It turns out that Monday’s dip in futures was a low-volume headfake, and on Tuesday global markets hit a new record high as U.S. equity futures jumped, with spoos also approaching all time highs, as oil rose above $70 to a two-year high after markets shrugged off concerns about rising inflation and looked ahead to U.S. data later in the week that should offer a major clue to the health of the world’s biggest economy. At 715am, Emini futs were 4,226 up 24 points ot 0.58%; Dow futs were up 212 to 0.61% while Nasdaq futs rose 52 pts, up 0.38%.

MSCI’s broadest gauge of global stock markets rose 0.3% to a record high, led by broad gains across Europe’s leading indexes with the US looking at a solid green open. Here are some of the biggest U.S. movers today:

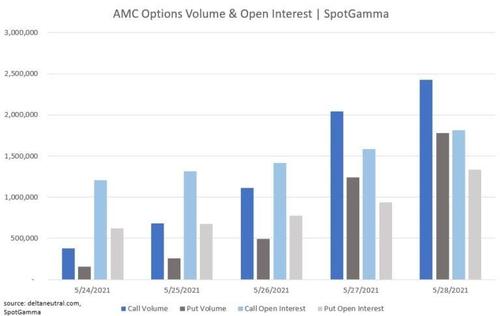

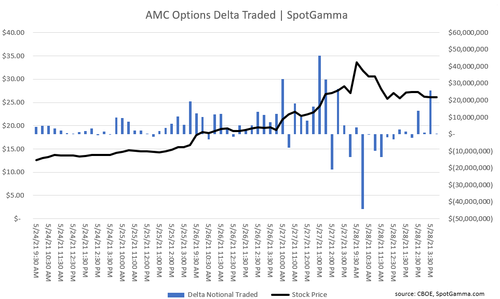

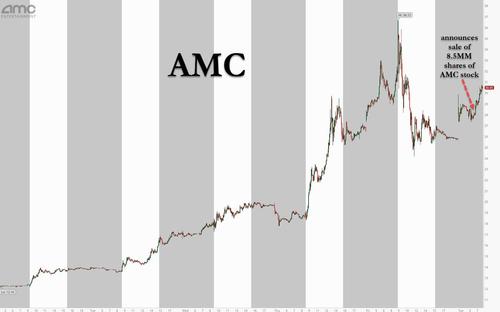

- AMC Entertainment Holdings climbs 6.3% in premarket trading. The company issued 8.5m shares to Mudrick Capital Management for $230.5m to pursue acquisitions. The shares gained 116% last week amid the continuation of a retail-trading frenzy that has boosted the stock this year.

- Cloudera rises 23% in premarket trading. Affiliates of KKR and Clayton Dubilier & Rice agreed to take Cloudera private in an all-cash transation that valued the company about about $5.3b.

- Vertex Energy jumps about 30% in premarket trading, building on a rally after agreeing to buy an Alabama refinery from Shell for $75 million.

“Although global stocks are now around 20% above pre-pandemic highs, a combination of strong earnings growth and reasonable valuations relative to still-low bond yields points to further upside for stocks,” said Mark Haefele, chief investment officer, UBS Global Wealth Management.

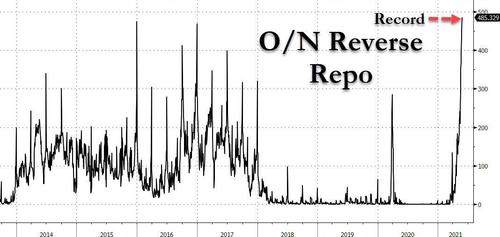

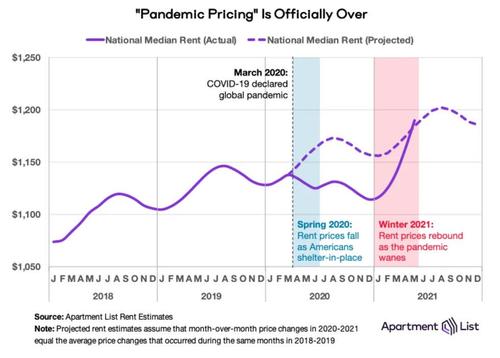

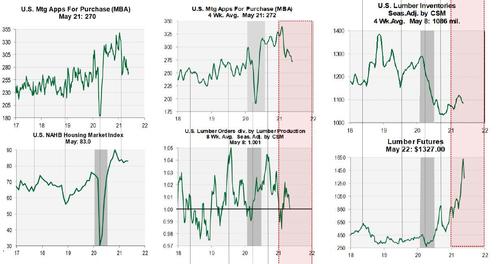

Global stocks started the new month near record highs, underpinned by the recovery from the health crisis and ample liquidity. Still, the jump in commodities prices is stoking concerns that rising price pressures could prompt central banks to withdraw support earlier than anticipated. Traders are awaiting key American jobs data later in the week to help assess the path of the rebound.

