Commemorative Prints Now Available: banzai7institute@gmail.com

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/WJui4oCG-vM/story01.htm williambanzai7

another site

Commemorative Prints Now Available: banzai7institute@gmail.com

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/WJui4oCG-vM/story01.htm williambanzai7

On the heels of his recent appearance pouring cold water on Jim Cramer's housing recovery exuberance, recent Nobel Prize winner Bob Shiller unloads another round of uncomfortable truthiness (presumably on the basis of his future-proofing tenure guaranteed by the Nobel). "Bubbles look like this," Shiller tells Der Spiegel, adding that he is, "most worried about the boom in US stock prices." As Reuters reports, Shiller is concerned since "the world is still very vulnerable to a bubble," and with stock exchanges around the world at record highs despite an economy that is "still weak," the Nobel winner proclaimed, "this could end badly."

[Bob Shiller] believes sharp rises in equity and property prices could lead to a dangerous financial bubble and may end badly, he told a German magazine.

…

"I am not yet sounding the alarm. But in many countries stock exchanges are at a high level and prices have risen sharply in some property markets," Shiller told Sunday's Der Spiegel magazine. "That could end badly," he said.

"I am most worried about the boom in the U.S. stock market. Also because our economy is still weak and vulnerable," he said, describing the financial and technology sectors as overvalued.

…

"Bubbles look like this. And the world is still very vulnerable to a bubble," he said.

Bubbles are created when investors do not recognize when rising asset prices get detached from underlying fundamentals.

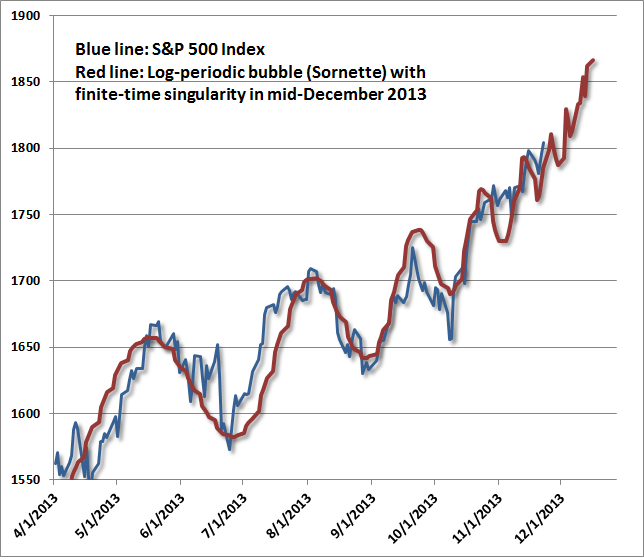

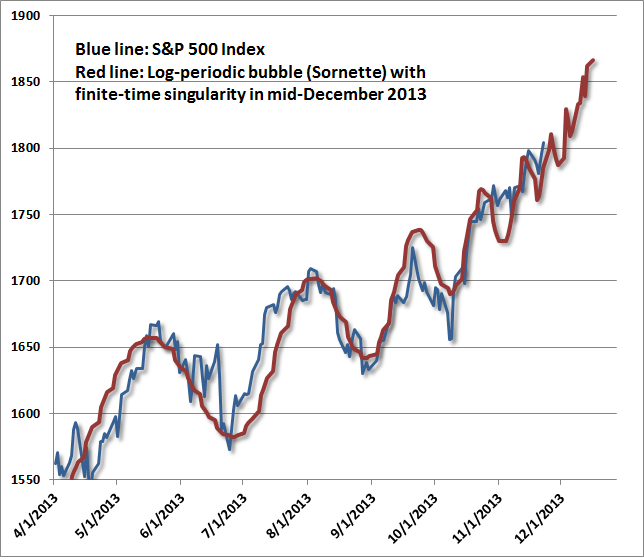

We tend to agree – bubbles do look like this…

…we observe a variety of other features typically associated with dangerous extremes:

Many of us in the financial world know these to be classic features of speculative peaks, but there is career risk in responding to them, so even those who view the situation with revulsion can't seem to tear themselves away.

