Morgan Stanley Warns “Market Ripe For A Drawdown” As “Risk/Reward Has Deteriorated Materially”

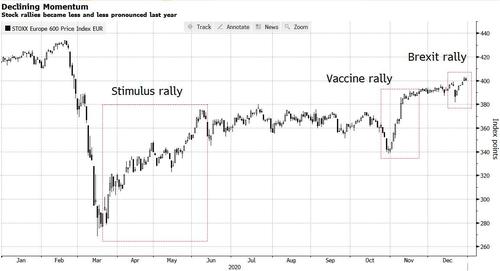

For much of November and early December (recall “Stocks are Overbought And Frothy” Warns Wall Street’s Most Accurate Analyst“), Morgan Stanley’s chief US equity strategist, Michael Wilson, repeatedly warned that stocks are poised for an (at least) 10% correction around year-end, before resuming their bullish trek higher (albeit under a different leadership as growth stocks are shunned in favor of value names). Well, the end of 2020 came and went and stocks pushed ever higher without a second thought, making a mockery of all predictions of imminent corrections.

So now that we are in the new 2021, has Wilson thrown in the towel on his imminent bearishness and has he joined the army of Wall Street strategists who see nothing but smooth sailing ahead?

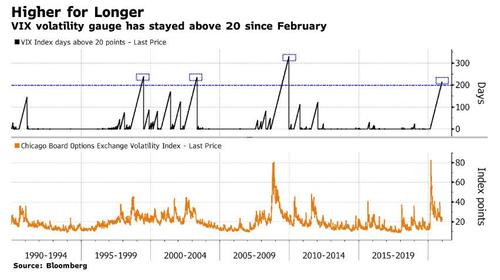

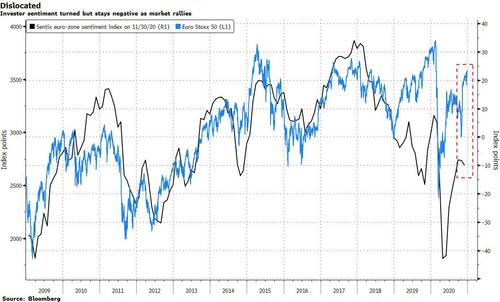

Not at all: in fact, according to his first US Equity Strategy research note for 2021, the strategist warns that “extreme optimism and/or high valuations” has persisted, and while they are neither necessary nor sufficient conditions for a meaningful equity market correction, he must acknowledge “that the “risk reward” of the US equity market has deteriorated materially and the market is ripe for a drawdown.” As potential catalysts for said correction he lists the Georgia Senate seat run-off election, softer guidance than expected during 4Q earnings season, and some kind of intervention by regulators and/or the Fed to quash the exuberance in crypto-currencies, while “exhaustion and positioning will do the rest.” To wit:

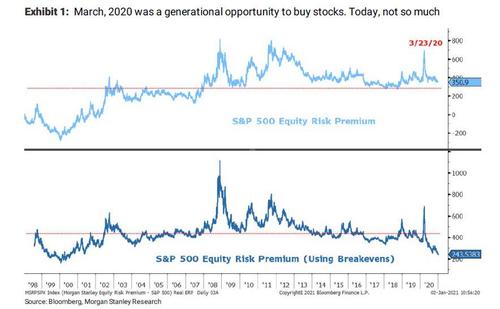

Unlike humans, financial markets don’t have feelings. Instead, they look ahead and discount what humans often can’t see or even imagine. In fact, 2020 may go down as one of the best examples on record of such vision. In late February, markets quickly discounted the end of the cycle, with many stocks falling 50% or more in a month. Then, just as quickly, markets began to discount what would be the fastest recovery on record. The “risk/reward” of investing is always greatest when fear is highest because valuation is cheapest. 2020 was textbook in that regard with March offering a generational opportunity to buy stocks.

The setup couldn’t be more different today. Optimism is high because the recovery is now visible to all and prices have appropriated adjusted. The only fear now is about missing out.

And while Wilson concedes that “extreme optimism and/or high valuations are necessary but insufficient conditions for a meaningful equity market correction” he acknowledges “that the “risk reward” of the US equity market has deteriorated materially and the market is ripe for a drawdown. Potential catalysts could include the Georgia Senate seat run-off election, softer guidance than expected during 4Q earnings season, and some kind of intervention by regulators and/or the Fed to quash the exuberance in crypto-currencies. Exhaustion and positioning will do the rest.”

But wait, there’s more.