“The inflation outlook is a risk because it is so unknown at the moment, and it will take a number of months to really get a true idea of whether we will see that inflation be persistently higher or not,” Kerry Craig, JPMorgan Asset Management global market strategist, said on Bloomberg TV.

In Europe, the Stoxx 600 Index gained 1.1%, rising to a new record high, led higher by cyclical shares, as data showed that euro-area factories are struggling to keep up with surging demand and joblessness in Germany fell. Italy’s FTSE MIB Index jumped to the highest level since 2008, while France’s benchmark CAC 40 Index climbs to highest level in more than 20 years, lifted by gains in companies including Total and ArcelorMittal. The Stoxx 600 Basic Resources index rose as much as 3.6%, with miners buoyed by continued gains in metal prices. Gains were led by London-listed Rio Tinto, Anglo American, BHP and Glencore. Copper miners Antofagasta, KGHM and Boliden also higher and steel makers Evraz and Voestalpline gaining. Here are some of the biggest European movers today:

- Hansa Biopharma shares climb as much as 15%, the most since July, after RBC raises its price target on the stock to SEK323 from SEK287 following new pricing information for kidney transplant drug Idefirix in Europe.

- M&A Saatchi shares gain as much as 13%, the most since Feb. 26, after the ad agency says it sees earnings ahead of consensus, with Peel Hunt saying the firm’s trading update is “reassuring.”

- Norwegian Air shares gain as much as 11% after SEB upgrades to buy from sell following recent share price drop, seeing a “newly born” company after the airline’s “harsh” restructuring process.

- Biffa shares climb as much as 9.7% to a record following full-year earnings that beat analysts’ estimates. Investec concurs with the message coming from the earnings release about opportunities in a circular economy and a likely regulatory tailwind.

- EssilorLuxottica shares rise as much as 1% as the company is pushing ahead with the sale of some optical retail businesses in Italy, the Netherlands and Belgium to meet antitrust requirements for its purchase of GrandVision, according to people familiar with the situation.

- Nel shares slump as much as 8% after SpareBank 1 Markets downgrades to sell from buy with PT NOK8.5 vs NOK20.

- Aryzta shares retreat as much as 7.4%, the most intraday since Dec. 21, on inflation worries after the Swiss baker said it will have to lift prices due to the higher cost of dairy ingredients, flour and packaging in the pandemic aftermath.

- Sixt shares fall as much as 5.4%, the most since March 9. The vehicle-rental company’s shares are now trading at a significant valuation premium reflecting expectations of a “seamless” recovery in earnings, Berenberg says in a note, downgrading the stock to hold from buy.

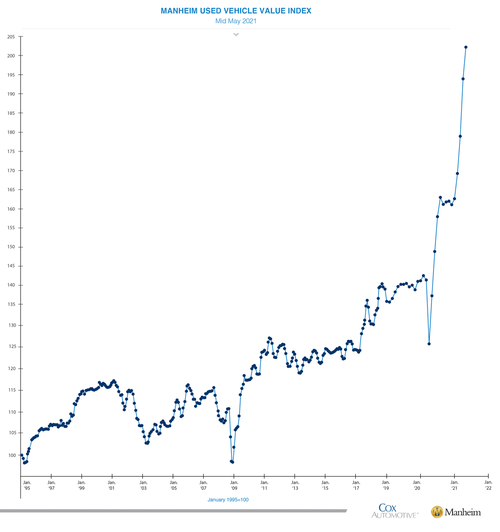

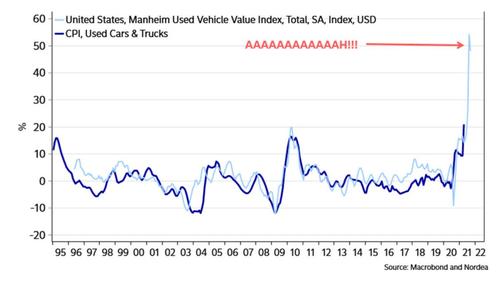

Against a backdrop of a patchy recovery from covid, May eurozone inflation came in higher than expected at 2%, driven by rising energy costs, above the European Central Bank’s target of below but close to 2% – and with even higher levels expected later in the year.

