While stocks are modestly lower overnight as “risk-off” returns, pushing yields and commodities lower and the VIX and gold higher, on one or more of the following catalysts – take your pick – listed by Nomura’s Charlie McElligott:

- More trade war noise / rhetoric—Xi’s “New Long March” commentary, but particularly Mnuchin “no plans to go to Beijing yet” headline—which makes tariff imposition likely

- US consumer concerns around outlook cuts from Nordstrom and Lowe’s

- QCOM blow-up -12.5% on anti-trust ruling from FTC (crowded / favorite HF name)

- Brexit again devolving with May “toast”

- The DoJ recommending to block the Sprint / T-Mobile deal

… the question remains why do markets continue to stubbornly selloff and reprice lower even as the probability of a drawn out, lengthy trade war with China, as neither Trump nor Xi will be willing to de-escalate absent a major market (or economic) shock lower, is now effectively 100%.

One possible explanation for this recurring refusal to drop suggested by McElligott (besides the now daily ramp in stocks at the open of trading) is a number of flow catalysts for “rolling squeezes” in Equities despite what the Nomura strategist calls “the deteriorating macro & trade — where despite the now very ‘neutral’ current options-implied Gamma & Delta profile of the market we see”…

- the recent bulking-up of Shorts and reduction of Nets (1Y + lows) from Leveraged Funds act as potential “upside risk” demand catalysts—especially with

- Nomura’s CTA models across Global Equities “well within” reach of COVERING levels in Russell, Eurostoxx, Nikkei, DAX, FTSE, CAC, Hang Seng / Hang Seng CH and KOSPI (while also near re-leveraging in critical SPX and Nasdaq, as well as Bovespa)—and while

- the bank’s Risk Parity model estimates exposure to US Equities futures at 26m lows—meaning there is plenty of room to add from systematic / vol-sensitive buyers—all at a time where

- VIX roll-down strategies are again in position to sell vol with the term structure back neatly in contango, while we are also seeing

- the gradual return of systematic vol sellers (i.e. put underwriters)—which not only means pressure on vol, but also then creates dealer Delta to “buy”

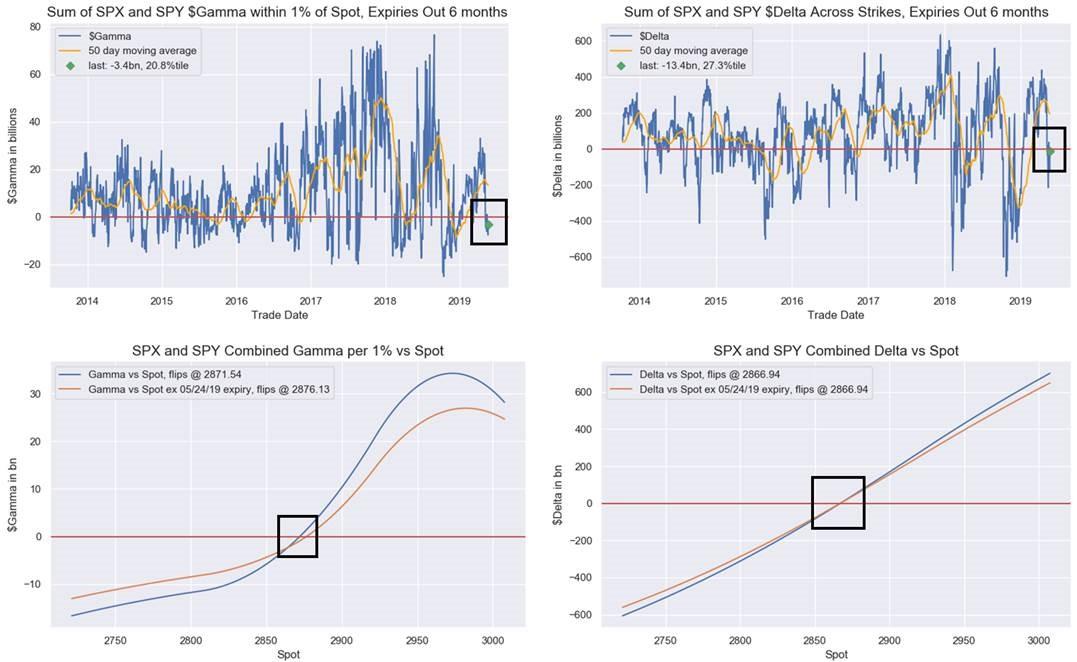

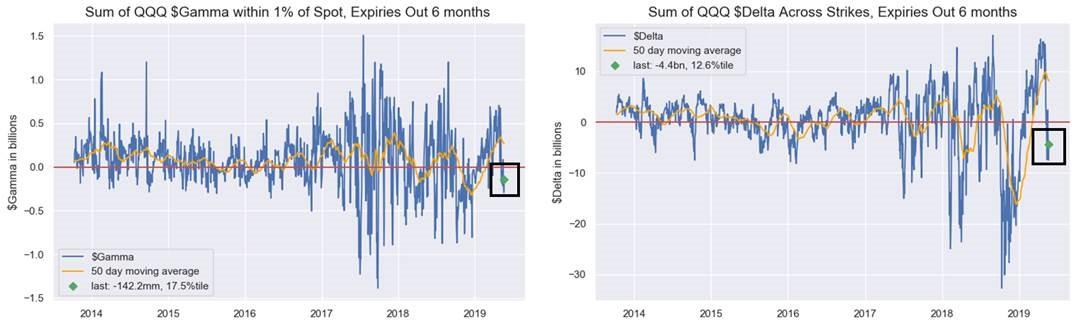

Digging into the technical and positional reasons for the continued levitation despite deteriorating sentiment, Nomura charts the latest market “Greeks” (see below) and highlights that “the SPX / SPY combined $Delta is now effectively “Neutral” at just -$13.4B (27th %ile since 2014) and with the SPX / SPY options Delta position vs Spot near “flip” level at 2866; for QQQ the $Delta position too is just -$4.4B (12th %ile since ’14)”

