Citi Warns “Markets Are Way Ahead Of Reality”, Urges Clients To Raise As Much Money As They Can Before The Next Crash

Tyler Durden

Sun, 05/31/2020 – 19:30

If the 35% surge in the S&P in the past two months seems too good to be true as even hard-core optimists like JPM’s Marko Kolanovic now admits, announcing that he is “dialing down” his optimism while Goldman sees little upside for stocks from here…

… it’s probably because it is, as the latest Wall Street professional to join the chorus of naysayers and skeptics including such luminaries as David Tepper and Stanley Druckenmiller, claims.

In an interview with the Financial Times, Manolo Falco, Citigroup’s co-head of investment banking said that financial markets were “way ahead of reality” with tougher times to come, and is warning corporate clients that they should raise as much money as they could before the pandemic’s true cost is factored in by investors.

“We definitely feel that the markets are way ahead of reality. We really are telling every client to tap the market if they can because we think the pricing now couldn’t get any better,” Falco said, adding that “as the second quarter comes along and we start seeing the pain, and the collateral effects of that, we think this is going to be much tougher than it looks.”

His comments came at the end of a week when stock markets largely rallied even as relations between the US and China just hit rock bottom, as riots were about to break out across the US which now has more than 40 million unemployed, and as millions of businesses around the world remained shut and economies lurched towards their worst recessions in memory.

“Markets are pricing a V [shaped recovery], everyone’s coming back to work, and this is going to be fine,” Mr Falco said. “I don’t think it’s going to be that easy quite frankly” said the investment banking icon who just made Robinhood’s shitlist.

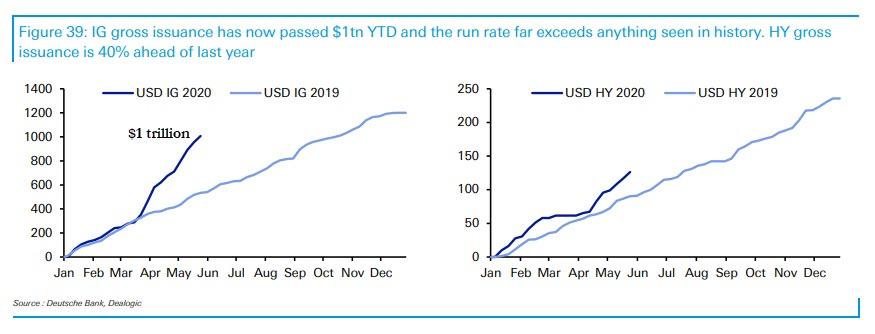

Investors’ optimism led investment grade companies to raise a record $1 trillion of debt in the first five months of the year, putting investment banks such as Citi on course for a surge in debt capital markets revenues in the second quarter of the year compared with 2019.

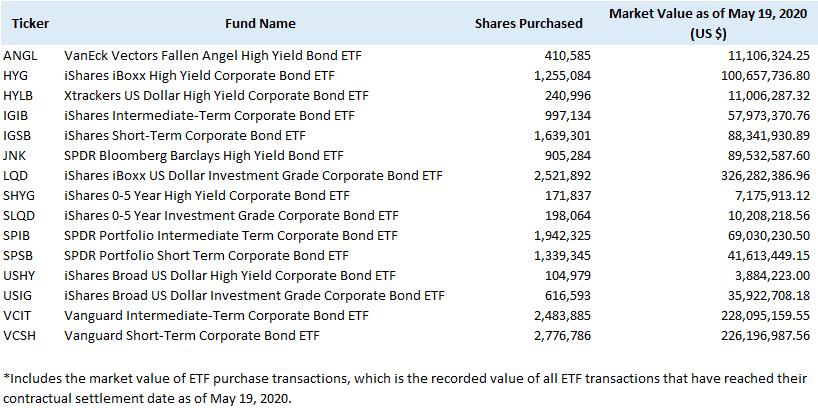

Citi is not the only bank to take advantage of the bond issuance feast, which has been explicitly backstopped by the Fed which as we learned last week has been busy buying up over a dozen ETFs.

Last week senior bankers predicted another strong quarter for trading. This was especially true at JPMorgan Chase, whose investment bank boss Daniel Pinto said trading revenues in the second quarter could be up as much as 50% compared with a year earlier.

Falco was more circumspect on the prospect of a wave of activist investment in the aftermath of the coronavirus crisis. Low asset prices can tempt activist investors to buy into companies on the cheap and then look for ways to make them more profitable, often by cutting costs and jobs, but mostly issuing more debt (although with corporate leverage now at even record-er levels than just 2 months ago it is unclear just who has the capacity for even more debt).

“You gotta be careful though because an activist can become very quickly a focus of governments if they really step in too hard at a time when people, what they want is to protect employment and to actually get things going in the economy,” Falco said. “We’ve got to be careful because in some cases . . . maybe those [investments] are at the wrong time and could create a lot of anger.”

We doubt that: in fact, if activist investors step up and end up causing millions more to be fired, it will simply mean that the government’s free handouts will have to be extended even further, Congress will have to pass even more stimulus bills, and the Fed will have to monetize even more debt bringing us that much closer to the period of runaway inflation so eagerly sought by the Federal Reserve.

In other words, more layoffs mean win, win, wins for everyone, except those who still believe in working hard and saving, of course.

via ZeroHedge News https://ift.tt/2Mi2bha Tyler Durden