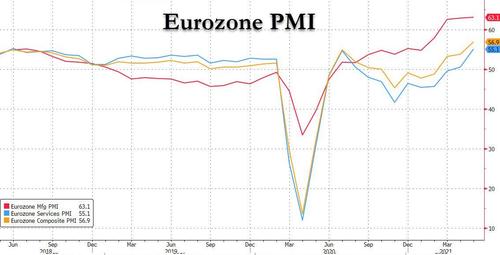

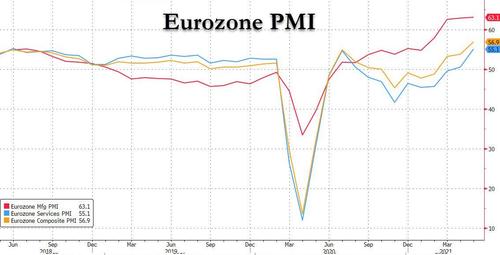

Euro zone manufacturing activity expanded at a record pace in May, according to the Tuesday PMI surveys which suggested growth would have been even faster without supply bottlenecks that have led to an unprecedented rise in input costs. IHS Markit’s final Manufacturing Purchasing Managers’ Index (PMI) rose to 63.1 in May from April’s 62.9, above an initial 62.8 “flash” estimate and the highest reading since the survey began in June 1997. In the UK, the manufacturing PMI was revised down by 0.5pt in the final release but remained almost 4.5pt above the previous all-time high from 1994. The Italian and Spanish manufacturing PMIs both improved slightly ahead of expectations in May and reached post-1998 highs. The final set of manufacturing PMIs for May confirms the continued cyclical strength of manufacturing activity across Europe, with elevated future output expectations suggesting scope for continued growth in coming months. An index measuring output, which feeds into a composite PMI due on Thursday and is seen as a good guide to economic health, eased from April’s 63.2 to 62.2. Anything above 50 indicates growth.

Earlier in the session, MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6% in a volatile trading day, with gains in consumer-discretionary and energy shares offsetting falls in the health-care and consumer-staple sectors; the index hit the highest in a month and taking total gains so far this year past 7% . South Korean stocks rose 0.6% after a jump in May exports, and Chinese stocks climbed 0.2% after data showing factory activity expanded at the fastest pace this year in May. China’s CSI 300 Index ended the day up 0.2% after falling as much as 1.2% as concern among foreign investors eased about Beijing’s move to slow the yuan’s rally. A gauge that tracks Chinese technology stocks in Hong Kong advance to the highest in a month, led by Kuaishou Technology and Meituan. The latter jumped for a second day in Hong Kong, and was one of the biggest boosts to the Asianstock benchmark, following Monday’s surge after it had better-than-expected earnings results. Thailand’s SET index was the biggest gainer in Asia, rising 1.6%, as the country approved stimulus measures worth 140 billion baht ($4.5 billion) to counter the impact from the nation’s biggest coronavirus outbreak yet. Korean stocks also rose after the trade ministry said exports surged the most since 1988 in May. The Asian gauge in May posted its first monthly outperformance against the S&P 500 Index since January. The broader MSCI Emerging Markets Index has also been on a tear, and is poised to close at its highest since Feb. 23. Indonesia was closed for a holiday

Chinese stocks ended Tuesday slightly higher, as foreign investors returned in afternoon trading with concerns easing over the impact of the central bank’s action to slow the yuan’s rally. The benchmark CSI 300 Index added 0.2% at the close, marking the fifth straight day with a move smaller than 1% after a jump of 3.2% a week ago. A subgauge of materials shares rebounded to lead the gains after losing 1.8% in the morning, with Hengli Petrochemical, Wanhua Chemical, Rongsheng Petrochemical and Hengyi Petrochemical among the best performers in the main index. Overseas investors resumed net buying onshore equities after selling in the morning session, picking up 1.1 billion yuan worth of stocks for the day. The inflows came after the People’s Bank of China announced on Monday that financial institutions would be required to hold more foreign currencies in reserve from June 15, in the first such hike since 2007. The central bank’s move will reduce the supply of dollars and other currencies onshore — putting pressure on the yuan to weaken. “The central bank’s policy could slow the pace of the yuan’s rally, but not the trend of its appreciation,” said Pei Xiaoyan, chairman of Shenzhen Qianhai Tonglu Capital Ltd. “The inflow will continue for sure,” he added, predicting the Shanghai Composite Index to climb to 4,000 points this year. The Shanghai Composite rose 0.3% to 3624.714 points, while the ChiNext slid 0.3%, the first drop in four sessions.