While I have no belief that markets follow any mathematical trajectory, the log-periodic pattern is interesting because it coincides with a kind of “signature” of increasing speculative urgency, seen in other market bubbles across history. The chart above spans the period from 2010 to the present. What’s equally unsettling is that this speculative behavior is beginning to appear “fractal” – that is, self-similar at diminishing time-scales. The chart below spans from April 2013 to the present. On this shorter time-scale, Sornette’s “finite time singularity” pulls a bit closer – to December 2013 rather than January 2014, but the fidelity to this pattern is almost creepy. The point of this exercise is emphatically not to lay out an explicit time path for prices, but rather to demonstrate the pattern of increasingly urgent speculation – the willingness to aggressively buy every dip in prices – that the Federal Reserve has provoked.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/_DAzCwweo2I/story01.htm Tyler Durden

On the heels of his recent appearance pouring cold water on Jim Cramer's housing recovery exuberance, recent Nobel Prize winner Bob Shiller unloads another round of uncomfortable truthiness (presumably on the basis of his future-proofing tenure guaranteed by the Nobel). "Bubbles look like this," Shiller tells Der Spiegel, adding that he is, "most worried about the boom in US stock prices." As Reuters reports, Shiller is concerned since "the world is still very vulnerable to a bubble," and with stock exchanges around the world at record highs despite an economy that is "still weak," the Nobel winner proclaimed, "this could end badly."

[Bob Shiller] believes sharp rises in equity and property prices could lead to a dangerous financial bubble and may end badly, he told a German magazine.

…

"I am not yet sounding the alarm. But in many countries stock exchanges are at a high level and prices have risen sharply in some property markets," Shiller told Sunday's Der Spiegel magazine. "That could end badly," he said.

"I am most worried about the boom in the U.S. stock market. Also because our economy is still weak and vulnerable," he said, describing the financial and technology sectors as overvalued.

…

"Bubbles look like this. And the world is still very vulnerable to a bubble," he said.

Bubbles are created when investors do not recognize when rising asset prices get detached from underlying fundamentals.

We tend to agree – bubbles do look like this…

…we observe a variety of other features typically associated with dangerous extremes:

Many of us in the financial world know these to be classic features of speculative peaks, but there is career risk in responding to them, so even those who view the situation with revulsion can't seem to tear themselves away.

While I have no belief that markets follow any mathematical trajectory, the log-periodic pattern is interesting because it coincides with a kind of “signature” of increasing speculative urgency, seen in other market bubbles across history. The chart above spans the period from 2010 to the present. What’s equally unsettling is that this speculative behavior is beginning to appear “fractal” – that is, self-similar at diminishing time-scales. The chart below spans from April 2013 to the present. On this shorter time-scale, Sornette’s “finite time singularity” pulls a bit closer – to December 2013 rather than January 2014, but the fidelity to this pattern is almost creepy. The point of this exercise is emphatically not to lay out an explicit time path for prices, but rather to demonstrate the pattern of increasingly urgent speculation – the willingness to aggressively buy every dip in prices – that the Federal Reserve has provoked.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/_DAzCwweo2I/story01.htm Tyler Durden

Is Obamacare back in action? For the last two

Is Obamacare back in action? For the last two

months, Healthcare.gov, the federally run insurance portal at the

heart of the law, has experienced numerous technical troubles. The

administration vowed to fix those problems by the end of November,

and today, the Department of Health and Human Services (HHS)

announced that it had met the goal of making sure that the site

“worked smoothly” for the “vast majority of users.”

In a conference call this morning, a spokesperson for HHS

said, “we believe we have met that goal.” A

six-page progress report released by the administration this

morning touts technical progress as well as managerial

improvements, declaring that the team making the improvements is

now “operating with private sector velocity and efficiency.”

Anyone else catch the irony there? Set up a vast,

government-managed tech operation, watch it fail—and then, as it

attempts to reboot itself, boast of private-sector quality

work? (Also, let’s not forget that the original failed work

was in fact done by private contractors working under the

managerial bumbling of the federal health bureaucracy.)

