Surging European PMIs Bolster Recovery Narrative

Tyler Durden

Tue, 06/23/2020 – 07:41

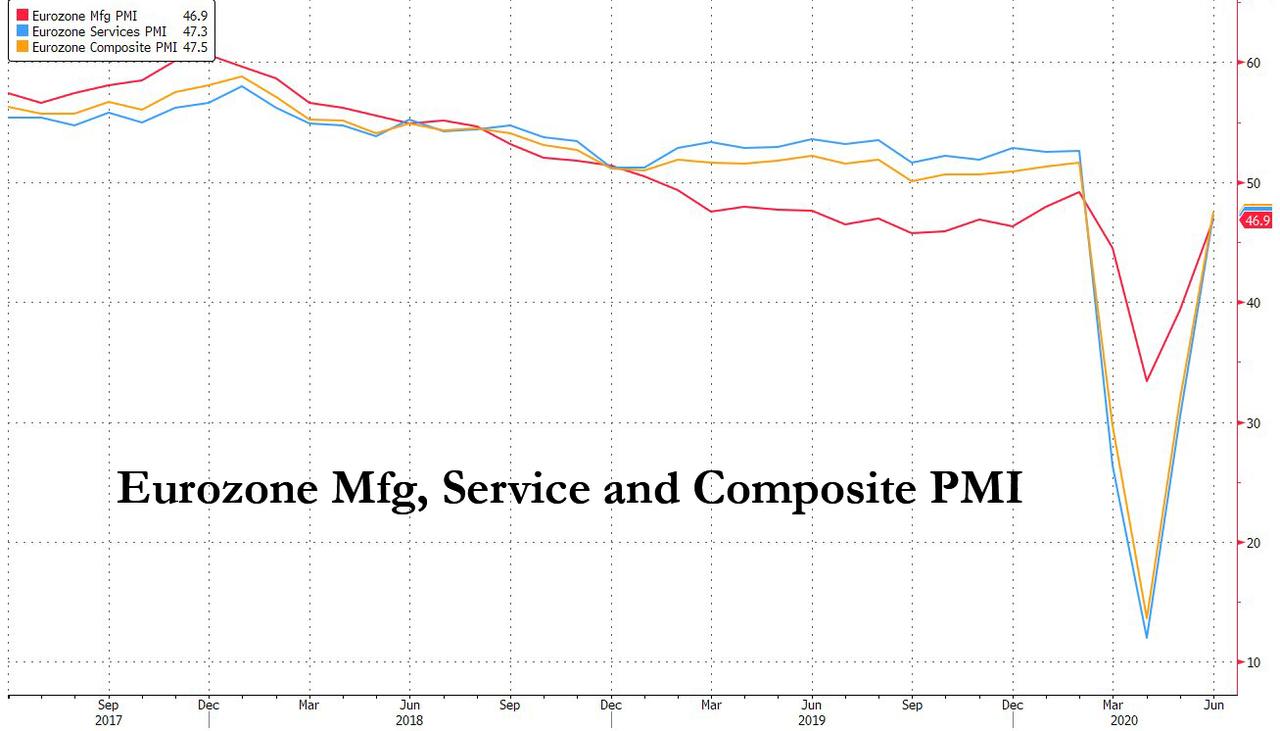

The economic recovery narrative got a solid boost this morning following the latest Eurozone flash PMIs which surged for a second month, beating expectations across the board.

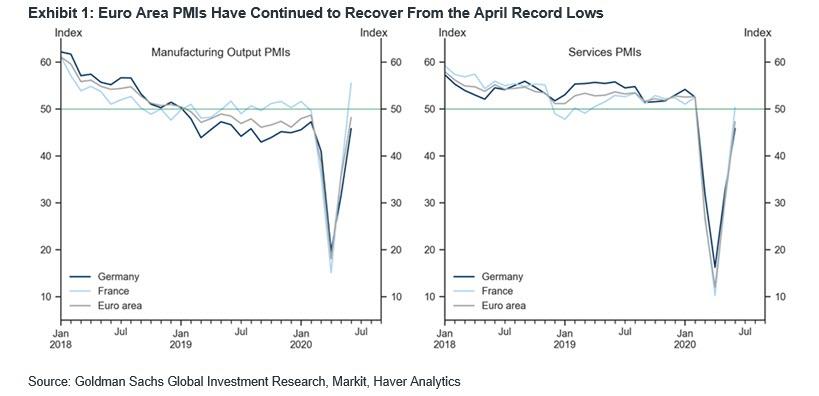

After a record monthly improvement in May, the Euro area composite PMI rebounded further by 15.6pt to 47.5 in June—above expectations—consistent with a further easing of lockdown measures and the improvements in high-frequency activity indicators.