In Australia, the S&P/ASX 200 index closed 0.3% lower at 7,142.60, falling for a second day. Weakness in health and bank stocks nudged the gauge lower. Earlier, the Reserve Bank of Australia kept its key interest rate and three-year bond target unchanged. The best performer was Whitehaven, jumping to its highest since April 14. The biggest laggard was Blackmores, falling the most since April 23. In New Zealand, the S&P/NZX 50 index rose 1.2% to 12,462.47

In FX, the dollar was mixed against most of its Group-of-10 peers with Scandinavian currencies leading the advance and the euro swinging between gains and losses. Bunds were little changed after paring earlier losses even as inflation in the euro area climbed to the highest level in more than two years; Eurozone PMI manufacturing index rose to 63.1 in May, from 62.9 in April. The pound was the worst G-10 performer and retreated after hitting its strongest level in three years as concern over a new coronavirus strain outweighed bets on the U.K. economic recovery. Australia’s dollar was higher even as it trimmed gains after the Reserve Bank left rates unchanged and reiterated that inflation and wage gains are unlikely to be at the point where an interest-rate hike is needed until 2024.

In rates, Treasuries were re under pressure as Friday’s month-end bid fades from the market and S&P 500 futures exceed last week’s high. Treasury yields cheaper by nearly 2.5bp at ~1.62% in 10-year sector, cheapening 5s10s30s fly by 1.7bp and steepening 2s10s by ~2bp; bunds outperform by 2bp vs Treasuries, gilts by less than 1bp. During Asia session 10-year sector lagged on the curve on good volume, suggesting fresh selling pressures. There’s no Treasury coupon supply this week, and USD IG issuance is expected to be moderate during holiday-shortened week capped by May jobs report Friday. Germany’s 10-year Bund yield, meanwhile, was steady at around -0.18% with bond markets taking news of the surge in euro zone inflation in their stride. In Japan, the benchmark 10-year bond did not trade on Tuesday, the first time since June 2020 that such an occurrence took place. Trading activity in Japanese government bonds has waned of late, mirroring moves in global markets where yields have been confined to narrow ranges amid a lack of direction. The 10-year JGB yield traded at 0.08% on Monday.

In commodities, Brent crude futures climbed to the highest in more than two and a half years after the OPEC+ alliance forecast a tightening global market ahead of a production policy meeting. West Texas Intermediate rose as much as 3.2% from Friday’s close to $68.42 a barrel, while global benchmark Brent topped $70, a level it has failed to hold for a sustained period since 2019.

Commodities from iron ore to copper also pushed higher. Concerns about global inflation have driven gold up 8% this month to comfortably above $1,900, although the yellow metal gave up early session gains to last trade down 0.2% on the day

This week’s main event is Friday’s U.S. payrolls data, with markets looking for a signal from the Federal Reserve on when it will start tapering its bond-buying program. Median forecasts are that 650,000 jobs were added in May, but the outcome is uncertain following April’s unexpectedly weak 266,000 gain. Though U.S. inflation data last week was above estimates, another big miss on the jobs front would delay prospects for any wind-down of stimulus, analysts say. SocGen strategist Sebastien Galy said he expected the jobs data to come in below or in line with consensus, but, given low levels of equity volatility, markets were primed for a jump on higher-than-expected numbers. “We remain constructive on risk as we expect a disappointment on NFP (non-farm payrolls) but the equity volatility market is likely to reprice higher from its rather extreme lows,” he said in a note to clients. Also on deck – fresh manufacturing data for May will provide further clues on the state of the recovery.

