The fraught, government-assisted courtship of troubled German banking giants Deutsche Bank and Commerzbank has hit yet another snag. According to a series of reports published Thursday morning, concerns about a mass defection of mutual clients moving some, or all, of their business is giving Deutsche Bank – long reputed to be the more reluctant partner – cold feet.

Deutsche CEO Christian Sewing is reportedly trying to devise a ‘Plan B’ to pitch to investors who support the tie-up. These investors are reportedly demanding that if Deutsche doesn’t go ahead with the merger, it must come up with a plan to turnaround its struggling business as its streak of declining revenue is widely expected to continue.

However, while investors are demanding that the bank try ‘something different’, the options reportedly under consideration (as described by Bloomberg) sound like more of the same: They include a) more cost cuts, focusing on DB’s investment bank and b) a nebulous ‘strategy shift’ that would involve more upfront costs. However, Sewing must at least find a way to paint the turd gold, so to speak, since a return to his original strategy simply ‘wouldn’t be credible’.

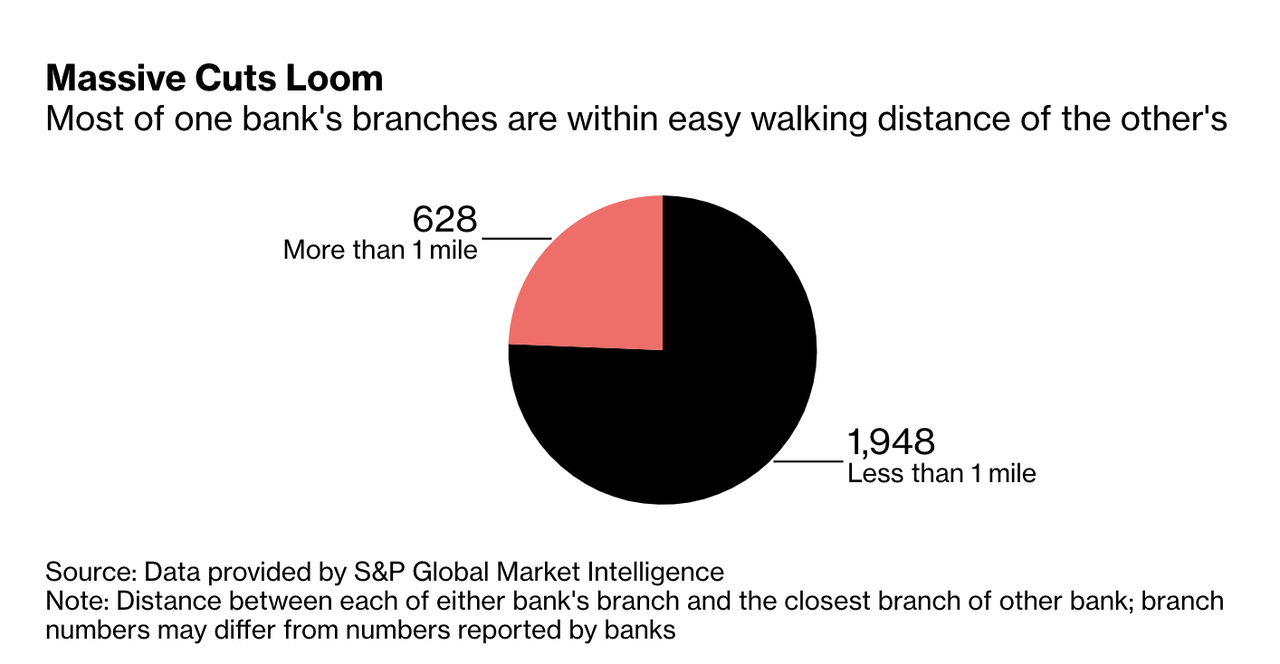

In another sign that the deal could be headed for the rocks, BBG noted that after five weeks of talks, the two banks are apparently no closer to a deal. Meanwhile, more Social Democrats, the party of finance minister Olaf Scholz – who is perhaps the biggest proponent of a merger, which he hopes will create a new German ‘national champion’ to support its industrial sector – are siding with the labor unions from the two banks, which have warned that a merger could lead to the loss of 40,000 jobs.

Yet even after senior ECB policymakers reportedly expressed skepticism about the deal, the talks have continued, perhaps because two other European lenders, Italy’s Unicredit and Dutch ING, have expressed an overt interest in buying Commerzbank.

Deutsche Bank Supervisory Board Chairman Paul Achleitner has said DB will give an update by April 26, when DB’s Q1 earnings are due out. Commerzbank has been pushing for an earlier update.

But in a sign that critics of the deal (of which there are many, including the Qatari wealth funds that are among the biggest shareholders in the two banks) are making headway in trying to stop it, the Financial Times reported that the prospects for ‘revenue attrition’ are why DB is suddenly getting nervous. BBG added that doubts about cost savings and the battle to raise capital to finance the deal are also among the bank’s concerns.

In another area where the two banks don’t see eye to eye, Deutsche Bank’s estimates for how much revenue would be lost as a consequence of the deal are significantly higher than Commerzbank’s.

Deutsche Bank and Commerzbank are at odds over how many clients would ditch the Frankfurt-based rivals if they merged, highlighting one of the many obstacles to a deal that could transform the face of German banking. Many companies in Germany are clients of both Deutsche and Commerzbank.

Some of them are expected to move parts of their business to rival lenders if the merger happens to avoid becoming overly dependent on a single lender. Deutsche’s internal estimates suggest that this would result in lost revenue of slightly more than €1bn a year, or about 3.5 per cent of the two lenders’ combined pro forma revenue of €33.5bn.

Commerzbank’s view is much more benign, however. It expects that the merged group will suffer only about half of the revenue losses its larger rival is predicting, people familiar with the matter told the Financial Times.

For what it’s worth, JPM’s estimates are more in line with Commerzbank’s.

Kian Abouhossein, analyst at JPMorgan, estimated earlier this year that about 2.5 per cent of joint revenue — or just under €900m by 2021 — would disappear “due to [an] overlap in clients and businesses”. He estimated the merged group would have its “biggest overlap in Mittelstand, followed by international corporates, financial institutions and small business customers”.

But in a ironic twist, it’s looking increasingly plausible that Deutsche Bank’s track record of being “the biggest money laundering bank in the world” – as Maxine Waters so eloquently put it – might end up sinking the deal that its CEO so clearly doesn’t want. According to a separate report in the FT citing internal Deutsche Bank sources, the bank has reportedly estimated that it processed at least €175 million ($197 million) of dirty money for Russian criminals between 2011 and 2014. The bank is bracing itself for fines and litigation. And this doesn’t include the €160 billion ($180 billion) in ‘suspicious’ money that it processed on behalf of Danske Bank’s Estonian branch.

Regulatory concerns about AML might be one potential out for DB. But if the bank really must come up with a ‘Plan B’ if it wants to justify abandoning the talks without risking shareholder backlash, well, we can only think of one realistic alternative: Let Deutsche Bank fail.

via ZeroHedge News http://bit.ly/2VRyAy1 Tyler Durden