Authored by Alasdair Macleod via GoldMoney.com,

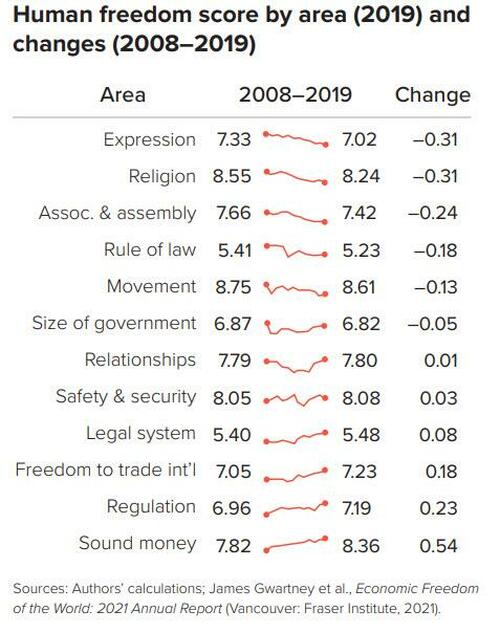

In recent weeks inflation has become a major economic concern. Nearly all the commentary emanating from monetary policy makers, economists, and the media is misguided, believing inflation is rising prices and must be addressed accordingly.

They are only the symptoms of inflation. The true cause is the expansion of currency and bank credit, which, reflected in the US dollar’s M2 money supply has increased substantially since March 2020, and now stands at nearly three times the level when Lehman failed.

After defining the differences between money, currency, and credit which together make up the media of exchange, this article explains how changes in the quantities of currency and credit translate into prices.

The solution to the inflation problem is not price controls, which are always counterproductive, but to return to a regime of sound money.

This article shows what must be done to achieve this outcome and concludes that it is impossible to do so without a sufficiently serious financial and economic crisis to discredit government intervention in markets and to then allow governments to stabilise their currencies and reduce their spending to a bare minimum.

Defining inflation, money, currency, and credit

A resolution of the inflation problem requires an understanding of inflation itself. It is an increase in the quantity of the media of exchange, whether it be money, currency, credit, or a combination of any or all of them. It is not a rise in the general price level. That is the consequence of inflation when the media of exchange loses purchasing power.

To avoid misunderstanding, it is important in any discussion about money to provide an accurate definition of what is money and what is not money. Let us clarify this at the outset:

That which is commonly referred to as money is more correctly any form of circulating media used for the payment of goods and services in an economy based on the division of labour. The term “circulating media” or “media of exchange” more accurately represents the common concept of money as the term is used today.

The amount of circulating media is never fixed. Indeed, the quantity of metallic money — gold, silver, and copper, but particularly gold, which we can simply define as pure money with no counterparty risk, has increased over the millennia since weights of these metals first evolved to replace barter. The population of active users of metallic money has also increased. Throughout history, the pace of increases of above ground gold stocks and the human population have been similar. The quantity of gold has therefore broadly kept pace with the population increase.

Over the long term, therefore, money proper has ensured a stable purchasing power despite the increase in above-ground stocks. An important advantage of gold as money is that its use is dominated by the twin functions of ornamentation and as the medium of exchange — unlike silver and copper it is never consumed. Gold’s utility is set by its users, who collectively decide how much circulates as money and how much is used for ornamentation. Its use switches between these two functions as its possessors collectively impose their needs, and gold’s purchasing power is determined by the quantity circulating as money. As well as the flows between its use as money and ornamentation, the quantity of money can also be affected by variations in mine supply from its general correlation with global population growth.

Gold’s purchasing power is stable due to these self-correcting factors. Currency is a different matter, always bearing in mind the counterparty risk of the issuer and its propensity to inflate its quantity. Today, these are central banks. A central bank’s balance sheet always shows currency in circulation as a liability of the bank, along with deposits owed by it to its depositors, normally confined to licenced commercial banks. The quantity of currency in circulation is set not by its users, but by the central bank managing its balance sheet.

In accordance with their monetary policies, Central banks can and do vary the amount of currency and the deposits recorded on their balance sheets, the latter more normally termed the reserves of commercial banks. Setting the level of these reserves in addition to a commercial bank’s shareholder capital used to be the means of regulating the quantity of credit that a commercial bank could issue. But today, central banks actively buy financial assets, payment being credited to the reserve accounts of the commercial banks. It is now the principal source of central bank inflation, and the regulation of a commercial bank’s lending capacity is now controlled more by other forms of regulation.

