Authored by Jeffrey Snider via Alhambra Investment Partners,

Gold is the ultimate hedge, but it is far from perfect. Unlike, say, sovereign bonds there should be no expectation for a negatively correlated price. You can buy a UST or German bund even at negative yields and at least expect the price to rise when things are at their worst. Flight to safety or flight to liquidity.

You can’t with gold. One big reason is its seemingly opposing uses. I got a chance to sit down once again with Erik Townsend of MacroVoices to talk about gold, negative rates, and the lies (of omission) of Janet Yellen, but to further that discussion, particularly the gold parts of it, I’ll add more here.

While a UST will rise in value during a liquidity event partly or even mostly because of its status in repo, the opposite happens in the gold market. Though gold is a collateral of last resort, too, it isn’t as flexible and so it gets dumped whenever deployed that way. Very negative for its price.

So, it ends up in a tug-of-war between what I’ve called collateral gold (negative price) and fear gold (positive price). What ultimately might determine which one wins out is hard to predict, and it’s not a precise and straightforward mix at least inferring ahead of time.

As I wrote last December during the landmine:

Gold may be collateral of last resort but many still treat it as a hedge against everything going wrong – including central banks and their numerous big errors (forecasts). Therefore, even with renewed deflation and market liquidations tied right into collateral problems gold has been moving in that other direction – UP…

In other words, if there wasn’t this fear bid, gold would probably be down huge likely more than it was after April 18. That it’s not and is in fact at multi-month highs is a testament to the level of anxiety permeating global markets right now.

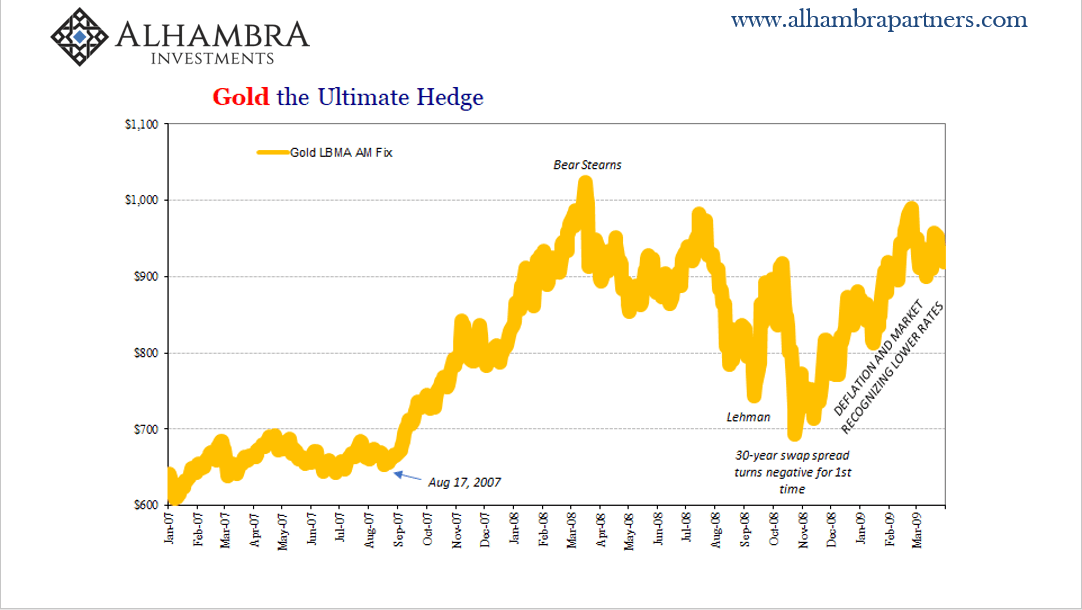

In 2008, for example, collateral gold was unleashed in the immediate aftermath of Bear Stearns – which makes sense given what Bear taught the marketplace about illiquid securities and the need for repo reserves. Gold was down sharply as collateral became very hard to source.

It gained a lot after Lehman because, well, fear. And then it promptly collapsed again when the repo market totally seized up in early and middle October once collateral became the most valuable commodity on the planet.

But then fear won out again late in October 2008 as it became (more) clear that the Global Financial Crisis was one of those historical events that changes things. Among the factors that would be changed was interest rates.

