Tesla Jumps After Beating On Sales And Earnings; Reports Record Free Cash Flow

Tyler Durden

Wed, 10/21/2020 – 16:21

Heading into today’s Tesla earnings call, a question in this case posed by GLJ’s Gordon Johnson, has emerged: do TSLA’s earnings tonight even matter? As Johnson responds, “not really. Why? Well, Consensus is calling for 31c/shr in EPS for TSLA in 3Q20. What’s key is ~16c/shr of this, or ~$200mn, is one-time credit sales which go away at the end of this year, and thus do not deserve a multiple… you put a multiple on recurring profit, not one-time profit. So TSLA’s core biz of making cars appears set to do around 15c/shr in EPS, or ~60c/shr annualized. That’s a P/E ratio of ~700x at TSLA’s stock price today. That means TSLA’s EPS should grow at a 700% CAGR over the next (at least) 5yrs.”

Johnson then asks “Is this realistic” and answers that “of the 505 companies in the S&P 500, NONE OF THEM have grown earnings at a 700% CAGR over the past five years. Conclusion? TSLA is grossly overvalued, and a 10-20c/shr beat/miss is meaningless. Stated differently, at a ~700x P/E ratio, TSLA is not being priced to perfection… it’s being priced to impossibility.”

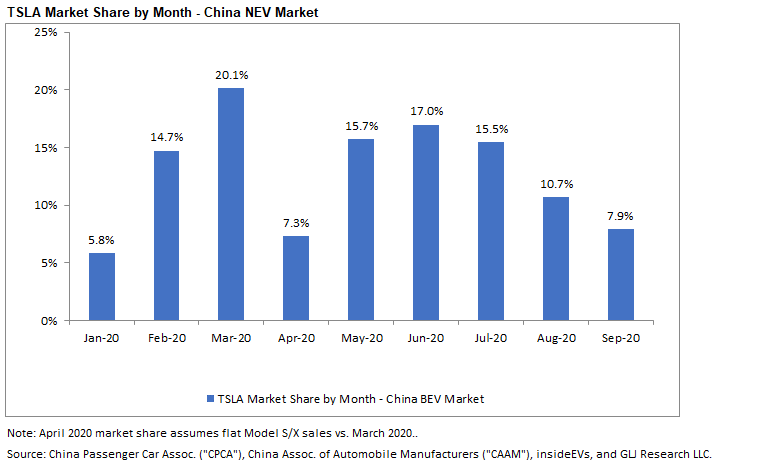

Why is this important? Because as the GLJ strategist continues, 2020 YTD EV sales in the EU (the world’s most competitive EV market) are up ~100% y/y, yet TSLA’s sales are down -14% y/y 2020 YTD.” In other words, not only is TSLA losing share, but they aren’t seeing growth in the world’s most important EV market of Europe. Meanwhile, in China, which is supposed to be TSLA’s major growth market, TSLA’s sales have been below production in each of the past 3 months, and their NEV market share in China has fell from 20.1% in Mar. 2020 to 7.9% in Sep. 2020. And, all of this has occurred despite TSLA cutting the price of its cars ~13 times this year (the price of a made-in-China [“MIC”] Model 3 in China is down 30% YTD). In fact, TSLA is now shipping MIC Model 3 cars to the EU, showing demand in China simply doesn’t exist despite cutting the price of the car 30% YTD,

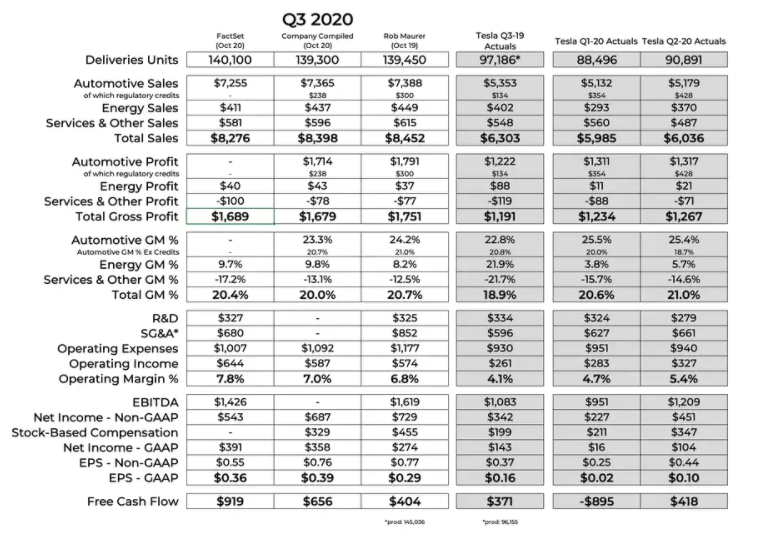

Of course, not everyone will agree, and for those who do care about earnings, here is a snapshot of what Wall Street consensus expects for the third quarter.