HP Enterprise and Zoom Video are among the companies due to report earnings today

Market Snapshot

- S&P 500 futures up 0.33% to 4,216.25

- STOXX Europe 600 +0.88% to 450.71

- MXAP up 0.3% to 209.74

- MXAPJ up 0.5% to 708.43

- Nikkei down 0.2% to 28,814.34

- Topix up 0.2% to 1,926.18

- Hang Seng Index up 1.1% to 29,468.00

- Shanghai Composite up 0.3% to 3,624.71

- Sensex little changed at 51,903.80

- Australia S&P/ASX 200 down 0.3% to 7,142.57

- Kospi up 0.6% to 3,221.87

- German 10Y yield rose 0.3 bps to 0.184%

- Euro little changed at $1.2229

- Brent Futures up 1.55% to $70.87/bbl

- Gold spot up 0.26% to $1,911.91

- U.S. Dollar Index little changed at 89.837

Top Overnight News from Bloomberg

- China forced banks to hold more foreign currencies in reserve for the first time in more than a decade, its most substantial move yet to rein the surging yuan

- U.K. house prices recorded double-digit growth for the first time since 2014 last month, as the nation’s booming market showed no signs of cooling

- A Group of Seven meeting this week is unlikely to settle on a rate for a global minimum corporate tax, Japan’s Finance Minister Taro Aso said, sounding a note of caution before he and his counterparts gather in London

- Asia’s manufacturing activity continued to advance in May, though at a slightly slower pace, despite flare-ups of Covid-19 around the region that could force some plants to close and weigh on sentiment

- Euro-area factories are struggling to keep up with the economic recovery as orders rise faster than production, setting the bloc up for a summer spike in inflation

- There is “no major obstacle” standing in the way of negotiations being held in Vienna to revive the 2015 nuclear agreement between Iran and world powers to lift sanctions, Government Spokesman Ali Rabiei says in press conference

Quick look at global markets courtesy of Newsquawk

Asian equity markets traded mixed after lacking firm direction in the absence of a lead from the US owing to the Memorial Day holiday and amid tentativeness ahead of this week’s key events culminating with Friday’s US jobs numbers. ASX 200 (-0.3%) was lower as losses in healthcare and the top-weighted financial industry led the declines seen across most sectors and with risk appetite also subdued by prospects of an extension to the Victoria state lockdown. Furthermore, a slew of data releases failed to inspire as Building Approvals, Net Exports Contribution to GDP and Company Q1 Profits were all in contraction territory, despite mostly beating expectations. Nikkei 225 (-0.2%) failed to hold on to opening gains and retreated below the 29k level alongside currency-related pressure, although the KOSPI outperformed after trade data remained solid including a 45.6% jump in Exports. Hang Seng (+1.1%) and Shanghai Comp. (+0.3%) conformed to the mixed picture with the Hong Kong benchmark kept afloat by strength in tech as e-commerce platforms began the 618 Mid-Year shopping extravaganza with early record sales. However, the mainland continued to suffer from a firmer currency despite the PBoC’s attempt to curb the one-way bets on the CNY through an increase in the FX reserve requirement ratio, while marginally better than expected Chinese Caixin Manufacturing PMI data and the recent announcement to allow couples to have three children did little to help the broader market although provided some tailwinds for baby-related stocks. Finally, 10yr JGBs were flat with price action subdued after the BoJ maintained the amount and pace of its intended JGB purchases for June and with the central bank only in the market today for treasury bills.

Top Asian News

- Malaysia Lockdown to Impact Growth, Deficit Targets, FM Says

- Japan’s Much-Maligned Vaccine Campaign Quietly Gathers Speed

- Hong Kong Calls on Banks to Push Staff to Get Vaccinated

Equities in Europe kicked off the session modestly in the green and thereafter extended gains (Euro Stoxx 50 +0.9%), with the Stoxx 600 notching another record high whilst the FTSE MIB revisits levels last seen in 2008. Overall, sentiment has been more constructive since APAC hours as UK and US players re-join trade following their respective domestic holidays, and with volumes looking less anaemic. US equity futures have also extended on modest broad-based gains, but upside is less pronounced vs peers across the pond as participants look ahead to a raft of Tier 1 data points this week kicking off with the ISM Manufacturing PMI later today – Note the Markit PMIs have widely been flagging inflationary pressures arising from supply chain complications and the rise in raw materials. The FTSE 100 (+1.2%) shrugged off yesterday’s lacklustre European performance as the rebound in base metals propels the miner-heavy index; meanwhile, the IBEX (-0.4%) lags amid losses in heavy-weight constituents. Sectors portray a more risk-on picture and pro-cyclical bias with the defensive peers towards the bottom of the pile. The Basic Resources sector outpaces its peers, closely followed by Autos and Oil & Gas. The Auto sector is buoyed by a string of constructive updates. Daimler (+2.7%) welcomes the settling of litigation with Nokia (+0.5%), whilst Volkswagen (+2.5%) cheers a potential battery unit IPO, and Stellantis (+1.6%) is bolstered by speculation that it may announce an entry into the EV battery market at an event on July 8th.

