“It’s not fashionable in progressive circles to talk too much about the debt,” said Democratic presidential candidate Pete Buttigieg at a town hall in New Hampshire this weekend, blaming this on “the way it’s been used as an excuse against investment.

“But if we’re spending more and more on debt service now, it makes it harder to invest in infrastructure and health and safety net that we need right now,” continued Buttigieg, whose past résumé includes a stint as a management consultant in addition to his time in the U.S. military and as the mayor of South Bend, Indiana. “And also this expansion…isn’t going to go on forever.”

Buttigieg said it’s time for Democrats to “get a lot more comfortable owning this issue, because I see what’s happening under this president—a $1 trillion deficit—and his allies in Congress do not care. So we have to do something about it.”

It’s certainly rare for a prominent Democrat to talk about deflating America’s ever-ballooning deficit, especially this election cycle. And good on Buttigieg for calling out Republican hypocrisy on this issue too. (Welcome to the club.)

But Buttigieg offered no specifics on how he would manage to cut debt while still expanding “infrastructure and health and safety net.”

“Asked to back up Buttigieg’s claim to fiscal responsibility, a campaign aide pointed to a recent study by the Progressive Policy Institute that says the tax revenues Buttigieg has proposed to raise would narrowly exceed his new spending,” reports NBC’s Sahil Kapur.

Still, at this point, even a small nod to fiscal responsibility from the 2020 candidates feels like weekend. And Buttigieg is now a top-tier candidate.

