Authored by Mark Orsley, PrismFP head of macro strategy

- The non-fundamental flattening reverses as the case for steepeners moves into “goldilocks” territory

- Powell makes watershed comments on the Dollar

- Deficits are the main non-economic data driven reason why the Fed will cut

On Tuesday we discussed how the curve flattening in the US over the last week made very little fundamental sense and provided an attractive risk/reward entry point. As the great Ron Burgundy said, “well that escalated quickly.”

On Tuesday 2s10s was at the bottom of the range and on Friday we are back at the top of the range where you can actually think about booking profits. US 2s10s hit trend support and bounced firmly. Notice the higher lows being put into place after a broken downtrend. Short-term you can take some profits but the long-term bullish technical narrative is still firmly in place…

The case for the steepener has only strengthened since Tuesday. On the one hand, the data deterioration theme got solidified with another labor market indicator showing rate-of-change weakness (JOLTS), but on the other hand there was surprisingly good inflation data and better claims.

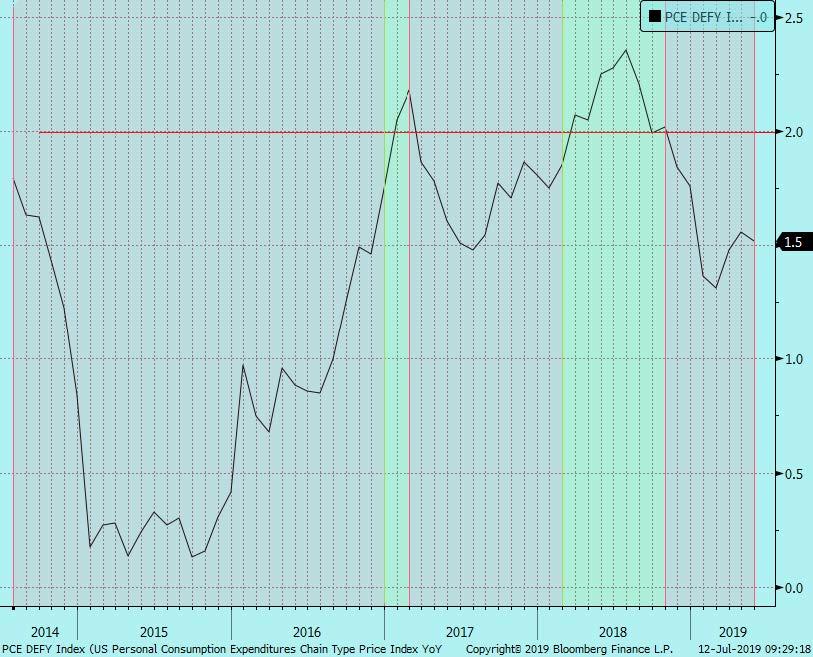

I am not trying to pour cold water on the CPI as it was firm in all aspects. You saw some payback of some of the “transitory” factors that were roundly expected to bounce with a bit of help from tariffs so it was a nice number. However, it is important to remember that the Fed’s preferred inflation metric is of course Core PCE. Ironically, that will arrive just before the July FOMC but do note that Core PCE remains below the Fed’s target.

Further, in the Fed’s newfangled mindset driven by the new core (the Average Inflation Targeting {AIT} clan of Williams, Clarida, Brainard, Evans), inflation on an average basis is still not where they would like it to be. If you look over the last five years, Core PCE has only been above the 2% target just 8 months out of 60 months.

Importantly, Fed officials, with CPI data in hand, were roundly dovish so you need to consider what the Fed WILL DO not what you think they SHOULD DO. Bostic and Barkin had a couple dovish twist but neither are voting members so let’s focus on the voters:

- Powell: “we’ve signaled that we’re open to accommodation; monetary policy hasn’t been as accommodative as thought”

- Williams: “arguments for adding accommodation have strengthened”

- Quarles: “there are significant risks out there (despite US economy being strong)”

- Brainard: “supports softening the rate path due to risks and low inflation”

- Evans: “a couple rate cuts could boost inflation; nervous about inflation”

- FOMC Minutes: “MANY Fed officials saw strong rate cut case amid rising risks; MANY saw more accommodation warranted in the near-term”

The Brainard comment is exactly what we are talking about. So yes CPI was firm, but inflation as measured by the Fed’s preferred metric is still below and averaging well below the Fed’s target.

Getting back to the steepener, isn’t this a goldilocks scenario for further steepening?

