As stock markets plunged in December, asset-gatherers and commission-takers (and politicians) rushed on to every media outlet to reassure everyone that the fundamentals are “solid”, “extremely strong”, “very positive” … pick your spin.

The only problem is that top-down, the fundamentals are dismally disappointing…

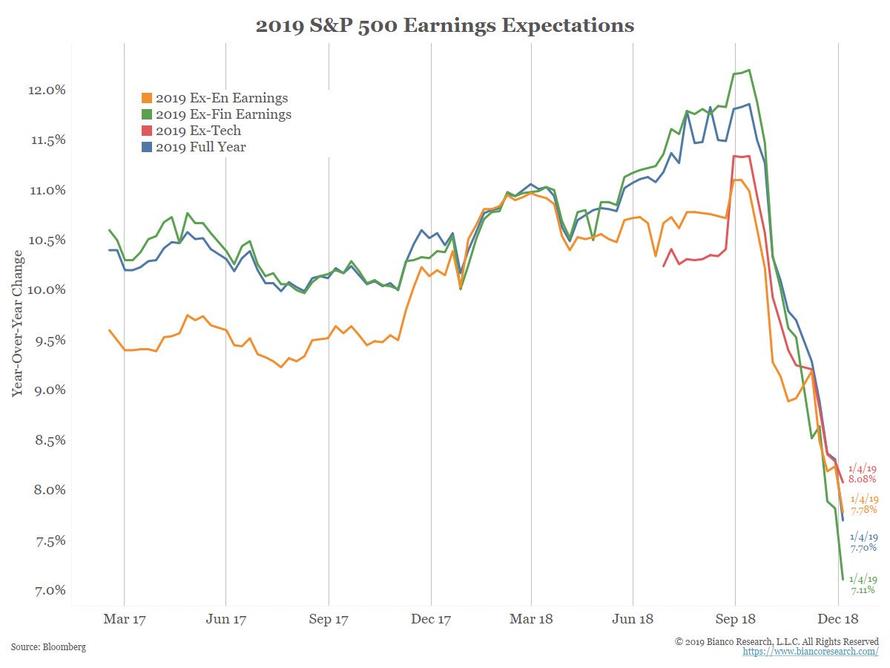

And bottom-up, the fundamentals are almost as bad as they have ever been as analysts take the ax to their outlooks…the number of analysts’ global earnings downgrades exceeded upgrades by the most since 2009.

And don’t try and claim that the US is the cleanest shirt in the dirty laundry pile of global markets, it’s not!! (@biancoresearch)

Oh, and one more thing – if everything’s so awesome, why is The Fed panic-jawboning away from its tightening policy trend?

Hey, don’t worry, it’s probably nothing…

“Analysts are always late to the party,” said Timothy Graf, head of macro strategy for Europe, Middle East and Africa at State Street Global Markets. “I don’t necessarily see this as a sign of more doom and would guess that quite a lot of bad news is already accounted for in prices.”

“If you’re going to get earnings downgrades, it’s more likely to be the more normal corporate-led pullback rather than a financial crisis like you saw in 2007,” said said Mike Bell, a global market strategist at JPMorgan Asset Management.

“You’d expect a much smaller decline in the stock market than you saw in 2000.”

…and besides, The Fed is about to entirely u-turn on its multi-year narrative that everything is awesome and shift to an easing tone to soothe the beating heart of all those investors who ‘deserve’ their fair share of stock market returns.

via RSS http://bit.ly/2RDTZfs Tyler Durden