Two weeks ago, the NY Fed made waves in the finance community when it reported that a record 7 million Americans are delinquent on their auto loans. Of course, to regular readers, none of this was new as we covered that exact same topic back in May 2018 when we reported that “Subprime Auto Loan Default Rates Are Now Higher Than During The Financial Crisis.”

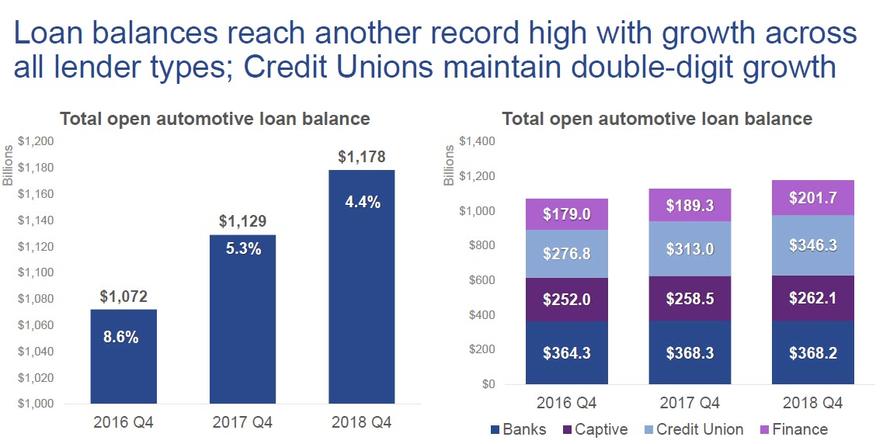

Alas, that does not make the Fed’s conclusions incorrect, and in fact according to the Experian’s latest State of the Automotive Finance Market report, the situation is getting worse by the day as not only are auto loan delinquencies rising but Americans are now paying a fresh record high monthly payment for both a new and a used car and assuming a larger amount of debt to make it happen as affordability continues to decline. Americans now hold $1.178 trillion of outstanding auto loan debt (a record) up from $1.072 trillion two years ago….

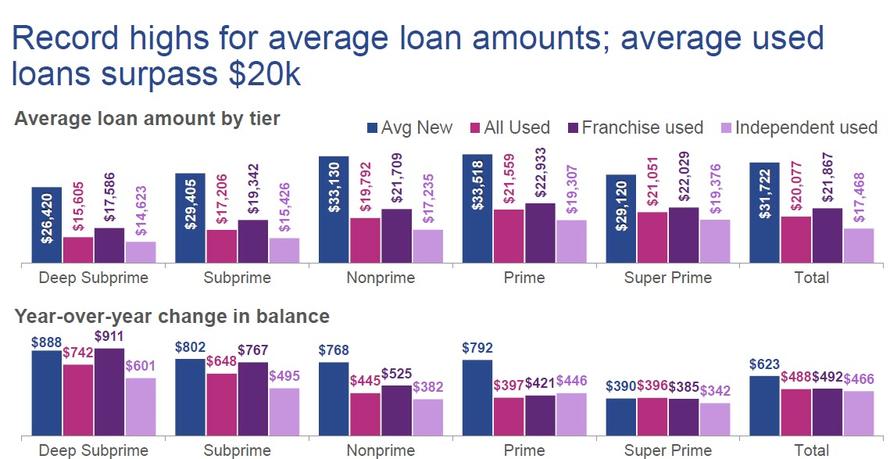

… with the average new car loan jumping $623 year-over-year to $31,722 in Q4 2018, while used vehicle loan amounts increased $488 to surpass $20K for the first time, or specifically $20,077.

And with loans still easy to come by, dealers can keep hiking prices and they sure are doing just that: according to Edmunds.com the average transaction price for a new vehicle in December hit an all-time high of $37,260, an increase of $6,598 from December 2010.