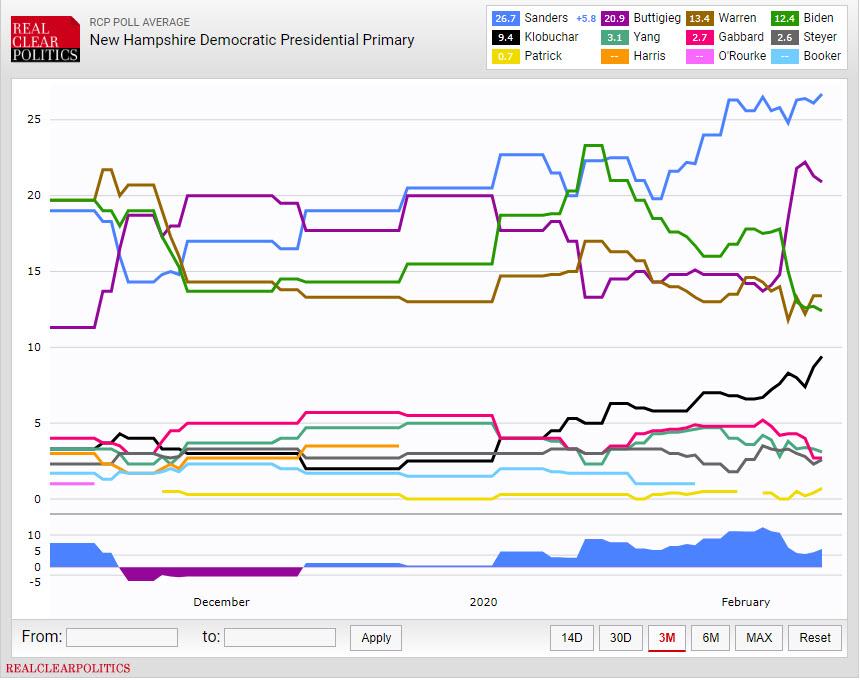

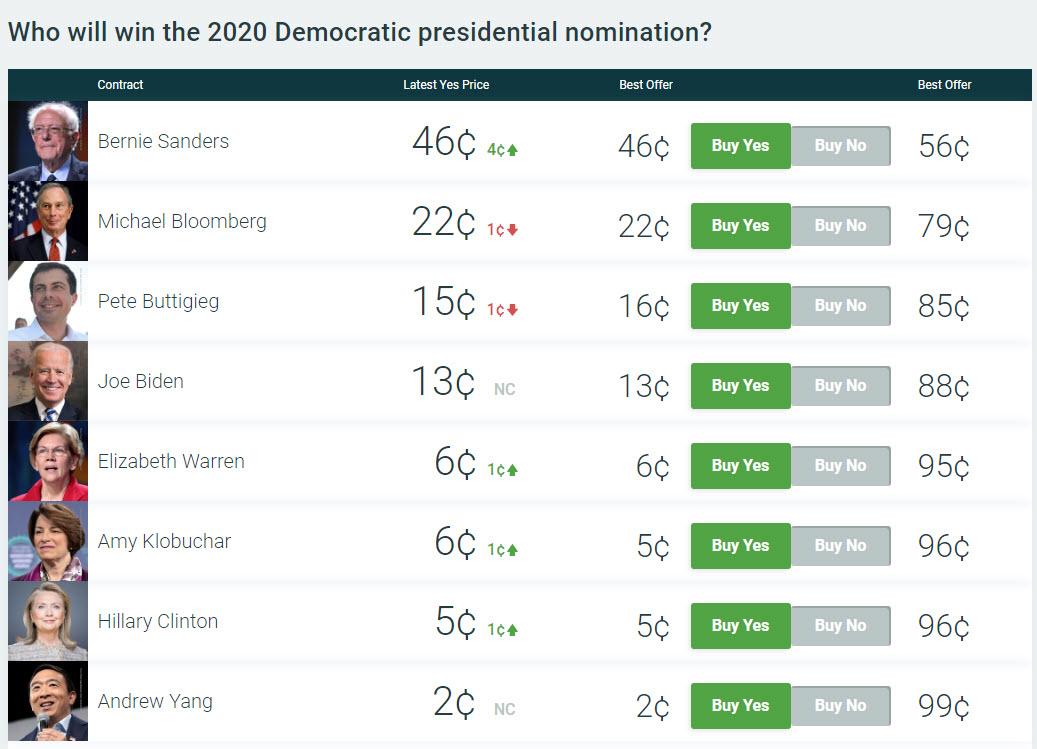

Over the weekend, Iowa Democrats finally released concrete results from last week’s caucuses, showing Buttigieg with a 0.1 percent lead over Sen. Bernie Sanders (I–Vt.) in the number of state delegate equivalents earned. Voters in New Hampshire go to the primaries tomorrow.

