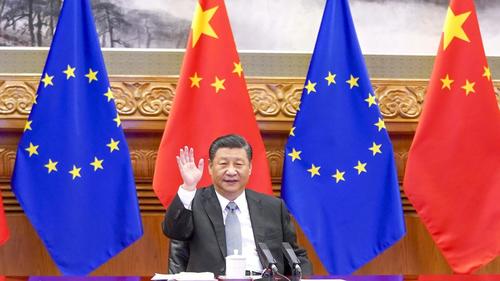

China Scrambles To Save EU Investment Deal After Xi’s Hardline Diplomacy “Backfires”

Nikkei in recent analysis noted that President Xi has “lost Europe” after his “hardline diplomacy” clearly backfired – on display after over a week ago the China-EU investment deal was suspended in a politically and symbolically resounding vote by European Parliament which has effectively put it in a deep freeze. The mood in Beijing was widely reported as collective “shock” given the marathon years-long negotiations that preceded the deal which was only concluded in December.

Brussels had moved to freeze talks until Chinese sanctions against individual EU lawmakers and scholars are dropped. Beijing is now on a diplomatic offensive to save the deal, with a flurry of recent top level meetings aimed at maintaining support for keeping the Comprehensive Agreement on Investment (CAI) alive from Poland to Hungary to Serbia to France to Ireland.

Those prior sanctions on EU officials came in response to coordinated efforts led by the US and UK, and which brought in the EU, to call out and punish Beijing over its atrocious human rights record, particularly centering on Xinjiang and Uyghur Muslims. This despite it taking seven years of negotiations which wrapped up and finally materialized into a deal last December, just before Joe Biden took the White House. Many criticized at the time that China was being allowed to “rush” through the agreement, which would in the long-run compromise European security and sovereignty.

And yet as Nikkei observes elsewhere, “Enthusiasm for China has cooled in much of central and eastern Europe, leaving Beijing alarmed as human rights concerns and stalled investments push disillusioned partners toward the U.S.”

It took a mere few months for Beijing’s “win” to unravel in the tit-for-tat hostilities with the West, ultimately led by Washington. The May 20 European Parliament vote to suspend the CAI was a landslide and hugely symbolic collective souring on Beijing as a European “partner”: 599 votes in favor of freezing ratification and 30 votes against (with 58 abstentions).

Bloomberg also weighed in on this theme of Xi losing Europe after making deep inroads especially in Eastern Europe and the Balkans: “The investment pact had been seen as proof of both Europe’s independence from the U.S. and China’s ability to collaborate with American allies who adopted a more moderate approach.” The weekend reports underscored additionally: “Attitudes in several European capitals have grown less favorable toward China since the coronavirus outbreak fueled a range of diplomatic disputes.”

With #Merkel 🇩🇪 soon leaving the political stage the Chinese Communist Party 🇨🇳 is turning to President #Macron 🇫🇷.

Let’s make sure he does not cave in and resuscitates the EU-China Comprehensive Agreement on Investment #CAI. #StopCAI #NotInMyName https://t.co/9TdqnaS8l5

— Andreas Fulda (@AMFChina) May 26, 2021

This past week Chinese foreign minister Wang Yi argued that a landmark seven years in the making investment deal should not be linked to what China sees as “separate issues”.

“The investment agreement is not a one-sided favor; the Xinjiang-related issue bears on China’s sovereignty and security,” Wang told the Munich Security Conference on Tuesday in a remote call. “Attempts by some in the EU to link issues of different nature and turn trade issues into political ones are not acceptable and will lead nowhere,” he added, which appears a favored point of emphasis whether Beijing is addressing deteriorated relations and trade from Australia to the UK to Washington.

Tyler Durden

Mon, 05/31/2021 – 05:15

via ZeroHedge News https://ift.tt/2S1kqO2 Tyler Durden