corp analyst Zhang Shuaishuai.

“Once a rumor like this spreads, it brings immediate liquidity risk to a bank.”

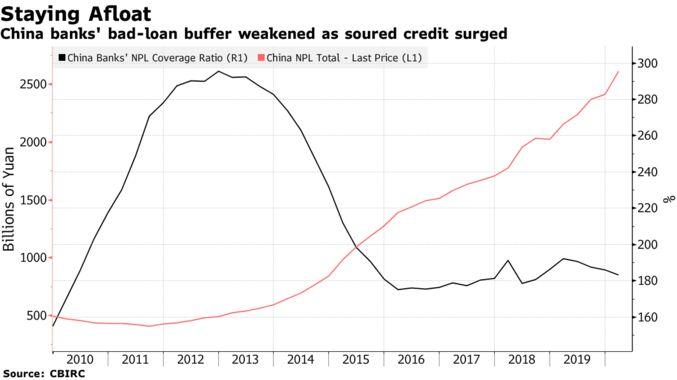

There is probably a reason for why these “rumors” have led to such a dramatic response: they merely bring to the surface whatever most already know, namely that behind its sterling facade, China’s banking system is rotten to the core, with lies upon lies about trillions in non-performing loans…

.. coupled with growing risks from billions parked at China’s unregulated and unstable shadow banking system (best known recently for stories such as this one “Anxin Trust’s $7 Billion Investment Black Hole“)

While regular readers are all too familiar with the story, Bloomberg recaps quickly why it is so crucial for Beijing to preserve the illusions that Chinese savings are sacrosanct and why bank runs can never take hold:

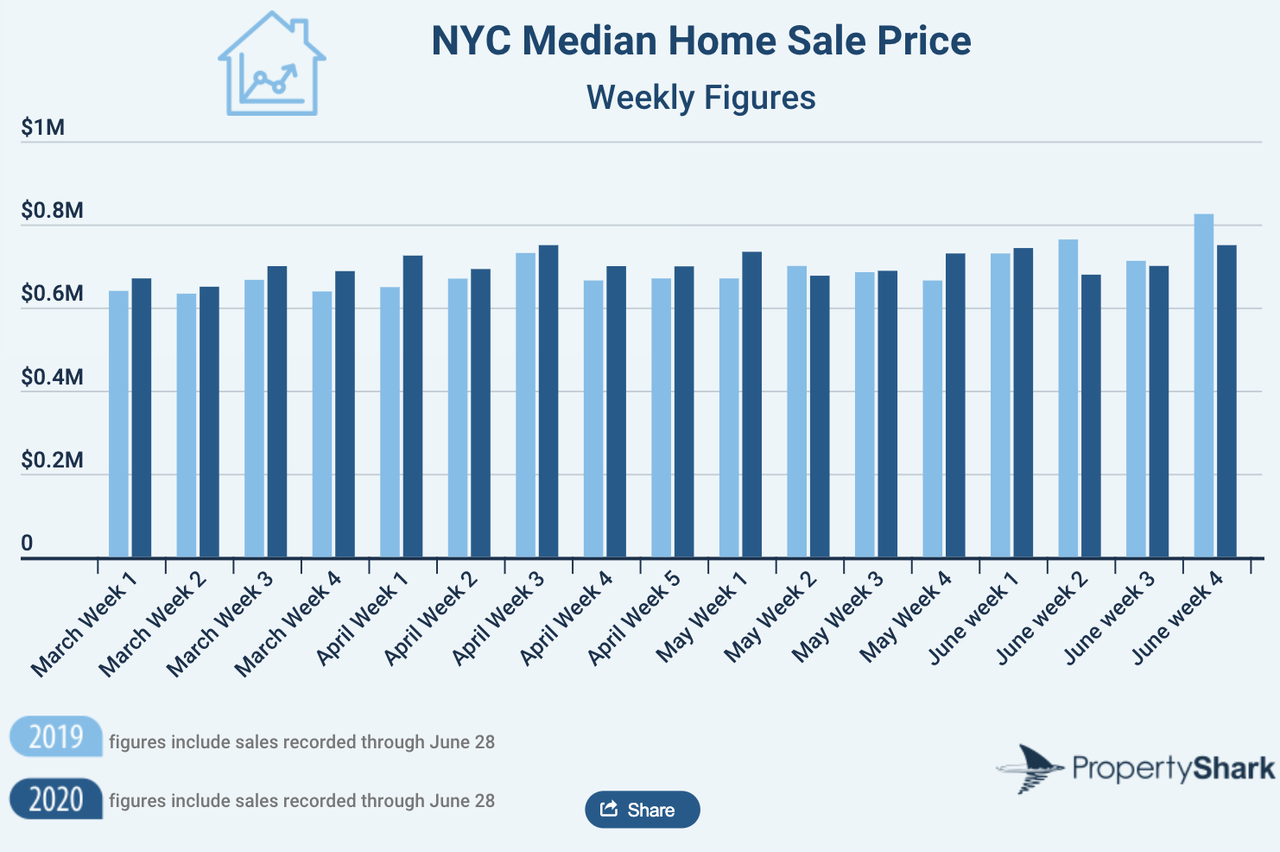

For decades, deposit-taking has provided a stable and low-cost funding base for China’s financial market, playing a key part in the rise of its economy to the second largest in the world. Chinese households hold about 90 trillion yuan ($13 trillion) of bank deposits, more than anywhere else in the world.