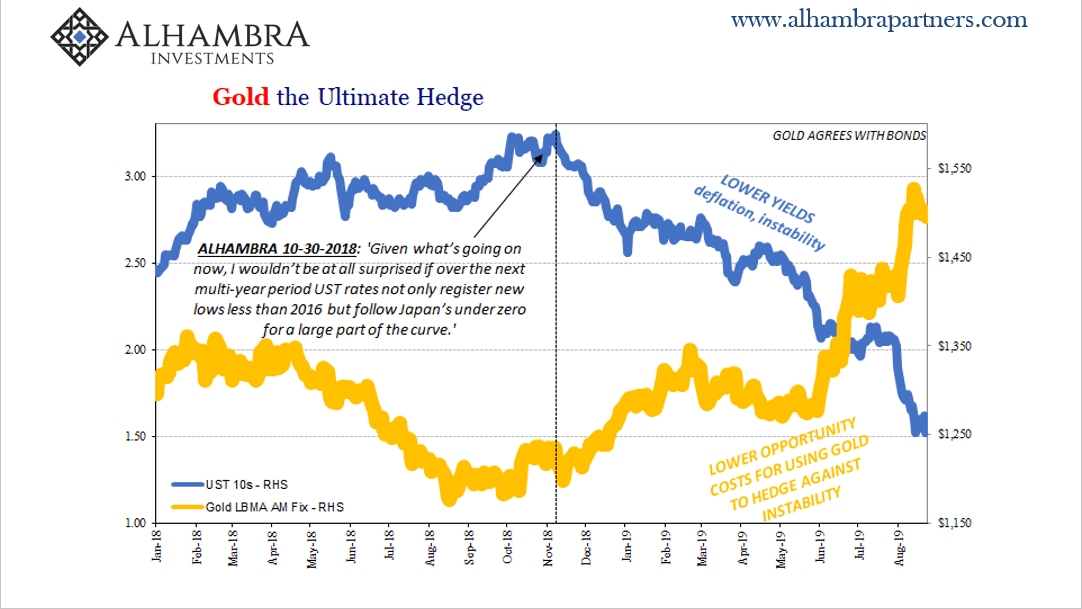

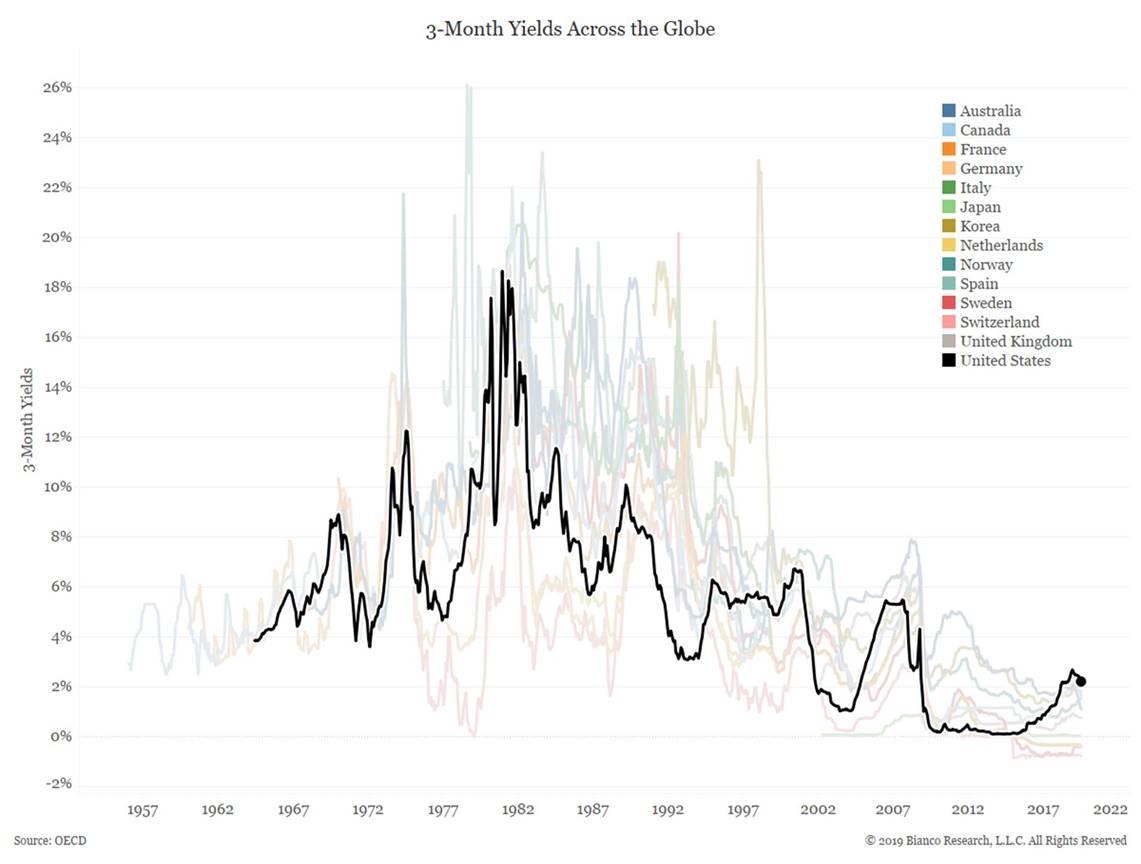

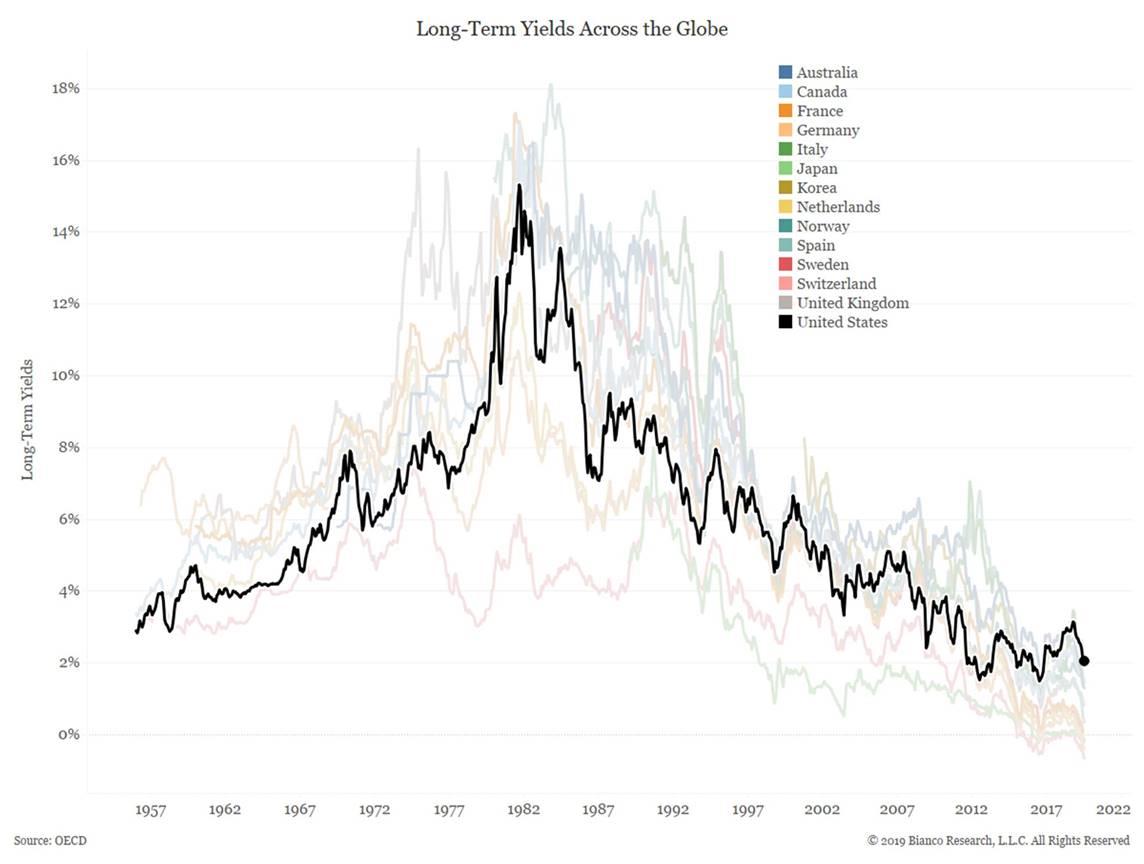

The cost of owning gold as a hedge is determined by the opportunity cost of not holding something else while you do. The metal pays no interest and if the market expects interest rates to rise or stay high, then it is a relatively more expensive and therefore unappealing hedge.

If, however, the market expects otherwise, that interest rates will fall, maybe even to less than zero, gold becomes a much more attractive prospect. Small wonder what happened for the final phase of the panic period where gold was concerned. As market expectations for interest rates (indicated by balance sheet constraints like swap spreads) fell sharply, gold took off even though stocks and other risky assets suffered a third wave of liquidations into early 2009.

Not only do lower rates reduce the opportunity costs for gold, they also signal the often-desperate instability which drives the demand for that kind of severe hedging in the first place. Fear gold and the expectation for, as well as the consequences of, lower rates go together.

