10Y Treasury yields lowest close since Jan 2018 and stocks ever-bid…

…despite sliding EPS expectations and macro data…

Makes us think…

Chinese markets closed green once again as two Friday pumps rescued them from the red – a terrifying thought after last week’s loss…

One-way street higher in European stocks this week…

This was the Nasdaq Composite’s best week since November, but the late-day weakness (as quad-witch bias fades) took the shine off of things…

NOTE: the opening panic-buying almost every day this week.

The S&P closed above 2800 and above the quad top highs…

The week’s biggest gains were thanks to a huuge short-squeeze but the last two days suggest they have run out of ammo once again…

FANG Stocks had their best week in 2 months but began to lose momo into the end of the week…

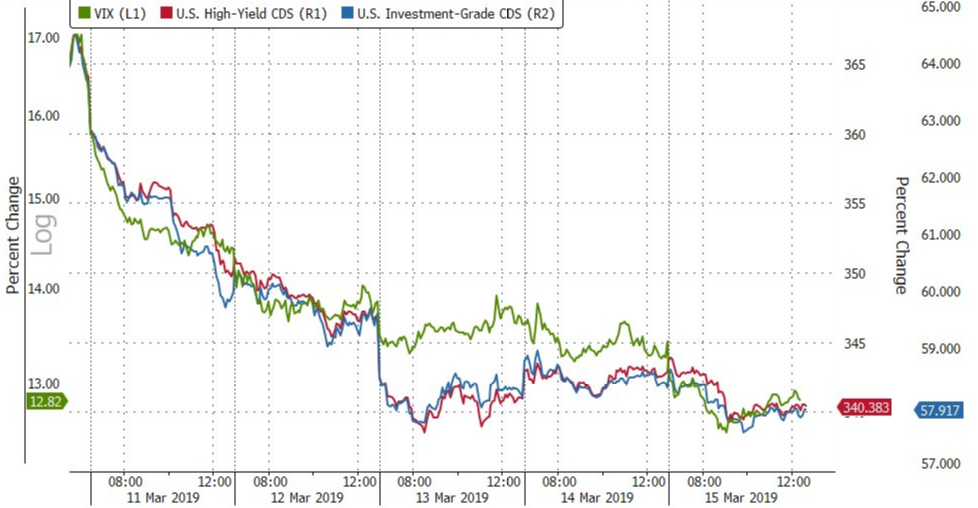

VIX collapsed to a 12 handle today and credit spreads continued to compress…

Treasury yields fell across the curve on the week but 30Y underperformed, scarping along at unchanged…

10Y Yields saw the lowest weekly close since Jan 2018…

The short-end of the yield curve has now been inverted all year, reaching its record inversion this week…

with 2s and 5s now below the effective funds rate…

Market expectations are now for a 16bps rate CUT in 2019, the most dovish since the early Jan crash…

This week was the dollar’s worst week of the year (since early December)

Cable soared this week as hopes that a no-deal brexit was the off the table buoyed sentiment… This is the second best week for sterling since Sept 2017…

EMs rallied most this week…

…with ARS having its best week in over 4 months…

Despite the dollar dump, only WTI managed solid gains as Copper (China) and PMs basically brokeven…

WTI surged above $58…

Gold managed to hold above $1300, but rejected the 50DMA…

And finally, pigs got slaughtered this week but Lean Hog futures enjoyed their greatest weekly gain on record…

Bloomberg explains that a nasty haemorrhagic virus in pigs might be throwing a lifeline to meat producers who have been badly hurt by the U.S.-China trade spat. As the highly-contagious African swine fever devastates Asian herds, Chinese hog inventories are tumbling, and buyers are turning to the U.S.

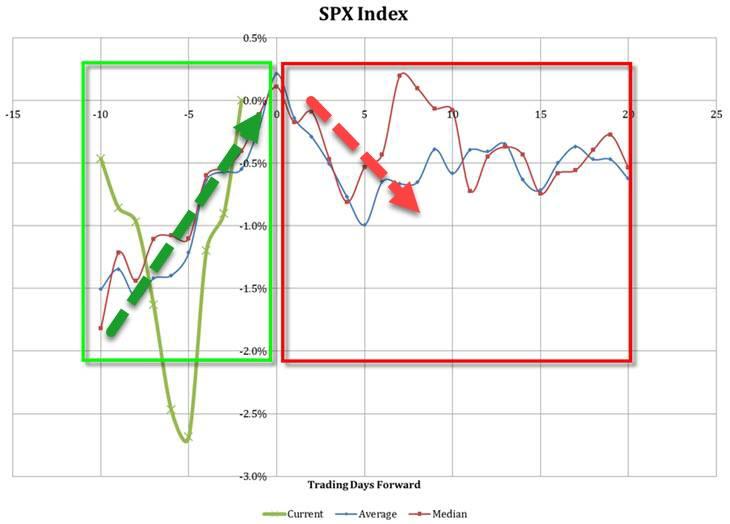

But all eyes will be on next week as the Quad Witch drift disappears…

via ZeroHedge News https://ift.tt/2Jfk2Xm Tyler Durden