The torrid post-Christmas rally, which fizzled last Friday, appears to be officially dead just as earnings season begins, with futures sliding early in the session only seeing the drop accelerated after dismal trade data out of China reignited concerns about global growth and ahead of a key Brexit vote on Tuesday, leading to a sea of red in global markets with S&P futures down 1% to session lows around 6am ET, alongside sliding stocks in Europe and Asia. Treasury yields fell to 2.66% while the dollar held steady.

Tech stocks were the biggest losers in the Stoxx Europe 600 Index on renewed fears about a China hard-landing; in Asia, losses were most pronounced in Hong Kong after China posted the worst import and export figures since 2016. The index of Europe’s leading 300 shares slipped 0.7 percent in early trade to 1,365 points. Germany’s DAX and France’s CAC fell around 0.6 percent, with shares in European tech and luxury goods companies and the automotive sector suffering some of the biggest declines.

“We believe trade growth next year will slow significantly on huge uncertainty and high base,” Citi analysts wrote in a note, predicting China’s exports and imports to fall 5.1 percent and 6.8 percent respectively this year. “Significant uncertainty remains as to whether there could be a ‘deal’ after March 1,” they added.

The falls in Europe followed hefty declines in Asia where MSCI’s broadest index of Asia-Pacific ex-Japan shares lost around 1 percent from Friday’s 1-1/2 month high – its biggest single-day percentage drop since Jan. 2. Chinese and Hong Kong shares suffered the worst hits.

Early on Monday, China reported dismal trade data with exports unexpectedly falling the most since 2016 in December, while imports also contracted, pointing to further weakness in the world’s second-largest economy in 2019 and deteriorating global demand. Specifically, China December exports tumbled Fall -4.4% Y/y in Dollar Terms, the weakest year-on-year reading since January 2017, and down from +3.9% in November; far below the 2.0% consensus increase, while imports plunged -7.6% from +2.9% in Nov, badly missing the 4.5% expected increase, ironically resulting in the biggest trade surplus on record of $57.1BN. In month-on-month terms, the contraction of exports and imports accelerated further in December. In sequential terms, exports contracted 6.2% mom sa non-annualized, down further from a decrease of 3.4% in November

“Today’s data reflect an end to export front-loading and the start of payback effects, while the global slowdown could also weigh on China’s exports,” Nomura economists wrote in a note, referring to a surge in shipments to the U.S. over much of last year as companies rushed to beat further tariffs.

The large contraction in Chinese imports was broadly consistent with a significant decrease of exports in December from Korea and Taiwan to China. Exports growth has been weaker than expected over the past two months, and sequential momentum has slowed significantly to a contraction since November from a strong rebound in September, which has been probably due to the fading impact from front-loading ahead of 10% tariffs levied on $200bn Chinese goods starting in late September (and ahead of the potential—and so far delayed—increase of tariffs on these goods to 25%). According to Goldman, exports growth is likely to remain soft in the near future, given moderation in global growth momentum suggested by GS Leading Current Activity Indicator, even though a faster-than-expected waning of impact from front-loading could potentially pose less downward pressure for exports in the coming months. Adding to policymakers’ worries, data on Monday also showed China posted its biggest trade surplus with the United States on record in 2018, which could prompt President Donald Trump to turn up the heat on Beijing in their bitter trade dispute.

The dismal December trade readings suggest China’s economy may have cooled faster than expected late in the year, despite a slew of growth-boosting measures in recent months ranging from higher infrastructure spending to tax cuts. Some analysts had already speculated that Beijing may have to speed up and intensify its policy easing and stimulus measures this year after factory activity shrank in December.

Elsewhere, ahead of a critical Brexit vote on Tuesday, UK PM May warned that failure to back her Brexit deal risks a no-deal Brexit and is to say she believes parliament will more likely block Brexit than the UK leave without a deal, according to the PM’s office. In separate reports, the UK government commented that any defeat by less than 100 votes on Tuesday would be counted as a good result. Furthermore, reports in The Times noted that Brussels expects the UK to ask for an extension to Article 50 to allow Brexit to be delayed if the House of Commons rejects Theresa May’s deal tomorrow, while there were separate reports that Pro-EU MPs are said to publish draft legislation on Monday for a 2nd referendum.

