Authored by Sven Henrich via NorthmanTrader.com,

All things being equal, the 2019 rally stinks. No really. Remember those new all time highs on $SPX and $NDX at the end of April? Fake. Why? Because on an equal weight basis the 2019 rally was the weakest of the last 3 rallies. By far.

Firstly, what is equal weight? Look no further than the $XVG, the value line geometric index.

$XVG tracks the median moves its components using the assumption that each stock has an equal amount (for example, $1,000) invested in them. The daily average moves of stocks are then calculated geometrically (rather than arithmetically). In basic terms, the Value Line Geometric Index eliminates an illusion created by cap-weighted index components. Heavily weighted stocks within a cap-weighted index can pull it higher even as the majority of the stocks within the index are not following along. For example, in a cap-weighted index like the S&P 500, it’s possible for the top 100 weighted stocks to carry the index higher while the remaining 400 stocks lose value. As an investor, it might be helpful to identify when this is happening.

Well it just happened in 2019 and in a big way.

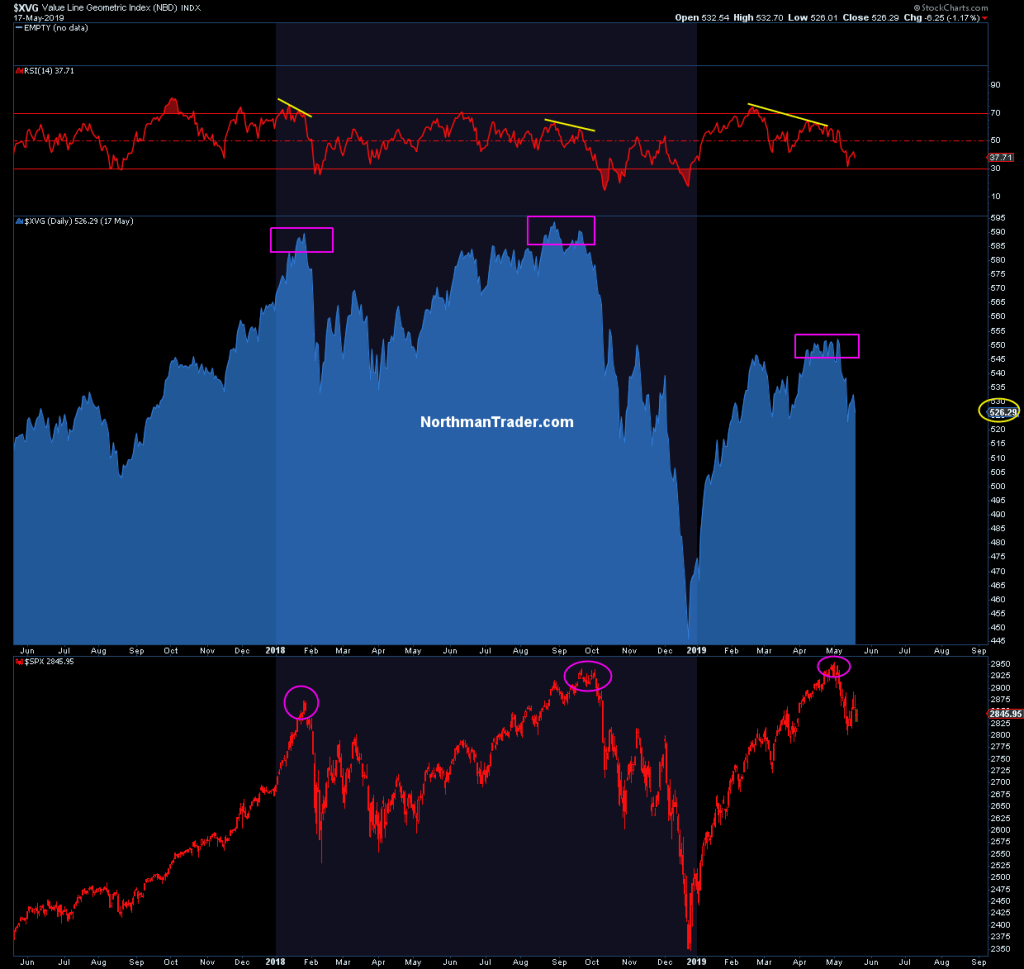

Compare the $XVG readings in 2019 to the readings of 2018 when $SPX made its previous highs:

Didn’t even get close. Which implies that the broader market did not follow some of the big cap names to new highs, hence the recent headlines of new market highs were very deceiving.

And now that $SPX has fallen below the January 2018 highs again this broader market underperformance is very visible.