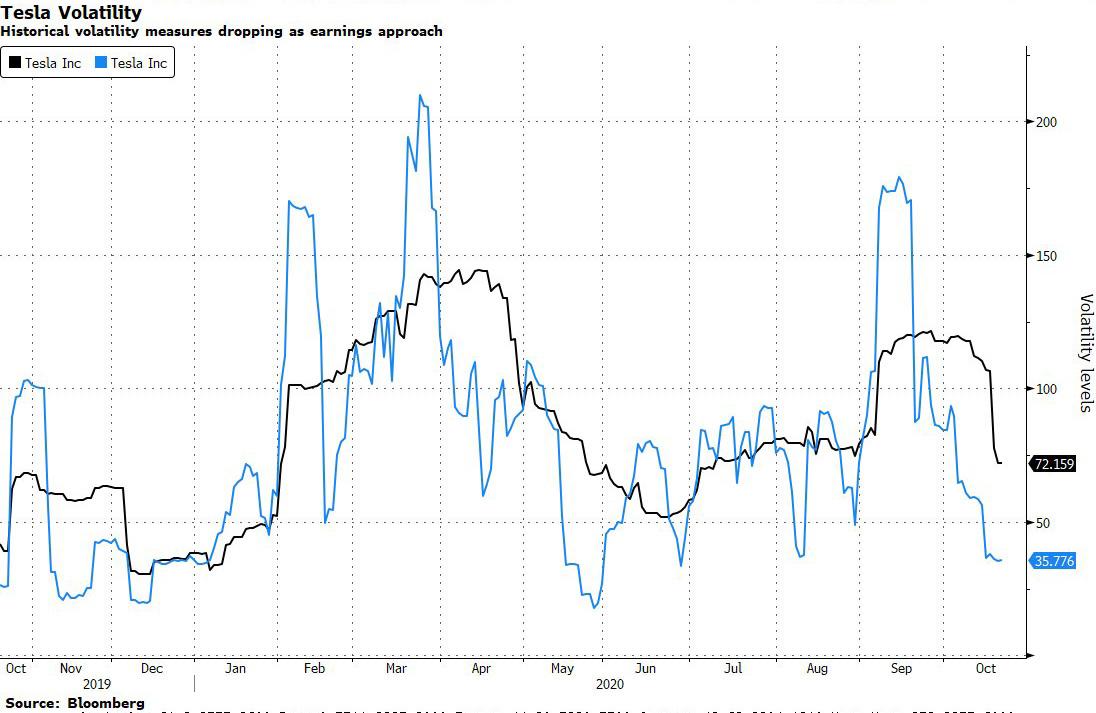

Meanwhile, after sending its stock soaring in the first half of the year, option traders appear to be taking a back seat: according to Bloomberg, volatility in the electric-car maker has been plunging after a flurry of retail investor demand contributed to a surge in options prices over the summer. Ten-day realized volatility has dropped to about 36, down 50% from its one-month level of 72, and there are signs that retail interest may be waning, according to Alon Rosin, Oppenheimer’s head of institutional equity derivatives.

Looking at the options, the current at-the-money straddle suggests shares will move 7.8% in conjunction with the report. That’s in line with the average move of 7.8% over the last eight reports, when declines outpaced rallies at a rate of 5-to-3.

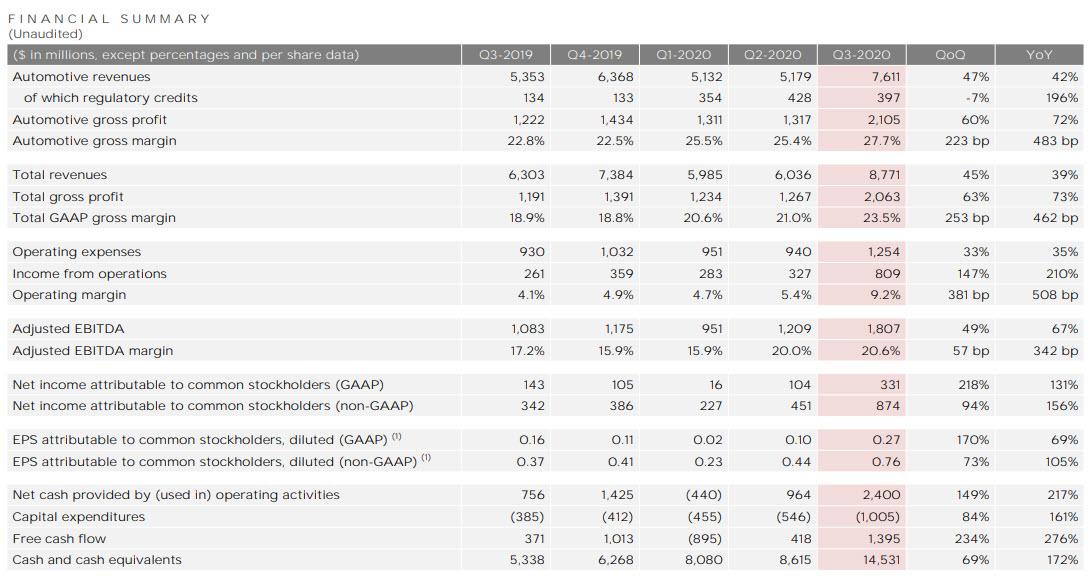

So with all that in mind, here is what Tesla just reported for the second quarter:

- Q3 GAAP EPS of $76 cents, up 105% from $0.37 a year ago, and beating expectations of 55 cents

- Q3 Revenue of $8.77BN, 39% Y/Y, and also beating the $8.26BN estimate.