At the same time, “the profile for SPX/SPY- and QQQ-options Gamma has changed meaningfully over the past week+ as well, with 1) the total notional $Gamma sum dropping significantly to VERY low historic %iles while also 2) the current spot location sees the overall Dealer Gamma profile at effectively “Neutral” (vs its recent “Negative Gamma” location)”,

- SPX / SPY $Gamma just 20.8th %ile since 2014; QQQ just 17.5th %ile since 2014

- SPX / SPY combined Gamma per 1% move vs Spot at “Neutral” position, with Spot essentially “at” the flip zone (@ 2871 including this week’s expiry; 2876 without this week’s expiry)

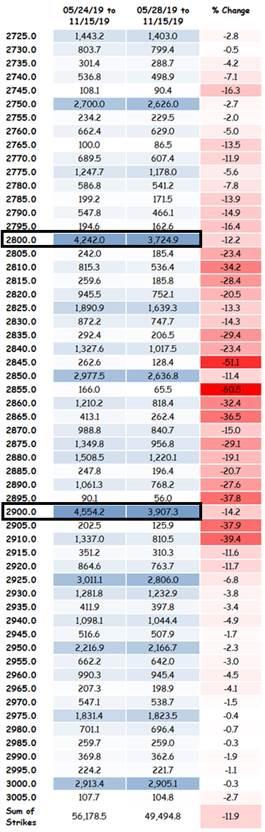

Finally, McElligott calculates that the two largest notional Gamma strikes in SPX/SPY consolidated options have spot “surrounded”, with the lower 2800 strike has $4.2B of Gamma, while the upper 2900 strike has $4.6B, serving as yet another source of “gamma gravity” around 2,850.

There is another reason for the lack of a selloff: the recent increase in shorts (at least according to Nomura, other sellside sources fail to find such a development) by leveraged funds has prompted fears of a short squeeze. Here are Nomura’s observations:

- Leveraged Funds actually ADDED to their US Equities futures shorts last week with -$9.6B of incremental notional selling WoW across SPX -$6.4B, NDX -$3.1B and RTY -$100mm

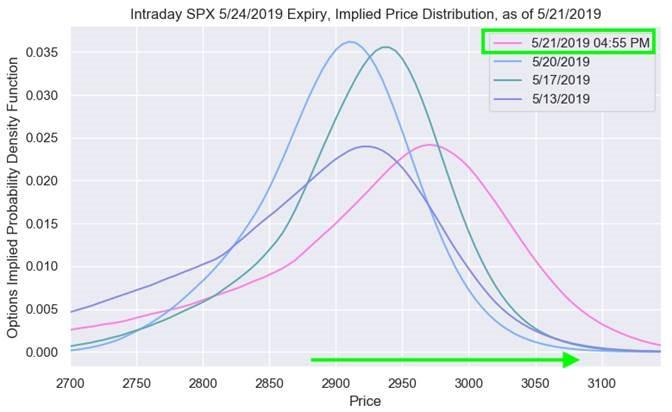

- Our intraday implied price distribution for SPX saw “real” shifts towards higher strikes yday, particularly for this Friday’s expiry:

It’s not just leveraged/hedge funds who have turned short: according to the Nomura QIS CTA model, there has been a “powerful blast of CTA deleveraging over the course of May, with Russell, Eurostoxx, Nikkei, DAX, FTSE, CAC, Hang Seng, Hang Seng Ch and KOSPI all flipping outright -100% Short—while SPX and NDX have reduced the size of their ‘long positions’ (although SPX and NDX are still the remaining ‘long’ holdouts along with ASX and Bovespa)”

The danger to McElligott, is this: the majority of the Equities futures we follow are well-within range of their “trigger” levels to COVER shorts or re-leverage longs (PARTICULARLY in global risk appetite indicators SPX and NDX).

Putting all this together, McElligott – who one should note has been predicting that a squeeze-driven melt up in stocks is likely – doubles down on his narrative, noting that the factors listed above “are at risk of providing new “mechanical” sources of covering / buying demand for stocks in coming weeks, despite the clear degradation of the US / China trade situation.”

His conclusion, “expect the sideways chop to continue despite this macro deterioration”, which of course is without a sharp drop in equities, the probability of a push to compromise in the trade war is nil. Meanwhile, the longer trade war continues – without the market noticing – the more the imbalances will build up, eventually leading to a far more painful collapse in risk, once markets can no longer ignore what is happening to the global economy.

via ZeroHedge News http://bit.ly/2JvL781 Tyler Durden