The Next Leg Down: The Top 10% Are About To Take A Hit

Tyler Durden

Thu, 07/30/2020 – 17:20

Authored by Charles Hugh Smith via OfTwoMinds blog,

No federal bailout or stimulus can reverse these three dynamics, and no amount of legerdemain can replace the spending of the top 10%.

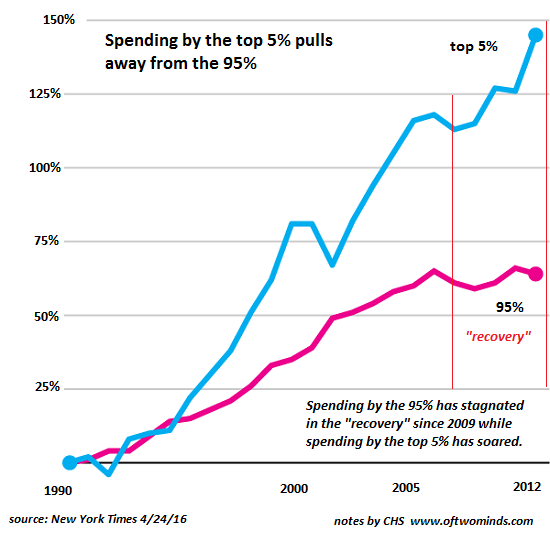

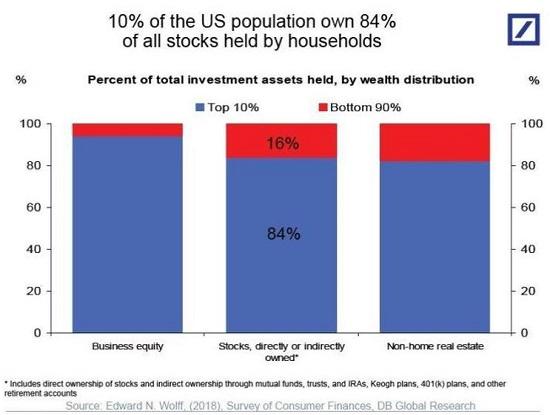

Few of those anxiously seeking a rebound in consumer spending take into account the top 10% of households account for almost 50% of consumption, and that top 10% skews heavily to the older, wealthier top tier whose free-spending ways have been built on the enormous wealth effect as their stocks, bonds and real estate assets have soared in value over the past 12 years.

The top 10% has largely escaped the significant financial hits cutting a swath through the bottom 90%, but that’s about to change. Few of the top 10% have seen their pensions cut, their portfolios of stocks and bonds shredded, their home value in free-fall or their managerial / technocrat position eliminated. Most are watching the financial devastation from the security of owning 85% of the nation’s assets, and from positions in the protected-class with access to federal money, either directly or indirectly.

Three factors could materially suppress the future consumption of those responsible for 50% of all consumer spending.

1. Age-related caution about exposure to the virus. Not only are many of the top 10% older, many of these households are caring for parents in their 70s, 80s or 90s. Given the heightened risks for these demographics, is it really worth it to go into crowds for entertainment? The short answer is no. Furthermore, these older, wealthier households have been there and done that— foregoing cruises, air travel, fine dining, live music, etc. is not that much of a sacrifice, as they’ve enjoyed all these niceties for decades.