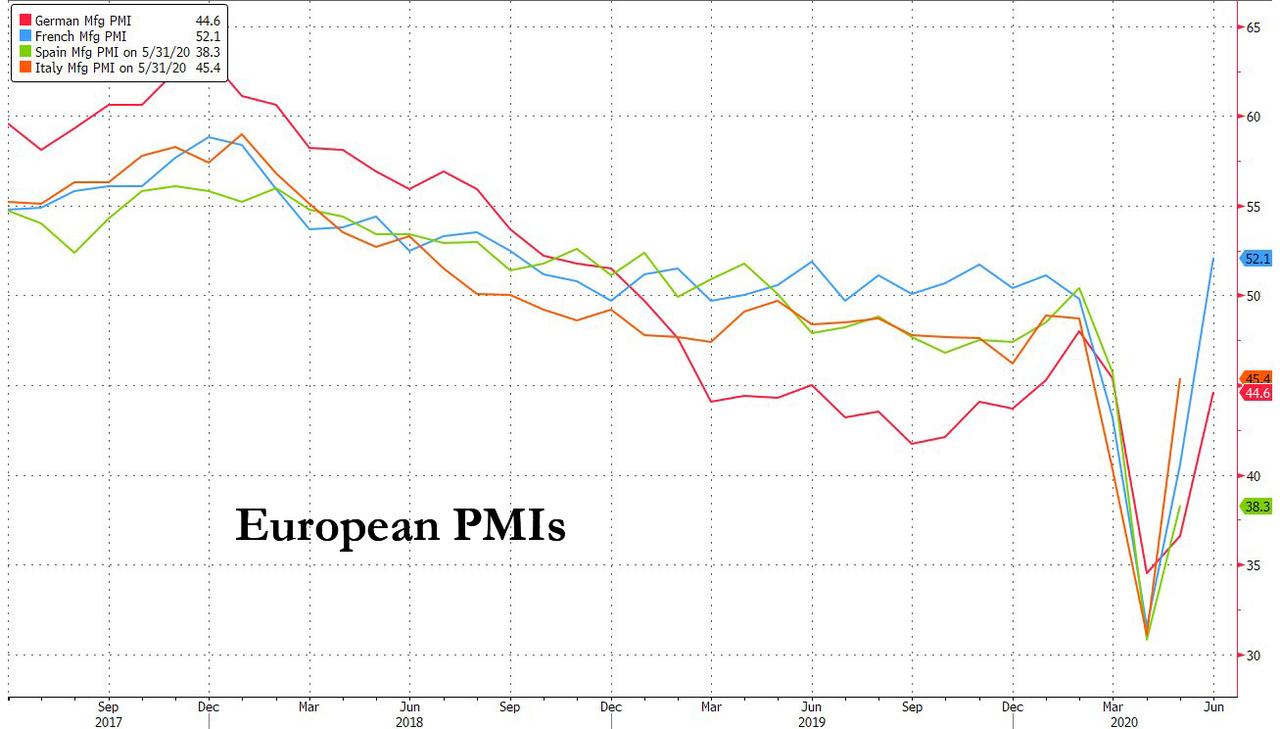

The recovery was broad-based across sectors but slightly stronger in the services PMI. The German and French composite PMIs also registered larger-than-expected increases, especially the latter, which would be consistent with stronger sequential growth but from a more depressed base.

Here are the key numbers (the responses were collected between 12 and 22 June)

- Euro Area Composite PMI (June, Flash): 47.5, beat consensus 43.0, last 31.9.

- Euro Area Manufacturing PMI (June, Flash) 46.9: beat consensus 45.0, last 39.4.

- Euro Area Services PMI (June, Flash): 47.3, beat consensus 41.5, last 30.5.

- Germany Composite PMI (June, Flash): 45.8, beat consensus 44.4, last 32.3.

- France Composite PMI (June, Flash): 51.3, beat consensus 46.8, last 32.1.

Overall, the June PMIs—despite several indices remaining below 50—are indicative of a continued recovery in economic activity across the Euro area given the nature of their empirical relationship with ‘hard’ measures of activity such as GDP.

Key Highlights from Goldman:

1. After a record monthly improvement in May, the Euro area composite PMI rebounded further by 15.6pt to 47.5 in June, above expectations. Around four-fifths of the increase were driven by a sequentially stronger services PMI (up 16.8pt), which has a larger weight in the overall index, with the remaining contribution due to an increase in the manufacturing output subindex (up 12.6pt).

