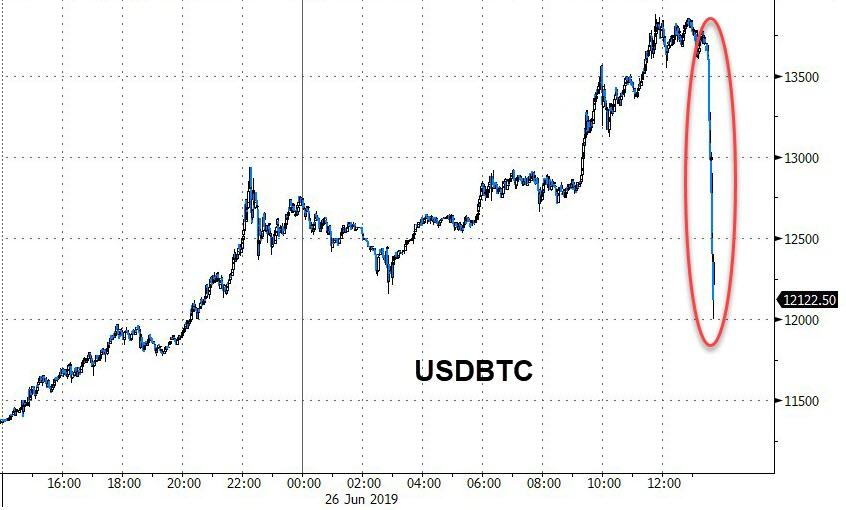

After the biggest day since December 2017, Bitcoin just crashed over $1500 in minutes, dragging the rest of the crypto space with it…

Erasing the day’s gains and then some…

As Tom Luongo warned earlier, this run up towards the end of this month into the end of Q2 may be morphing quickly into a FOMO rally that could see a blow-off top in the near future.

Markets that go vertical without really pausing to take a breather will always correct down. Hard.

When that happens given the expansion of Bitcoin’s dominance of the crypto market by market cap percentage in the past few weeks, I would expect to see some strong rotation into both cash and alt coins just clearing major technical hurdles on any correction.

And just so we’re clear as to what’s happening here. The mother of all safe haven trades is emerging. Trade Wars, Near Hot Ones, tariffs, sanctions, popular uprisings and political instability are all on the table.

While we’re all focused on whatever short-term idiocy comes out of Donald Trump’s mouth to secure his control over the Overton Window, we should be asking ourselves why the ECB is going looking at even more negative rates, LIBOR has inverted alongside Eurodollar and the U.S. Treasury market and stocks are at all-time highs.

The markets aren’t irrational. Our perceptions of what is driving this behavior is. Safe haven assets change with the times.

And when you step back from the insanity of the fiscal and political situation in the U.S. and Europe, the fall-out from their instability on emerging markets and the potential for major shifts in the geopolitical game board does it really seem all that odd that a simple electronic proxy for gold with thin supply, high trust and low holding risk would become a darling of the risk averse?

I don’t.

However, perhaps it is as simple as this chart…

Bitcoin is still protection from the idiocy of policymakers…

via ZeroHedge News https://ift.tt/2NfRkHT Tyler Durden