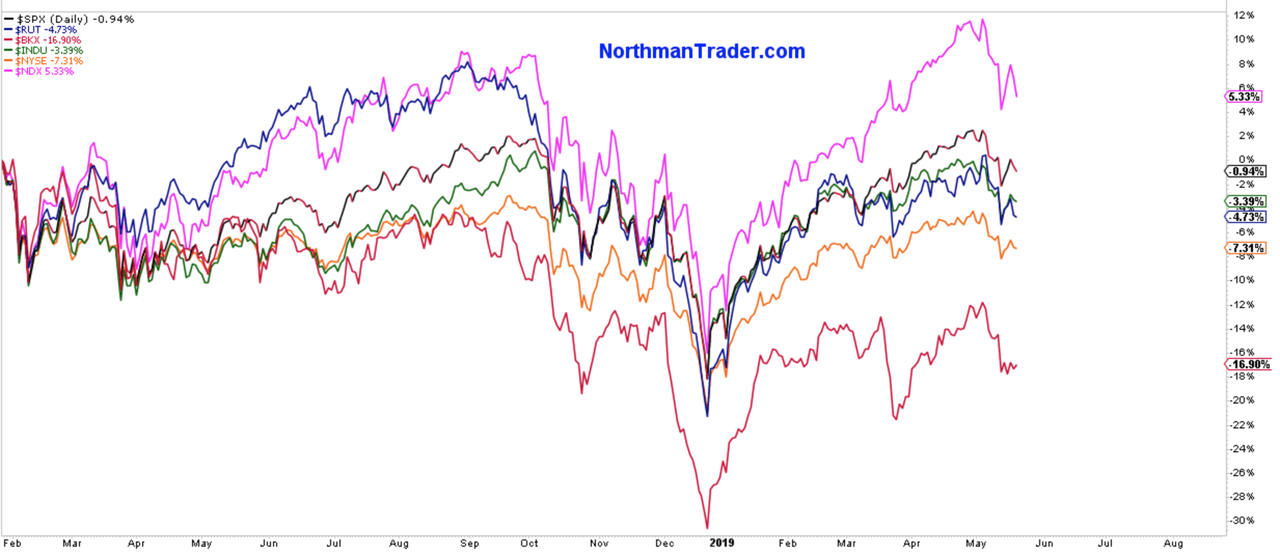

Big bull market? Where? Negative returns since the January 2018 highs, except select tech:

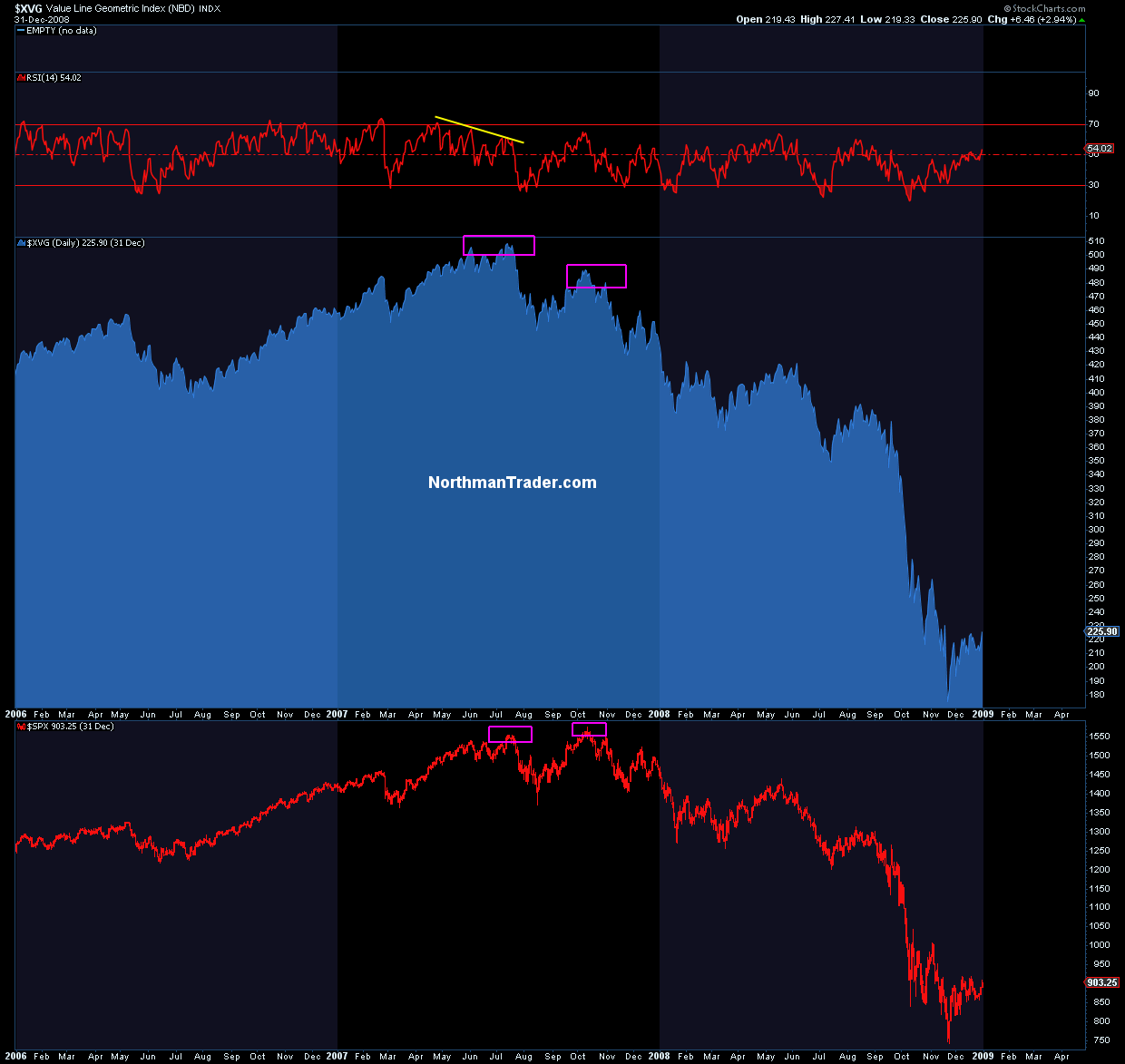

Why is all this potentially critically important? Well, simply because we’ve seen this movie before.

After all the market highs in the fall of 2007 came in a weakening $XVG:

New highs on weakening equal weight have been the hallmark of major previous tops before (see also 2000) as investors piled into the select winners and ignored the message of the larger market beneath.

But hey, maybe it’s different this time. All things being equal, they don’t appear to be.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2wbZPrS Tyler Durden