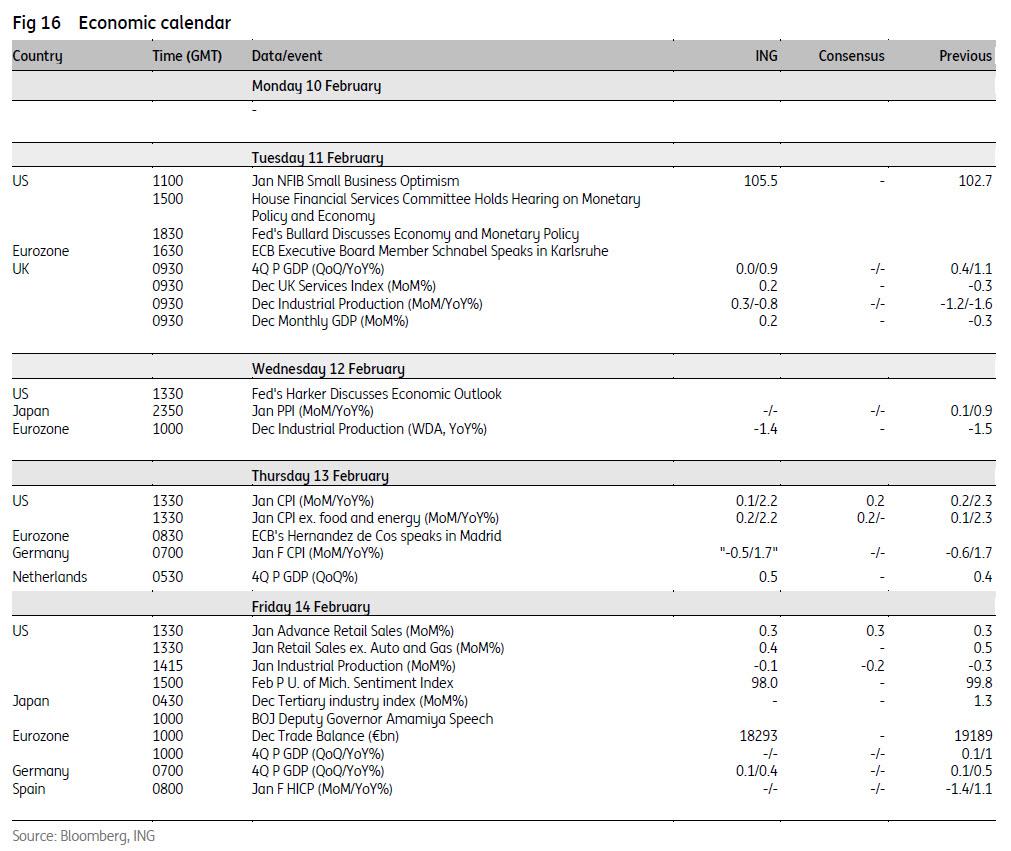

Meanwhile, President Donald Trump’s proposed budget for fiscal year 2021—a $4.38 trillion package to be presented to Congress today—includes $740.5 billion in military spending, a 0.3 percent increase over this year. It also includes $590 billion for non-military spending, down 5 percent from 2020. “Trump’s budget has no chance of winning approval in Congress,” notes USA Today, “but it does reflect his priorities as he pursues re-election.”

FREE MINDS

Remembering Victoria Woodhull. “She was the first woman to run for president, the first to address a congressional committee, and the first to own a brokerage on Wall Street. She was also a con artist, a gold digger, and a scandal magnet,” writes John Strausbaugh in National Review:

When she ran for president in 1872, she sat out Election Day in a Manhattan jail, arrested on charges of obscenity. Victoria Woodhull was unquestionably a pioneer in women’s rights, yet her legacy is so messy and complicated that she remains an outlier in feminist history.

More here.

FREE MARKETS

More tough-on-tech posturing. Sen. Josh Hawley, endless font of bad ideas, wants to make the Federal Trade Commission (FTC) a part of the U.S. Justice Department. “The FTC isn’t working,” the Missouri Republican senator said in a statement. “Nobody is accountable for decisions.”

So far, so good. But,alas, Hawley’s complaint isn’t that the agency engages in too much meddling. He thinks it doesn’t do enough, at least when it comes to what he calls “Big Tech’s rampant abuses.” The FTC “lacks the ‘teeth’ to get after” them, he said, and “Congress needs to do something about it.”

“The FTC has been under fire from both Republicans and Democrats calling for tougher action on Big Tech,” notes Axios, which also offers more details on Hawley’s proposal. But “relocating the agency, created in 1914, to a branch of the Justice Department is a tall order and it’s unclear if Hawley’s idea will gain any support.”

QUICK HITS

- “I like a lot of what [Tulsi Gabbard] has to say,” Gary Johnson tells Reason. But “my guy is Bill Weld.”

- For the first time ever, a foreign-lanaguage film—in this case, Bong Joon-ho’s Parasite—won best picture at the Oscars. Bong also won best director. Renee Zellweger won back actress (for her role in Judy) and Joaquin Phoenix best actor (for Joker). See the full results here.

How the hell did Parasite win so many awards on a night that the Oscars had no Host?

— Pat Ward (@WardDPatrick) February 10, 2020

- Sex work is dividing the National Organizaiton for Women (NOW). “Women’s organizations like NOW, founded at a time when many feminists considered prostitution inherently demeaning, continue to oppose it,” writes Emily Shugerman. “Internally, however, backlash is brewing.”

- “Instead of removing Trump from power, remove power from the presidency.”

