As the Brexit doomsday clock ticks ever closer to day zero, Tory Brexiteers and their allies in the DUP (the tiny Northern Irish party that props up May’s government) are facing an incredibly difficult decision. Should they finally relent in their opposition to Theresa May’s deal and effectively take the European Union’s word – or whatever assurances it might offer – that the “Irish Backstop” wouldn’t be permanent? Or, should they risk the possibility of a Brexit delay or – as May has repeatedly warned – the prospect of no Brexit at all?

After leaders of the ERG hinted earlier this month that they might be open to a compromise after months of staunchly opposing May’s deal, it’s looking like, after a week of negotiations between Michel Barnier (the chief EU negotiator) and Geoffrey Cox (May’s attorney general), that, once again, absolutely no movement has been achieved.

Despite a flood of headlines and updates about the talks, Cox wasn’t able to secure the assurances he’d been seeking – which would have, ideally, allowed him to change his legal advice on May’s deal (as it stands, according to Cox’s reading of the withdrawal text, the possibility of the UK being permanently trapped in the EU customs union, which the ERG fears would transform proud Britain into a “vassal state”, remains a possibility).

Negotiations are expected to continue through the weekend (and probably up until Tuesday, when the next meaningful vote on May’s Brexit plan is expected), but, if the past is any guide, it’s unlikely that a compromise will be reached before Tuesday.

Last time around, MPs rejected May’s deal by a historic 230 vote margin, the worst defeat for a British government since before the Second World War. If the EU doesn’t sweeten the deal, it’s very possible that May will face a second humiliating defeat.