So it’s all fixed, and Obamacare’s going to be great, right? Not

so fast. The White House’s

stated goal of improving the website so that 80 percent of

users can get all the way through the system still means that one

in five users won’t make it through the digital gauntlet. It also

claims that the site is stable and accessible 90 percent of the

time, a figure it only gets by excluding the hours of scheduled

maintenance it undergoes each day.

And that’s if the website even works as well as the

administration says it’s supposed to. Which is, at best, a very big

if.

According to The Washington Post, some progress has

been made, but the techies and bureaucrats attempting to patch

together the site have not fully met their own internal goals for

performance yet. That would certainly fit the pattern. All

throughout the development of the online insurance exchange system,

the administration has claimed that Obamacare’s tech is working, or

just about to work—but its promises have repeatedly been proven

wrong.

Given its history, the administration’s claims have to be taken

with a cargo ship full of salt—especially since there’s no good way

to independently confirm that the website is working as well as the

administration claims. You just have to

take their word for it.

Even if the website appears to be working on the user end,

there’s no guarantee that less visible functions are performing

adequately. Insurers have been reporting dropped or incorrectly

transmitted enrollment data since the exchanges launched. And

according to The New York Times, the repair team

prioritized front-end fixes for consumers over accurate

insurance-company connections. So the site might appear to be

working just fine, until you try to actually use the insurance that

you thought you purchased.

These are just the known problems. There are plenty more

opportunities for technical troubles down the line, particularly

because when administration officials say the website is working

better, they mean the portion of the website that’s actually been

built. Yet by the reckoning of a senior Obamacare tech official,

some 30 to 40 percent of the exchange functionality has yet to

been constructed, including some of the crucial insurer payment

systems. (“It’s not built, let alone tested,” one insurance

industry official

told The Washington Post.”) So the best possible

scenario here is that the 70 percent of the site that’s been built

works for about 80 percent of the people who want to use

it.

from Hit & Run http://reason.com/blog/2013/12/01/has-obamacare-been-rescued-by-the-admini

via IFTTT

Is Obamacare back in action? For the last two

Is Obamacare back in action? For the last two

months, Healthcare.gov, the federally run insurance portal at the

heart of the law, has experienced numerous technical troubles. The

administration vowed to fix those problems by the end of November,

and today, the Department of Health and Human Services (HHS)

announced that it had met the goal of making sure that the site

“worked smoothly” for the “vast majority of users.”

In a conference call this morning, a spokesperson for HHS

said, “we believe we have met that goal.” A

six-page progress report released by the administration this

morning touts technical progress as well as managerial

improvements, declaring that the team making the improvements is

now “operating with private sector velocity and efficiency.”

Anyone else catch the irony there? Set up a vast,

government-managed tech operation, watch it fail—and then, as it

attempts to reboot itself, boast of private-sector quality

work? (Also, let’s not forget that the original failed work

was in fact done by private contractors working under the

managerial bumbling of the federal health bureaucracy.)

So it’s all fixed, and Obamacare’s going to be great, right? Not

so fast. The White House’s

stated goal of improving the website so that 80 percent of

users can get all the way through the system still means that one

in five users won’t make it through the digital gauntlet. It also

claims that the site is stable and accessible 90 percent of the

time, a figure it only gets by excluding the hours of scheduled

maintenance it undergoes each day.

And that’s if the website even works as well as the

administration says it’s supposed to. Which is, at best, a very big

if.

According to The Washington Post, some progress has

been made, but the techies and bureaucrats attempting to patch

together the site have not fully met their own internal goals for

performance yet. That would certainly fit the pattern. All

throughout the development of the online insurance exchange system,

the administration has claimed that Obamacare’s tech is working, or

just about to work—but its promises have repeatedly been proven

wrong.

Given its history, the administration’s claims have to be taken

with a cargo ship full of salt—especially since there’s no good way

to independently confirm that the website is working as well as the

administration claims. You just have to

take their word for it.

