Put your hand up if you know what an autocallable is. Put your other hand up if you also know that ground zero of the next volatility catastrophe could be South Korean autocallables.

Not a lot of hands in the air, so let’s back up.

As the “world’s most bearish hedge fund manager”, Horseman Global’s Russell Clark explained back in January, autocallables, which are fundmentally structured products that are extremely popular with South Korean traders, are best thought of as a service. A bank will offer to sell insurance on the stock market on your behalf, so that you can generate an income from the premiums received. So rather than buying an autocallable, it’s better to think of an investor as posting collateral for a bank to sell puts on their behalf. Typically, the bank will tell the investor what sort of yield they can generate, for a certain level of insurance. For example, a 5% return as long as the S&P 500 does not fall to 2000, from roughly 2900 today.

Typically, when markets fall, the price of insurance rises, and the bank does not need to sell that much insurance to meet a 5% yield target for an investor. Conversely, when markets rise, insurance prices fall, and banks would need to sell more insurance to meet the target yield. Hence, in normal markets, the risk to clients is balanced. More insurance is sold when market rise as insurance prices are low, and less insurance is sold when market fall as insurance prices rise.

However, there are increasing signs that this market dynamic is breaking down.

According to Horseman research, Europe’s Stoxx 50 is the most popular underlying index in the entire autocallable industry globally. Why is the Euro Stoxx 50 so popular among autocallable products? Clark believes that there are two reasons.

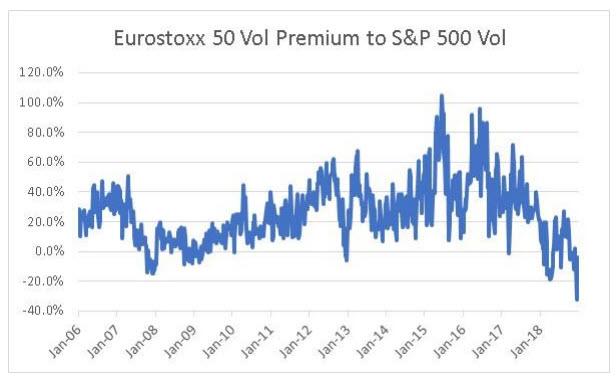

- Until very recently, the Euro Stoxx 50 has tended to have a higher implied volatility, which has meant that yields on Euro Stoxx autocallables have tended to be higher.

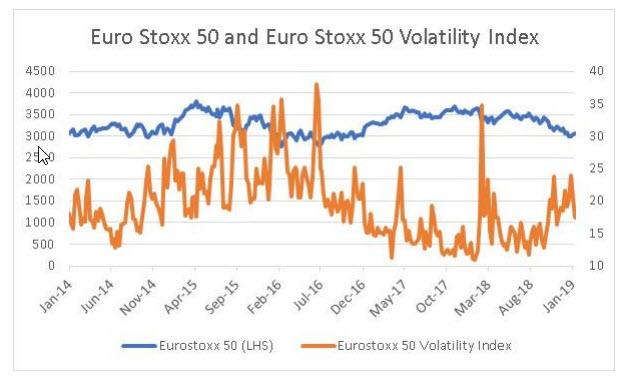

- The second reason is that the biggest structurers of autocallables tend to be French banks, so it would be easier for them to use their local index. Euro Stoxx 50 was weak in 2018, falling 18%. Volatility rose a little bit during the same period, but is still at a much more subdued than level seen in 2016 and 2015 for equivalent market movements.

However, as Horseman cautions, the relatively subdued level of Euro Stoxx 50 increasingly looks out of sync with underlying features of the European financial markets. Euro Stoxx volatility rarely trades below S&P volatility, but currently this is the case. It is possible to argue that lower recent historic volatility in the Euro Stoxx 50, relative to the SPX 500 has caused this, but given that Europe has many structural issues, and far fewer stocks in its index, this tends to be an aberration.