A commercial bank is a dealer in credit. It lends money to borrowers at a higher rate than it pays to its depositors. By lending money, it creates an asset on its balance sheet, and at the same time a counterbalancing liability is credited to the borrower, representing the amount of credit that the borrower has available to draw upon. The borrower’s bank statement will not usually reflect the counter-deposit, but double-entry bookkeeping demands that it exists. By a few strokes of a bookkeeper’s pen, credit which is indistinguishable from currency is created out of thin air and put into circulation.

We therefore have three types of circulating media: money, currency, and credit. A central bank sets the quantity of currency, and the commercial banks the quantity of bank credit and therefore deposit money, which is bank credit’s counterpart. The only circulating media whose use-value is set by its users is money. For the modern state which demands control over what circulates as the circulating media, money is actively discouraged in favour of its own substitutes, currency and bank credit issued by its licenced commercial banks, which it controls. Even under a gold coin standard, very few transactions involved money, being almost entirely settled by currency and credit.

The consequences of inflation

As the British economist John Stuart Mill pointed out there is a relationship between the quantity of money, currency, and credit in circulation (today, collectively termed erroneously as the stock of money) and the purchasing power of its units. This is now described as the equation of exchange, mathematically formulated later by Irving Fisher, which states that changes in the general level of prices are proportional to changes in the quantity of circulating media. But Mill’s equation of exchange showed a variance between changes in the quantity of media in circulation and the effect on prices, which was resolved by Fisher introducing another factor to make the equation balance. He called this its velocity of circulation, introducing the concept of money “working” to a greater or lesser extent in setting prices.

This is an error, as a moment’s thought confirms. In accordance with the division of labour, we earn salaries and profits which we then spend or save. Over any given period, such as a year, there is a total deployment of income that can only occur once. The relationship in the equation cannot be one of “velocity”, confirming it is a catch-all factor to make an equation balance which should only have ever been regarded as a theoretical concept.

John Stuart Mill described the relationship between the quantity of money and money substitutes in the nineteenth century when people commonly understood money to be gold. There can be no doubt that the price stability that gold brings with it ensures that quantity was the dominant factor in the price relationship. Today, the circulating media is exclusively unbacked currency and credit, which are less stable because they impart additional risk.

The addition of fiat currency risk into the media of exchange introduces uncertainty to its value because an issuer with a history of inflating currency quantities will find its currency deemed more risky and prone to valuation shocks than that of a currency with a more stable history. This is why the Turkish lira loses purchasing power more rapidly than the Swiss franc for given quantity changes. The introduction of the risk variable can have a significant effect on confidence in an unbacked currency.

Simply by varying the amount the average person holds in readily accessible currency reserves, its purchasing power can be altered considerably. Imagine, for a moment, a population that loses all faith in a currency. It will reduce its accessible reserves to zero by buying goods just to dump the currency, irrespective of the quantity in circulation. This was described by Austrian economists as the flight into goods, or a crack-up boom. The currency loses all its functionality.

Alternatively, if a currency is increasingly hoarded, perhaps by a population fearing events that require it to increase its currency reserves, the purchasing power of the currency, being more scarce in its circulation, will increase. Again, this is independent of any changes in the quantity in issue.

These variations from the monetarist norm are poorly understood by mathematical economists but were properly explained by the founders of the Austrian school. Being originally published in German their British contemporaries were generally unaware of these findings. And it was from these errors that our current understanding of the relationship between circulating media and its purchasing power have evolved.

Nevertheless, assuming a reasonable degree of stability in the use-value of a currency by a given population, there is a strong link between the quantity in circulation and the general level of prices. If the quantity is increased, the issuer gains a benefit through being able to issue currency or credit before it has the impact on prices. As the new currency and bank deposits (being the balance sheet counterpart of credit expansion) are spent into circulation, they will reduce the purchasing power of pre-existing currency and deposit balances. It is a gradual process as the new currency is passed on from buyers of goods to sellers. Known as the Cantillon effect (after the eighteenth century Irish-French banker and economist, Richard Cantillon), the increased quantity of money drives up prices following its entry and subsequent pathway into circulation.

Just as the issuer of currency or credit derives a seigniorage benefit, a loss is suffered by its users. The time taken for this loss to be realised depends on the speed of the absorption of currency and bank credit into general circulation, and the effect is never even. The least loss is suffered by its early spenders as explained by the Cantillon effect, and the greatest by those who spend it last. The further away from a financial system spewing out currency and credit both geographically and in the chain of transactions, the greater is the loss, which is why prices are highest in financial centres, being the source of inflation, declining as one moves into rural backwaters. But once extra currency and credit is fully absorbed into the existing stock everyone with currency and bank deposits will have lost purchasing power. And the purchasing power of those unable to adjust their income for falling purchasing power, such as the low-paid and pensioners, declines as well.

