WTI is modestly lower overnight, back below $54, after a ‘meh’ inventory report from API following the oil market’s best day in 5 months. This slide comes despite Saudi Arabia, Iraq, and the U.A.E. all agreeing they want to keep restraining production in a bid to buttress crude amid signs of faltering demand.

As Bloomberg notes, however, investors will focus on refinery consumption and imports for their impact on total supply.

“Historical data indicates another rise in utilization; shipping data indicates imports at best remaining unchanged,” says Thomas Finlon, director of Energy Analytics Group Ltd in Wellington, Florida. “This should result in a drawdown in crude inventories”

API

-

Crude -812k (-1.75mm exp)

-

Cushing +520k (+30k exp)

-

Gasoline +1.46mm (+900k exp)

-

Distillates -50k (+700k exp)

DOE

-

Crude -3.106mm (-1.75mm exp)

-

Cushing +642k (+30k exp)

-

Gasoline -1.692mm (+900k exp)

-

Distillates -551k (+700k exp)

After two weeks of surprisingly large crude builds, expectations (and API confirmed) were for a modest draw but DOE data surprised with the largest crude draw in six weeks…

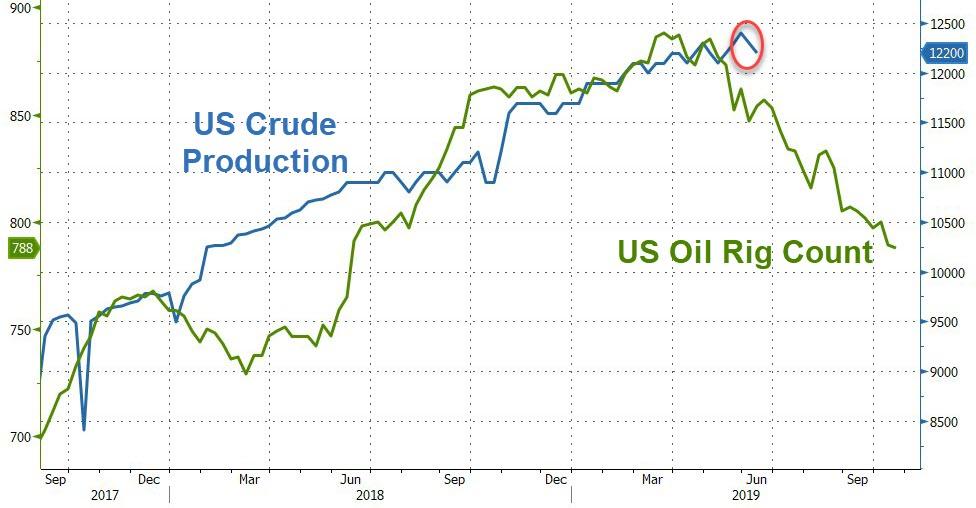

With the ongoing slide in rig counts, expectations continue to view production levels declining over the next few months and they did for the second week in a row…

On the price action side, WTI broke above its 5-, 8-, and 13-DMAs yesterday, testing towards 21DMA resistance, before it started to fade overnight.

WTI hovered around $53.70 ahead of today’s inventory data but spiked to overnight highs after the surprise inventory draw…

via ZeroHedge News http://bit.ly/2FnIdyq Tyler Durden