Rabo: Once Again The Global Architecture Is At Risk Of Collapse… Which Is Why Markets Will Keep Rising

Tyler Durden

Mon, 08/10/2020 – 09:45

By Michael Every of Rabobank

Action, sanctions, action,…sanctions

The US Congressional stand-off between Democrats and Republicans over a new stimulus bill was temporarily resolved in controversial fashion by President Trump on Saturday via a series of executive orders which: extend unemployment benefits for two months at a level of USD300 per week, down from USD600, with an additional USD100 top up possible from states by tapping FEMA funding; extend the moratorium on rental evictions, although critics say the wording is too vague to help; extend zero rates and deferments on student loans; and defer payments of payroll taxes backdated to 1 July, with the explicit promise from Trump that if he is re-elected he will make this permanent.

Obviously this is less stimulus than was previously available, which was probably already not enough to stop the economy from slowing –regardless of the good US employment news on Thursday and Friday– and kicks the can at best. However, it is mathematically better than nothing. Markets get to see action – and, crucially, so do voters…and it’s the president taking it. (Yes, this is an election year, and all actions need to be viewed through that lens.) Of course, it is also highly controversial and, Democrats claim, of dubious constitutionality which may be challenged in court. Objectively, however, the measures don’t seem to be any more of a stretch than ones previously taken by the Democrats when in office. It does seem that the door is opening for the White House to dip into the huge Treasury balance it has on hand to keep kicking that can until 3 November.

Meanwhile, if Trump vs. Biden is the lens for most market actions, the other is still the US vs. China. Friday saw the US impose sanctions on Hong Kong CEO Carrie Lam as well as senior members of the Hong Kong government. Markets didn’t like this, presuming as usual that no such boats would be rocked. Indeed, the Hong Kong Autonomy Act (HKAA) allowed Trump far longer to make this decision, and there had been whispers, always wrong in my view, that only small-fry would be targeted rather than the head of government. For the bulls, the new “She’ll be right” mantra is that no *banks* were named and, as China has officially stated, this US action is both an egregious insult and ultimately meaningless.

Yet as the Financial Times’ Simon Rabinovitch tweeted over the weekend, quoting an unnamed executive from the Chinese unit of a major European bank:

“…the impact will begin to be felt on Monday morning. He variously described all officials on the list as “toxic” and as “pariahs” for all foreign banks, not just US banks, who deal with them…his view is that major Chinese banks, afraid of trouble with the US, would themselves comply with the sanctions.”

Indeed, as has been underlined before, the HKAA starts with individuals and then automatically moves to banks, and to the USD. So she won’t be right on this glide path.

Then today anti-Beijing Hong Kong press billionaire Jimmy Lai and his sons were arrested for “collusion with a foreign country, uttering seditious words, and conspiracy to defraud,” according to press reports of the words of an arresting officer. The HQ of Lai’s media empire, the newspaper HK Apple Daily, was also raided by dozens of police, all journalists made to show their IDs, and crates of evidence taken away.

Obviously, this does not help sell Hong Kong as an international media center any more than US sanctions on its government help to sell it as an international banking centre.

Moreover, what are the odds the US escalates sanctions in response to China’s reply to Friday’s action? Be assured if there is one thing feuding Democrats and Republicans have in common it will be anger at what China has just done.

So risk on for Trump’s actions, or risk off for China’s? What is actually happening seems to bear very little relation to what markets do nowadays.

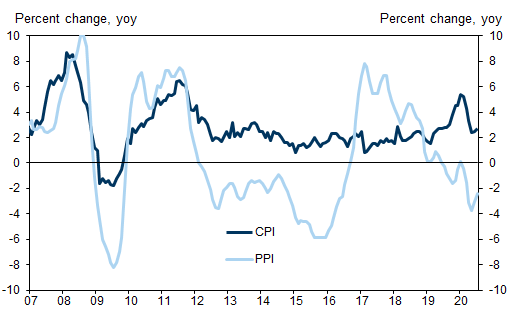

One thing we can say, however, is that with July Chinese CPI at 2.7% y/y, only higher than consensus due to food inflation at 13.2% y/y, with core CPI at the lowest since 2010, and key PPI at -2.4% y/y, deflation is still the name of the game, not inflation; and despite the enormous USD62bn Chinese trade surplus for July, and the lack of outbound tourism, and the assumed gain in valuation in non-USD FX reserves from a weaker USD, China’s FX reserves did not move much in the month from their obligatory “none shall pass!” USD3.1x trillion level. Which means more money flowed out than in even when the USD was being talked about as a busted flush.

Meanwhile, New Zealand, which just celebrated 100 days with no local virus transmission, just saw ANZ business confidence FALL from -31.8 to -42.4 and the business outlook from -8.9 to -17. You can beat Covid-19, but if you are doing it all alone then you are still facing a very hard slog. Wait until nobody turns up for the key summer tourist season and imagine how things will look. Let’s see what the RBNZ has to say when they meet later this week.

And in the northern hemisphere, if it’s Monday it must be another bout of selling in TRY, which was below 7.30 at time of writing. As noted last week, this is a situation which is not going to resolve itself: outside involvement is likely to be needed in terms of foreign exchange. Ironically, today marks the 100th anniversary of the signing of the Treaty of Sevres, which dismantled the Ottoman Empire post-WW1, and which is likely to get far more attention in Turkey than it does in the West –where nobody seems to study history anymore– even as France jostles with Turkey over both Cyprus and Libya. Of course, it is also the date that saw the start of the French mandate in Syria and Lebanon, which coincides with French President Macron’s recent visit to ruined Beirut, a promise that France won’t walk away from it (which will be very expensive, if so), and a Lebanese petition signed by 61,000 people so far demanding the country once again “be placed under a French mandate for the next 10 years.”

Even if that is highly unrealistic, it underlines that once again the global architecture is at risk of collapse as we see realpolitik trump the ‘liberal world order’, huge explosions, warnings of war, political polarization, dubious constitutionality, warnings of election fraud, sanctions, tariffs, and now the arrest of press barons.

You know, the perfect environment for markets to keep rising.

via ZeroHedge News https://ift.tt/2DtNIOl Tyler Durden