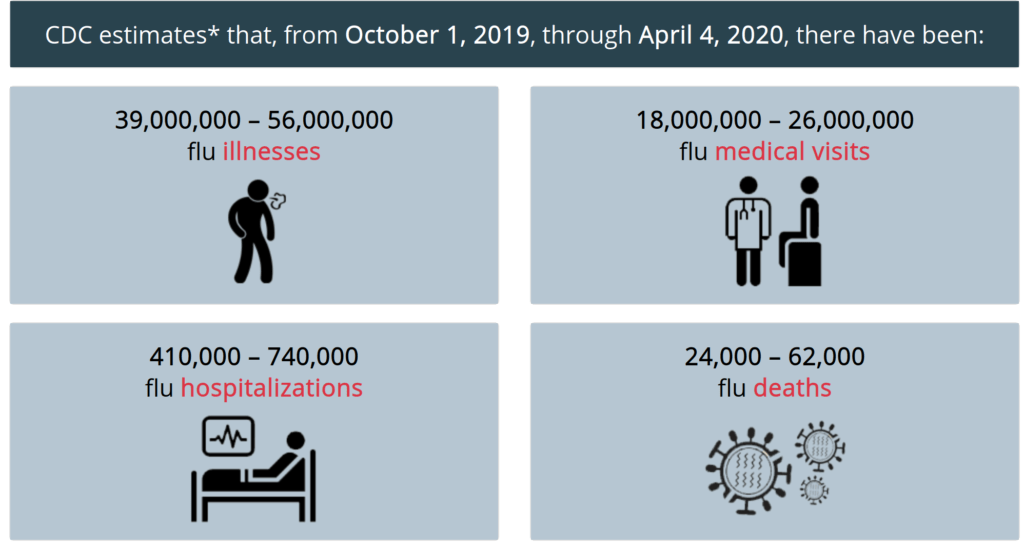

Reminding clients that one year ago he suggested that a recession was likely to arrive in the next 12 months because the end-of-cycle conditions were vulnerable to a shock, the actual outcome – and one which Morgan Stanley did not expect – was a global pandemic which served as the shock in question, “but the public health nature of it almost ensured a more aggressive transition to fiscal policy than even what we had been expecting.“

Taking this a step further, Wilson writes that “one could argue we have officially moved into what was first described by Nobel winning economist Milton Friedman in 1969 and subsequently by former Federal Reserve Chair Ben Bernanke in 2002 as “helicopter money.”

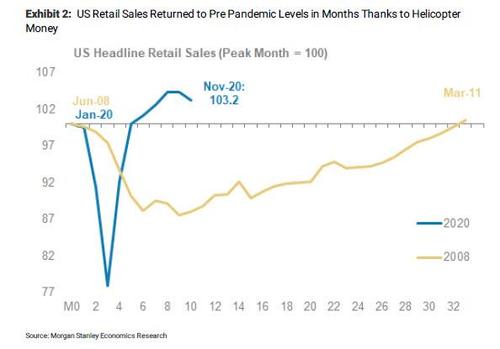

In short, as the MS strategist describes it, the new regime is defined by the Fed using its balance sheet to print money and send it directly to consumers and companies who will spend it in the real economy. This is very different than the Quantitative Easing programs used after the financial crisis, which simply shored up damaged consumer and bank balance sheets.

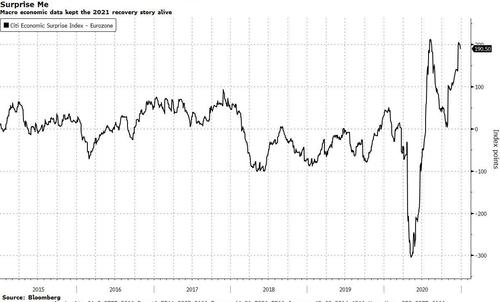

In other words, the money-printing then was simply filling a hole left by the crisis. This time around, money is creating newfound spending that has led to the fastest economic recovery on record (Exhibit 2).

Taking this another step further, the results of the recent election and the announcement that Janet Yellen will be appointed as Treasury Secretary suggest that we are likely to see more political support for Modern Monetary Theory (MMT) policies and specific programs like Universal Basic Income (UBI). Furthermore, Wilson believes that “the public may demand a QE for the people this time.”

Ominously, what this means to the bank which recently surpassed Goldman in total trading revenues “is that the Fed may no longer be in control of the velocity of money and that is exactly the kind of sea change that can lead to unexpected outcomes in the financial markets.“

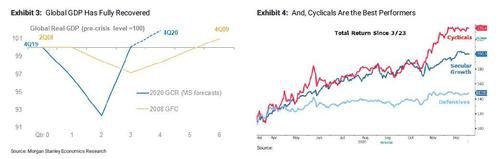

Of course, so far we have only seen the benefits from this nascent explosion in helicopter money, with a surge in asset prices tied to accelerating economic growth (i.e. stocks), especially cyclically oriented equities

Yet while almost all stocks have done well since the market lows in March, ‘new leadership is emerging’ according to Wilson. This is natural after a recession, particularly one that was triggered by a health crisis and led to a generational shift from monetary to fiscal policy dominance.