- Q3 Adjusted Net Income $874MM, up 156% Y/Y however, as in the previous quarter, nearly half of this was thanks to regulatory credits of $397MM

- Q3 Free Cash of $1.95BN, vs Exp. cash burn of $1.1BN

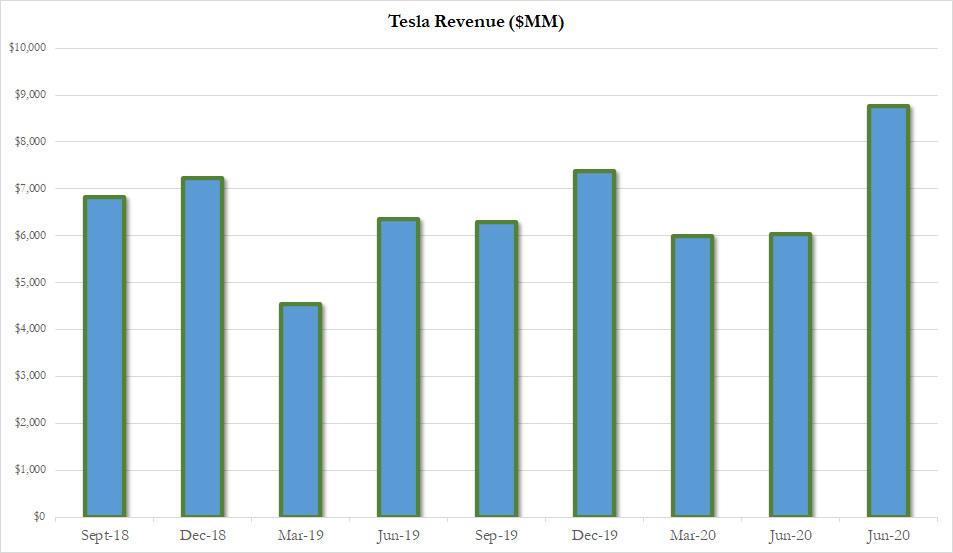

What is bizarre is that for a company that is valued more than most other automakers in the world combined on its prospective growth, and is larger than both the entire US and European auto sector, one would expect far more revenue growth even after this quarter’s bounce:

Full breakdown of Q3 results:

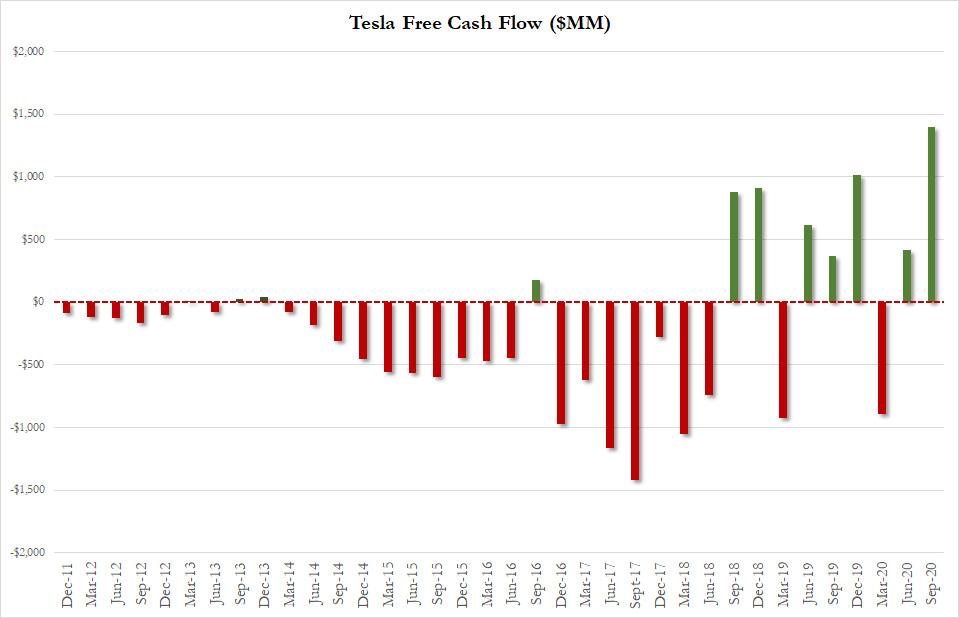

One big surprise in the report was Tesla’s free cash flow, which soared from 418MM in Q2 to a record $1.395BN in Q3, surprising Wall Street which expected $1.1BN in FCF

Thanks to positive free cash flow and the company’s equity offering in the quarter, cash grew impressively to $14.5 billion, up almost $6BN from the previously quarter, which means that Tesla will have no issues meeting debt maturities.

So what was the market’s verdict? In kneejerk reaction Tesla stock is higher but only modestly so compared to previous post-earnings spikes, and was last trading at $437/share, back to levels last seen just 3 days ago.

Developing

via ZeroHedge News https://ift.tt/3o8xrRn Tyler Durden