Germany’s Overdose Of Renewable Energy

Authored by Jonathan Tennebaum via AsiaTimes.com,

This is part 2 in a series. Click here to read part 1.

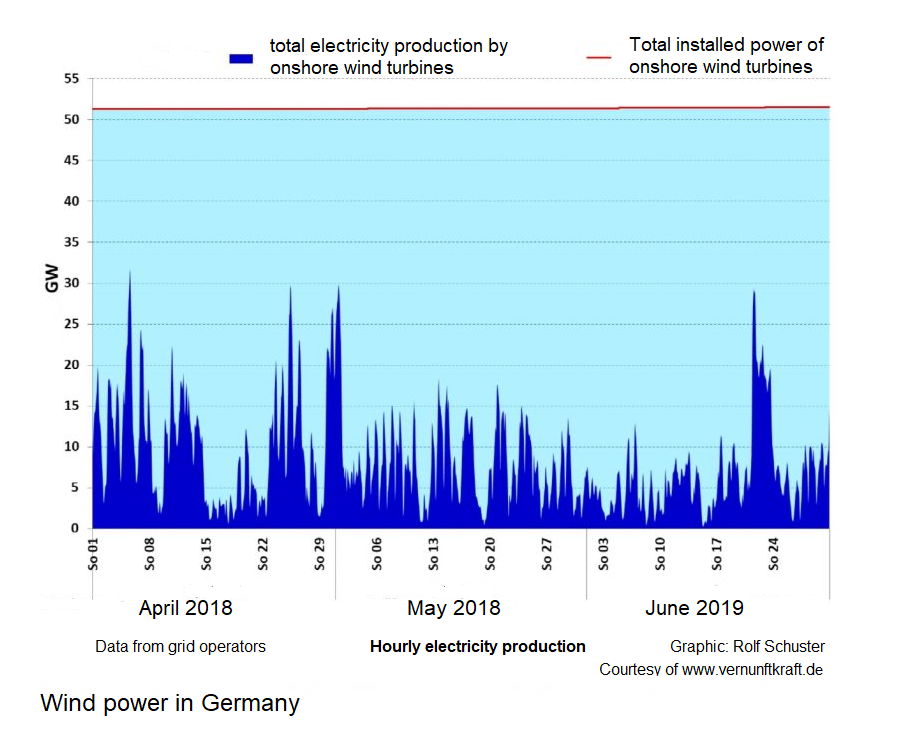

Germany now generates over 35% of its yearly electricity consumption from wind and solar sources. Over 30 000 wind turbines have been built, with a total installed capacity of nearly 60 GW. Germany now has approximately 1.7 million solar power (photovoltaic) installations, with an installed capacity of 46 GW. This looks very impressive.

Unfortunately, most of the time the actual amount of electricity produced is only a fraction of the installed capacity. Worse, on “bad days” it can fall to nearly zero. In 2016 for example there were 52 nights with essentially no wind blowing in the country. No Sun, no wind. Even taking “better days” into account, the average electricity output of wind and solar energy installations in Germany amounts to only about 17% of the installed capacity.

The obvious lesson is: if you want a stable, secure electricity supply, then you will need reserve, or backup sources of electricity which can be activated on more or less short notice to fill the gaps between electricity demand and the fluctuating output from wind and solar sources.

The more wind and solar energy a nation decides to generate, the more backup capacity it will require. On “bad days” these backup sources must be able to supply up to 100% of the nation’s electricity demand. On “good days” (or during “good hours”) the backup sources will be used less, or even turned off, so that their capacity utilization will also be poor. Not very good economics.

Much better would be to limit wind and solar to a relative minimum, and rely instead upon controllable, non-fluctuating power sources operating with a high capacity factor, to meet the nation’s base load electricity requirements and to adjust total output in accordance with varying demand. This corresponds to world-wide practice prior to the recent huge buildup with renewable energy.

In theory the ideal backup for wind and solar energy would be to store excess electricity produced when the Sun is shining and strong winds are blowing, and inject it back into the grid when needed. Unfortunately, electricity is a difficult and expensive commodity to store.

By far the most efficient presently available solution for storing excess electric power is to use it to pump water against gravity into a reservoir. When electricity is needed again, it is produced by letting water flow down again via a turbine generator. In this process about 25% of the energy is lost.

Naturally, the costs of construction and operation of such pump storage plants will add to the real costs of providing electricity. Plus, these installations use up a large amount of land area.

Here, too, Germany provides an instructive example. A 2014 study by the Bavarian Ministry of Energy came to the conclusion that pump storage plants were not an economically viable solution. Much better would be to exploit already existing water reservoir resources in Norway and Sweden, where the capacity of pump storage plants can be greatly expanded and new ones built at much lower cost.

This “solution,” however, would require transporting large amounts of electricity over long distances back and forth between Germany and those countries – which in turn would require additional high-voltage lines and cables that have not been built and that no one wants to pay for.

Given the high costs and other obstacles to creating large electricity storage systems, it is not surprising that Germany’s electricity storage capacity amounts today to less than 2% of total electricity output.

There has been much discussion and research concerning alternative ways to store electricity. Theoretically one could be to use excess power to produce hydrogen, store it somehow and then use fuel cells to generate electricity back from the hydrogen. This would be vastly more expensive than pump storage, however, and with much greater losses.

Overdose of renewables?

Today, in order to guarantee stable baseline power and fill the gaps left by its fluctuating wind and solar generators, Germany is forced to rely on (1) CO2-spouting coal and natural gas power plants; (2) its remaining handful of nuclear plants, which it plans to shut down by 2022; and most notably (3) importing electricity from other European nations.