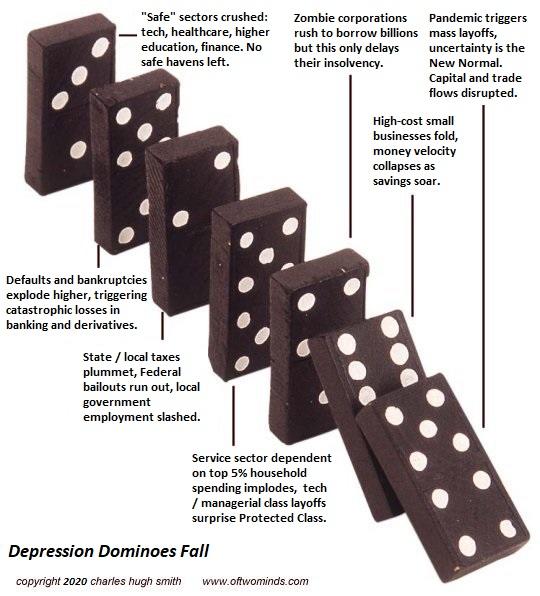

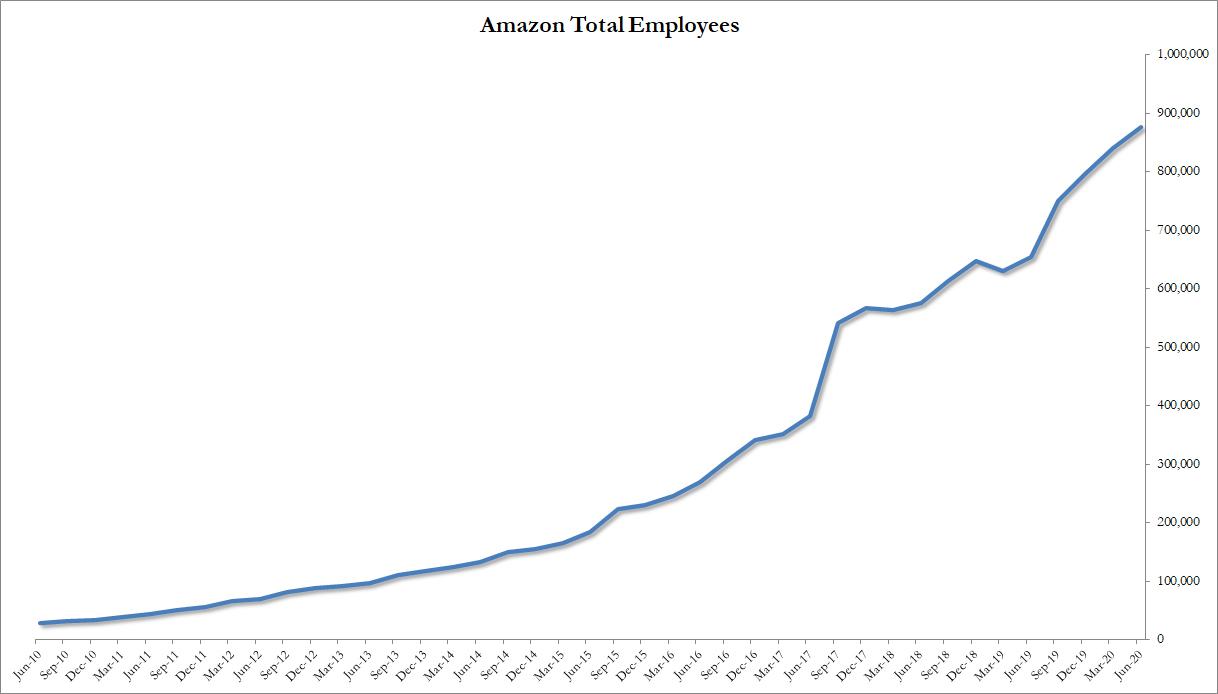

2. As corporate revenues and profits continue sliding, the managerial / tech class will start getting culled. All sorts of positions that looked “essential” before the pandemic are suddenly on the chopping block.