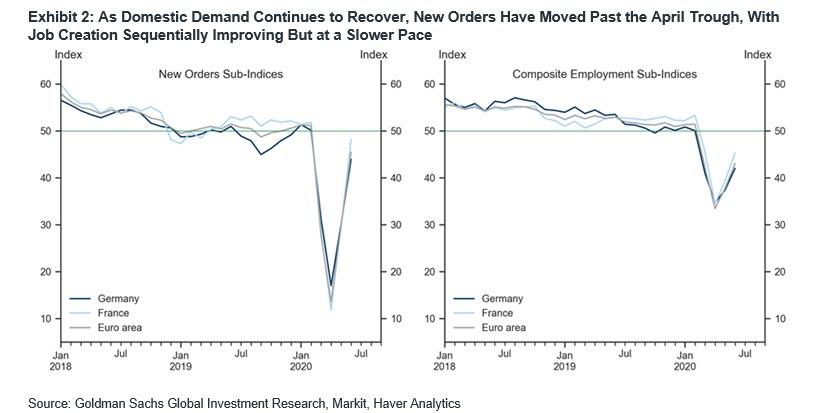

The improvements in the PMIs from May are consistent with a further easing of lockdown measures across the Euro area in June and high-frequency activity indicators, which have continued to improve since May. The rebound in the combined Franco-German composite PMI was only 0.2pt stronger than that in the composite PMI related to the rest of the Euro area, suggesting a notable recovery in the Italian and Spanish PMIs as well. The new orders subindices saw equally sized strong increases on the month across both sectors (up 15.8pt), driven primarily by a continued recovery in domestic demand.

The pace of job creation was sequentially less weak than in June, but saw a smaller improvement than headline activity in either sector. Despite a continued recovery in demand, the subindex measuring suppliers’ delivery times suggests they shortened in June—in normal times, they would have likely lengthened as orders increase—suggesting that factory reopenings and production restarts have continued to alleviate the pressure on supply chains. Expectations of 12-month-ahead output continued to rise from the record April low, but remain below their historical average at the area-wide level, as well as in Germany and France.

2. Although the Euro area PMIs (as well as those in Germany) remain below the expansionary mark of 50, they are nonetheless consistent with a continued recovery in activity. Despite the PMI questionnaire asking about monthly changes in activity, Goldman argues that the empirical evidence suggests that the PMIs are much more informative about growth in activity on a rolling, multi-month basis (such as average growth over the past 3 months, or longer). Therefore, as the area-wide ‘run-rate’ of activity in June remains depressed and its growth contractionary on a sufficiently long rolling, multi-month basis (after the sharp contractions over March and April), the PMI values empirically consistent with that are below 50. June PMI readings above 50 in France—unlike in Germany —are consistent with stronger sequential growth but from a more depressed base.

Overall, the May and June PMIs are indicative of a significant recovery in activity from the April trough across the Euro area. Still, given the uncertainty around mapping the composite PMIs into GDP—with the PMIs omitting significant parts of the economy such as construction, wholesale and retail trade, and non-market services, and having a non-linear relationship with GDP at business cycle extremes—Goldman left its growth forecasts for Q2 unchanged, which embed a significant near-term recovery over May and June.

3. The German composite PMI increased by 13.5pt to 45.8 in June, somewhat above expectations. This reflected similarly sized increases in the manufacturing output subindex (up 14.2pt) and the services PMI (up 13.2pt), with both reaching the same level in June as the composite PMI of 45.8. The increase in the headline manufacturing PMI was smaller (up 7.9pt) as its subcomponents other than output and new orders saw smaller increases. The manufacturing new orders subindex increased much more sharply than in May (up 17.6pt), with a similarly sized increase in new export orders. The sequential monthly improvement in new business in the service sector was also sizeable, albeit slower than in May. That said, the press release noted that “there were reports of coronavirus-related uncertainty continuing to weigh on demand and leading to contract postponements or cancellations”. The improvements in the respective employment subindexes were more moderate than those in headline activity, especially in the manufacturing sector. Suppliers’ delivery times notably shortened further, suggesting that supply chains are being restored after significant impairments due to factory closures.

4. After a 21-point increase in May from the record low in April, the French composite PMI saw a further sharp increase in June, by 19.2pt to 51.3—significantly above expectations. This reflected equally sized increases of 19.2pt in both the manufacturing output and services PMIs. The improvements in the June PMIs are consistent with the significant further easing of lockdown measures in France over June—with all of France now marked as a ‘green zone’—as well as high-frequency activity indicators, which have continued to improve into June. The new orders subindex increased more strongly than in May across both sectors, in contrast to the new export orders subindex, which rose, but to a lesser extent, consistent with a recovery primarily driven by stronger domestic demand. Relatedly, the press release noted that respondents “mentioned fewer orders from the US, China and Europe” due to the COVID-19 pandemic. The employment subindex was stronger than in May, but increased more modestly than headline activity. Suppliers’ delivery times remain abnormally long given the still very subdued levels of activity, indicating remaining impairments to supply chains. As its subcomponents other than output and new orders saw smaller increases, the headline manufacturing index rose by 11.5pt, less than the 18-19pt increases in manufacturing output and new orders.

via ZeroHedge News https://ift.tt/37U77CE Tyler Durden