All in all, gold performed a whole lot better than many other assets – if you were willing to sit through its severe ups and downs.

This is a different take on how gold is conventionally viewed – seen often as an inflation hedge exclusively. That’s not true, not entirely. It is an instability hedge which includes inflation as one form. As we saw in 2008 and 2009, it is also a deflationary hedge as nothing more than one other form of instability.

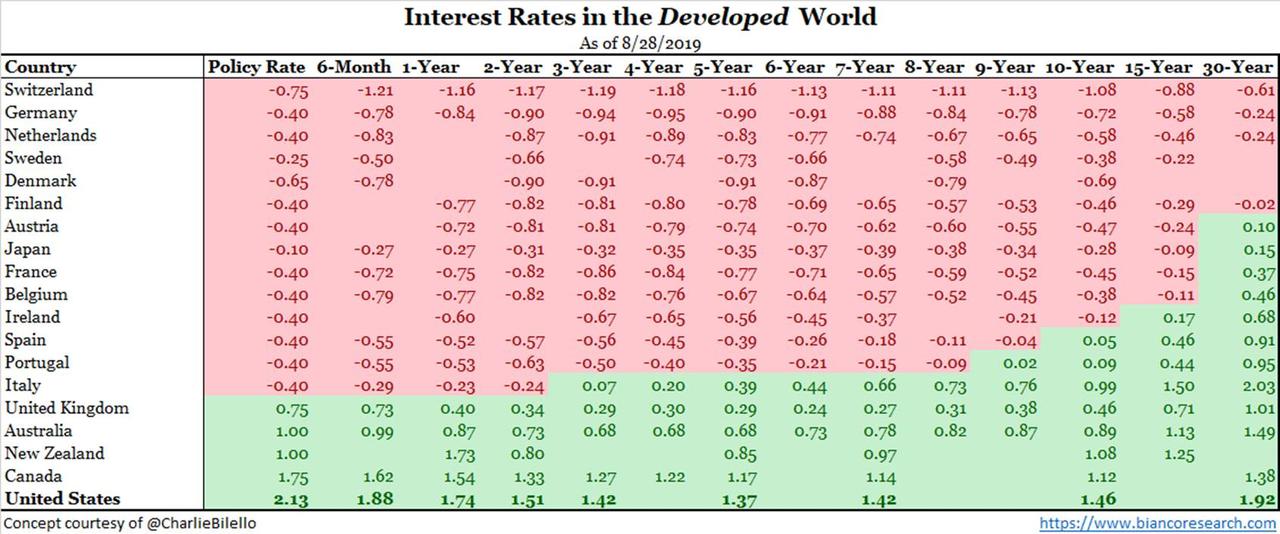

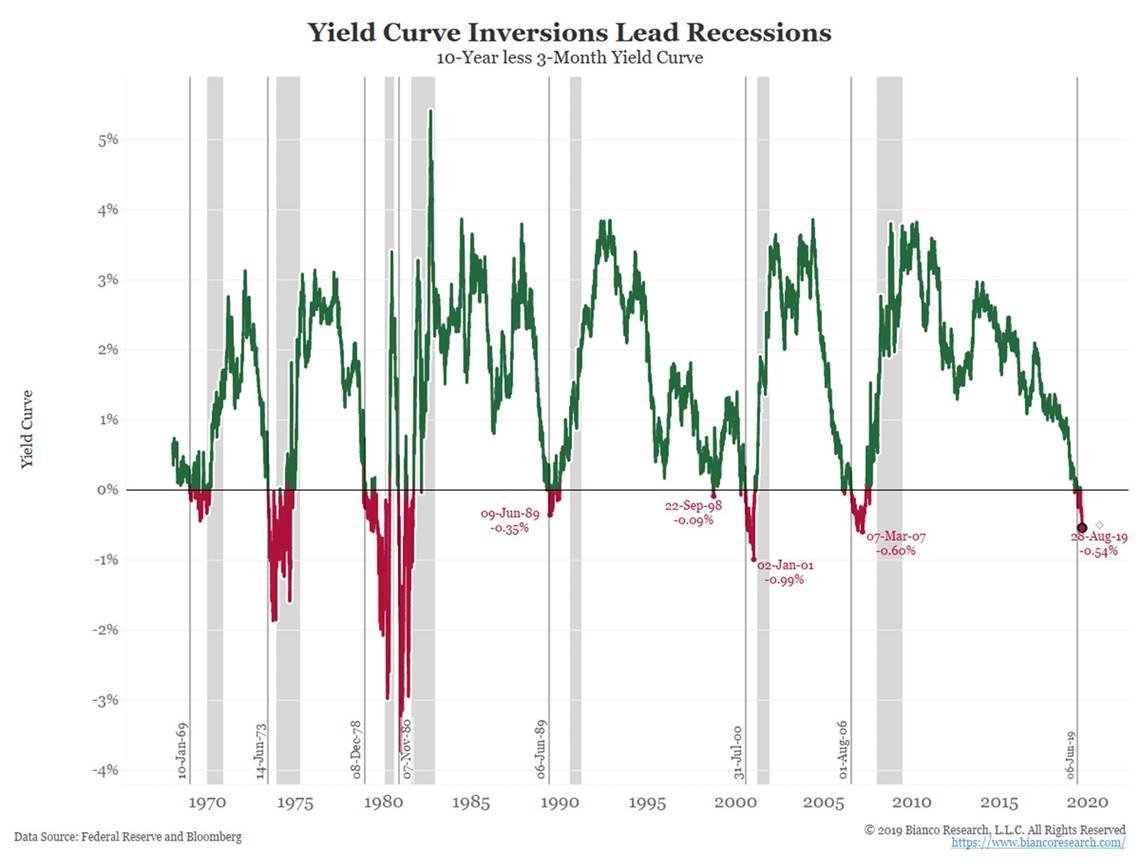

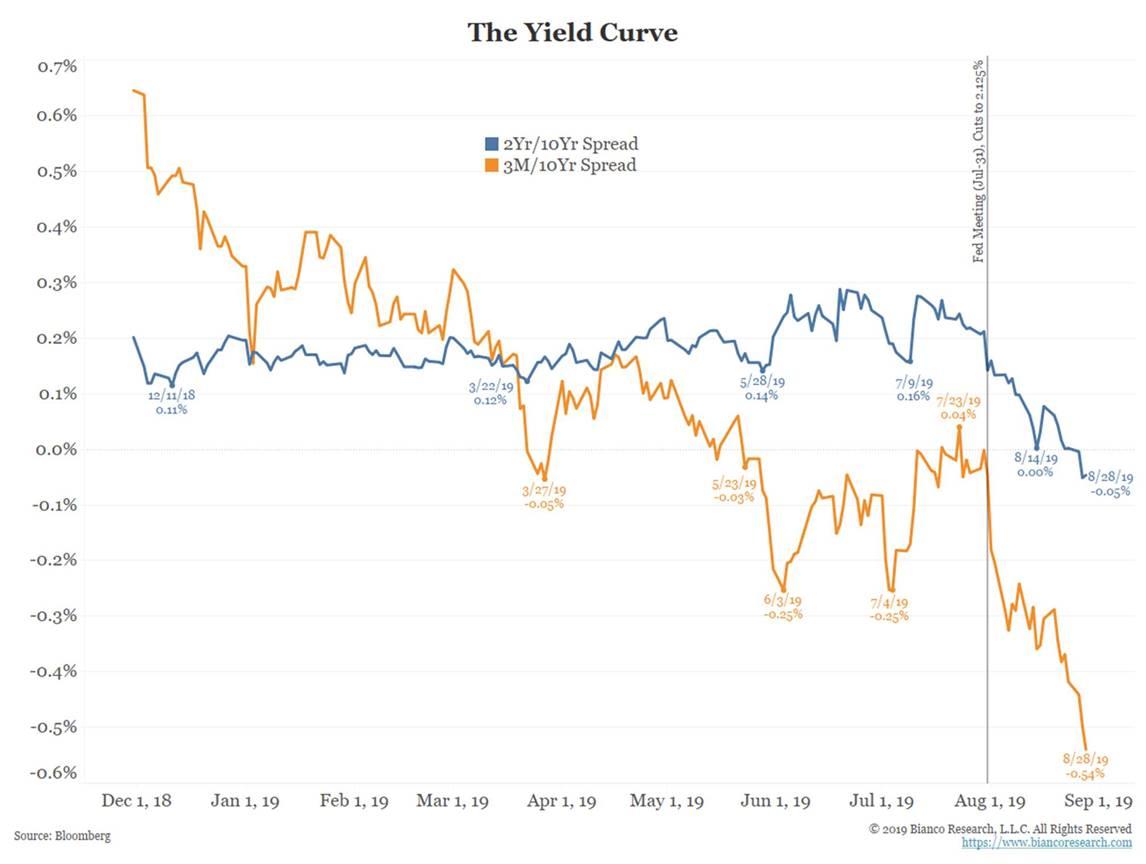