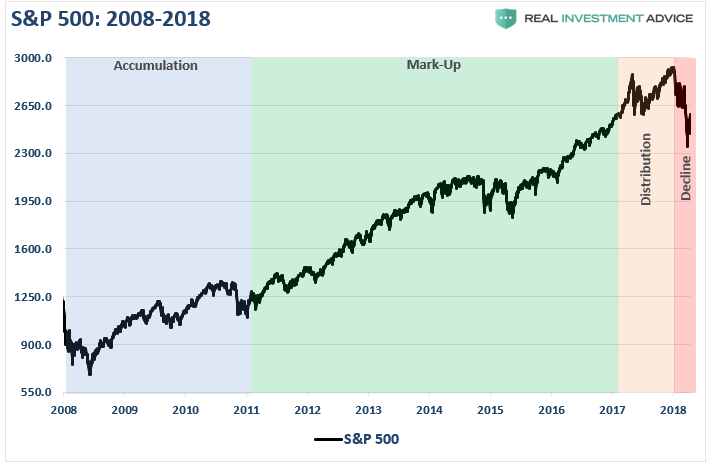

All this adds to tensions as traders watch the record rally of the last two weeks finally collapse and as the banks are set to report earnings. As Bloomberg notes, this month’s buoyancy in global equities, triggered by signs of progress in U.S.-China trade talks and dovish commentary from Federal Reserve officials, faces a test with the Chinese data underscoring the impact of the trade spat. The next hurdles to clear will be a slew of U.S. bank profit reports and earnings season, amid worries global growth is slowing. Also weighing on sentiment is the partial U.S government shutdown that’s entered its fourth week.

In FX, the Bloomberg Dollar Spot Index was little changed while the yen climbed as Chinese trade data and caution ahead of key earnings curbed risk appetite. The euro hit a session low after data showed euro-zone industrial production contracted 3.3% y/y in November, compared to an estimate of a 2.1% decline; Bunds gained, lagging Treasuries, while Italian bonds fell ahead of possible supply. Sweden’s krona recovered from an earlier decline after inflation data beat analyst estimates, while matching the central bank’s forecast. Finally, the Turkish lira slumped after Trump warned Turkey not to attack Kurdish forces in Syria after a planned U.S. pullout, saying it would be economically devastated if it did so.

The prospect of slowing global growth also roiled commodity markets, with oil prices slipping 1% after initially rising, and industrial metals copper and aluminum losing ground in both London and Shanghai. Meanwhile safe havens trades benefited from the equity pullback with U.S. 10-year Treasury yields falling to as low as 2.6690 percent – their lowest level in a week – while gold prices gained as Newmont announced it would buy Goldcorp to create the world’s largest gold miner.

In geopol news, President Trump tweeted that US is starting long overdue pullout from Syria, while he also threatened to devastate Turkey economically if Turkey hits the Kurds and likewise doesn’t want the Kurds to provoke Turkey. Iran suggested it could restart its nuclear program as its nuclear program chief stated that they have started preliminary activities for designing a modern process for 20% uranium enrichment for its reactor in Tehran. In separate news, US President Trump’s reportedly instructed the Pentagon last year to provide military options to strike Iran.

