The latest confirmation that global trade is suffering its gloomiest period since the financial crisis came overnight from Asia, where first global trade hub Singapore delivered some shockingly bad news about the state of its economy, followed shortly by the latest disappointing Chinese exports report.

The first warning shot to the global economy came from Singapore, where Gross domestic product in the trade-reliant city state declined an annualized 3.4% in the second quarter, a plunge from 3.8% in Q1 and far below the 0.5% consensus estimate. This was the biggest drop since 2012.

“I thought the numbers would be bad, but this is ugly,” said Chua Hak Bin, an economist at Maybank Kim Eng Research Pte in Singapore. “The whiff of a technical recession is real. We thought it might be shallow, but the risks now is that it might be deeper.”

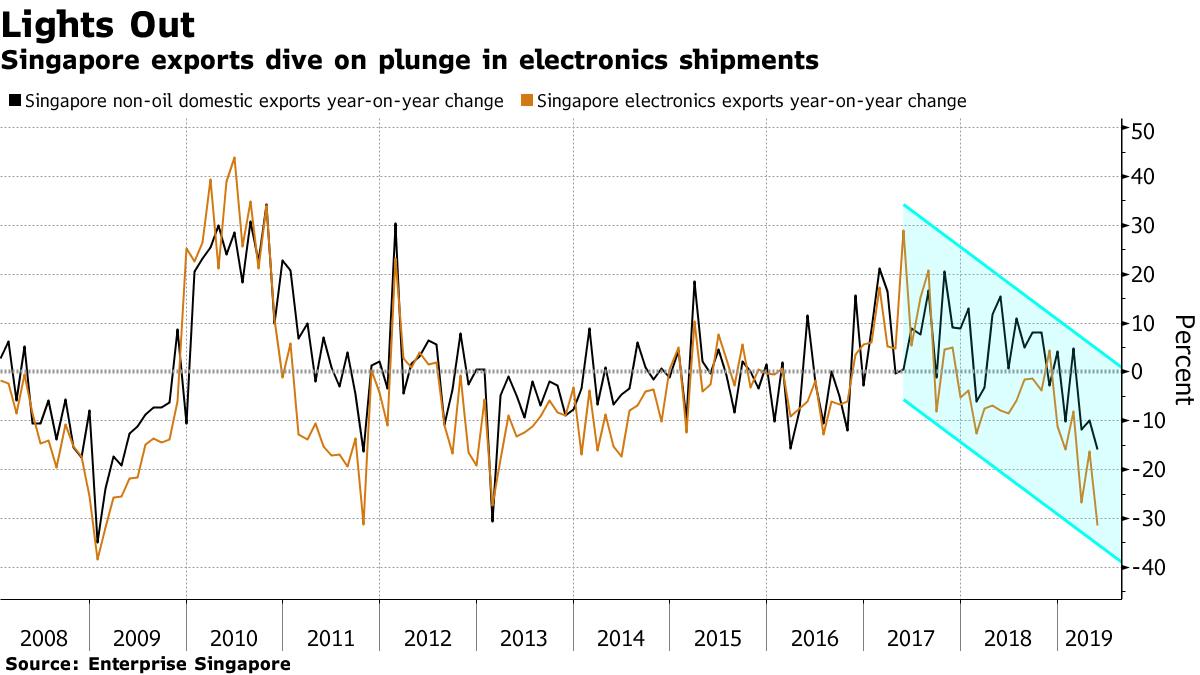

Singapore, which is one of the world’s most reliable trade proxies and due to its heavy reliance on commerce and its complicated integration in regional and global supply chains makes it vulnerable to a slowdown in world growth and tariff wars. Exports have already taken a big hit over the past few months, with shipments plunging in May by the most since early 2013; the latest report revealed that the plunge in GDP was largely due to a collapse in electronics shipments.

Manufacturing contracted an annualized 6% in the second quarter from the previous three months. Construction declined 7.6%, reversing a 13.3% expansion in the first quarter. The services industry shrank 1.5% in the second quarter.

“Singapore is the canary in the coal mine, being very open and sensitive to trade,” said Chua Hak Bin, an economist at Maybank Kim Eng Research Pte in Singapore. The data “points to the risk of a deepening slowdown for the rest of Asia.”

Despite the dismal numbers, the local government is still hopeful about the future, and sees the economy expanding 1.5%-2.5% this year, compared with 3.1% in 2018. Officials are set to revise that projection in August, Minister for Trade & Industry Chan Chun Sing told Parliament this week, adding that Singapore was “well-placed to weather the storm” given its sound economic fundamentals, strong fiscal position, and progress in restructuring the economy. Singapore isn’t expecting a full-year recession yet but the government is “monitoring the situation closely,” Finance Minister Heng Swee Keat said in a Facebook post.

Others are far more skeptical: “As weak as Singapore’s standstill in 2Q GDP was, 2H will probably be much worse without a rapprochement in U.S.-China trade relations. Our forecast for a 0.2% year-on-year contraction in 2019 remains on course” said Bloomberg economist Tamara Henderson.

* * *

Separately, in the second blow to global trade – and the latest confirmation that China will be forced to engage in even more aggressive stimulus – Beijing’s latest trade figures showed exports fell 1.3% in June from a year ago and imports shrank a more-than-expected 7.3%.

Exports were in line with consensus expectations, with imports slightly weaker. In sequential terms, exports were down by 1.0% mom sa non-annualized in June, partly reversing a gain of 2.2% in May which was boosted by the frontloading from exporters. Imports remained weak, down by 0.6% mom sa non-annualized in June, albeit to a lesser extent (-6.1% non-annualized in May). China’s trade surplus increased to US$50.4bn in June from US$41.7bn in May.

The main culprit for the latest disappointin data? Exports to the US contracted significantly by 7.8% yoy in June, down further from -4.1% yoy in May. Exports to the EU also decelerated to a decline of 3% yoy in June from +6.1% yoy in May, and exports to Japan increased modestly by 2.4% yoy (v.s. +0.5% yoy in May). In contrast, exports to ASEAN accelerated significantly to +12.9% yoy in June from +3.5% yoy in May.

Meanwhile, on the other side, imports of crude oil accelerated in June, while imports of steel products remained weak. Imports of iron ore continued to decline in volume terms, though increasing in value terms on higher prices. In value terms, crude oil imports accelerated to +8.2% yoy in June (vs. +5.5% yoy in May); steel products imports declined by 19.5% yoy in June (vs. -22.5% yoy in May); iron ore imports increased +34.6% yoy in June (vs. +24.0% yoy in May). In volume terms, crude oil imports were up by 15.2% yoy in June (vs. +3.0% yoy in May); steel products imports remained weak at 9.1% yoy in June (vs. -13.4% yoy in May); iron ore imports decreased by 9.7% yoy in June (vs. -11.0% yoy in May).

According to Goldman, “weaker global demand, higher tariffs from the US and smaller impacts from the frontloading (compared to May) may have contributed to the slowdown in exports momentum in June, though depreciation in RMB over the past several months may have been supportive.” As a result Goldman believes that exports momentum may remain modest in coming months, given moderate global economic growth, and combined with weak private demand, will result in easier domestic policy to maintain growth stability. The latest State Council meeting also announced measures to support exports (e.g., improving export tax rebate policies and lowering export insurance fees). And since China’s trade surplus jumped, if for all the wrong reasons (drop in exports, bigger drop in imports), expect a furious Trump to opine negatively any moment, putting a China deal further out of reach.

via ZeroHedge News https://ift.tt/2GaGgWf Tyler Durden