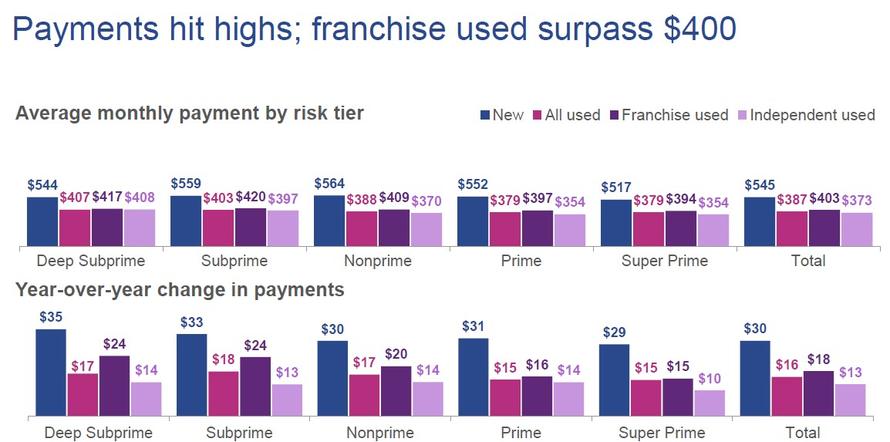

Not only are consumers borrowing more to pay for a new vehicle, they are also making higher monthly loan payments. Experian said the average monthly payment for a new vehicle hit a record high of $545, up $30 from a year earlier. That increase is driving up interest in used vehicles, which sell at a far lower price and typically carry a lower monthly payment; even so the average monthly payment for a used vehicle has also surpassed $400 for the first time, rising by $18 to $403.

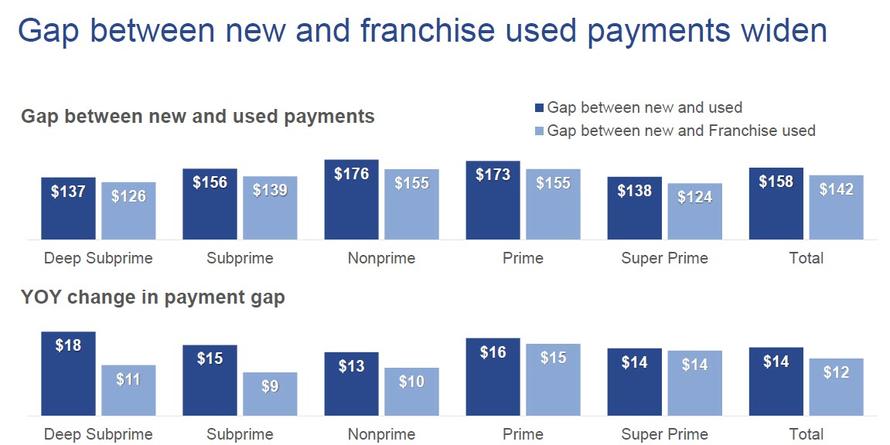

Taking a closer look at the data, the gap between new and used financing payments continues to widen, reaching $158 in the fourth quarter. For some consumers, that gap can often mean the difference between buying a new or used vehicle.

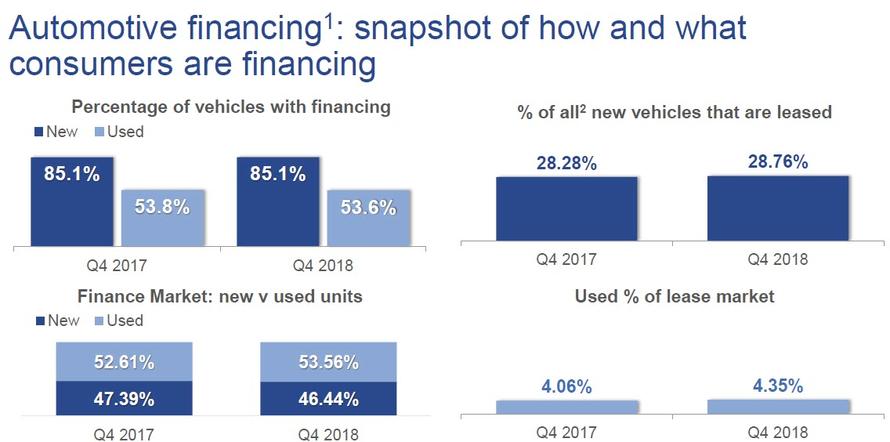

A breakdown of the auto financing market shows that in Q4, 85% of all new vehicles and 54% of used cars were purchased with financing, while the number of leased vehicles in the quarter rose modestly from a year ago to 28.8% from 28.3%.