Top European News

- AB Science Halted After Suspending Drug Trials on Heart Risk

- Aryzta Shares Decline Amid Worries Over Raw-Material Prices

- VW Nears Diesel-Damages Agreement With Former CEO, BI Says

- Haldane: Half of U.K. Charities Are at Risk of Failing

In FX, the Aussie was elevated amidst a rise in iron ore prices and better than anticipated data, including building approvals, current account, net exports and gross company profits going into the RBA policy meeting, and only suffered a temporary setback on initial less hawkish than expected perceptions as all settings and guidance were left unchanged. However, its relatively rapid recovery owes more to the failings of the Buck as Aud/Usd rebounds firmly through 0.7750, but the Aud/Nzd cross remains anchored around 1.0650 in wake of last week’s recalibration to price in an earlier OCR hike by the RBNZ. Indeed, the Kiwi has also regained momentum vs its US peer to retest resistance and offers ahead of 0.7300 in advance of NZ Q1 terms of trade, while next up for the Aussie Q1 GDP. Elsewhere, the Pound also derived strength at the expense of its US counterpart, albeit with extra impetus from strong oil prices, Nationwide hpi and hawkish rhetoric via BoE’s Ramsden in the Guardian, though Cable came up against a barrier around 1.4250 and lost grip of the 1.4200 handle even before a downgrade to the final manufacturing PMI.

- CAD/USD/NOK – Not a normal major grouping, but the Loonie and Norwegian Krona have the prop of crude in common, as WTI approaches Usd 68.50/brl and Brent touches Usd 71 awaiting JMMC/OPEC+ meetings from midday London time. Usd/Cad is straddling 1.2050 and Eur/Nok has retreated sharply from recent highs to probe 10.1000, but the Crown also taking advantage of the Euro’s fade more broadly. Meanwhile, Buck has bounced on the back of a corrective rebound in US Treasury yields ahead of the return of cash markets from Monday’s Memorial Day holiday, with the DXY just shy of a recovery high close to 90.000 within a 89.915-717 range and now looking towards the final Markit manufacturing PMI, ISM, Dallas Fed and Beige Book for some independent direction along with speeches from Fed’s Quarles and Brainard.

- EUR/JPY/CHF – All off best levels vs the Dollar, as the Euro loses some traction from firm EGB yields irrespective of decent Eurozone manufacturing PMIs and data such as German jobs, Italian GDP, Eurozone inflation, and unemployment. Eur/Usd waned circa 1.2241 and hefty option interest at the 1.2275 strike (1.7 bn), while the Yen is pivoting 109.50 and Franc is hovering above 0.9000 in wake of an acceleration in Swiss retail sales, mixed GDP and a slight dip in the manufacturing PMI following latest comments from the SNB reiterating the need to keep monetary policy loose given the still highly valued Chf, albeit weaker recently.

In commodities, WTI and Brent front month futures have been extending on APAC gains throughout the European morning, with the former printing north of USD 68/bbl (vs low 66.41/bbl) and the latter grinding higher to earlier test USD 71/bbl to the upside (vs low 69.29/bbl). The energy market is eyeing a few moving parts alongside the overall risk profile across the market. Firstly, JCPOA talks are taking longer than anticipated, with some officials noting a potential spill-over into a sixth round of negotiations. However, Iran has reassured that the deal is not dead and could be inked by mid-to-late June. Secondly, OPEC+ producers are poised to meet at 13:30BST after the JMMC at 12:00BST. Members are expected to maintain current quotas, but Iranian supply will reportedly be high on the agenda. Analysts and some energy officials have suggested that Iranian and OPEC+ supply can be absorbed by the market heading into a less COVID-restricted summer period, with the US driving season also looming – Click here for a full primer. Elsewhere, spot gold and silver have been moving at the whim of the Buck but retain USD 1,900/oz and USD 28/oz statuses respectively, ahead of a risk-packed week. Turning to base metals, LME copper kicked off the week on the front-foot amid the subdued Buck, the risk appetite across markets and supply woes emanating from mine strikes at BHP’s most extensive Chilean operations. Finally, Dalian iron ore futures rose over 4% overnight as China’s top steelmaking city of Tangshan announced the easing of restrictions – although this comes against the backdrop of China cracking down on rising commodity prices.