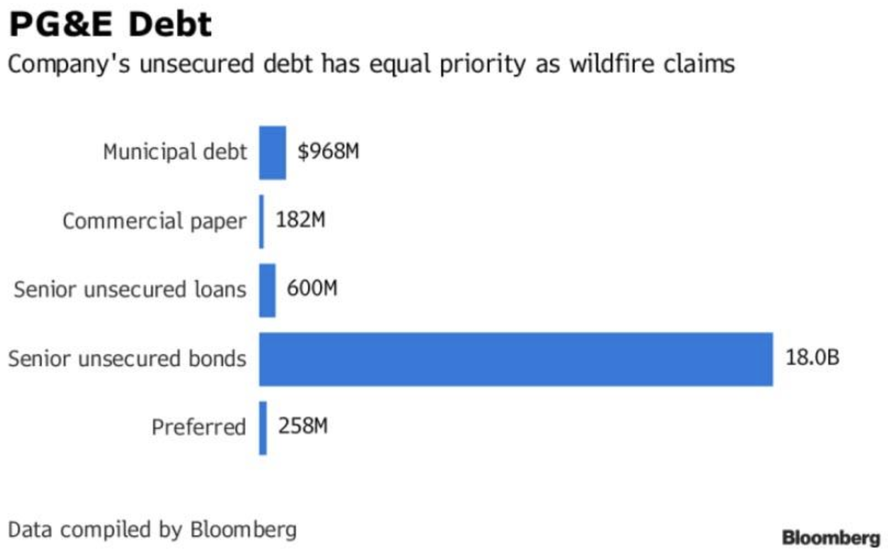

In other news, PG&E (PCG) said to be in discussions with banks about multi-billion dollar bankruptcy financing and may inform employees on Monday it is preparing a bankruptcy filing for January 29th.; the Co’s CEO Williams is leaving with general council John Simon to takeover in the interim. Company shares are down 50% pre-market.

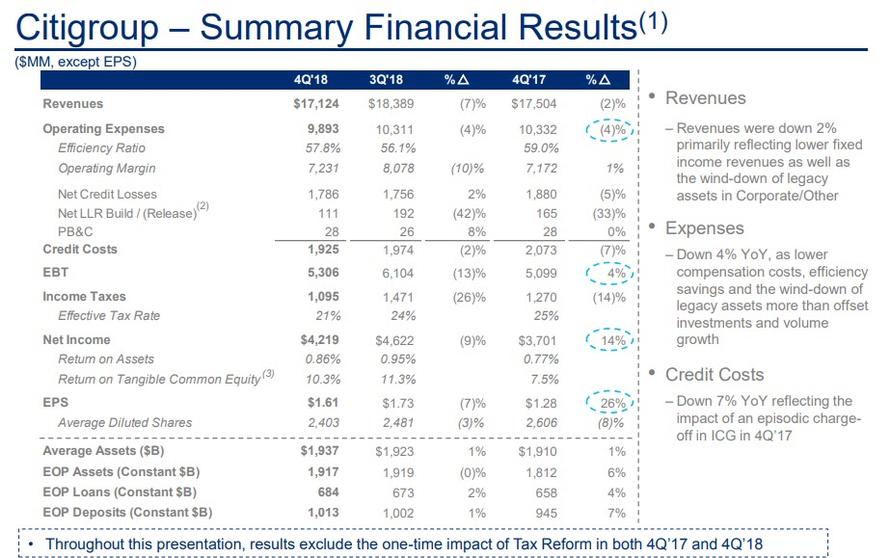

For the U.S. trading day ahead, banks will be in sharp focus as they kick off the earnings season. Quarterly results from Citigroup are due on Monday followed by JPMorgan Chase, Wells Fargo, Goldman Sachs and Morgan Stanley later in the week. Expectations are dour with profits for U.S. companies forecast to rise 6.4 percent, down from an Oct. 1 estimate of 10.2 percent and a big drop from 2018’s tax cut-fueled gain of more than 20 percent. Investor attention was also on the U.S. government shutdown, now in its 24th day, and with no resolution in sight.