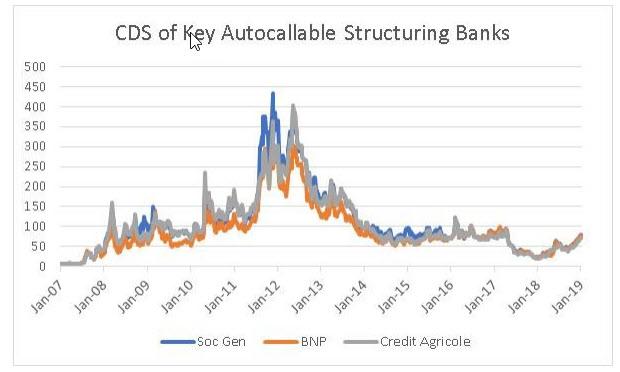

This is even more striking when one observes that a classic risk indicator such as the spread between French and German Collateralised Debt Securities (“CDS”) is beginning to diverge.

While the divergence in French and German CDS is bearish in itself, it is having a feeback, or “knock-on” effect for French banks, which are key autocallable structurers. Two of these banks are also members of the Euro Stoxx 50, which creates the potential for a vicious cycle – just recall the trading blows ups at Natixis and SocGen earlier this year, much of this came from the structured market.

As such, a French CDS widening could cause problems for French banks, which could cause problems in autocallables, which then could cause more problems for French banks and so on.

Besides European banks, autocallables are especially sensitive to changes in Korean (South, of course) risk assets. Or rather, the other way around.

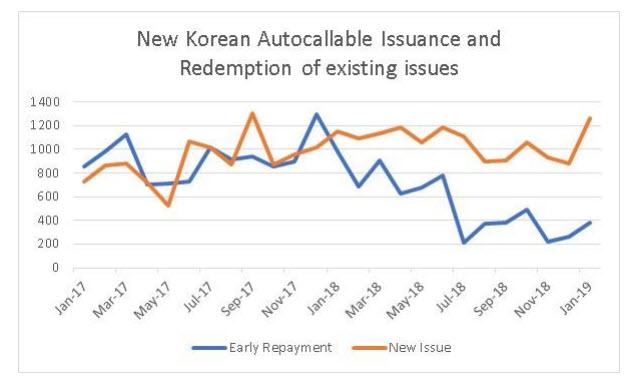

The amazing resilience of the Kospi to virtually any stress in the past decade having traded in a tight range around 2000, is – according to Clark – explained by the fact that Korean volatility is been kept subdued by a large increase in the amount of autocallables outstanding. This can be seen from the NICE P&I annual review of Korean Autocallables; the review gives the number of new issues, as well as existing issues that have been redeemed. Redemption occurs when the underlying index rises above an upper barrier. As markets were weak over the last year, fewer redemptions have occurred, implying a substantial increase in outstanding autocallables. This would imply not only increased downward pressure on the price of volatility, but also a substantial increase in hedging needed for these products or volatility selling.

For those who see analogues between autocallables and inverse VIX ETFs, or VIX futures, that’s not by accident – as a result of the reflexive nature of the market, trading the derivative of market vol, when in sufficient size and scale, can reverse the arrow of causality and lead to vol derivatives determining which way the underlying (in this case market) moves.

Going back to autocallables, historically their supply and demand has been kept in check by rising markets. If the market rises over an upper barrier, old autocallables are redeemed, reducing supply from the market, alternatively they can be cancelled by being “knocked in” (a situation where the underlying investor no longer receives a yield, but the underlying index is at current value). The lower barrier is usually between 25% and 40% below market levels and if “knocked in” the buyer of the autocallable will lose capital equal to the fall in the index.

So what does all of this mean?

Well, as Clark wrote back in February, “in my opinion, the market has become overburdened with autocallables. In the short term they tend to reduce volatility of the underlying market. But if the underlying index, in this case the KOSPI falls – for example because due to a plunge in semiconductor stocks – it will likely result in autocallables getting ‘knocked in” and the pressure on Korean volatility disappear, “the resulting rise in Korean volatility will likely lead to significant rise in the price of volatility.”

That was 6 months ago… where are we now?