US Event Calendar

- 9:45am: May Markit US Manufacturing PMI, est. 61.5, prior 61.5

- 10am: May ISM Employment, prior 55.1

- May ISM Prices Paid, est. 89.0, prior 89.6

- May ISM New Orders, prior 64.3

- May ISM Manufacturing, est. 60.8, prior 60.7

- 10am: April Construction Spending MoM, est. 0.5%, prior 0.2%

- 10:30am: May Dallas Fed Manf. Activity, est. 36.2, prior 37.3

DB’s Jim Reid concludes the overnight wrap

Welcome back after the long weekend to readers in the UK and the US, and hope you had a restful break. For us in the UK it seemingly marked the arrival of summer after some very wet weeks in May, though much of my weekend was spent wandering through various furniture outlets as we look to fit out our next place. It was also the first time since the pandemic began that I ventured onto the tube and actually felt squashed, which shows that life does seem to be returning to some semblance of normality. Don’t just take my word for it though, as the data shows that the Saturday before last was the first time in over a year that tube usage was running at more than half of its pre-Covid levels. With stats like these you can tell I’m the life and soul of the party.

Given it’s the start of the month, we’ll shortly be releasing our performance review running through how various financial assets have fared in May and YTD. For the month overall, most of the key assets in our sample made gains in spite of increased concern regarding inflation risks, and commodities were one of the best-performing asset classes as they extended their YTD gains. However, it was a very different story for crypto-assets, with Bitcoin seeing a massive -35.4% slump in May as it came under the spotlight of the authorities. Full details in the report out shortly.

We’ll have to wait and see as to what June will bring, but markets in Asia have started the month on a mixed footing with the Nikkei (-0.35%) and Shanghai Comp (-0.11%) moving lower whilst the Hang Seng (+0.45%) and Kospi (+0.53%) have both risen. Over the long weekend, an important story from Asia was that the People’s Bank of China increased the reserve ratio for foreign exchange holdings at financial institutions to 7% from June 15, which is 2 percentage points higher than its current level. This follows a noticeable strengthening for the yuan over recent months that’s sent it to a 3-year high against the US dollar.

Otherwise overnight, the main news is that Brent crude oil prices have surpassed $70/bbl again after the OPEC+ group forecasted a tightening market with declining inventories, with the glut built up thanks to the pandemic nearly gone. Meanwhile US equity futures are pointing modestly higher, with those on the S&P 500 up +0.02%, and 10-year Treasury yields have also risen +2.0bps this morning to 1.615%.

Back to China, and another important headline from yesterday was the confirmation by the official Xinhua News Agency that all couples would be allowed to have three children, which marks an easing of the current two-child restriction. This comes against the backdrop of a noticeable decline in the birth rate in recent years, and the latest census release in May showed that population growth over the last decade was the slowest since data collection began in 1953. Furthermore, the UN’s population forecasts show that by the end of the decade, China is expected to have fallen behind India as the world’s most populous country.

Over in Europe, equities slipped back amidst thin trading volumes as they awaited the coming week’s data releases. The STOXX 600 ended the session down -0.49%, ending a run of 7 successive gains, though the index’s performance was cushioned by the fact UK markets were closed, and France’s CAC 40 (-0.57%) and Germany’s DAX (-0.64%) saw larger declines. For sovereign bond markets it was a pretty uniform story across the continent, with yields on 10yr bunds (-0.5bps), OATs (-0.5bps) and BTPs (-0.4bps) all moving slightly lower.

Turning to the week ahead now, the calendar will begin to pick up again following a quieter couple of weeks just gone, and this will mark the start of an eventful period as we get an array of important data releases (including the US CPI release in 9 days’ time) along with the next big round of central bank meetings. In terms of this shortened week ahead, the main highlight will be the US jobs report for May on Friday, which will give us a fresh perspective on the state of the recovery there, but on top of that we’ve also got the release of the May PMIs from around the world (starting today), along with the Euro Area’s flash CPI reading for May (also today), which will be an important one as investors stay focused on signs of building price pressures throughout the global economy.