The link between changes in media of exchange and consumer prices

It is commonly said that inflation is rising prices. But as stated above, this is not so. Rising prices are the consequence of an increase in the quantity of money, currency, or credit, diluting their purchasing power which is reflected in higher prices for goods and services. If, instead of inflating, the quantity of the media of exchange remains the same, then consumers must choose how they spend the media they have earned. And they cannot spend collectively more than they have earned. The prices of some goods will fall while others rise, reflecting the choices consumers make, but the general level of prices will remain approximately the same, other factors being equal.

Alternatively, if the quantity of credit is expanded, by borrowing consumers no longer have to choose between their preferences. The prices of goods will rise above what they would otherwise be without credit expansion. Therefore, on an economy-wide basis, the availability of expanded credit will lead to an increase in the general level of prices to the extent it is drawn down, assuming other influences on prices do not change.

The source of expanded credit is the commercial banking system and shadow banks — a term which embraces financial intermediaries which are dealers in credit but are not licenced specifically as banks.

If a central bank increases the quantity of currency, it makes it available to the private sector on demand. By the same process as the expansion of bank credit, prices will tend to rise from the extra spending an expansion of currency permits.

An increase in bank reserves is nowadays the result of the central bank purchasing financial assets. It is recorded as a central bank’s liability, which through quantitative easing for example, is matched by both increases in a commercial bank’s assets and its liabilities (deposits) in favour of its depositors (usually pension funds or insurance companies) which sell the securities to the central bank. The selling institution then has a surplus of liquidity to invest.

It may subscribe for a new issue or buy securities in the secondary market. By subscribing for a new issue, the cash balance of the issuer increases, who then spends it on the factors of production. This spending of additional deposit money tends to raise prices. If the investing institution buys existing securities in the secondary market, the seller of these securities may reinvest the proceeds or spend some or all of them. Again, the extent to which they are spent on goods or services will tend to raise prices, because this deposit money is additional to that previously existing.

It can therefore be seen that inflation is always a monetary phenomenon, and not one of changes in consumer preferences and suppliers’ ability to satisfy them. But so ingrained has the fallacy become that changes in the level of circulating media have little or nothing to do with changes in the general price level, that current attempts to control it are repeating the same errors seen throughout history. By not understanding or denying the origin of the inflation curse, the state attempts to pass the blame on to others, when it is the state’s agencies, being its central bank and its licenced commercial banks, which are responsible.

By not addressing the source of rising prices but the symptoms instead, the problem of rising prices is usually made worse. In 301 AD, the Emperor Diocletian pronounced an edict of maximum prices on more than 1,200 products, raw materials and labour, animals and slaves, which had risen as a result of the debasement of the coinage. Any tradesmen caught selling goods for more than the edict’s limitations were punished, even to the point of execution. Unable to make a profit, the affected trades ceased and the citizens in Rome faced starvation. Throughout history, when governments have debased the coinage, or inflated the currency, they have embarked on similar policies.

The solution to the inflation problem

The traditional solution to the inflation problem was for the state to operate a gold coin standard. This differs from a bullion standard, such as that introduced in Britain in 1925, when deposits could only be exchanged for 400-ounce bars — an operating standard that excluded most of the population.

A gold coin standard permitted anyone even with limited currency or bank deposits to exchange bank notes for gold coin on demand. This did not require the issuer of bank notes to back every note in issue with gold coin at the ratio of the standard, but it did require the further issuance of bank notes to be fully backed. And for anyone wishing to cash in a bank deposit for gold coin, the route was either to do so with the deposit-taking bank itself, or to exchange deposits for bank notes which could then be exchanged for gold coin.

Operating a gold coin standard was incompatible with a government’s spending exceeding its tax revenues for anything other than a temporary basis. Failure to comply with this iron rule always led to a surplus of currency and credit in the hands of domestic and foreign actors, who had the right to demand gold coin in exchange and tended to do so.

Before the First World War a secondary standard become increasingly common. A note-issuing central bank would work a currency board standard, whereby it operates a note and deposit exchange facility not with gold but with another currency on a gold standard. In all essentials, the modus operandi was the same as a working gold standard.