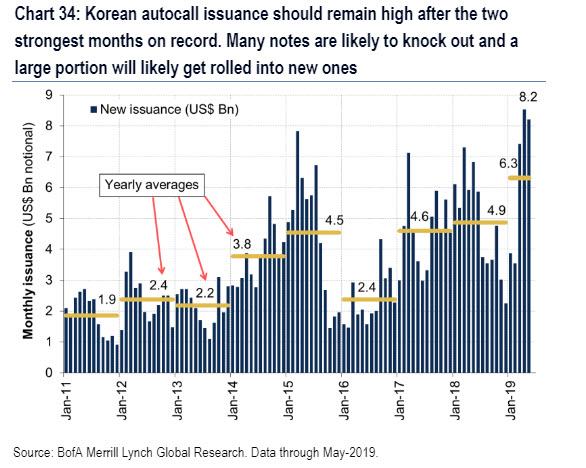

Well, after a brief period of market turmoil, the Kospi resumed its upward grind, and as stocks rose and vol dropped, autocall issuance exploded. According to Bank of America, Korean autocallable notes continue to get issued at a record-high pace of > $8 BN per month (nearly double the monthly average last year was US$4.9 Bn).

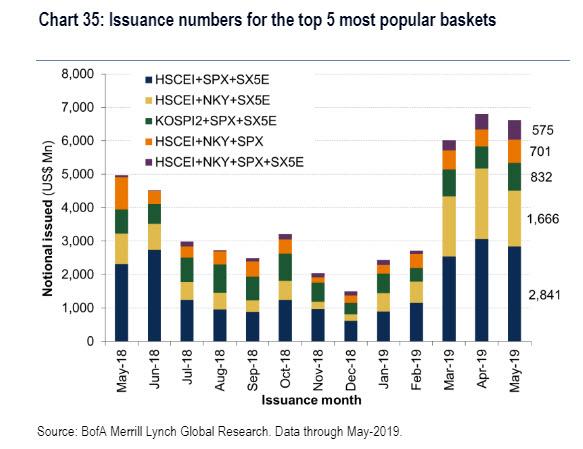

As for the underlying assets, at US$ 2.8 BN notional, the most popular basket remained HSCEI + SPX + SX5E.

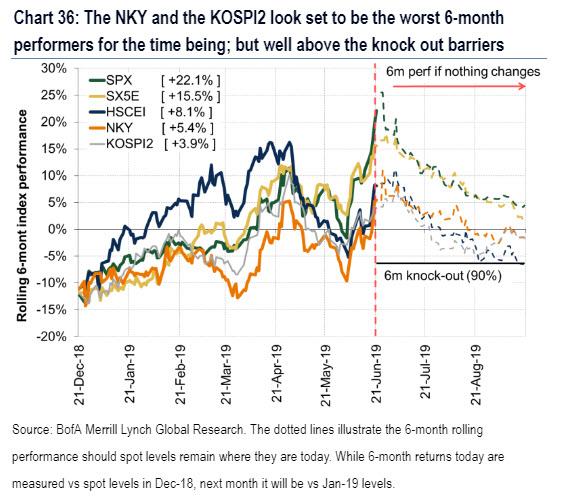

As BofA further adds, Korean autocalls are likely to knock out as stocks continued their upward grind.

So what does all this mean? Well, in a somewhat deja vu repeat of what happened in February 2018, an instrument that not only benefits from lower vol, but its purchases actually lead to lower volatility, is now being purchased (and issued) at never before seen levels, in the process resulting in subdued equity vol across such global markets as the HSCEI, the S&P and Stoxx 50.

And yet this is precisely the trade that Clark believes will end in tears as everyone is one again on the same side of the vol trade, which as readers may recall ended spectacularly on Feb 5, 2018 when too many investors had purchased the XIV only to see it meltdown following a somewhat modest increase in volatility.

Which begs the question: could autocallables be ground zero – in S.Korea of all places – for the next volatility catastrophe? To Clark the answer is yes. As he told Bloomberg last month, investors hungry for yields have piled into autocallables, artificially suppressing stock market instability. This is “unsustainable and will end badly. I’ve seen it twice, three times even. And it feels so close to that inflection point. Everyone’s in the same trade.”

He is, of course, correct, but just as the XIV doomsayers were ignored up to Feb 2018, so too those who forecast the collapse of the autocall market will be ignored until it is too late. The question is what happens once the autocall house of dominoes starts to collapse – will it result in a contained implosion, much the same way the inverse VIX ETF disaster failed to shock the market for too long – or will the negative feedback loop only escalate as one after another autocallable is knocked in, resulting in a volatility shockwave that spreads instantly around the globe?

The answer will likely be revealed during the next VIX spike, and if Clarke is correct, the outcome will be the worst possible one.

via ZeroHedge News https://ift.tt/31WW8oQ Tyler Durden