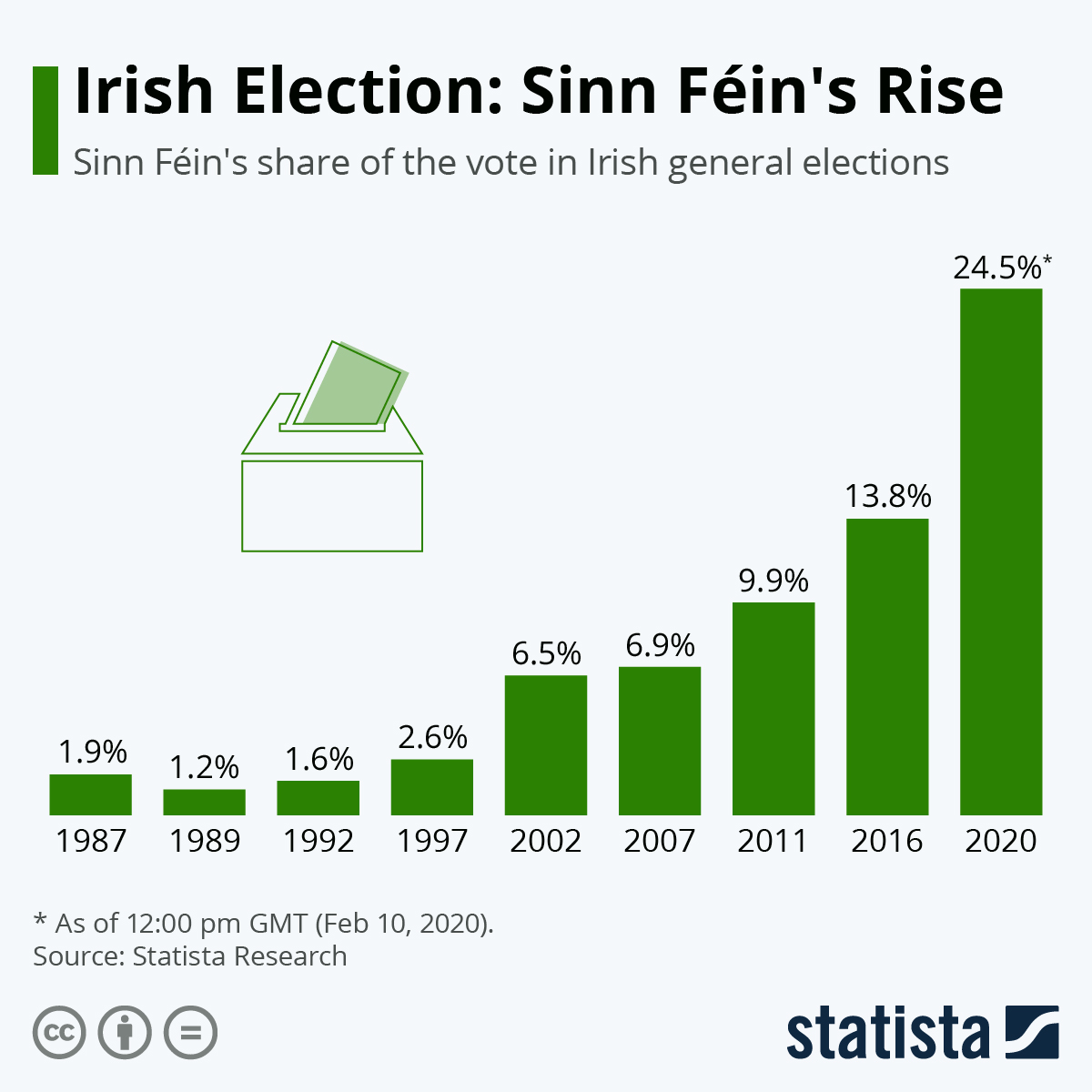

- What Sinn Féin’s win in Ireland’s latest elections means.

from Latest – Reason.com https://ift.tt/2uCFmiT

via IFTTT