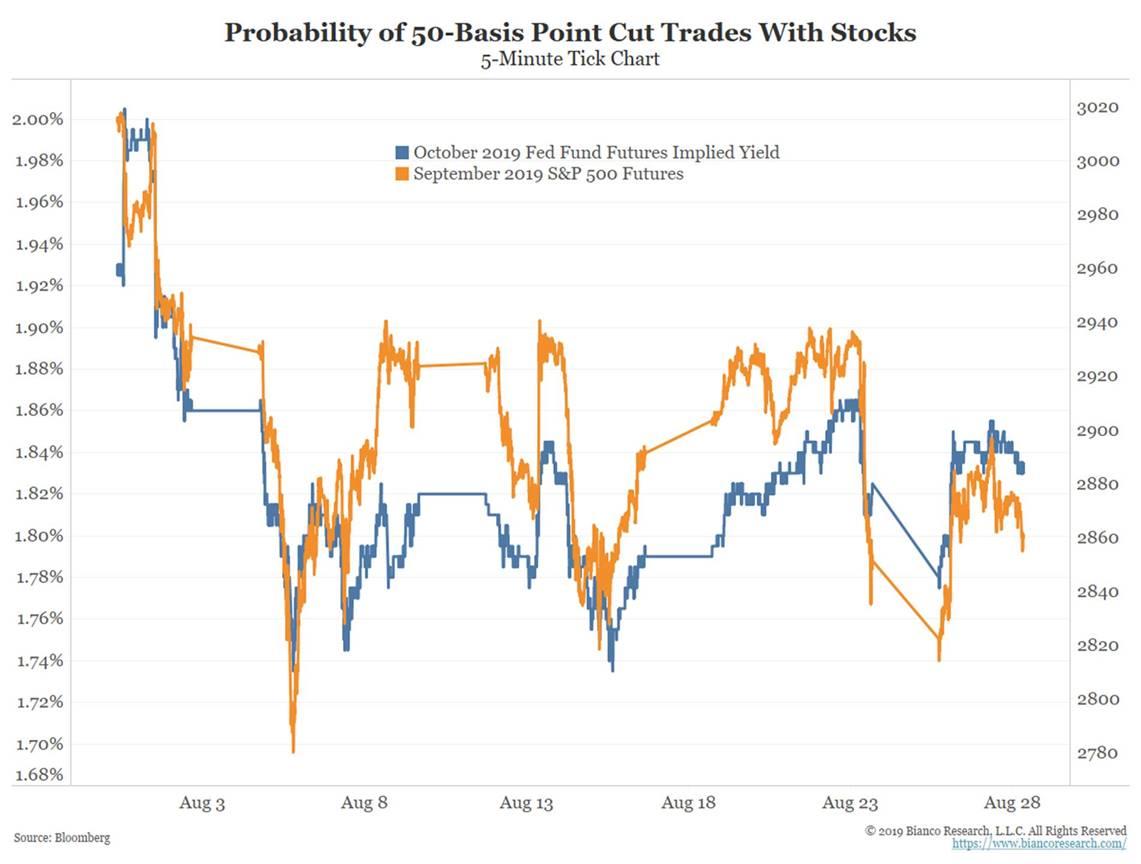

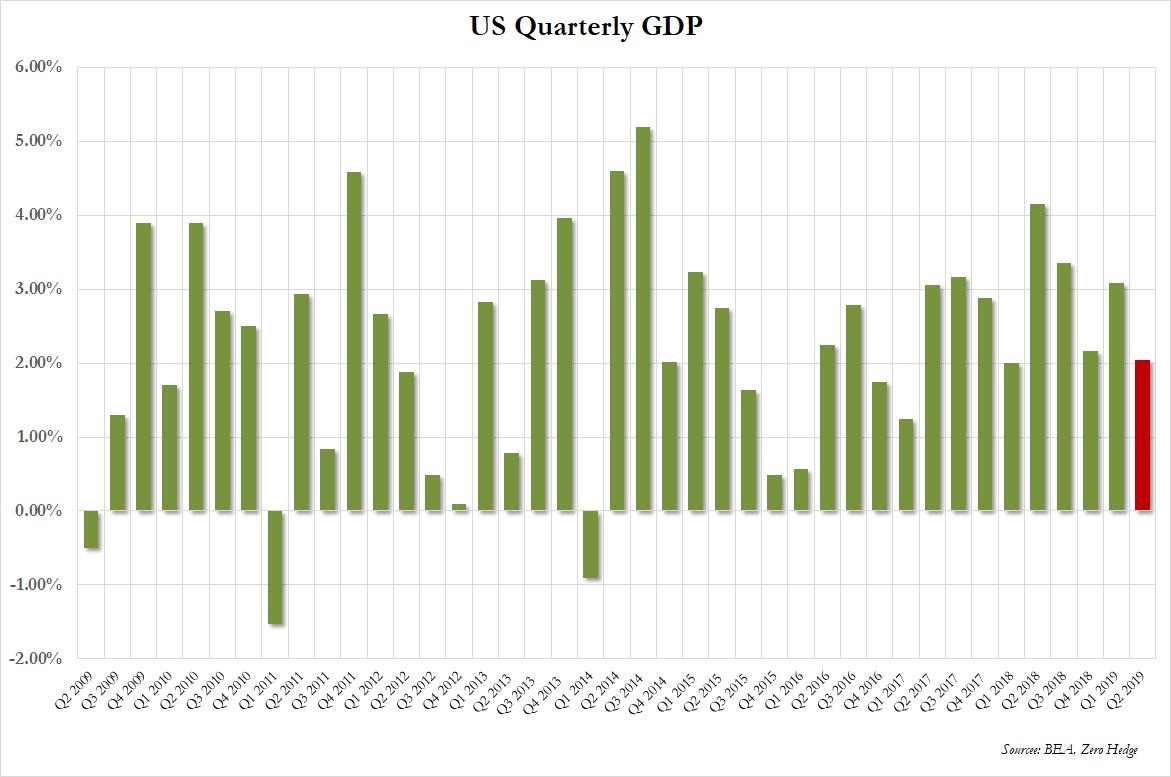

Why has gold had such a tremendously positive run in 2019 despite the lack of inflation? Fear gold is much less expensive to hold if the market also expects interest rates to tumble. And as interest rates do tumble, that merely reinforces the deflationary message as it relates to expected elevated instability and uncertainty. Higher demand and lower perceived cost equal much higher price.

The resulting pricing of fear gold simply reinforces perceptions which have already proliferated throughout bond markets around the world. It is corroborating the general sense of unease and maybe fear, along with the expectation that such instability will continue to lead bond markets to lower interest rates (and maybe that central banks will have no choice but ditch their yield curve denial and get with reality) which will make the gold hedge even less expensive as one.

There are those who still believe a rising gold price is indicative of only inflation. To this other view, what gold in 2019 might mean is a negative event which forces central banks into overdrive. In other words, supposedly, gold is rising in anticipation of the “money printing” that will be unleashed once central bankers are made to realize the seriousness of this situation; they’ll surely overdo it on the “accommodation.”

But if that was so, why aren’t bond market inflation expectations also rising? TIPS and euro-denominated inflation-protected bonds would be trading that way and they aren’t. The bond market sees disinflation even though bond investors, meaning banks buying up balance sheet tools, are very well aware of what central banks are most likely going to be doing at some point.