- Continued data deterioration which signals end of cycle

- Firmer inflation data

- Fed that is about to cut rates and possibly have two more additional doves added to the board

In other words stagflation that is likely driven by supply side considerations for you neo-Keynesians out there. The front end will be pegged lower by the Fed and a back end that can trade heavy due to the better inflation, and that is what has driven us back to the upper end of the range in steepeners.

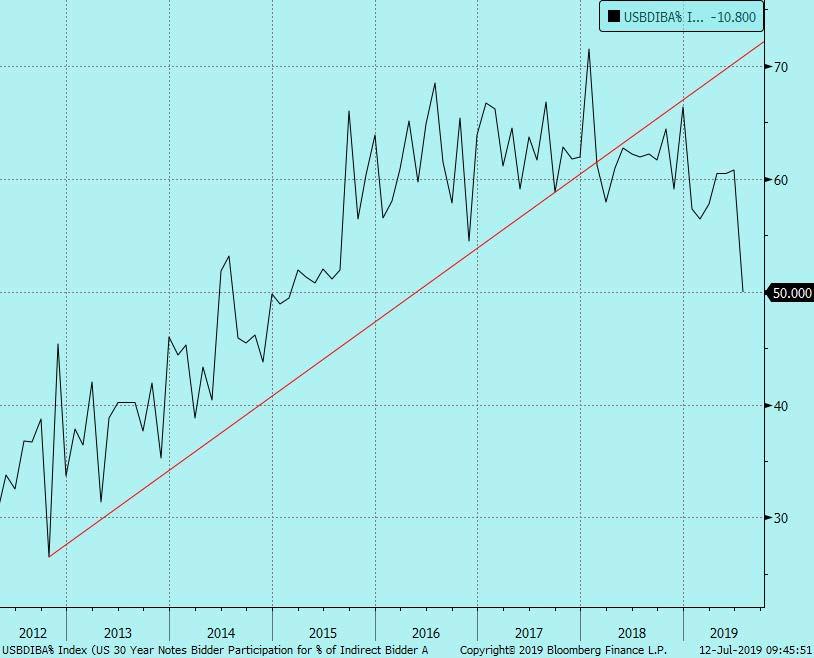

It was also notable how poorly the 30yr bond auction went yesterday that saw weak bid-to-cover along with a plunging indirect bid (or lack thereof). Suddenly, foreign investors are shunning the long end.

Why would you buy the long end when you can buy the front end where the Fed has your back? Also note per Quarles that when the Fed starts to buy Treasurys again via SOMA, the average maturity the Fed purchases will shift down more into the front end. Therefore, I am ok with taking partial profits and playing the range on the curve, but the long-term bull case for steepeners has only gotten better this week.

I wanted to highlight this one comment from Powell separately because I think it is vitally important. Chair Powell said:

“Do not assume the US Dollar status as a reserve currency is permanent.”

I mean….WOW! Does anyone recall a Fed chair outright talking down the Dollar like that? First I would say that is Gold bullish.

Gold is in the midst of forming a bull flag pattern. Depending on the breakout level of the flag, the target will be up around 1560ish…

However let’s get to the heart of that statement. Powell was referring to the US fiscal deficit and what that would mean for the Dollar. The deficit has been increasingly coming up in Powell’s communication. He had it noted as a concern in his statement to Congress this week as well as in the Q&A.

“And I remain concerned about the longer-term effects of high and rising federal debt, which can restrain private investment and, in turn, reduce productivity and overall economic growth. The longer-run vitality of the U.S. economy would benefit from efforts to address these issues.”

This is the main point you should chew on this weekend; you may disagree with my data deterioration theme which gives the Fed reasons to cut, but do not miss this important point why the Fed will cut:

Rising deficits which causes increase treasury supply at a time when foreigners are losing their appetite to fund the US govt (as noted above in the bond auction) means the Fed needs to talk dovish/cut rates/provide accommodation/inject liquidity in order to keep yields from rising. We saw what happens when front end yields like 1y1y rise above 3% as it did in Q3 2018; the system breaks.

As I said in Tuesday’s note, we are seeing this issue play out in the FF/IOER spread whose widening is purely on the back of too much government debt sitting on bank balance sheets. The Fed is struggling to control front end rates and you cannot have rates rising or this whole economic cycle and market will fall apart.

The Fed has to ease, long-term economic trends show data deterioration, but there appears to be a bit of inflation creeping into the pipeline, i.e. stagflation. That all means steeper curves and now higher gold prices.

via ZeroHedge News https://ift.tt/32rdWbA Tyler Durden