Market Snapshot

- S&P 500 futures down 1% to 2,569.00

- STOXX Europe 600 down 0.5% to 347.32

- MXAP down 0.4% to 150.88

- MXAPJ down 0.9% to 486.56

- Nikkei up 1% to 20,359.70

- Topix up 0.5% to 1,529.73

- Hang Seng Index down 1.4% to 26,298.33

- Shanghai Composite down 0.7% to 2,535.77

- Sensex down 0.4% to 35,862.08

- Australia S&P/ASX 200 down 0.02% to 5,773.37

- Kospi down 0.5% to 2,064.52

- German 10Y yield fell 1.9 bps to 0.22%

- Euro up 0.02% to $1.1471

- Italian 10Y yield fell 3.5 bps to 2.493%

- Spanish 10Y yield fell 1.2 bps to 1.433%

- Brent futures down 1.8% to $59.40/bbl

- Gold spot up 0.3% to $1,294.05

- U.S. Dollar Index little changed at 95.67

Top Overnight News from Bloomberg

- Trump’s refusal to reopen the U.S. government reflects the growing influence of his acting Chief of Staff Mick Mulvaney and senior adviser Stephen Miller, hard-right conservatives who are closer to the president thanks to turnover within the White House

- With Washington mired in gridlock and markets flashing all sorts of warning signs, the majority of Americans expects 2019 to be a grim one for their finances, according to a new study

- Industrial output in the euro area fell the most in almost three years in November, raising questions over the economy’s ability to regain momentum after a broad-based slowdown

- Greek Prime Minister Alexis Tsipras’s political future is on the line this week after a coalition breakdown prompted him to call a confidence vote in parliament set for Wednesday, raising the risk of an early election

- Italy’s economy is probably in a phase of stagnation not recession, Finance Minister Giovanni Tria said in a newspaper interview, adding that the country’s deficit will be kept under control

- Germany should try to head off an economic slowdown by easing the tax burden on companies, according to the new chairwoman of Chancellor Angela Merkel’s Christian Democrats

Asian equity markets began the week subdued following the indecisive close on Wall St last Friday as the US government shutdown extended to its longest in history, while disappointing Chinese trade data and the absence of Japanese participants for Coming of Age Day also contributed to the downbeat sentiment. ASX 200 (Unch.) failed to hold on to early gains as strength in Telecoms and its largest weighted Financials sector was eventually overwhelmed by losses in the broader market, while KOSPI (-0.5%) was lacklustre amid softness in the index heavyweights including Samsung Electronics and Hyundai Motor. Hang Seng (-1.4%) and Shanghai Comp. (-0.7%) were also pressured as Chinese Exports and Imports figures took a further hit from the US-China trade dispute, although losses in the mainland were capped after the PBoC injected liquidity to the interbank market in which it utilized 28-day reverse repos for the first time since June last year. PBoC injected CNY 80bln via 7-day and CNY 20bln in 28-day reverse repos for a net daily injection of CNY 20bln. PBoC set CNY mid-point at 6.7560 (Prev. 6.7909).

Top Asian News

- China Doubles Foreign Investment Limit in Further Opening

- CapitaLand CEO Puts Stamp on Developer With $4.4 Billion Deal

- Etihad Agrees to Raise Stake in India’s Jet to 49%, Report Says

- Jet Airways Jumps on Report Founder Goyal Is Giving Up Control

- China Is Said to Extend Foreign Bond Quota for 28 More Firms

Major European Indices are in the red [Euro Stoxx 50 -1.0%], with some underperformance seen in the SMI (-1.1%) weighed on by poor performance in luxury names such as Richemont (-2.1%) and Swatch (-1.0%) following poor Chinese trade data. Other luxury names including Pandora (-6.5%), and LVMH (-3.5%) are in the red on the back of this as well; Burberry (+0.3%) is bucking the luxury trend after being upgraded at Bank of America Merrill Lynch. Sectors are similarly in the red with some slight outperformance seen in healthcare. Other notable movers include Next (-2.9%) in the red after being downgraded at Credit Suisse, and Dialog Semiconductor (+4.3%) after reporting a 7% Y/Y increase in full year revenue.

Top European News

- Orsted Shares Slump Most Since July as Asset Sale Scuppered

- Telecom Italia Is Said to Bid for BT’s Scandal-Plagued Business

- Monte Paschi Drops After ECB Says It Has Capital, Profit Issues

- Euro-Area Production Slump Adds to Gloom for Economic Outlook

- Continental AG Issues Gloomy Auto Market Forecast for First Half

In FX, it has been a relatively docile session for the USD thus far as the index sits around the middle of tight 95.527-726 range as the US government shutdown extends to the longest in history. Subsequently, the US data originally scheduled for release today (building permits, advanced goods trade balance and durable goods) have been cancelled.

