Authored by Anthony Mueller via The Mises Institute,

The longing for the socialist dream comes in part from the great success of capitalism as an engine of prosperity. From the nineteenth century onwards, the entrepreneurial economy created prosperity on a scale that had never been seen before in history.The socialists, however, believed economic success would become even greater in a society of egalitarian redistribution. The socialists expect that under their rule, the economy would become more productive and society more just.

This illusion of obtaining prosperity and justice under socialism was already evident in the Communist Manifesto of 1848. In their pamphlet, Karl Marx and his sponsor Friedrich Engels enthusiastically praised capitalist achievements:

“The bourgeoisie,” they declared, “has been the first to show what man’s activity can bring about. It has accomplished wonders far surpassing Egyptian pyramids, Roman aqueducts, and Gothic cathedrals; it has conducted expeditions that put in the shade all former Exoduses of nations and crusades.”

During its rule, the bourgeoisie

has created more massive and more colossal productive forces than have all preceding generations together. Subjection of Nature’s forces to man, machinery, application of chemistry to industry and agriculture, steam-navigation, railways, electric telegraphs, clearing of whole continents for cultivation, canalization of rivers, whole populations conjured out of the ground – what earlier century had even a presentiment that such productive forces slumbered in the lap of social labor?

Yet, according to Marx and Engels, the capitalist system is doomed, and private property stands in the way to a perfect society: “the theory of the communists may be summed up in the single sentence: abolition of private property.” Doing away with private property implies the “abolition of bourgeois individuality, bourgeois independence, and bourgeois freedom…”

For Marx and Engels, the bourgeois family remained a fundamental part of liberal and capitalist. Thus, under communism, the “bourgeois family will vanish along with country, nationality, and religion.”

The Socialist Plan

To achieve these aims, the Communist Manifesto demands the following measures:

1. Abolition of property in land and application of all rents of land to public purposes.

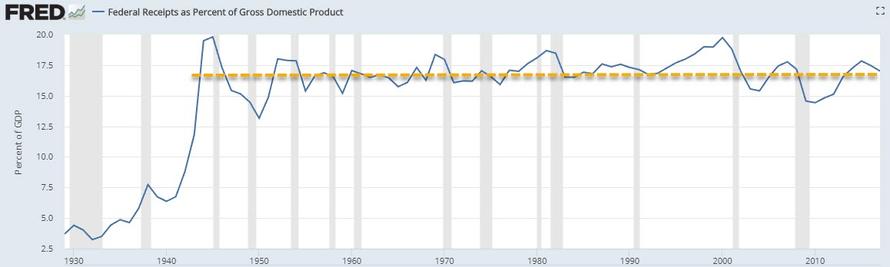

2. A heavy progressive or graduated income tax.

3. Abolition of all rights of inheritance.

4. Confiscation of the property of all emigrants and rebels.

5. Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly.

6. Centralization of the means of communication and transport in the hands of the State.

7. Extension of factories and instruments of production owned by the State; the bringing into cultivation of waste-lands, and the improvement of the soil generally in accordance with a common plan.

8. Equal liability of all to work. Establishment of industrial armies, especially for agriculture.

9. Combination of agriculture with manufacturing industries; gradual abolition of all the distinction between town and country by a more equable distribution of the populace over the country.

10. Free education for all children in public schools. Abolition of children’s factory labor in its present form. Combination of education with industrial production”

Under socialism, individualism must make way for collectivism. Then the state will replace private initiative. Communist rule also requires the centralization of money and credit in the hands of a state and production must follow a central plan. Public education comes with the obligation to work and its combination with industrial production.

On the way to achieve these aims, “the Communists everywhere support every revolutionary movement against the existing social and political order of things… They openly declare that their ends can be attained only by the forcible overthrow of all existing social conditions.”

From Dream to Nightmare

The motivation for this revolution is not hard to understand. Who would not want a society that guarantees prosperity for all but does not ask for an equivalent contributory effort? Socialism promises equality and that everyone would receive what he needs — whether one adds little or nothing to produce the goods. The fatal attraction to socialism results from the wishful thinking there could be an economic system, which would be as productive as capitalism and come with equality. The problem with this promise is that it does not work.

While private property lies at the heart of the free order of classical liberalism, socialism requires its abolishment. The means of production must come under the regime’s control.

But not all advocates of socialism want immediate and total revolution as Marx and Engels implied. Different from the communists — who want to install the “dictatorship of the proletariat” — are the “democratic socialists,” who believe in a gradual method, and who also believe that one could maintain personal freedom under socialism. Yet while the declared aim is different, the modern socialists plan to use the same instruments as the communists.

Socialists want to abolish private property and the market. Yet if prices as an information and incentive system no longer exist, a command system must supplant it. When there is no market, state directives must take its place. Without prices, however, there is no way of knowing how to coordinate economic activity. The rulers must apply coercion, and everyone must follow the central plans. In practice, socialism installs a power center, the ruling party, which collaborates with the central economic planning apparatus.

But it is not the proletariat that employs the dictatorship. It is the secret police and the military who will alsosuppress all dissent and make sure that the true voice of the people is kept silent and that the workers obey the state’s plans.

Socialism in Disguise

When the murderous reality of communism in the Soviet system became well known in the West with the publication of Solzhenitsyn’s The Gulag Archipelago in 1973, the term “communism” fell out of favor and was replaced by the less burdensome concept of “socialism.”

When this term became less appealing, the expression “left” came to the fore. When “left” got a bad name, “liberal” became the brand name, as has happened in the United States. Here, the socialists have usurped the concept of “liberal”, so that “liberalism” denotes the opposite of its original meaning. Now, the term “democratic socialism” is en vogue.

In this expression, “democratic” has replaced the communist concept of the “proletariat.” The idea behind this change is that “the people” are identical with the proletariat because they are the large majority. “Dictatorship of the proletariat” gains a new meaning. For the democratic socialists, majority rule gives the party in power the legitimacy to erode and finally to do away with private property — at first by taxation and regulation and finally through the collectivization of the means of production.

All of this is in service to the socialist dream which maintains that under socialism there would be both material abundance and equality. As Marx and Engels proposed, socialism is to offer all the benefits and abundance of capitalism, but maintain perfect equality as well. The reality, however, illustrates that socialism comes with economic misery, social deprivation, and political suppression. Socialism shows that the more one wants to realize the paradise on earth with the use of force the more one will, in fact, create a hell .

via ZeroHedge News http://bit.ly/2D2Bojw Tyler Durden

A first-time author of young adult fiction, Amelie Wen Zhao, has decided not to publish her book Blood Heir after progressive critics in the YA community decided that she was guilty of a litany of crimes: racial insensitivity, plagiarism, and more.

A first-time author of young adult fiction, Amelie Wen Zhao, has decided not to publish her book Blood Heir after progressive critics in the YA community decided that she was guilty of a litany of crimes: racial insensitivity, plagiarism, and more.

You’ve heard of the “

You’ve heard of the “

Another day, another Democrat running for president. New Jersey Sen. Cory Booker announced this morning that he’ll be competing for the Democrats’ 2020 presidential nod. So what do we know about Booker? “Is he a vegan? Is he really Spartacus? Did he really save a guy from a fire?”

Another day, another Democrat running for president. New Jersey Sen. Cory Booker announced this morning that he’ll be competing for the Democrats’ 2020 presidential nod. So what do we know about Booker? “Is he a vegan? Is he really Spartacus? Did he really save a guy from a fire?”