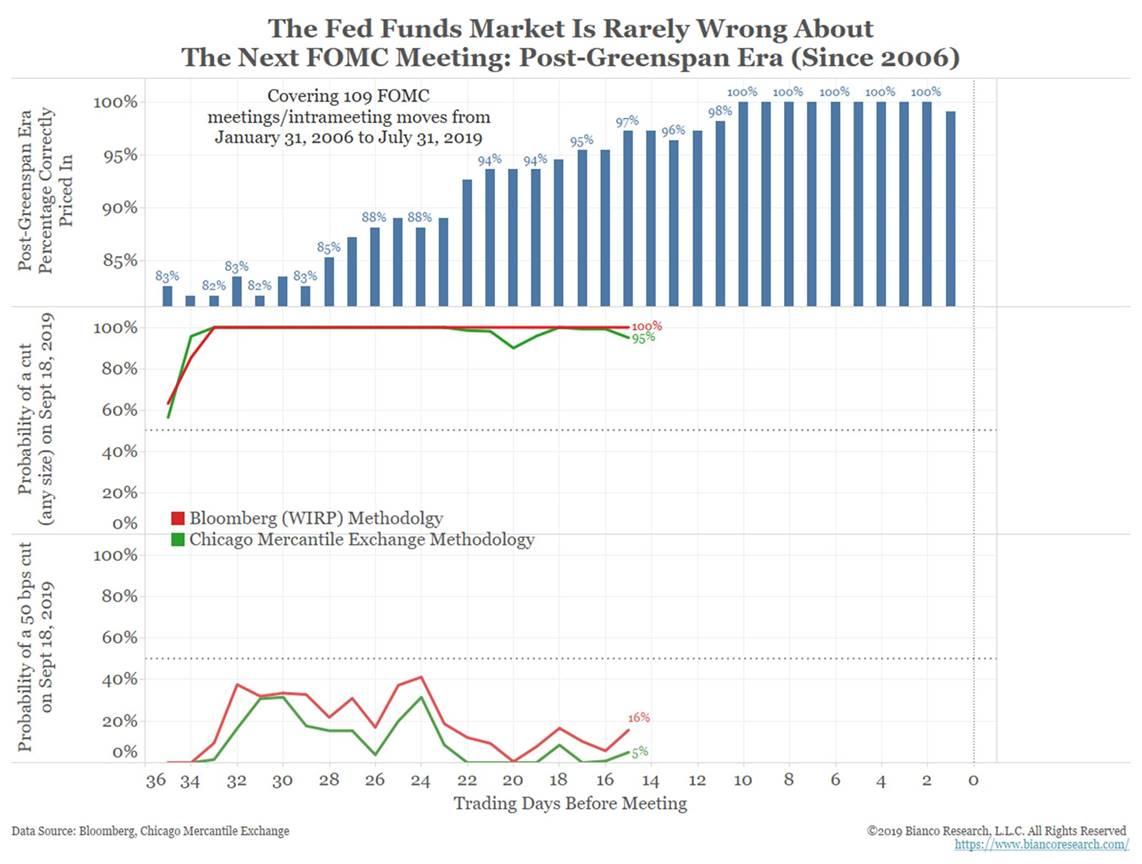

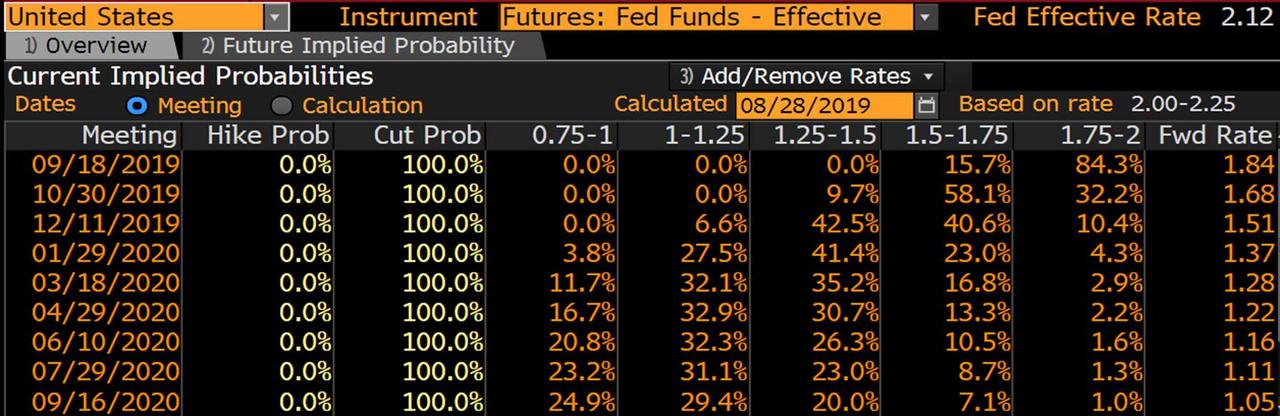

That’s what eurodollar futures are also telling us; that the market is already pricing a serious probability of a return to ZIRP in the US which in all likelihood won’t be the only component; it will almost certainly include a restart of QE if not more. The ECB has already practically confirmed as much on its end.

The reason the bond market isn’t pricing in a resulting burst of inflation is because the banks buying the balance sheet tools in the bond market (and maybe gold, too) know from experience and practice central banks are incapable of creating inflation. That much has been fully established by the last twelve years. The fact that central bankers don’t know it yet further strengthens the case; they’ll try and simply repeat the same failures even if they go full BoJ QQE shock and awe.

For fear gold, it doesn’t matter. Gold demand is against instability, which takes many forms not just inflation. And since the rising dollar tends to also indicate the deflationary form, gold can, has, and does rise at certain times the dollar’s exchange value is also rising.

via ZeroHedge News https://ift.tt/2Zyq1gx Tyler Durden