EU Contagion Risk Spreads As CDS Market Puts Focus On Deutsche Bank

Authored by Simon White, Bloomberg macro strategist,

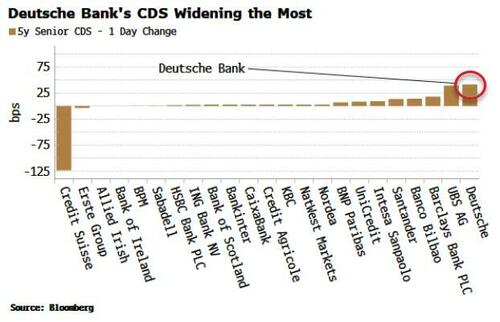

For once, the focus of a negative story on European banking hasn’t been Deutsche Bank. But the credit market isn’t letting DB off scot-free. The largest one-day move in 5-year credit-default swaps of European banks is Deutsche, with its spread widening more than even UBS’s.

DB’s CDS has widened by virtually the same as UBS’s over the last month, even though it has not had to digest a rival with $575 billion in assets over a weekend.

[ZH: we also note that while UBS equity price rebounded from its 16% plunge at the open, CDS has not…]

Deutsche Bank’s revenues have fallen over most of the last decade, and the bank has faced questions around its governance, with BaFin, the German bank regulator, censuring it over its money-laundering controls.

However, over the last two years the investment bank has spearheaded a recovery, with revenues and profitability improving.

Nonetheless, DB lagged the rebound seen in European bank shares that began last summer, while its price-to-book ratio remains subterranean.

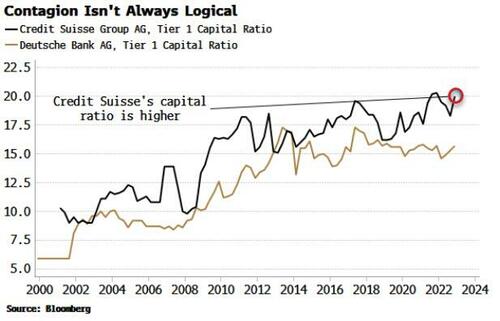

Contagion risk is much lower than it was in 2008, but it is not zero. And contagion is not always fully logical: Credit Suisse’s tier 1 capital ratio was higher than DB’s.

Keep watching CDS spreads to see if and where stress is spreading.

Tyler Durden

Mon, 03/20/2023 – 13:05

via ZeroHedge News https://ift.tt/xtXSujQ Tyler Durden