Starting with the US jobs report, last month we saw nonfarm payrolls significantly underwhelm expectations with just a +266k increase, contrary to the consensus expectation for a +1m gain, while the previous month also saw downward revisions. This raised fears among investors that the US could be experiencing labour shortages and supply-chain constraints, but positive data since then like the weekly initial jobless claims have raised hopes that this was just a blip rather than a trend, and that we might start to see the “string” of positive releases that Chair Powell alluded to that would show progress towards the Fed’s goals. However our economists are expecting a bounceback in May, with a rise in nonfarm payrolls of +800k, which in turn would see the unemployment rate decline to a post-pandemic low of 5.9%. They note that it’s also worth bearing in mind some of the distributional variables that the Federal Reserve are tracking, in addition to the main numbers, as they seek to achieve their maximum employment objective.

Ahead of that, today will offer some more clues on how global economic momentum is faring into Q2 as we get the release of the manufacturing PMIs from around the world, before the services and composite numbers come out on Thursday. Overnight we’ve already had some of the numbers out of Asia, with China’s May Caixin manufacturing PMI printing in line with consensus at 52 while Japan’s final manufacturing PMI also printed 0.5pts stronger than the flash reading at 53.0 . Similarly, Australia’s final manufacturing PMI also pointed towards manufacturing strength and printed up +0.5pts from the flash at 60.4. Later on we’ll also get the numbers from Europe and the US, though the flash PMIs we’ve already got were generally strong, with the Euro Area composite PMI at a 3-year high of 56.9, while the US composite PMI was at a record high of 68.1 since the series started in 2009.

Finally on the data front, we’ll get the Euro Area flash CPI release for May later today, which will be in focus given the upside surprise in the US reading. We’ve actually already got the readings for the biggest countries, with Germany reporting a rise in their harmonised index of consumer prices yesterday to +2.4% in May (vs. +2.3% expected), which is the fastest rate of inflation since October 2018. For the Euro Area as a whole, our economists are looking for a +1.8% year-on-year print, which would be the fastest since November 2018.

Another event that could potentially be of interest this week is the meeting of G7 finance ministers in London on Friday into Saturday. They already had a virtual meeting with central bank governors last Friday, and speculation has been increasing that they could be close to reaching an agreement on the corporate taxation of multinationals that would see a global minimum corporate tax imposed. Indeed, Reuters reported that “sources close to Friday’s talks” were saying that a deal on the tax issue could be reached as soon as this week. This could in turn pave the way for it to be signed off by G7 leaders when they gather for their own summit the following week.

Of course, the pandemic will continue to remain in the spotlight over the week ahead as the world continues to grapple with renewed outbreaks. Starting with the good news, the picture at the global level does appear to be brightening of late, with data from John Hopkins University showing that cases rose by +3.66m in the week ending May 28, which is the 4th consecutive weekly decline and down by more than a third compared to 4 weeks ago. Within that a number of countries are seeing major progress, with US cases rising at their slowest level in nearly a year and the numbers in India continuing to fall, albeit from still elevated levels. Nevertheless there remain a number of signs of concern. Here in the UK the number of cases has started to rise again, which comes amidst the spread of the Indian variant, and has led to rising questions as to whether the easing of restrictions on June 21 will be able to go ahead. Separately over the weekend, health officials in Vietnam reported a new variant that combines characteristics of the variants initially discovered in India and the UK, and the country’s health minister said it was more transmissible than previous versions. Meanwhile the surge in cases in Argentina has seen the Copa America football tournament moved to Brazil instead.

Given the UK and the US were both out yesterday, we’ll finish with our usual recap of the week just gone, which saw an incredibly positive performance for markets across all the major asset classes. Risk appetite was strong, supported by further signs of improvement regarding Covid-19, as well as the fact that investors remained relaxed for now about inflation risks. And in turn, this helped equities advance to fresh highs, with the STOXX 600 up +1.02% to a new record (though it’s since come down yesterday), while the S&P 500 was up +1.16% to close less than 1% away from its all-time high in early May. Cyclical sectors led the moves higher along with small-cap stocks, and the Russell 2000 saw an even bigger +2.42% rise over the week.

Otherwise sovereign bonds made gains as well, with yields on 10yr Treasuries down -2.7bps to 1.594%, as part of a decline that was entirely driven by lower real rates (-2.8bps) rather than inflation expectations (+0.1bps). And European sovereign debt had an even more positive performance, with yields on 10-year bunds seeing a -5.3bps decline as part of their largest weekly decline so far this year. Finally we saw another rise in commodity prices after two weeks of decline, with Brent Crude (+4.80%), WTI (+4.31%) and copper prices (+4.04%) all moving higher.