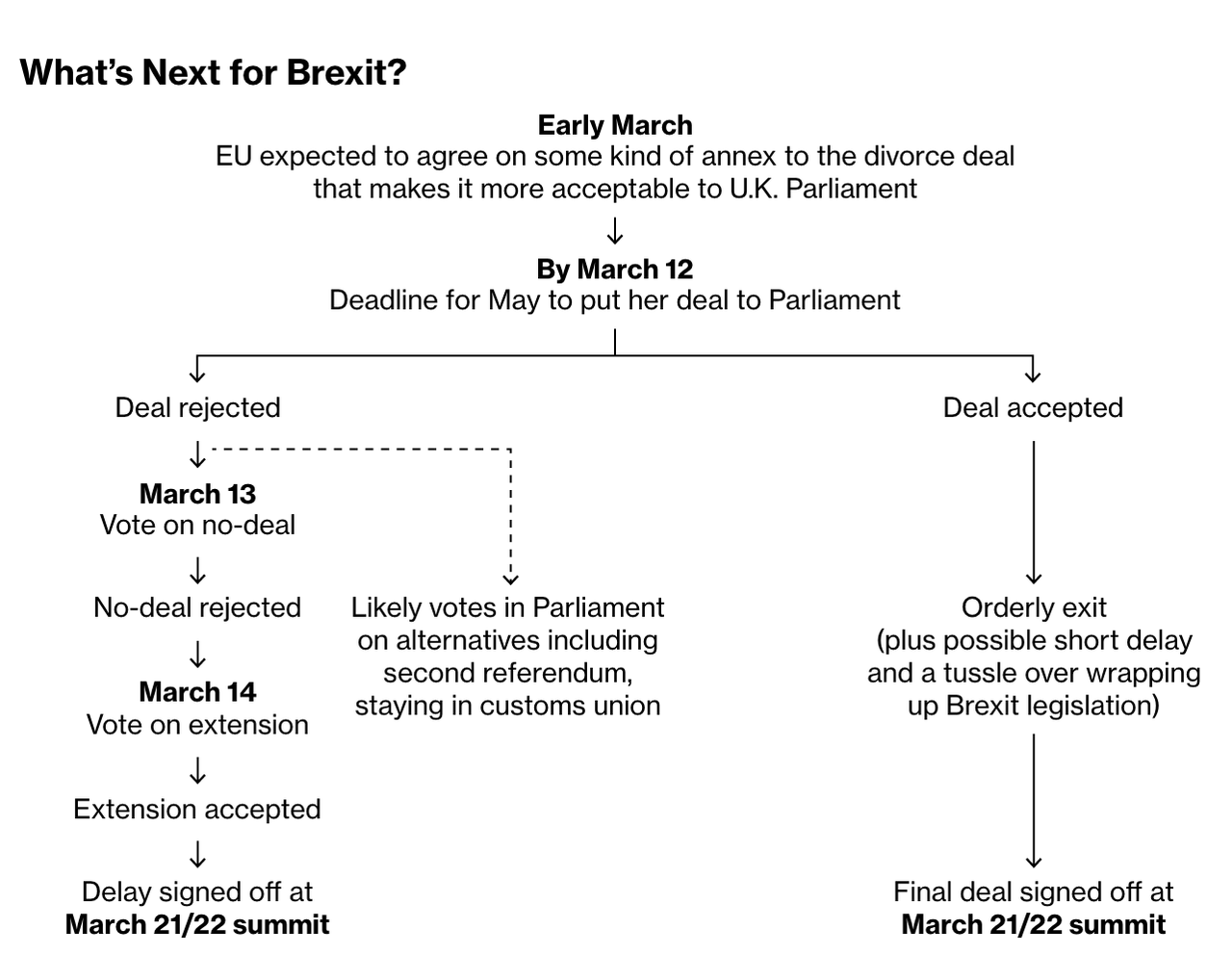

Which brings us to next steps. If May’s deal is defeated, she has promised to hold a vote the following day on whether Parliament would support leaving the EU without a deal. If that, too, fails (which would be expected), May will hold a vote to gauge support for a Brexit delay. If the first two votes fail, but the final vote passes, a delay would likely be requested at the upcoming EU summit (the bloc would need to sign off, of course).

The pound weakened this week as traders were left in a uncomfortable – yet familiar – position: With less than three weeks until the March 29 ‘Brexit Day’, nobody has any idea what happens next.

Fortunately, Bloomberg has published a handy guide to walk us through a few scenarios (and what impact they might have on the market):

May prevails:

Negotiators are working through the weekend to try to find tweaks to the deal May negotiated last year to make it more acceptable to Parliament. Both sides are gloomy, but we’ve seen last-minute breakthroughs before. Whatever is agreed must convince the pro-Brexit faction of the Conservative Party and also the proudly obstinate Northern Irish lawmakers who prop up her government. If she pulls it off, markets will rally.

A ‘softer’ approach:

If the deal is rejected, the most likely next step is that members of Parliament start maneuvering to force the government into a softer Brexit policy that can win cross-party support. Labour leader Jeremy Corbyn has already been talking to backbench members of the Conservative Party who want to maintain close ties to the bloc. Norway Plus and the Customs Unionwill be back on the table. Markets will see this as moderately positive.

One last go:

If she’s defeated on Tuesday, the prime minister could be tempted to give lawmakers one more chance to back her deal — now that the prospect of an extension to Brexit day is before them. It’s not clear when she might do this — but it could be as soon as next week.

Just end it:

Members of Parliament are set to put forward amendments next week calling for a second referendum. Labour has come out in favor of a second vote — albeit with some reservations. There’s probably still not a majority in Parliament for a re-run, but that could change in the weeks ahead. May said on Friday the chances of another plebiscite have gone up since Labour changed its position. Expect her to keep playing that up as she tries to convince purists that her version of Brexit is better than the risk of none at all. Markets see a second referendum as positive.

Kick the can:

It’s just possible that no majority for any kind of Brexit emerges in Parliament. If that happens, Parliament remains gridlocked, the EU reluctantly agrees to a short extension to avoid the pain of no-deal, and in three months time we’re back to the cliff-edge. This is what Brexit hardliners are hoping for — that they will get another chance to force May to take the U.K. out of the bloc with no deal. Markets will slump if this starts to look likely.

Unless May’s deal passes, markets will be left to parse an increasingly uncertain future. Shrewd Wall Street analysts have warned in the past that, if the EU does decide to budge, concessions (a reopening of the withdrawal agreement) likely won’t be allowed until the very last minute (which, as we have pointed out before, would be the EU summit beginning on March 21). If it doesn’t it’s likely Brexit Day will be delayed by a few months. But the problem remains: Amid all of the political infighting, no alternative to May’s deal has emerged. And if Europe doesn’t concede, the possibility of the UK leaving without a deal would be impossible to rule out.

via ZeroHedge News https://ift.tt/2J5aJci Tyler Durden