- AUD/NZD/CNY/JPY – The major G10 movers, all in the aftermath of below-forecast Chinese trade data as exports and imports both declined to a 6-month low in USD terms vs. expected rises. As such trade-proxy AUD/USD fell around 0.4% to test its 100 DMA at around 0.7180 while NZD/USD declined 0.3% to test its 200 DMA at around 0.6797, ahead of its 50 DMA at 0.6789 as the technicals are still poised to form a golden cross. Meanwhile, global-growth fears sparked safe-haven demand into the Yen as USD/JPY tested 108.00 to the downside ahead of a Fib level at 107.91, of note 1.1bln in option expiries sit between 108.00-15. Finally, the Yuan snapped a three-day winning streak but remains sub-6.80 vs. the greenback, though the currency is of course dampened by the disappointing trade figures, USD/CNY is capped by a firmer PBoC CNY fix of 6.7560 (Prev. 6.7909). In terms of techincals, USD/CNH breached its 50 HMA to the upside at 6.7692 with the 100 HMA above the 6.8000 level. It is also worth noting that Goldman Sachs raised their 3, 6, 12 month USD/CNH forecast to 6.80 (Prev. 6.95), 6.80 (Prev. 7.10) and 6.70 (Prev. 6.90) respectively citing an improvement in sentiment around US-Sino trade talks.

- GBP, EUR – Both little changed on the day, while the latter is largely fluctuating with the dollar and the Pound awaits tomorrows meaningful vote, which was originally scheduled for December 11th last year. The deal is widely expected to be voted down and BBC reports that around 100 Tory and the 10 DUP MPs are expected to join the Labour and the opposition parties in voting against the deal. In terms of where we stand with Brexit, PM May is to deliver a speech at 15:30 GMT where she will warn that Parliament is more likely to block Brexit rather than let Britain leave without a deal. Furthermore, the assurances provided by Brussels are also understood to not be enough to sway MPs towards PM May’s deal scheduled for 19:00GMT tomorrow. Cable was largely unfazed by the release of the EU assurances which offered little in the way of legally-binding material MPs sough for. From a technical standpoint, Cable recently saw a pop higher and rests just below its 100 DMA at 1.2893 with no notable option expiries for the day. Going back to the EUR, the currency was relatively unmoved by below-forecast industrial production figures following Germany’s dismal IP release last week. EUR/USD is currently below its 100 DMA at 1.1476 and in close proximity to the psychological (and 200 HMA) at 1.1450, while there is nothing notable to report regarding option expiries.

- TRY – The stand-out EM underperformer as USD/TRY reclaimed 5.50 to the upside amid a tweet by US President Trump over the weekend where he threatened to devastate Turkey if Turkey hits the Kurds, subsequently pouring cold water over what seemed like a fruitful relationship between the countries.

In commodities, Brent (-1.4%) and WTI (-1.6%) prices are in the red, just below USD 60.00/bbl and USD 51.00/bbl respectively, as the risk tone stemming from the ongoing US government shutdown and disappointing Chinese trade data weighs on markets. Regarding China, December oil imports of 10.35mln BPD, down from November’s figure but up from the 7.97mln BPD for December 2017. Separately, Saudi Energy Minister Al Falih stated that in his opinion OPEC+ has taken enough action to balance the oil market this year, and that there is no need for an extraordinary OPEC meeting before April. Gold (+0.4%) is in the green, towards the sessions high of USD 1294.57/oz as the aforementioned risk tone weighs on markets. Elsewhere, China’s 2018 iron ore imports fell -1% Y/Y, the first yearly decline since 2010. In contrast China’s 2018 copper imports increased 12.9% to a record high of 5.3mln tonnes.

