There’s a dip…

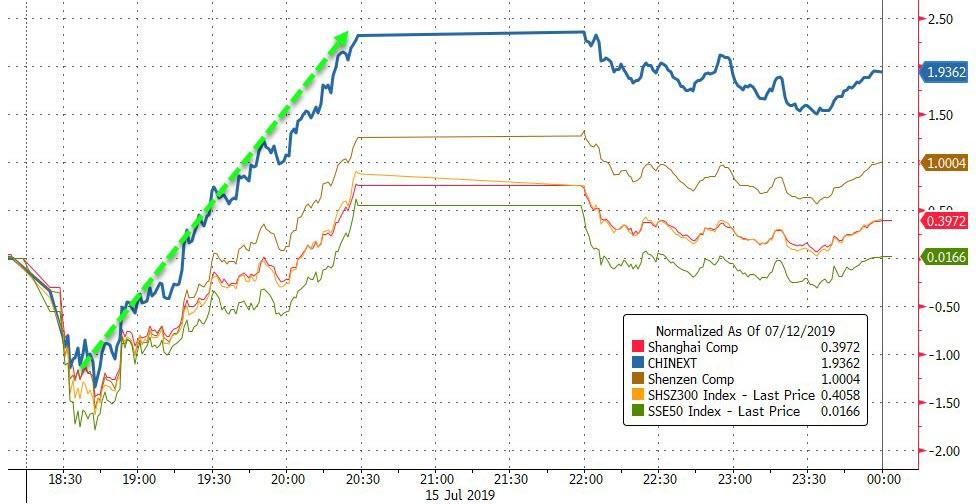

Chinese stocks were broadly higher overnight led by a panic bid in tech-heavy ChiNext…

Because nothing says buy highly-levered growth stocks like record weakness in economic growth.

You will find more infographics at Statista

European stocks were higher today, ramping back from early weakness…

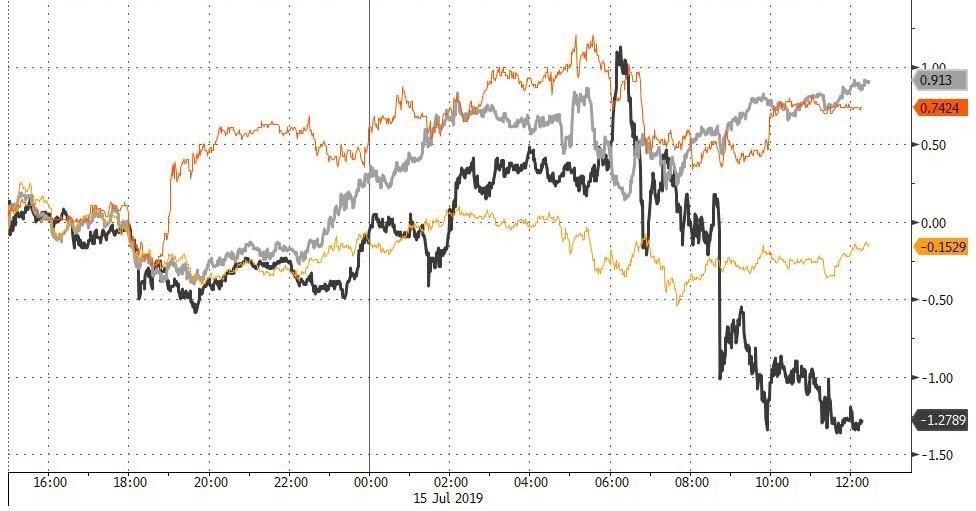

US markets were mixed once again with Nasdaq leading and Small Caps lagging considerably (Dow and S&P flatlined)…

NOTE – look at the close in S&P and Dow!!!

In fact, Small Caps continue to collapse relative to large caps sparking major concerns about the sustainability of this surge…

“Small caps are more sensitive to liquidity issues, both good and bad,” said Tom McClellan, publisher of the McClellan Market Report, in a recent research note.

“They are like the canaries in Great Britain’s coal mines during the 1800s, birds who were more sensitive to bad gases than the big burly coal miners.”