In the days of empire, this was how the sterling area linked local currencies to the pound. Today, in our fiat money system, currency boards usually operate with the US dollar as the exchange alternative. Properly run, a currency board is extremely robust, tested recently by the failure of American attempts to drive the Hong Kong dollar off its currency peg. Economist Steve Hanke of John Hopkins University has advised several foreign governments over the years to adopt dollar-based currency boards to bring high rates of price inflation under control. Properly implemented they have always worked.

Stabilising purchasing power

From the foregoing, we can see there are two sources of monetary destabilisation. Since the time of the goldsmiths in London, when the role of banks first evolved into being dealers in credit, the periodic expansion and contraction of bank credit has driven the repetitive cycle of booms and busts. Recognising that this is the case is just the first step in eliminating monetary instability from this source, or at least reducing its disruptive effects.

There are two basic approaches that might apply. The first is to split bank roles into deposit-taking and the arranging of finance, while the second approach is to moderate the extent to which bank credit can be expanded. We shall comment briefly on these in turn.

The first approach is to eliminate the role of banks as dealers in credit entirely, and separate their functions into custodial deposit taking, offering the facility for individuals to temporarily store money and currency liquidity, and into the separate function as arrangers of finance. By their nature, custodial deposits would not pay interest, and depositors face charges for the facility. A custodial deposit-taker would in turn have to act as agent for customer deposit accounts at the note-issuing bank, so that electronic currency has the same status as bank notes. Charges for the service can be expected to be similar to secure vaulting services today.

Instead of creating loans, banks would arrange finance off balance sheet, with savers offered specific investment opportunities, either directly into loans and equity or into collective investment schemes. The provision of working capital for businesses would be through funds established specifically for the purpose.

Interestingly, suitable central bank digital currencies could be ideal as the media of exchange for establishing separated custodial deposit and investment arranging functions. But that is not what they are intended for, so there is little point in discussing them in the context of a sound monetary system.

The second basic approach is not to undertake a root and branch reform of the banking system as described above, but to remove the limited liability status enjoyed by commercial banks and to ban the central bank from bail-outs and bail-ins. The human desire to take insufficient account of lending risk at times of economic expansion by pricing loans not on their merits but to attract lending business would come under greater control. Instead of seeing asset to equity ratios of ten or more times, these can be expected to fall perhaps to three or four times. Bank shareholders would expect their investments to be dull, but safe, given they would face the entire losses from their managers’ mistakes.

Bank reform on these scales would meet insurmountable resistance from banking interests except in the wake of a decisive financial crisis when the whole banking system faces collapse and the opportunity to reset the whole system is presented.

Having identified the problem of fluctuating bank credit, our attention turns to inflation of the currency. The most effective way of dealing with this is to remove the temptation of unfettered seigniorage from the state and its agents and let the currency’s users decide on its quantity requirements. This is the role that a gold coin standard plays, whereby the state must cover every supplementary currency unit issued with gold at the rate of exchange laid down. The users of a gold-backed currency determine the quantity. Thus, the quantity of money in circulation is set by market demand and supply, which in turn sets gold’s purchasing power and therefore that of its exchangeable bank notes and deposits.

If it was only a question of turning a fiat currency into a functioning gold substitute, it could be dealt with very simply. But it also requires the state and its central bank to accept the other disciplines of sound money, including not intervening in markets. In the event of a commercial bank failure or of an industrial enterprise, markets must determine outcomes without state intervention. But the likelihood of bank failures and their systemic consequences will have been eliminated or lessened considerably by the banking reforms recommended above.

More difficult, perhaps, will be the discipline sound money imposes on government spending. From the state’s point of view, the purpose of inflation is to permit it to spend more than it raises in taxes. For money in the form of gold coin to back a fully exchangeable currency requires abandoning inflation as a source of finance. Sound government finances with budget surpluses are initially required to reduce today’s extraordinarily high levels of government debt over time. Any deviation from this objective must be only temporary. And legislation to eliminate most of mandated future liabilities must also be introduced. The role of the state must be reduced to a bare minimum, and taxes reduced in step with declining government spending.

It amounts to a denial of anything other than very basic roles for the state, going against the modern democratic socialist grain.

The difficulties of persuading the political class and its electorate to accept this course of action are such that it will only be adopted after a currency crisis has been sufficiently dramatic to undermine socialist ideals and persuade the political establishment and the people that unsound monetary practices must be avoided at all costs.

It will happen because the current relationship between the state, the economy and fiat currency is wholly untenable. And a gold standard will be reintroduced by the state as the only way to save itself. We can only hope that when they are politically possible the required actions are taken swiftly and without compromise.