With Wall Street desperate for the Fed to announce emergency measures on Sunday (after disappointing last week), and ideally before the futures open, Jerome Powell did not disappoint and moments ago the Fed announced a barrage of emergency measures which included:

- Welcome back ZIRP: Fed cuts rates by 100bps to 0-25bps from 1.00 -1.25bps. This is in addition to the 50bps rate cut on March 3, which means that in just under two weeks the Fed has cut rates by 150bps to zero.

- Fed officially launches QE5 (no more “Non-QE” bullshit), consisting of “at least” $500BN in Treasury purchases and $200 billion in MBS.

- Boosting intraday liquidity: The Fed announces Measures related to the discount window, intraday credit, bank capital and liquidity buffers, reserve requirements, and—in coordination with other central banks—the U.S. dollar liquidity swap line arrangements

- Reserve requirements cut to zero: The Fed cuts reserve requirement ratios to zero percent effective on March 26.

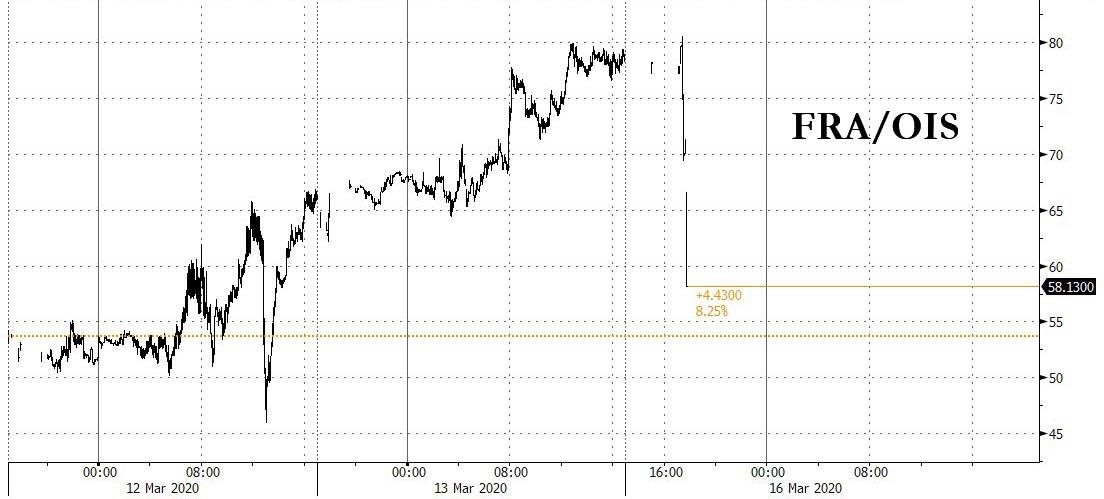

- Coordinated swap lines: The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank announced a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements. The pricing on the dollar liquidity swap arrangements is cut by 25 basis points, so the new rate will be the US dollar overnight index swap (OIS) rate plus 25 basis points.

Amusingly, the Fed announces that the emergency action wasn’t unilateral, with Loretta J. Mester voting against the action, as she was “fully supportive of all of the actions taken to promote the smooth functioning of markets and the flow of credit to households and businesses but preferred to reduce the target range for the federal funds rate to 1/2 to 3/4 percent at this meeting.”

The full statement is below (link):

The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States. Global financial conditions have also been significantly affected. Available economic data show that the U.S. economy came into this challenging period on a strong footing. Information received since the Federal Open Market Committee met in January indicates that the labor market remained strong through February and economic activity rose at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending rose at a moderate pace, business fixed investment and exports remained weak. More recently, the energy sector has come under stress. On a 12‑month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation have declined; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook. In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals. This action will help support economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2 percent objective.

The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy. In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

The Federal Reserve is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals. To support the smooth functioning of markets for Treasury securities and agency mortgage-backed securities that are central to the flow of credit to households and businesses, over coming months the Committee will increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion. The Committee will also reinvest all principal payments from the Federal Reserve’s holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. In addition, the Open Market Desk has recently expanded its overnight and term repurchase agreement operations. The Committee will continue to closely monitor market conditions and is prepared to adjust its plans as appropriate.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; and Randal K. Quarles. Voting against this action was Loretta J. Mester, who was fully supportive of all of the actions taken to promote the smooth functioning of markets and the flow of credit to households and businesses but preferred to reduce the target range for the federal funds rate to 1/2 to 3/4 percent at this meeting.

In a related set of actions to support the credit needs of households and businesses, the Federal Reserve announced measures related to the discount window, intraday credit, bank capital and liquidity buffers, reserve requirements, and—in coordination with other central banks—the U.S. dollar liquidity swap line arrangements. More information can be found on the Federal Reserve Board’s website.