Even if the website appears to be working on the user end,

there’s no guarantee that less visible functions are performing

adequately. Insurers have been reporting dropped or incorrectly

transmitted enrollment data since the exchanges launched. And

according to The New York Times, the repair team

prioritized front-end fixes for consumers over accurate

insurance-company connections. So the site might appear to be

working just fine, until you try to actually use the insurance that

you thought you purchased.

These are just the known problems. There are plenty more

opportunities for technical troubles down the line, particularly

because when administration officials say the website is working

better, they mean the portion of the website that’s actually been

built. Yet by the reckoning of a senior Obamacare tech official,

some 30 to 40 percent of the exchange functionality has yet to

been constructed, including some of the crucial insurer payment

systems. (“It’s not built, let alone tested,” one insurance

industry official

told The Washington Post.”) So the best possible

scenario here is that the 70 percent of the site that’s been built

works for about 80 percent of the people who want to use

it.

from Hit & Run http://reason.com/blog/2013/12/01/has-obamacare-been-rescued-by-the-admini

via IFTTT

If you put a bunch of people who identify

If you put a bunch of people who identify

as feminists into a room with a bunch of people who identify as

free market capitalists, they would likely have some strained

conversations. At best. They just don’t roll with the same crowds.

This is a shame, argues Zenon Evans, because feminists are actually

quite savvy at operating within the voluntary mechanisms of the

free market system.

from Hit & Run http://reason.com/blog/2013/12/01/zenon-evans-on-why-feminists-make-great

via IFTTT

While even the most naive private sector cyber-experts knew well in advance that an effective rewrite of Obamacare’s 500 million lines of code would take a “little longer” than the month promised by the government in advance of the November 30 fix deadline, the Obama administration went ahead with its much touted healthcare.gov relaunch anyway. The results have been mixed.

The WSJ quotes Obama administration officials who said Sunday there has been “dramatic progress” in fixing HealthCare.gov but acknowledged “there is more work to be done” in improving the site and its underlying technology and that technicians for the site said they will not be able to fix all the glitches by the deadline.

Centers for Medicare and Medicaid Services officials released an eight-page report Sunday morning offering a few details of progress in fixing the site, which crashed shortly after its launch Oct. 1.

The site now allows 50,000 people to use it at the same time, according to the report, and wait times for Internet pages to load have dropped from 8 seconds to less than a second. More than 400 fixes have been made to the site.

“The bottom line, HealthCare.gov on Dec. 1 is night and day from where it was on Oct. 1,” said Jeffrey Zients, the Obama aide tasked with fixing the technical mess, in a call with reporters.

Ironically, if Obamacare ends up being the success Obama has portrayed it as since day one, and traffic to the website surges (as is needed for Obamacare to become financially viable as opposed to just stop showing 404 screens), it is likely that it will crash once again. CMS representative Julie Bataille cautioned, “If there are extraordinary high spikes in traffic, which exceed the site’s capacity, consumers will be put in a new advance queuing system that will give them an expected wait time, or allow them to be notified via email when they can return to the site.” Aka: F5.

That said, assuming the website is indeed finally fixed, it is clear who should be thanked: Google and Oracle. “Contractors and outside engineers from Google Inc. and Oracle Corp. brought in by Obama administration officials have been working overtime over the past five weeks to try to fix the site and its underlying technology, including systems that send information and payments to insurers. Administration officials say they installed fixes this weekend to address erroneous customer data that have been sent to insurers. They won’t know if that issue has been fixed until more consumers get through the enrollment process and more customer data is sent to insurers, said Julie Bataille, a CMS spokeswoman.”

In other words, you have to sign up for Obamacare, to find out not only what’s in it and what your premiums will be, but if it has even been fixed.

Finally, those still confused about the enrollment process, will get some much needed clarity from the flowchart below.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/FvB3dFzSaUk/story01.htm Tyler Durden

While even the most naive private sector cyber-experts knew well in advance that an effective rewrite of Obamacare’s 500 million lines of code would take a “little longer” than the month promised by the government in advance of the November 30 fix deadline, the Obama administration went ahead with its much touted healthcare.gov relaunch anyway. The results have been mixed.