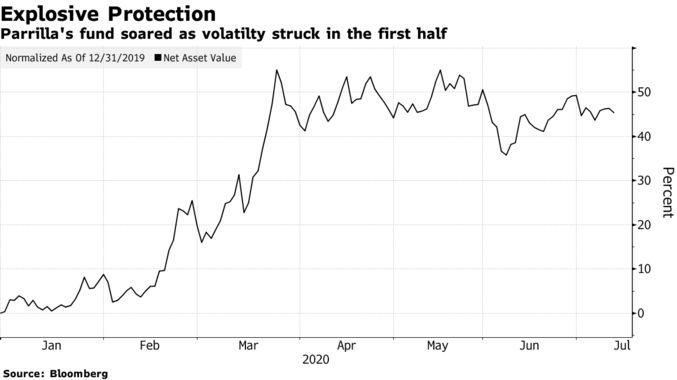

China’s increasingly shaky banking system has also been cited as one of the reasons why Beijing has been aggressively seeking to blow another stock market bubble in hopes it leads to fund flows away from bank savings accounts: after all, it’s politically safer and more palatable to store funds in capital markets rather than in banks, which are looking increasingly shaky by the day. Ultimately, if faced with a decision between another stock bubble-bust cycle, or a loss of confidence in its banks, Beijing will always pick the former.

In any case, regulators are now not only seeking to soothe nerves publicly, but are also raising the protection to preserve this cushion for banks. The run in Hebei came after authorities kicked off a pilot program to limit large transactions in the province. The two-year program, which Bloomberg explains is set to be expanded to Zhejiang and Shenzhen in October to encompass 70 million people, would require retail clients to pre-report any large withdrawals or deposits of 100,000 yuan ($14,000) to 300,000 yuan.

That could be problematic to say the least in a country whose own banking regulator, the China Banking and Insurance Regulatory Commission, on Saturday again warned that lenders are facing a surge in bad debt as the economy sputters at its slowest pace in four decades.

While stopgap measures, which have included rolling over debt and delaying loan payments, have limited an immediate surge in bad debt, the regulator said the fundamental issues of poorly managed banks and the deteriorating ability of companies and individuals to repay loans are still far from solved. They are also asking banks to forgo 1.5 trillion yuan in profit this year by offering lower lending rates, cutting fees, deferring loan repayments, and granting more unsecured loans to small businesses to help the economy.

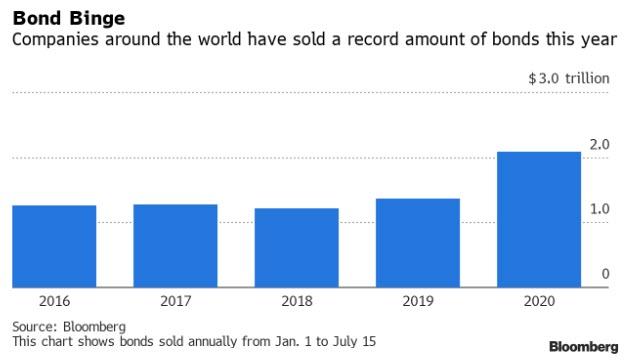

Alas for China’s regulators, they are facing an uphill battle: with authorities overseeing more than 3,000 banks, most of which are small, rural entities without ready access to capital, their job equates to whack-a-mole – the moment they stop one bank run, several new ones take its place. And so, in another unprecedented move, China now plans to allow local governments to use about 200 billion yuan from bond sales to help smaller banks replenish their capital.

It gets worse.

According to S&P, China’s industry may suffer a whopping 8 trillion yuan increase in bad debt this year. Even without this balance sheet “neutron bomb” small banks are facing a $349 billion shortfall in capital, according to UBS analysts, leading to even more small bank failures. Putting that figure at only $50 billion, the regulator said the shortfall could mean slower profit growth or even sliding profits at some institutions.

Meanwhile corporate bonds are also suffering, adding further pressure on banks and hurting corporate funding. According to Bloomberg data, about 80 billion yuan worth of Chinese bonds defaulted on and offshore so far this year, the most in at least three years.

The result of all this, predictably, has been a collapse in confidence in Chinese banks and its logical next step: bank runs.

In the most recent episodes, authorities stepped in last month to halt banks runs at two local lenders in Hebei and Shanxi. On July 11, savers rushed to withdraw money from Hengshui Bank, also based in Hebei, before the police put a stop to it.

In response, the local offices of the People’s Bank of China and the CBIRC did what China does best: they scrambled to preserve confidence in the system, saying in a joint statement that Hengshui Bank and its branches are legitimate financial entities where any savings under half a million yuan are protected under China’s deposit insurance regulation. They also reassured depositors that their money is safe and urged them not to “blindly” withdraw savings.

In fact, they also urged them not to withdraw savings at all.

When that did not work, police took people into custody, issuing reprimands to those spreading rumors, according to the statement.

Meanwhile, as Bloomberg adds, Hengshui Bank said in an emailed reply on Wednesday that the city government is actively dealing with the issue and called for less publicity for fear the incident leads to regional systemic risks. In other words, China is now aggressively censoring any online media that discusses China’s questionably solvent banks.

Knowing this won’t work, regulators have been working on a plan since last year that would see more small banks merge to shore up their strength, but so far little of that effort has come to fruition.

“China has too many banks,” said Zhang. “Quite a few of them are weak in corporate governance and earnings capacity. A better option is to take a more proactive approach to restructuring those regional banks.” He is, of course, correct, however any restructuring would require taking a very risk first step of admitting banks have a big problem, and with China having swept up its bank problems under the rug for years, it is anybody’s guess how the world’s largest depositor base reacts on learning that its money resides in the world’s biggest house of cards.

via ZeroHedge News https://ift.tt/3912Uhh Tyler Durden