On the topic of all important Swap Lines, which we said there is a distinct chance could be unviled, the Fed issued the following announcement:

Coordinated Central Bank Action to Enhance the Provision of U.S. Dollar Liquidity

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

These central banks have agreed to lower the pricing on the standing U.S. dollar liquidity swap arrangements by 25 basis points, so that the new rate will be the U.S. dollar overnight index swap (OIS) rate plus 25 basis points. To increase the swap lines’ effectiveness in providing term liquidity, the foreign central banks with regular U.S. dollar liquidity operations have also agreed to begin offering U.S. dollars weekly in each jurisdiction with an 84-day maturity, in addition to the 1-week maturity operations currently offered. These changes will take effect with the next scheduled operations during the week of March 16.1 The new pricing and maturity offerings will remain in place as long as appropriate to support the smooth functioning of U.S. dollar funding markets.

The swap lines are available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses, both domestically and abroad.

Finally, here is what the Fed is doing to boost day-to-day credit, including encouraging banks to use the Discount Window (good luck with that), encouaring the use of intraday credit and cutting reserve requirements to zero.

Federal Reserve Actions to Support the Flow of Credit to Households and Businesses

The Federal Reserve is carefully monitoring credit markets and is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals. In addition to actions taken by the Federal Open Market Committee, including actions taken in coordination with other central banks, the Federal Reserve Board announced a series of actions in support of these goals. These actions are summarized below.

Discount Window

Federal Reserve lending to depository institutions (the “discount window”) plays an important role in supporting the liquidity and stability of the banking system and the effective implementation of monetary policy. By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers, such as withdrawing credit during times of market stress. Thus, the discount window supports the smooth flow of credit to households and businesses. Providing liquidity in this way is one of the original purposes of the Federal Reserve System and other central banks around the world.

The Federal Reserve encourages depository institutions to turn to the discount window to help meet demands for credit from households and businesses at this time. In support of this goal, the Board today announced that it will lower the primary credit rate by 150 basis points to 0.25 percent, effective March 16, 2020. This reduction in the primary credit rate reflects both the 100 basis point reduction in the target range for the federal funds rate and a 50 basis point narrowing in the primary credit rate relative to the top of the target range. Narrowing the spread of the primary credit rate relative to the general level of overnight interest rates should help encourage more active use of the window by depository institutions to meet unexpected funding needs. To further enhance the role of the discount window as a tool for banks in addressing potential funding pressures, the Board also today announced that depository institutions may borrow from the discount window for periods as long as 90 days, prepayable and renewable by the borrower on a daily basis. The Federal Reserve continues to accept the same broad range of collateral for discount window loans.

Intraday Credit

The availability of intraday credit from the Federal Reserve supports the smooth functioning of payment systems and the settlement and clearing of transactions across a range of credit markets. The Federal Reserve encourages depository institutions to utilize intraday credit extended by Reserve Banks, on both a collateralized and uncollateralized basis, to support the provision of liquidity to households and businesses and the general smooth functioning of payment systems.

Bank Capital and Liquidity Buffers

The Federal Reserve is encouraging banks to use their capital and liquidity buffers as they lend to households and businesses who are affected by the coronavirus.

Since the global financial crisis of 2007-2008, U.S. bank holding companies have built up substantial levels of capital and liquidity in excess of regulatory minimums and buffers. The largest firms have $1.3 trillion in common equity and hold $2.9 trillion in high quality liquid assets. The U.S. banking agencies have also significantly increased capital and liquidity requirements, including improving the quality of regulatory capital, raising minimum capital requirements, establishing capital and liquidity buffers, and implementing annual capital stress tests.

These capital and liquidity buffers are designed to support the economy in adverse situations and allow banks to continue to serve households and businesses. The Federal Reserve supports firms that choose to use their capital and liquidity buffers to lend and undertake other supportive actions in a safe and sound manner.

Reserve Requirements

For many years, reserve requirements played a central role in the implementation of monetary policy by creating a stable demand for reserves. In January 2019, the FOMC announced its intention to implement monetary policy in an ample reserves regime. Reserve requirements do not play a significant role in this operating framework.

In light of the shift to an ample reserves regime, the Board has reduced reserve requirement ratios to zero percent effective on March 26, the beginning of the next reserve maintenance period. This action eliminates reserve requirements for thousands of depository institutions and will help to support lending to households and businesses.

With all due respect to Thursday’s massive repo expansion, this is the Fed’s bazooka. It also means that after this, the Fed – which just cut rates to zero and launched QE5 – is now out of ammo, as Powell will have to cut rates to negative next and/or buy stocks outright for further monetary stimulus, something that would require the permission of Congress. And since that is unlikely absent a total collapse in the financial system, we are now down to fiscal stimulus and US politicians acting in a bipartisan fashion. Which may be a huge gamble.

Curiously, in this barrage of emergency actions, the one which arguably was most needed, a commercial paper facility, was missing. As such, it wouldn’t be unthinkable to see the dollar funding squeeze worsen after the initial euphoria fades on Monday despite the launch of enhanced global swap lines.

The good news is that at least there is nothing more the Fed can announce on Wednesday, absent buying single stocks and ETFs of course, and as such all attention will now be on Congress and what additional fiscal stimulus the Fed can push through.