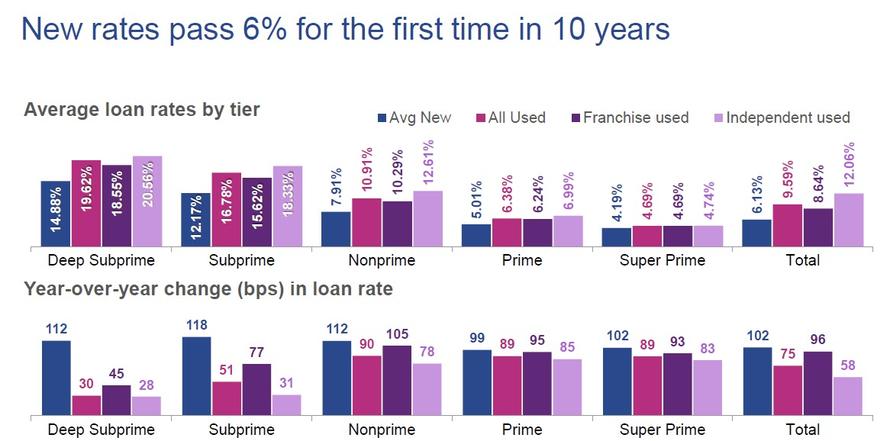

More troubling, however, and further depressing auto affordability is that interest rates continued to creep higher across all loan types. The average new car loan is now the highest in a decade, rising above 6% for the first time in 10 years, or 6.13% to be precise – up a whopping 102bps bps Y/Y, while the average used car can be had if a consumer can afford the annual 9.59% interest rate.

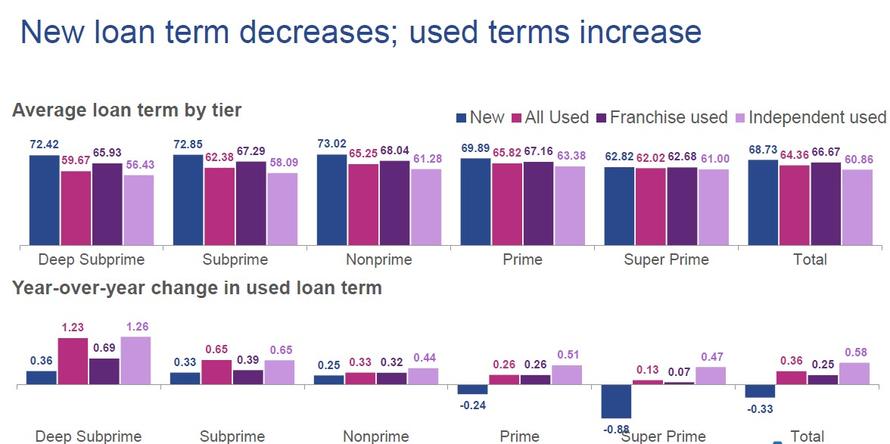

Also not surprising is that consumers are staying with a “strategy” of taking out long-term loans, to try and offset higher sticker prices, higher interest rates and higher loan amounts. The flipside is that longer terms mean consumers pay more interest over the life of a loan. The average term for a new car in the second quarter was just under 69 months, marginally lower than a year ago, even as the terms for all used, franchise used and independent used cars all hit new all time highs.

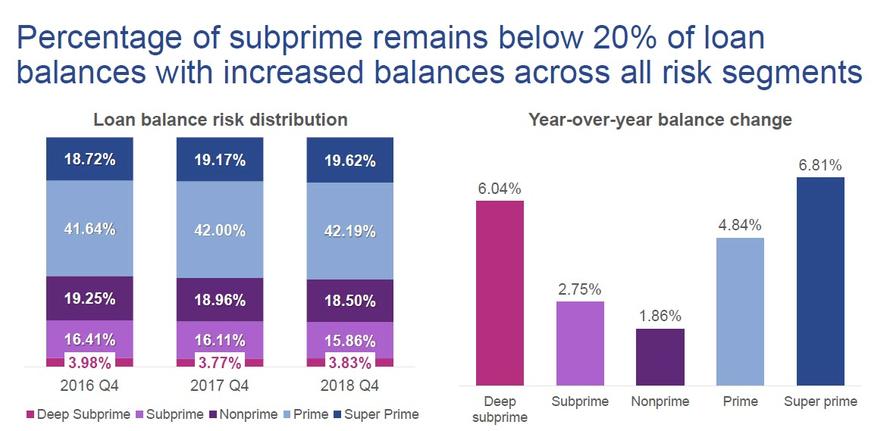

The effect is being felt mostly at the risky end of the credit spectrum, where compared with last year, lenders are becoming increasingly more skittish and conservative as market share for subprime and deep-subprime automotive loans continues to fall.

