Though Kim Jong Un has a long train ride back to Pyongyang to ponder how the collapse of Thursday’s talks in Hanoi might impact his relationship with Trump, senior officials in his government are already signaling that the detente between the two geopolitical rivals might be over, having deliberately undermined President Trump by contradicting his version events during a midnight press conference – even going so far as to suggest that Kim has “lost the will” to continue negotiating (since North Korea’s “reasonable” position “will never change” – something that US intel analysts have been saying for months).

And as we wait for a rebuttal from President Trump (who will arrive back home much quicker than Kim despite the greater geographical distance), it’s worth noting that the reaction to Trump’s performance in Hanoi – which provoked some twitter wits to joke that he managed to find another way for America to “lose” in Vietnam – hasn’t been as negative as one might have expected.

In one of the few examples of true bipartisanship during the Trump era, lawmakers from both parties chimed in on Twitter and on the floor of the Senate to praise President Trump for having the temerity to walk away from the table.

Confounding Trump’s allies and his enemies, Senate Minority Leader Chuck Schumer even praised the president during a speech on the Senate floor for choosing to walk away instead of accepting an inferior deal that would have made the US less safe in the long run.

All 47 @SenateDems are introducing a resolution today that affirms 3 things:

1. Climate change is real.

2. It’s caused by humans.

3. Congress must act.Will the @SenateGOP sign on? https://t.co/PNiaAMWFxk

— Chuck Schumer (@SenSchumer) February 28, 2019

And Schumer wasn’t the only Democratic leader to offer praise. According to Bloomberg, Nancy Pelosi told reporters “It’s good that the president did not give him anything for the little he was proposing,” and that “diplomacy is important; we all support it,” but the prospects for a deal were dim.

Connecticut Sen. Chris Murphy tweeted that, while he wished Trump had stood up to Kim on the North’s “brutal” human rights record (a sentiment that was echoed by other Democrats), “talking is never a bad idea and no deal is better than a bad one.”

I wish Trump stood up to Kim more forcefully on his brutal human rights record. But talking is never a bad idea and no deal is better than a bad one. If outcome is that both missile test moratorium and our sanctions continue, and we keep dialogue going, that’s not a bad outcome.

— Chris Murphy (@ChrisMurphyCT) February 28, 2019

Marco Rubio took a brief break from tweeting about Venezuela to contradict an Axios report about his reaction to the talks, saying that, while he would love to “deal with a #NorthKorea that eliminates their nuclear weapons”, agreeing to “sanctions relief while allowing them to hide warheads” would not only be a bad deal, but a “dangerous one.”

I would love to have a deal with #NorthKorea that eliminates their nuclear weapons & missiles in exhange for lifting many sanctions.

But agreeing to sanctions relief while allowing them to hide warheads & keep missiles would not just be a bad deal,it would be a dangerous one. https://t.co/SIrOw9hR9v

— Marco Rubio (@marcorubio) February 28, 2019

Taking a slightly more belligerent tack, Senator Lindsey Graham applauded Trump for walking away, affirmed that the only good deal would be complete denuclearization and warned that, if relations with NK completely break down, there may come a time when the nuclear threat posed by North Korea must be dealt with “one way of the other.”

I appreciate the effort by President @realDonaldTrump to reach a peaceful conclusion to the North Korean nuclear threat.

It’s better to walk away than sign a bad deal.

— Lindsey Graham (@LindseyGrahamSC) February 28, 2019

There is only one good deal: the complete denuclearization of North Korea in return for security guarantees and economic assistance.

— Lindsey Graham (@LindseyGrahamSC) February 28, 2019

I am encouraged that there are plans to continue talking.

We must not go back to the status quo.

If negotiations fail, it would be time to end the nuclear threat from North Korea – one way or the other.

— Lindsey Graham (@LindseyGrahamSC) February 28, 2019

Senate Majority Leader Mitch McConnell, meanwhile, said Trump should be “commended” for his performance.

The President should be commended for his personal commitment to persuading Kim Jong Un to pursue a different path — and for walking away when it became clear North Korea was not ready to commit enough to de-nuclearization.

— Leader McConnell (@senatemajldr) February 28, 2019

But the response wasn’t all positive. Virginia senator and former vice presidential candidate Tim Kaine questioned why Trump decided to ‘stick up’ for Kim by telling reporters he believed Kim had no knowledge of the brutal treatment suffered by US student Otto Warmbier in a “rough” North Korean prison.

President Trump continues to praise Kim Jong Un despite zero evidence of denuclearization from North Korea in the entire year since the last summit. Before he heaps on more, we ought to see something in return. https://t.co/IP59cxNXMu

— Tim Kaine (@timkaine) February 26, 2019

Trump says Kim Jong Un didn’t know about brutalization of VA student Otto Warmbier. MBS had no knowledge of VA resident Jamal Khashoggi’s murder. Oh, and Putin had nothing to do with 2016 election interference… Why does he keep sticking up for dictators over his own people??

— Tim Kaine (@timkaine) February 28, 2019

Both Pelosi and Kaine agreed that Trump’s willingness to defend dictators was troubling.

Still, it’s hardly surprising given all of the evidence that the intelligence community has unearthed showing that NK has continued its nuclear program at several clandestine sites exposed by satellites. Trump said that Kim expressed surprise when he presented him with evidence of the secret sites during the talks.

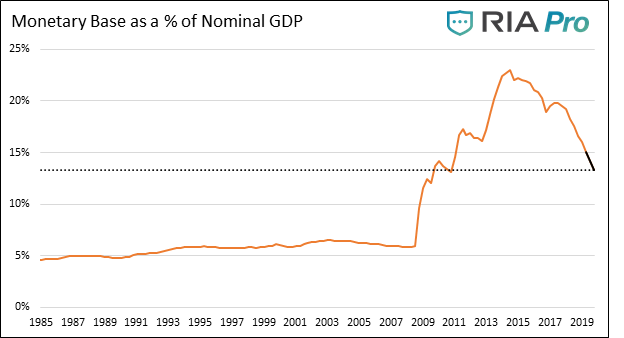

While it’s still unclear exactly what impact the collapse of the Hanoi talks might have on Trump’s negotiations with China, equity bulls better hope that Trump doesn’t take the phrase “no deal is better than a bad one” to heart.

via ZeroHedge News https://ift.tt/2HdWgIH Tyler Durden

Trump Dynasty, a three-part documentary that aired this week on A&E, features an interview with Reason Contributing Editor J.D. Tuccille, whose father wrote the

Trump Dynasty, a three-part documentary that aired this week on A&E, features an interview with Reason Contributing Editor J.D. Tuccille, whose father wrote the  Gary Steele, a white police officer in Detroit, has been fired after mocking a black woman following a traffic stop.

Gary Steele, a white police officer in Detroit, has been fired after mocking a black woman following a traffic stop.

Today at the annual Conservative Political Action Conference (CPAC) near Washington, D.C., Ronna McDaniel, chair of the supposedly-impartial-in-primaries Republican National Committee (RNC), said that anyone foolish enough to challenge President Donald Trump would “

Today at the annual Conservative Political Action Conference (CPAC) near Washington, D.C., Ronna McDaniel, chair of the supposedly-impartial-in-primaries Republican National Committee (RNC), said that anyone foolish enough to challenge President Donald Trump would “

Food and Drug Administration chief Scott Gottlieb

Food and Drug Administration chief Scott Gottlieb