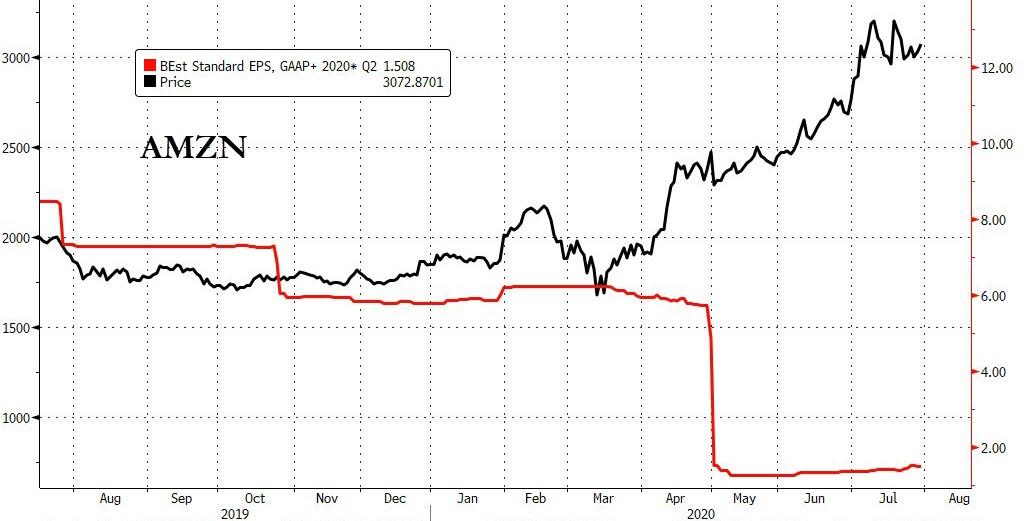

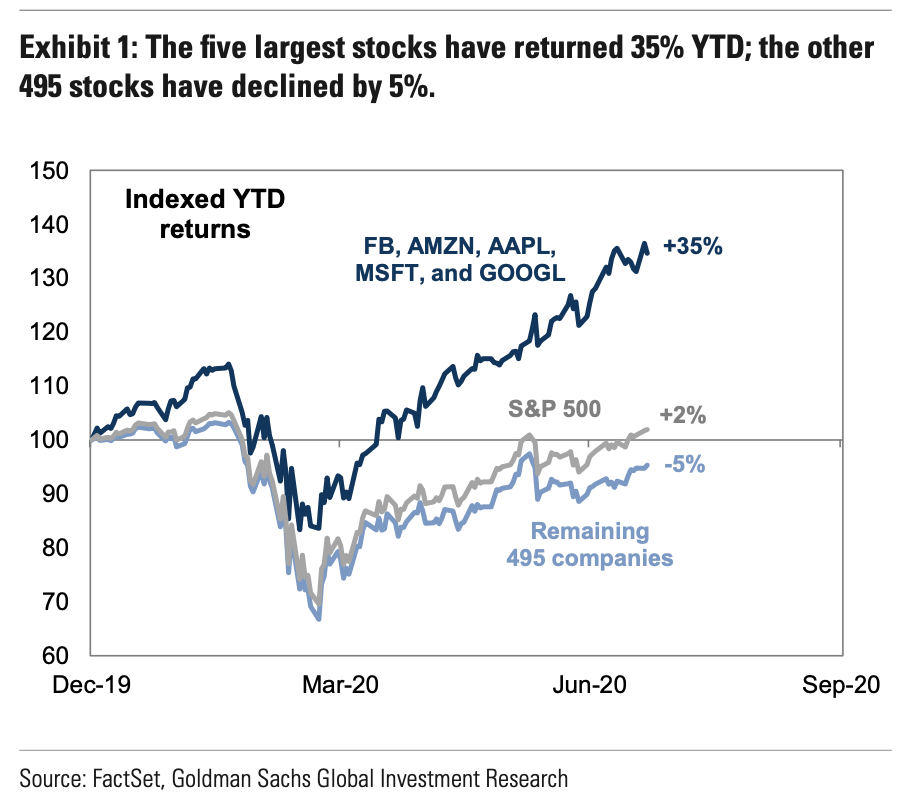

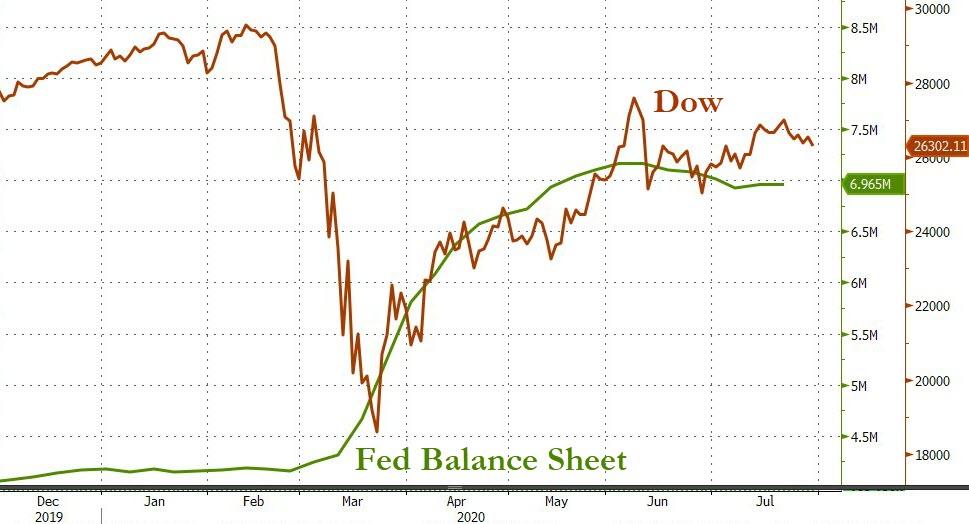

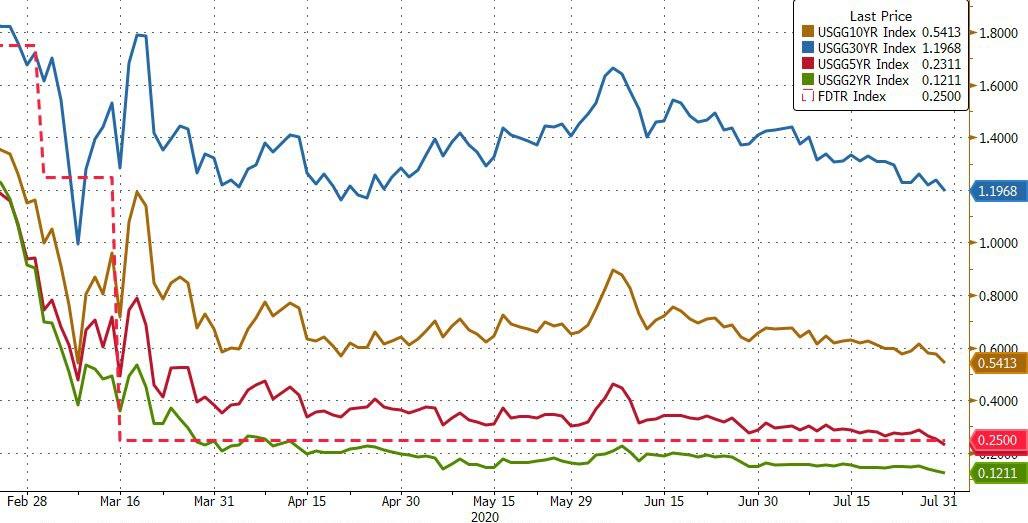

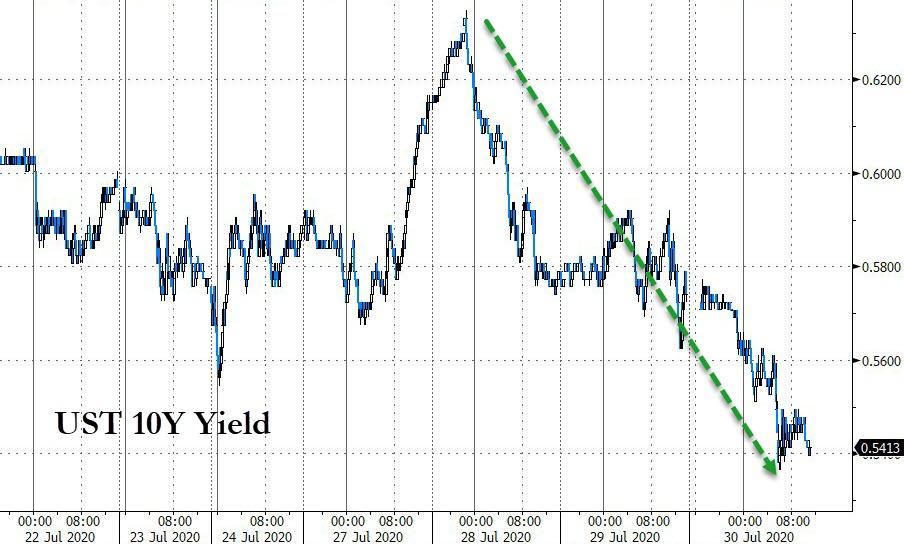

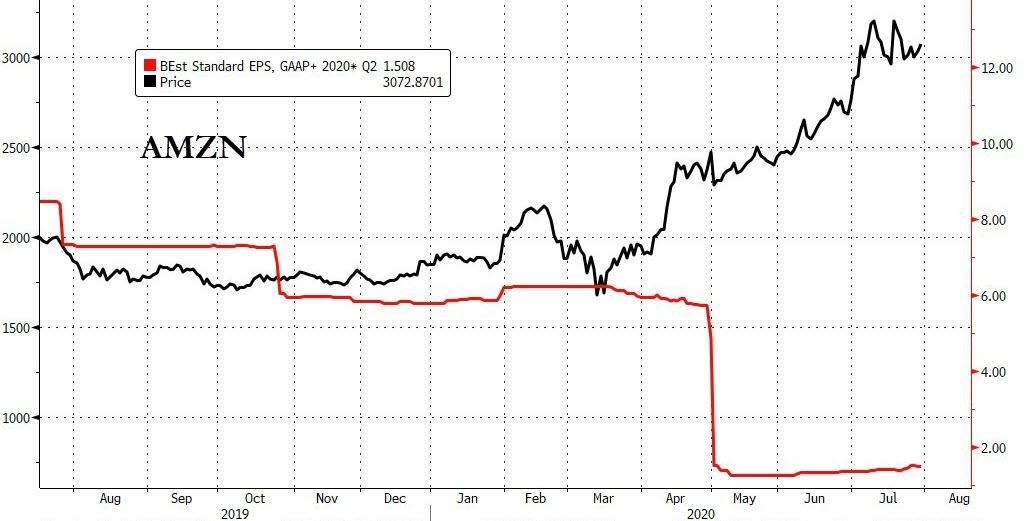

3. The wealth effect is about to reverse as the Everything Bubble finally pops. With the Nasdaq at record highs, bonds rising in value as yields plummet and the real estate market bubbling along on 3% mortgage rates, such a reversal is widely viewed as “impossible.” Of course it is–until it isn’t. All bubbles pop.

All the bright spots of consumption fueled by top 10% spending–rising sales of second homes, RVs, home remodeling, etc.–are based on the incomes and wealth of the top 10% never materially declining. But how realistic is it to reckon a rotten-to-the-core economy dominated by greedy monopolies and cartels and looted by financier skims that is finally in an inevitable free-fall would magically leave the top 10% untouched?

How realistic is it to reckon that the Everything Bubble would magically continue inflating forever when history is conclusive that all bubbles pop?

No federal bailout or stimulus can reverse these three dynamics, and no amount of legerdemain can replace the spending of the top 10%.

* * *

My recent books:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

via ZeroHedge News https://ift.tt/2XbG1CZ Tyler Durden