These new areas of leadership line up with what we have been recommending and allocating to since March—small caps, consumer discretionary, materials, financials, cyclical tech like semiconductors and hardware and industrial stocks.

Yet while all of the above may explain how we ended up here, what does it mean for the future? Looking ahead, the question for investors should center around the unexpected consequences of this policy change and what it could mean for asset prices going forward, according to Morgan Stanley.

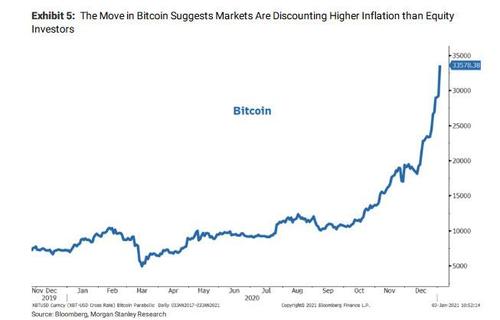

Wilson writes that in his view, “the big surprise of 2021 could be higher inflation than many, including the Fed, expect.” And while he notes that currently the consensus is expecting a gradual and orderly increase in prices as the economy continues to recover, the move in asset prices like Bitcoin suggest markets are starting to think this adjustment may not be so gradual or orderly.

Needless to say, Wilson agrees with this troubling outlook, and explains that “with global GDP output already back to pre-pandemic levels and the economy not yet even close to fully reopened, the risk for more acute price spikes is greater than appreciated.” He then cautions that that risk is likely to be in areas of the economy where supply may have been destroyed and ill-prepared for what could be a surge in demand later this year—e.g. restaurants, travel and other consumer/business related services. As such, while the best inflation hedges are stocks and commodities in the intermediate term, “inflation can be kryptonite for longer duration bonds” – and stocks – “which would have a short term negative impact on valuations for all stocks should that adjustment happen abruptly.”

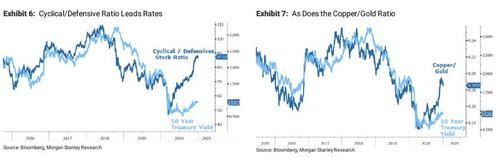

Finally, as Wilson peruses the financial markets today, he can’t help but notice one major outlier to the constructive economic story line that has now been adopted by most investors: long-term bonds/interest rates: “No other asset in the world is as mispriced for even the modest increase in growth/inflation that is expected. Based on some simple relationships with stocks, commodities and economic growth projections, the 10-year US Treasury yield appears to be at least 100 basis points, or 1%, too low.”

According to Wilson, this should be the most crucial consideration for investors because every asset in the world is dependent on the 10-year US Treasury yield. It is the pricing mechanism for all long-duration financial and real assets—equities, credit, real estate and commodities. In other words, while better economic growth positively affects the value of these assets, low long-term Treasury yields play just as big of a role, if not bigger.

Quantifying the impact of such a move, and using the S&P 500 Index as an example, Wilson writes that an increase of 1% in the 10-year US Treasury yield from current levels would lead to an 18% decrease in the price/earnings multiple (P/E), all else equal. For the Nasdaq 100 Index, such a rise would equate to a 22.5% decline in the P/E according to the MS strategist who writes that “while such an abrupt increase in interest rates is unlikely, we wouldn’t rule it out.”

The point here is that asset prices are looking rich at the moment given the upside risk to interest rates and very low chance they fall further in the absence of some bad economic developments.

As Wilson concludes, “while there is still very good potential upside for many of the stocks we like in this new bull market, one should be prepared for an adjustment in valuations lower as interest rates catch up to what other asset markets have been saying for months. If this adjustment is gradual, then stocks and other assets will likely go sideways for a while until earnings eventually take them higher. However, should that adjustment in rates occur more rapidly, all stock prices will adjust lower, perhaps sharply, rather than just go sideways. We suspect such an adjustment is more likely than most if we are right about growth and inflation surprising further on the upside.“

To this we would add just one caveat: if stocks indeed plunge, all of the freshly released money will go back into – where else – Treasurys, which will promptly send yields much lower, which will ease any fears of a sharp and violent repricing higher in yields, and so on. In short: while the bearish case is one of a sudden jerk higher in yields and lower in stocks, the reality is that such a move would not be linear but would take place in a staggered staccato as investors bounce from stocks to bonds and back again.

Finally, don’t forget the Fed which will immediately implement its plunge protection powers should yields truly surge and force stocks to crash. In fact, some would welcome such a development as an outsized risk asset crash would merely force the Fed to cross the final Rubicon and after it started buying corporate bonds last March, Powell (and Yellen) would finally join the BOJ and SNB in openly “monetizing” stocks in the open market.

Tyler Durden

Mon, 01/04/2021 – 13:05

via ZeroHedge News https://ift.tt/3rSaDHc Tyler Durden