US Event Calendar

DB’s Jim Reid concludes the overnight wrap

For those disappointed with the news on Friday that Mr Trump has cancelled his trip to the World Economic Forum in Davos next week, then fear not. I’ll be making my debut at the event and will be presenting at two Deutsche Bank hosted events. If you or anyone you work with are attending and would like to come along please let me know and I’ll let you know how to register. I’m hoping Bono finds time away from fixing the world’s problems to attend one of my sessions. Failing that I’d be happy to discuss my views on the yield curve with Angelina Jolie.

That’s for next week. For this it’s all about the Brexit vote, what happens next, and the start of US earnings season. Before we preview this, today marks the 24th day of the US government shutdown eclipsing the previous longest ever (21 days) seen in 1995-96. For markets the main inconvenience so far is the delay in some data releases. This Wednesday’s US retail sales release is the highest profile casualty to date data wise. Our economists highlighted that the 2013 shutdown was calculated to have cost about 0.1% of GDP per week lost. However at 850k furloughed workers, the shutdown over 5 years ago led to double the temporary losses of jobs than the current impasse has created. So the overall economic impact should be minimal for now even if it is distressing for those directly impacted. However the longer it goes on the more the lack of visibility on data will be a problem and the more it will start to make a meaningful impact on the immediate economic outlook. We’re not there yet but we’re also not seemingly near a solution.

Outside of US politics the main story this week will be Brexit. The Withdrawal Agreement vote takes place tomorrow evening but The Times on Saturday suggested that if an earlier amendment (the amendments get voted on first) is passed that rejects the deal but also rejects a no-deal then it’s still possible the vote won’t take place and the government will admit defeat but avoid the actual process. Regardless of what happens it seems possible that the deal won’t pass and we could get a constitutional head scratcher of a week. The opposition Labour Party will likely call a no-confidence motion that they have very little chance of winning but more importantly the weekend press (Bloomberg) is increasingly suggesting that Parliament will try to wrestle control of Brexit from Mrs May after Tuesday. Meanwhile, in a last ditch effort PM May is going to make a speech today appealing to members of Parliament to vote for her deal and at the same time warning them that there’s now more chance of them blocking Brexit than of Britain leaving the European Union without a deal.

Overnight the Guardian has reported that the EU27 is considering extending the Article 50 deadline until July should the UK request it assuming Mrs May loses tomorrow. To extend beyond the Euro Parliamentary elections would show the EU are keen to avoid a no-deal. If true one could argue that we’ll now increasingly likely to get a rolling extension until we get a deal, the U.K. decides to stay in, or there is a Parliamentary majority for a no-deal exit (highly unlikely). This news if verified would ultimately reduce the pathways to a hard, cliff edge Brexit.

As it stands Mrs May needs to come back by next Monday with a plan B if she loses tomorrow (thanks to a constitutionally questionable amendment last week that shortened the required response time from 21 to 3 days). However it appears that procedure in the U.K. Parliament is highly unpredictable at the moment and it wouldn’t be a surprise to see more constitutional deviations to standard procedure. . Anyone who says they know exactly how this all ends is either lying or a time traveller. If they are the latter can you ask them whether Liverpool win the league as I wouldn’t mind knowing so as to cut down the tension and stress I’m feeling at the moment. However if the answer is that after waiting 29 years there’s another 29 years further to wait then maybe I’ll be better off blissfully unaware.

On a serious note the direction of travel seems likely to be a pivot towards a softer Brexit or a delay to Brexit if the main motion is defeated tomorrow night. However many bumps are likely on the way.