And yet, despite a sharp drop in deep subprime loan issuance in early and mid 2018, it appears that as the year ended, lenders once again hit the gas on issuing subprime loans, and as a result there was a 6% surge in deep subprime loan balances in Q4…

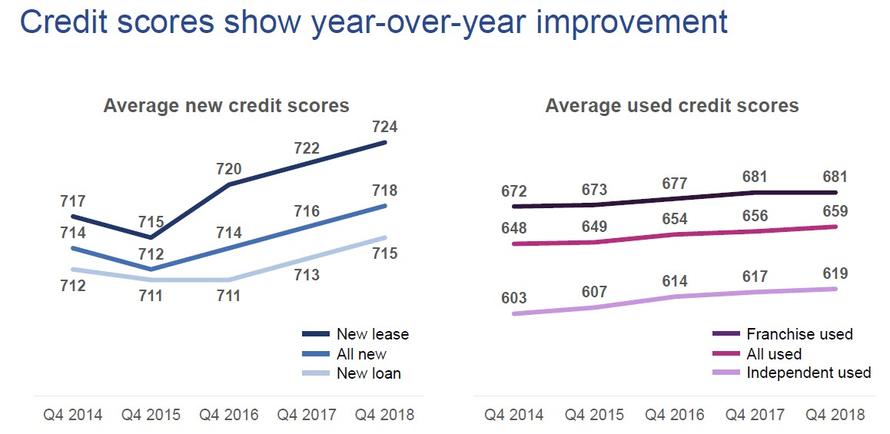

… even as the average new credit score for loans and leases rose once again to 718 on average in Q4 from 716 in the prior quarter.

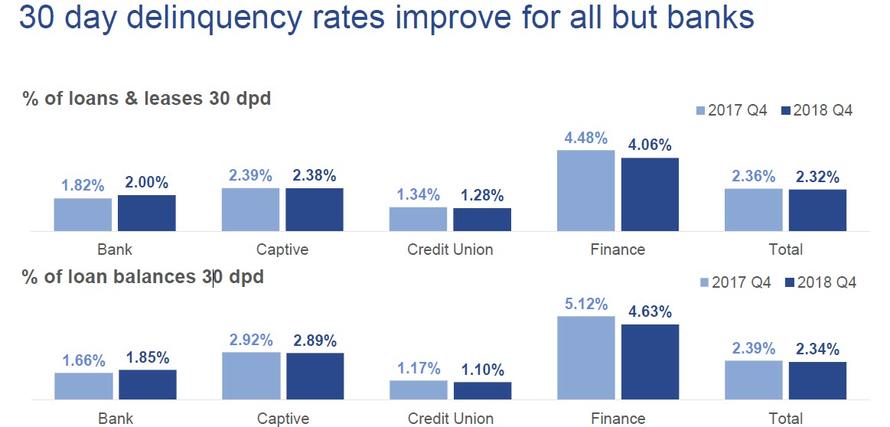

There was some good news in the latest auto loan data: the percentage of delinquent loans showed a decline in the fourth quarter. Experian reported 30-day delinquencies accounted for about 2.32% of outstanding balances in the second quarter, vs. 2.36% a year ago.

“The percentage of delinquencies has trended upward within the last few years,” said Melinda Zabritski, senior director of automotive financial solutions for Experian. “But it is worth noting, the percentages are still well below the high-water mark set in 2009.”

The rising delinquencies are a clear indicator that millions of Americans are struggling financially to even make their monthly auto payments. As noted above, earlier this month, the Federal Reserve Bank of New York reported that more than 7 million borrowers were at least three months behind on their auto loans at the end of last year — more troubled borrowers than at the end of 2010 when overall delinquency rates were at their worst. The delinquency rates are lower now because the market for auto loans has since grown.

