Courtesy of Russ Winter of Winter Actionables

(Originally published on Dec. 20)

JP Morgan is procuring gold on behalf of China. That’s according to TPMetalsReport’s “Turd Ferguson,” who wrote an article on this topic on Wednesday. I think it’s basically true, keeping in mind that other offshore agents are working for China through JP Morgan. It’s logical when one considers that JPM is the largest bullion bankster and, as the report indicates, it has a huge long position [see “One for the Ages“]. China and its agents hunt where there is treasure.

Here’s how I think it works: The Peoples Bank of China and sovereign wealth funds don’t operate directly with JP Morgan but through offshore funds and representatives. Many are just hired guns, or even American or British firms. They procure gold for China’s huge appetite.

Ferguson writes that the forensics point to kilobars showing up in JPM’s customer warehouses, which don’t conform to normal Comex standards. But who is looking anyway. I believe it is quite logical that recently refined kilobars could show up in JPM’s customer warehouses. After all, a Chinese firm now owns Chase Manhattan Plaza, which contains a big gold vault. The point is that this is a logical transit point on the way to China, meaning it probably won’t stay there long. At the moment, there are nearly 1.14 million ounces being held in JPM’s customer accounts.

Let’s dispense with the absurd notion that these are bars recycled back out of China. Absolutely not. Once it goes into China’s vault, it’s like going into a black hole. Remember the interview Koos Jansen conducted with the chief market strategist of Anglo Far-East for insights into the gold refinery business. He said:

“In China, there are six LBMA refineries, but he has never seen a Chinese gold bar. They’re keeping it all. Gold that goes into China is like going into a black-hole.”

The bottom line on this theory it that is logical and likely that a portion of the huge JPM long position demonstrated by the banker participation report could represent gold destined for China on behalf of these agents. As Ferguson asserts: By extension, China is a party to the bullion bankster net long position. But for the Chinese, this is not just a paper long. It’s a mechanism to take physical gold.

Meanwhile, gold is finally being settled out of the puny deliverable or registered stash on the Comex, which dropped to 490,000 ounces today. Here, JPM holds only 87,071 ounces.

There has been some speculation as to who keeps indiscriminately selling gold in the paper market. Central banks are mentioned a lot. However, at these prices, I don’t think it serves the interests of the U.S. to create conditions whereby China grabs thousands of tonnes of cheap gold in lieu of U.S. Treasuries. Nor is it in U.S. interest to encourage China to make an announcement that the PBoC holds more gold than Fort Knox. It is a little thing called prestige and waving a big stick.

That’s why I keep coming back to a rogue or a whale or series of whales within the fund or speculative community. These function as foils and allow the bullion banksters and Chinese to get cheap gold. During the housing bubble, Bear Stearns, Lehman Brothers and AIG were the aggressive players at the margin that allowed the extreme risk and froth in that market. Something similar is going on in the short gold trade. New commitment of trader data released Friday by the CFTC will show the extent through last Tuesday (before the FOMC announcement).

Incidentally, I think these short attacks as occurring in the middle of the night. More accurately, a slinger shows up in the access market after London opens or in the Globex session. Since I am up and awake in Europe during that period, I can see the plunges and the rapid quick-hit volume on the Globex during the speculative attacks. Afterward, when the Comex opens, volume tends to shrivel. Late in the session yesterday, the Comex exhibited signs that some remaining spec longs were being margin liquidated. Those are 2,000- to 3,000-contract sell offs, that are then reversed and have a completely different hallmark from a spec short attack.

Thursday in the comments section on my site, I remarked that GLD showed signs of a high-volume final capitulation. Volume was 90% higher than average. I said that we could see a large extraction. But only 125,400 ounces came out of GLD SPDR. There could still be a delayed release from GLD today, but that seems like chump change for such intense post Mini Me taper market action. More and more, the forensics point to extremely offside slingers driving this action through off-the-deep-end short sales, much more so than western gold liquidations, margin calls and central banks.

Meanwhile on the Shanghai Exchange, it was a very busy night as a stunning 21,392 kg (754,585 oz) was physically delivered. Gold procurement in China appears to be a well oiled machine at this point and gold extraction out of GLD looks exhausted. For its part, the Chinese must be sending the slinger speculators a last minute Christmas card as we speak.

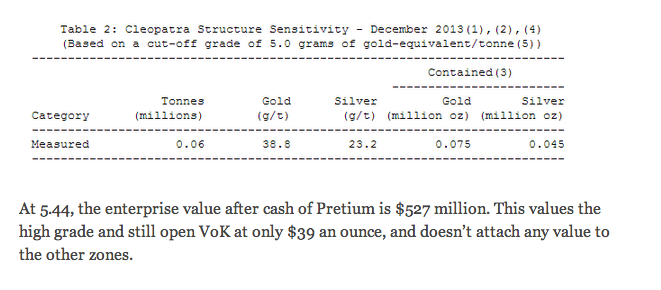

During the session, Pretium released its reserves and resources numbers for Valley of the Kings. This does not include the other previous zones in PVG’s district. It uses a very conservative 5-gram cutoff. Notice that the inferred — which I think is the more recent step-out holes that hit new veins — is 25.6 grams. And here is what’s especially bullish about this report: They only used 0.06 tonnes from the Cleopatra vein,which will be evaluated separately. This is very conservative, making it all the harder to believe they were subjected to such caca a few month ago.

[Subscribe to Winter Actionables here.]

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/PDFXtz8CC4A/story01.htm ilene