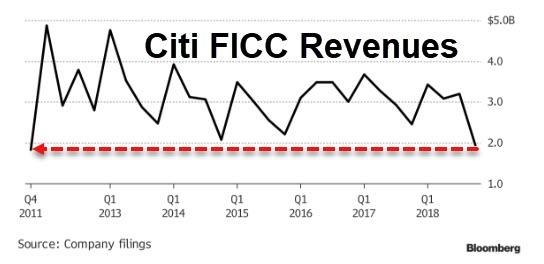

Meanwhile, earnings season is back in the US with 35 S&P 500 companies set to report this week. The highlights will likely be the banks with Citigroup reporting today, Wells Fargo and JP Morgan tomorrow, Goldman Sachs and Bank of America on Wednesday, and Morgan Stanley on Thursday. UnitedHealth and Delta Airlines are also due to report on Tuesday, Netflix on Wednesday, and Schlumberger and American Express on Thursday. For Q4, earnings growth for the S&P 500 is expected to be 11.4% which compares to around 25% growth reported in each of the previous three quarters. Still, if Q4 comes in in-line this would be the fifth straight quarter of double digits earnings growth. It’s worth noting also that over the past five years on average, actual earnings have exceeded estimated earnings by nearly 5% according to Factset. In terms of data we show the full week ahead at the end.

This morning in Asia markets are heading lower with the Hang Seng (-1.43%), Shanghai Comp (-0.56%) and Kospi (-0.66%) all down weighed by the disappointing December trade data from China with both exports (at -4.4% yoy vs. +2.0% yoy expected) and imports (at -7.6% yoy vs. +4.5% yoy expected) declining at a faster pace and at the worst levels since 2016, thereby raising concerns of a slowdown in global growth. The Australian dollar (-0.44%) also came under pressure following China’s disappointing trade data even as China’s onshore yuan is eking out a small gain (+0.06%). Japan’s markets are closed for a holiday. Elsewhere, futures on the S&P 500 are also down -0.73%.

Turning to a recap of last week, Friday turned out to be quite a calm trading session, especially relative to the rest of the week. The highlight was the US’s December CPI data, which printed exactly in-line with consensus expectations. Core prices rose +0.2% mom and +2.2% yoy. Headline inflation moderated a touch, to -0.1% mom and +1.9% yoy, though it was driven by transitory energy dynamics.

On the week, the S&P 500 ended +2.54% higher (-0.01% on Friday), while small caps outperformed with the Russell 2000 up +4.83% (+0.14% Friday). Other major indexes also advanced, with the DOW and NASDAQ gaining +2.40% and +2.78%, respectively (-0.02% and -0.30% Friday). In Europe, the STOXX 600 rose +1.69% on the week (+0.09% Friday) while Italy’s FTSEMIB outperformed, up +2.43% (-0.06% Friday). Asian equities advanced as well, with the Nikkei and Hang Seng indexes up +4.08% and +4.06% (+0.97% and +0.55% Friday) respectively. The main drivers of this broad risk-on sentiment were: positive progress on US-China trade talks, Fed Chair Powell and other Fed officials signaling a pause in the rate hike cycle, and low valuations after December’s steep selloff.

In fixed income, US HY credit stole the show with a -44.5bps rally on the week, its strongest week since March 2016 (+2bps Friday) and 84bps tighter than its recent wides on January 3rd. European HY also gained -28bps (-4bps Friday). Sovereign bond yields rose slightly, with Treasuries and Bunds ending the week +3.0 and +3.1 bps higher at 2.70% and 0.24% (-4.5bps and -1.6bps on Friday). The dollar retreated -0.53% while EM currencies gained +0.36%, though the moves moderated on Friday (dollar +0.14% and EMs -0.14%). The euro ended the week +0.59% stronger at 1.146 (-0.33% Friday). Finally, oil continued its strong rally as well, gaining +6.15% on the week (-1.80% Friday) to close above $60. The two week gain for Brent was 16.05%, the best performance in over two years.

It should be a quiet start to the week on Monday with the only data due out being the Euro Area November industrial production report and China’s December trade balance. Meanwhile earnings season gets underway with Citigroup reporting.

via RSS http://bit.ly/2Fr5j92 Tyler Durden

As his last move before resigning as U.S. attorney general in October, former Sen. Jeff Sessions signed a memo making it much more difficult for the Department of Justice (DOJ) to enter into binding court agreements with police departments accused of civil rights violations.

As his last move before resigning as U.S. attorney general in October, former Sen. Jeff Sessions signed a memo making it much more difficult for the Department of Justice (DOJ) to enter into binding court agreements with police departments accused of civil rights violations.