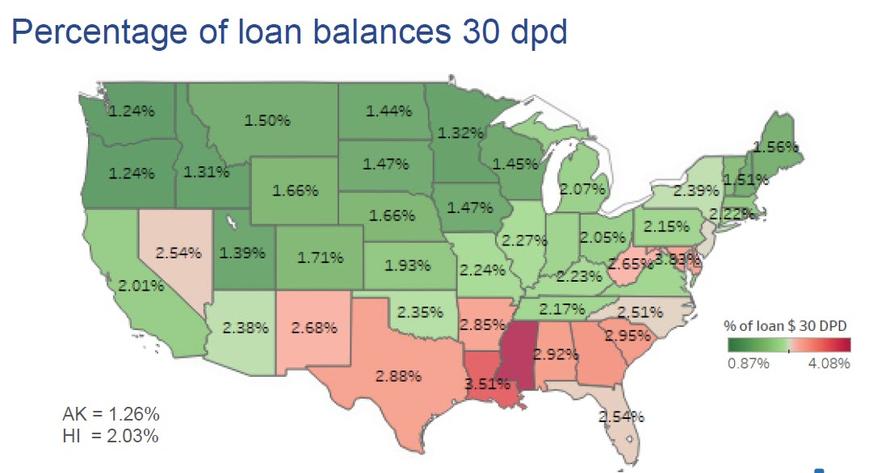

Meanwhile, as the map below shows, 30-day delinquencies still remain a substantial problem across much of the southern US.

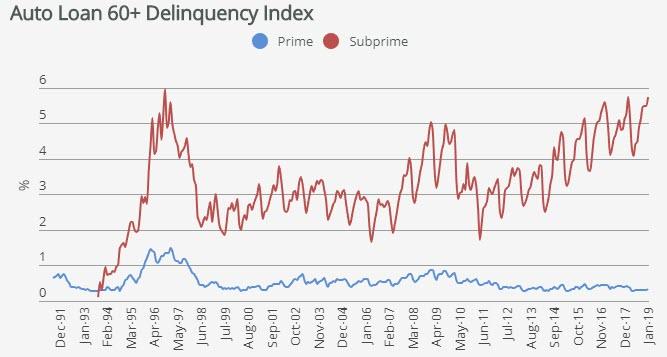

Of course, what is most troubling is the following chart from Fitch showing the ongoing surge in 60+ day delinquencies, and which hardly needs an explanation.

Zabritski says the stats are worth watching, but not yet to the point of serious concern. “It’s only natural to see an uptick in automotive delinquent loan volume. It’s important to view these trends within the larger industry context,” she said according to CNBC.

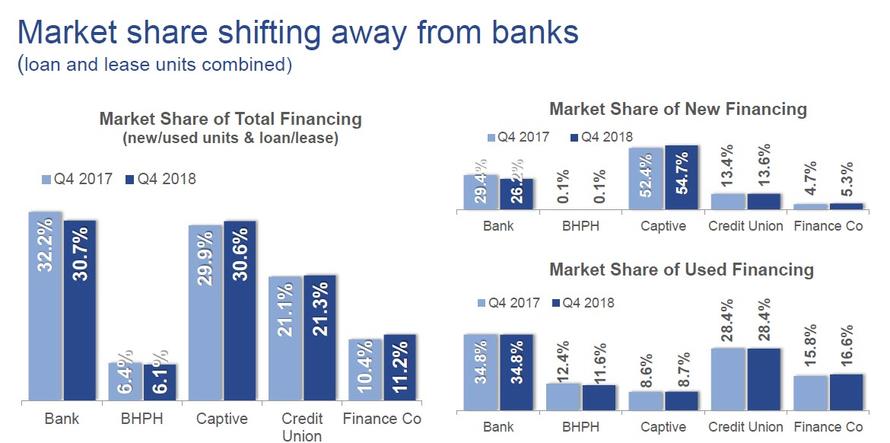

But the key data which seems to suggest that the auto bubble may have run its course comes from the following charts which confirm that traditional banks and finance companies continue to aggressively slash their share of new auto originations especially when it comes to the subprime segment, while OEM captives (and Credit Unions) are being forced to pick up the slack in an effort to keep the ponzi schemes going just a little longer.

And while some can claim that this is just a natural result of healthy competition between lenders, what is likely causing sleepless nights at banks who have tens of billions in outstanding loans, is the coming tsunami of lease returns which will lead to a shock repricing for both car prices and existing LTVs once the millions in new cars come back to dealer lots.

via ZeroHedge News https://ift.tt/2Xtpvg5 Tyler Durden