The COVID-19 projections presented at a White House briefing yesterday imagine two scenarios, one utterly fanciful and the other intolerably vague. With “no intervention,” the main graph says, the United States could see 1.5 million to 2.2 million deaths from the disease. But “with intervention,” it says, the number of COVID-19 deaths plummets to somewhere between 100,000 and 240,000.

The “no intervention” scenario is clearly counterfactual, since it ignores all the steps governments, businesses, and individuals already have taken to curtail the spread of COVID-19. The “intervention” scenario assumes continued social distancing of the sort currently recommended by the federal government and enforced by state and local governments. What’s missing? Anything in between, which is the area that really matters for policy makers.

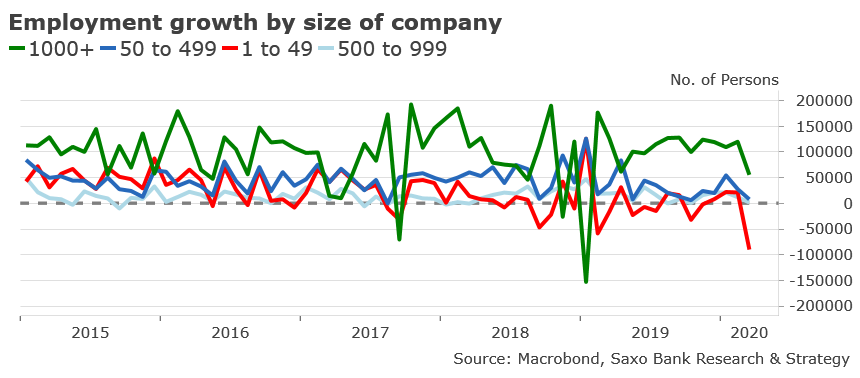

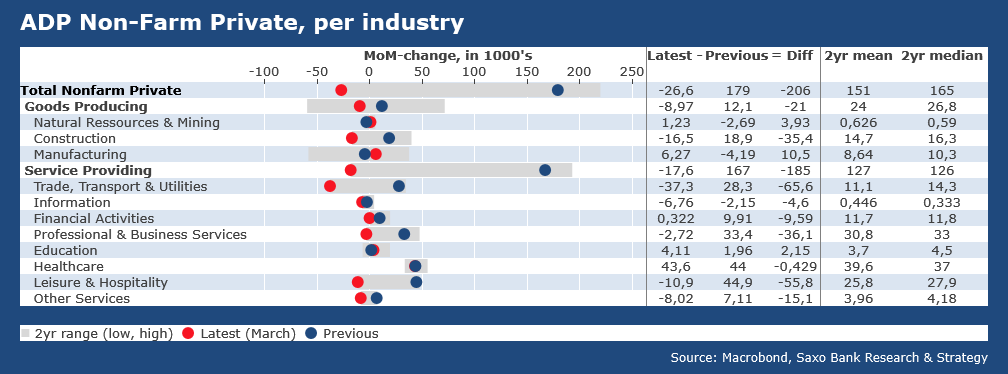

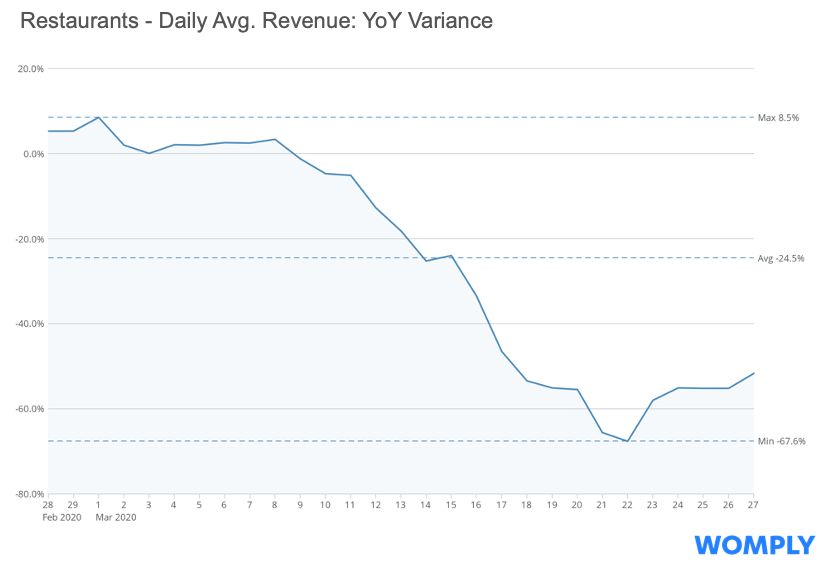

Governments right now are not deciding whether to do nothing or do something. Rather, they are confronting choices about which restrictions should be imposed, where they make sense, and how long they should be maintained. In this context, a simple binary choice between “intervention” and “no intervention” is highly misleading, since it obscures myriad options for confronting the epidemic, including measures more carefully tailored than mass business closures and stay-at-home orders. Sooner or later, those options will have to be weighed, taking into account not only the deaths they might prevent (or allow) but also their economic impact, which under the current approach is already severe and could get much worse.

