Following a slowdown in headline consumer price growth, headline producer price inflation was expected to slow in June (already at the lowest since Jan 2017) but it printed hotter than expected at +1.7% YoY (vs +1.6% YoY exp).

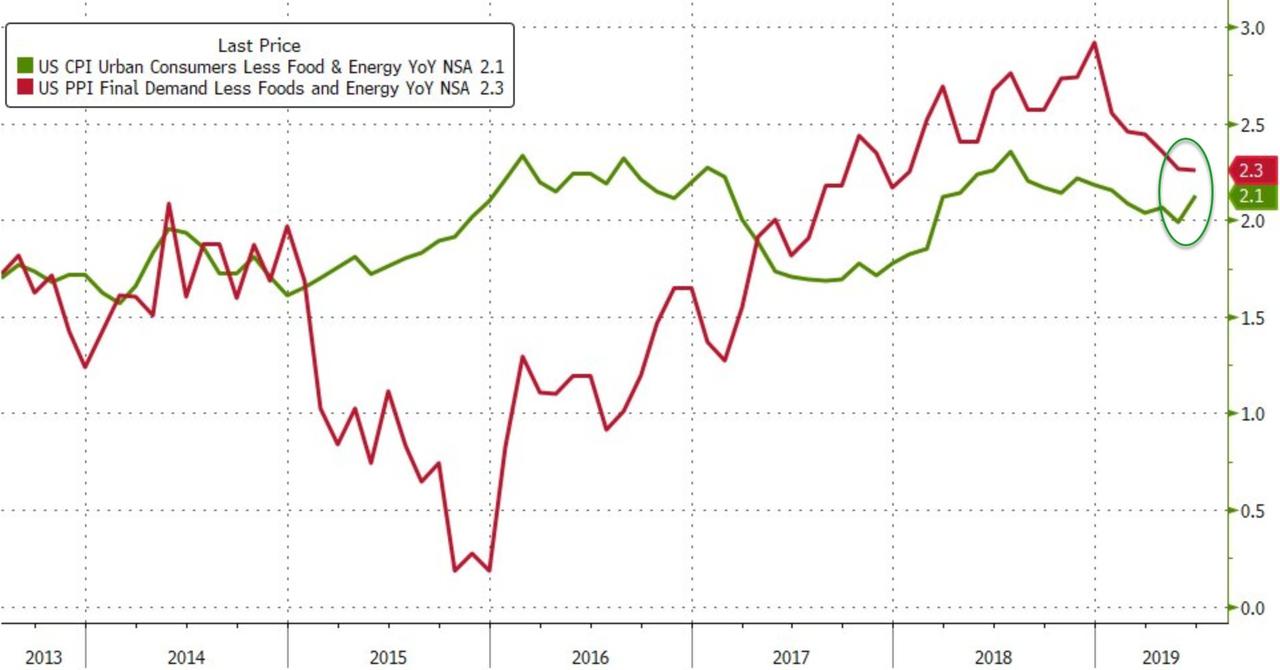

However, more worrying for the goldilocks-crowd baying for a Fed rate-cut, is Core PPI printed much hotter than expected (+2.3% YoY vs +2.1% YoY exp) confirming the rebound in consumer price inflation…

Transitory seems to be the only word!!

So will The Fed actually be data-dependent? or is this rebound in inflation also transitory?

via ZeroHedge News https://ift.tt/2JuH5LG Tyler Durden