German Chancellor Angela Merkel (CDU) fetches a green folder from her briefcase at the start of a government consultation round concerning bill on renewable energy at the Chancellery in Berlin, Germany, 31 May 2016. Photo: AFP / Maurizio Gambarini / dpa

Most of the imports come from France, where about 75% of electricity is produced by nuclear plants, and from Sweden, where 40% is nuclear-produced. On “bad days” Germany could hardly get along without a piece of this much-dreaded nuclear energy.

On “good days” Germany floods the rest of Europe with excess power from its wind and solar installations, often at dumping or even negative prices. In this way Germany has turned its huge amounts of wildly fluctuating renewable power sources into a European-wide problem.

Even with the flourishing European electricity trade, however, Germany is still far from being able to close down its coal and gas power plants.

The German Energy Agency (DENA) published a long-term scenario for electricity production in Germany, based on the assumption that so-called renewable sources should account for 80% of total electricity consumption by the year 2050.

Among other things DENA concluded that in order to insure a stable electricity supply, Germany would still need to maintain 61 gigawatts of conventional power plant capacity “in reserve” and for a remaining portion of base-load production. Electricity storage systems would provide only 9% of reserve capacity in 2050.

Despite – and to a large extent because of — the massive expansion of renewables, conventional power capacity could only be reduced by 14% up to 2030 and by a maximum of 37% by 2050.

Given the government’s commitment to shut down nuclear energy in Germany, this would mean keeping a large reserve of CO2 -emitting, fossil fuel-based generation capacity. At the same time the political decision has been made to phase out the coal-power stations which up to now have produced the largest part of Germany’s electricity.

That leaves essentially only petroleum (heating oil) and natural gas as realistic fuels for backup power. Natural gas would take first place because it generates about 50% less CO2 per kWh of electricity than coal or petroleum-powered plants.

With this background one can appreciate the German government’s concern to guarantee long-term supplies of natural gas at stable prices. Hence also the government’s insistence on the North Stream 2 project to build a system of offshore natural gas pipelines from Russia to Germany.

The good news, so to speak, is that for most of the time the backup plants would operate at only a fraction of their installed capacity, with many even standing still on “good days.” That way they would release much less CO2 to the atmosphere.

That’s nice for the environment, but not a very efficient way to utilize equipment, infrastructure and manpower – and not very attractive for investors. Also it’s still far from the green dream of a CO2-free energy system.

Preserving the stability of Germany’s electricity grid while at the same time integrating tens of thousands of fluctuating energy sources distributed over the entire country has been a major technical challenge. It has meant reorganizing much of the electricity transmission and distribution system, which was designed and built to operate in a completely different regime.

It means also the construction of thousands of kilometers of new high-voltage lines, including four projected long-distance transmission lines which are needed to move electricity from the windy north to the industrial west and south of the country. This again adds to the real (systemic) costs of supplying the country with electricity.

There is no doubt that the attempted transition to renewable sources as the foundation of Germany’s energy system – Angela Merkel’s famous “Energiewende” – has already significantly reduced the country’s economic efficiency. The constantly rising electricity prices, taxes and levies only begin to reflect the true costs of the government’s policy. There is also a debate concerning the future stability of the electricity grid.

Merkel and others often argue that a successful “Energiewende” would place Germany in a unique position to export know-how and technology for the ongoing “green transformation” of the world economy. Increased income from export of green technology is supposed to compensate for the costs of the Energiewende. This calculation assumes that the other countries will choose to follow the radical German example in reorganizing their power sectors, which is doubtful.

Meanwhile resistance has been growing inside Germany itself, as local environmental groups and citizens’ initiatives mobilize to block construction of wind turbines, transmission lines, pump power stations and other renewable energy projects.

The environmentalist ideology is coming into contradiction with itself. The unprecedented scale of destruction of the natural landscape by 30 000 gigantic wind turbines has brought a growing realization, that reliance on renewable energy is by no means friendly to the environment – and not necessarily safe.

People don’t want to live near wind turbines, because of unpleasant noise and possibly dangerous infrasound emissions, disturbing optical effects, reports of fires, broken-off turbine blades flying through the air, ice throws, etc. And the dead birds.

In Germany there is political pressure to increase the legally-set minimum for the distance between wind turbines and houses to 1 or even 1.5 kilometers, which would drastically reduce the availability of construction sites. Already, protests and law suits have brought the construction of new wind turbines in Germany to a near-standstill.

Wind farm photo by Winchell Joshua, US Fish and Wildlife Service (Wikicommons)

Solar energy has encountered much less resistance, no doubt to a large extent because only a few large solar farms have been built in the country. Most of the present capacity comes from roof-mounted solar cells, especially on private houses, where they have become quite popular.

The big problem is how to store the electricity, which is generated only during daylight hours and fluctuates according to the cloud cover. So far relatively few house owners have been willing to pay for batteries and other storage devices. Instead, excess electricity is taken up by the grid at a subsidized price.

Projects for pump storage stations, and for new transmission lines have met with such intense resistance, that there is little chance of fulfilling the original goals of the Energiewende.

The question is, whether it makes sense at all to depart from the tried-and-proven model of a stable electricity system based on continuously functioning sources, a large percentage operating in base load mode.

If we want the system to be largely CO2-free, then the only available option is nuclear energy.

Tyler Durden

Thu, 01/30/2020 – 05:00

via ZeroHedge News https://ift.tt/37La8Ve Tyler Durden