In addition to presenting a false choice, the Trump administration’s framing relies on assumptions that may prove to be mistaken. One important variable is the number of Americans who will ultimately be infected by the COVID-19 virus. Another is the case fatality rate (CFR).

Because existing data are very limited in the absence of wide testing, we can do little better than guess at those numbers. Yet getting them wrong has profound implications, potentially leading to an overreaction that wrecks the economy while saving relatively few lives or (less likely, given the current political climate) an underreaction that costs many lives and allows hospitals to be overwhelmed by COVID-19 cases.

The White House seems to be relying on projections by the University of Washington’s Institute for Health Metrics and Evaluation (IHME), some of which were included in yesterday’s presentation. The IHME model, which assumes that current policies are maintained until June, predicts that “an estimated 97% of the population of the United States will still be susceptible to the disease” at that point, which implies that 3 percent of Americans, or nearly 10 million people, will have been infected.

If that happens, we can be pretty sure it will not be reflected in the official numbers, which include only confirmed cases. That tally underestimates the true number of infections, because many people with mild to nonexistent symptoms, which are typical of COVID-19, will not seek medical treatment or testing. The extent of that gap, which is by definition unknown, is crucial in estimating the true CFR, which federal public health officials say could be anywhere from 0.1 percent, making COVID-19 about as lethal as the seasonal flu, to 1 percent, making it 10 times as deadly.

The IHME projects that “approximately 81,000 people will die from the virus” by late June if current policies are maintained, which implies a CFR of about 0.8 percent. Projections by the Centers for Disease Control and Prevention (CDC) assume the same CFR, while modeling by researchers at Imperial College in London is based on a slightly higher rate of 0.9 percent. Both of those estimates are near the upper end of the range that U.S. officials consider reasonable.

That does not mean those estimates are wrong, but their accuracy makes a big difference. If the CFR turns out to be 0.5 percent, the number of deaths in the IHME scenario of about 10 million infections by June would be fewer than 50,000 rather than 81,000. A CFR of 0.2 percent (still twice the estimated CFR for the seasonal flu) would reduce the death toll at that point to fewer than 20,000. By comparison, the CDC estimates that influenza has killed 12,000 to 61,000 Americans each year since 2010.

The true CFR matters even more when you consider alternatives to current COVID-19 control measures. It is hard to weigh the risks and benefits of relaxing restrictions—whether in May (as currently envisioned by the Trump administration), in June (as some experts suggest would be possible with wide testing), or even later than that (as assumed in the Imperial College’s “best-case” scenario)—when you don’t know the potential cost in terms of additional deaths, which could number in the thousands, tens of thousands, or hundreds of thousands, depending on your assumptions. One thing we know for sure is that the economic burden on millions of innocent people will be magnified with each passing week.

It seems that people who are pessimistic about the COVID-19 death toll want to have it both ways. When it comes to justifying immediate, sweeping, and sustained control measures, they emphasize how quickly the virus spreads. But high estimates of the virus’s reproduction number (the number of people the average carrier can be expected to infect) imply a bigger gap between confirmed cases and total infections, which in turn implies a lower CFR.

There is also a tension between the short-term goal of avoiding a hospital crisis by reducing transmission of the virus and the longer-term goal of mitigating the impact of COVID-19 through herd immunity, which requires widespread infection. After three months of lockdowns, the IHME model predicts, 97 percent of the population will “still be susceptible to the disease.”

I do not pretend to have the answers. But given the high level of uncertainty, I am skeptical of people who claim they do, and it seems to me that the potentially devastating economic effects of aggressive and prolonged interventions have not received the consideration they deserve. Eventually we will have a clearer picture of the price exacted both by the epidemic and by efforts to fight it. But that knowledge will come too late for it to figure in the decisions politicians are making now.

from Latest – Reason.com https://ift.tt/344ARL2

via IFTTT