The WSJ quotes Obama administration officials who said Sunday there has been “dramatic progress” in fixing HealthCare.gov but acknowledged “there is more work to be done” in improving the site and its underlying technology and that technicians for the site said they will not be able to fix all the glitches by the deadline.

Centers for Medicare and Medicaid Services officials released an eight-page report Sunday morning offering a few details of progress in fixing the site, which crashed shortly after its launch Oct. 1.

The site now allows 50,000 people to use it at the same time, according to the report, and wait times for Internet pages to load have dropped from 8 seconds to less than a second. More than 400 fixes have been made to the site.

“The bottom line, HealthCare.gov on Dec. 1 is night and day from where it was on Oct. 1,” said Jeffrey Zients, the Obama aide tasked with fixing the technical mess, in a call with reporters.

Ironically, if Obamacare ends up being the success Obama has portrayed it as since day one, and traffic to the website surges (as is needed for Obamacare to become financially viable as opposed to just stop showing 404 screens), it is likely that it will crash once again. CMS representative Julie Bataille cautioned, “If there are extraordinary high spikes in traffic, which exceed the site’s capacity, consumers will be put in a new advance queuing system that will give them an expected wait time, or allow them to be notified via email when they can return to the site.” Aka: F5.

That said, assuming the website is indeed finally fixed, it is clear who should be thanked: Google and Oracle. “Contractors and outside engineers from Google Inc. and Oracle Corp. brought in by Obama administration officials have been working overtime over the past five weeks to try to fix the site and its underlying technology, including systems that send information and payments to insurers. Administration officials say they installed fixes this weekend to address erroneous customer data that have been sent to insurers. They won’t know if that issue has been fixed until more consumers get through the enrollment process and more customer data is sent to insurers, said Julie Bataille, a CMS spokeswoman.”

In other words, you have to sign up for Obamacare, to find out not only what’s in it and what your premiums will be, but if it has even been fixed.

Finally, those still confused about the enrollment process, will get some much needed clarity from the flowchart below.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/FvB3dFzSaUk/story01.htm Tyler Durden

Sunday morning yak shows got you down? Then check

Sunday morning yak shows got you down? Then check

out this November 14 episode of John Stossel’s eponymous Fox

Business show. Titled “The Rise of Libertarians?” Stossel talks

with, among others, Ron Paul, Penn Jillette, Matt Welch, and me to

figure out whether believers in social tolerance and fiscal

responsibility really are taking over the country. Stossel also

talks to folks from the fast-growing Students for Liberty group and

gets a negative take on “Free Minds and Free Markets” from The

Weekly Standard’s Fred Barnes.

The YouTube vid of the show clips the commercials. Matt Welch

and I show up around the 2.30 minute mark, in the show’s first

segment.

Take a look – I’m pretty certain this will be far more

interesting than anything currently showing up on this morning’s

broadcast and cable chin-stroke-athons.

For more on Stossel’s show, go

here.

from Hit & Run http://reason.com/blog/2013/12/01/watch-john-stossel-ron-paul-matt-welch-p

via IFTTT

Sunday morning yak shows got you down? Then check

Sunday morning yak shows got you down? Then check

out this November 14 episode of John Stossel’s eponymous Fox

Business show. Titled “The Rise of Libertarians?” Stossel talks

with, among others, Ron Paul, Penn Jillette, Matt Welch, and me to

figure out whether believers in social tolerance and fiscal

responsibility really are taking over the country. Stossel also

talks to folks from the fast-growing Students for Liberty group and

gets a negative take on “Free Minds and Free Markets” from The

Weekly Standard’s Fred Barnes.

The YouTube vid of the show clips the commercials. Matt Welch

and I show up around the 2.30 minute mark, in the show’s first

segment.

Take a look – I’m pretty certain this will be far more

interesting than anything currently showing up on this morning’s

broadcast and cable chin-stroke-athons.

For more on Stossel’s show, go

here.

from Hit & Run http://reason.com/blog/2013/12/01/watch-john-stossel-ron-paul-matt-welch-p

via IFTTT