As MarketWatch notes, Small-cap underperformance is coming at a time when many feel the biggest headwind for the stock market and the economy is all the uncertainty surrounding the U.S.-China trade war, which should weigh on large-cap multinational companies more than small-cap companies that have more domestic exposure.

“The message here is that something is wrong with liquidity, and it is affecting the small-caps but not so much the big burly large-caps,” McClellan said.

“This ratio does not tell us what that ‘something’ is, only that there is a problem.”

Another chart suggesting liquidity is drying up is the relative weakness in high-yield corporate bonds:

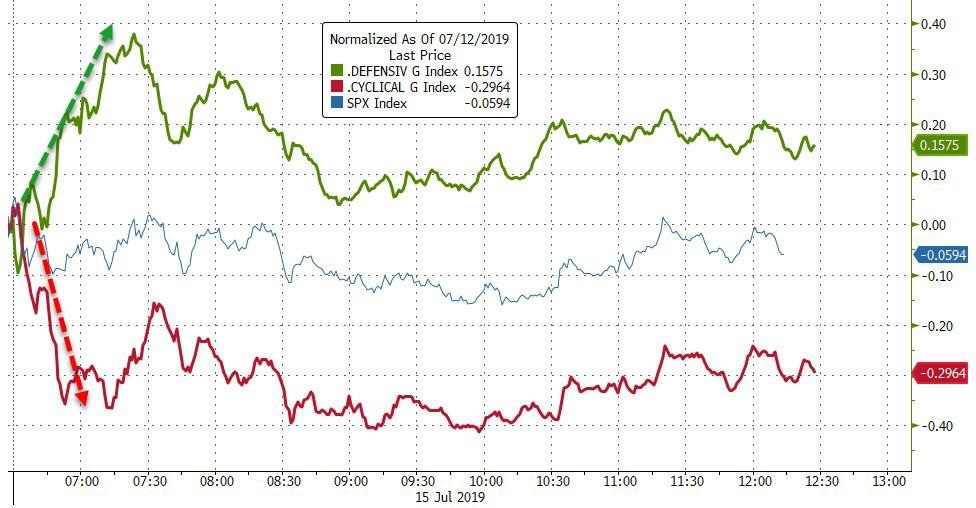

Defensive stocks dominated market performance today…

VIX was higher on the day, despite stocks gains…

Treasury yields were lower across the curve with the long-end outperforming (after last week’s underperformance)…

The yield curve (3m10Y) stalled at zero and remains inverted…

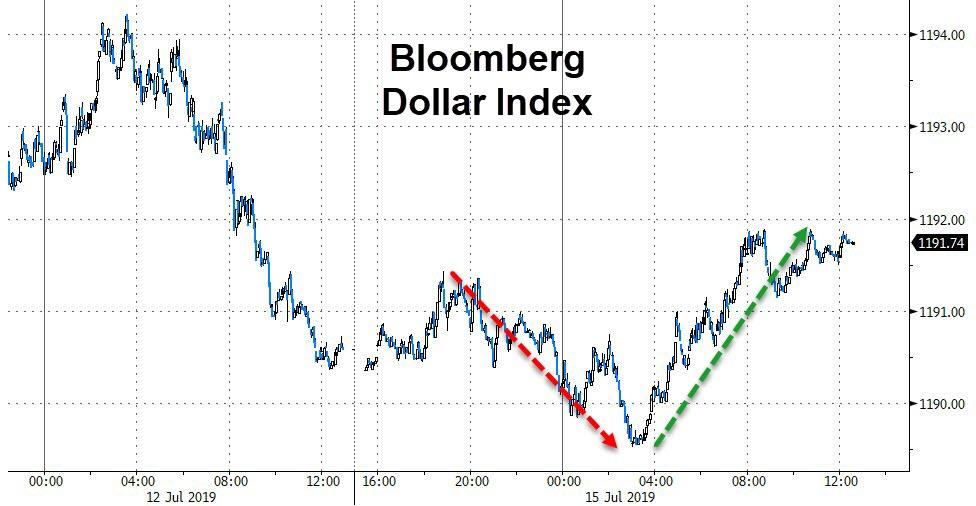

The dollar bounced back from overnight weakness to end the day higher…

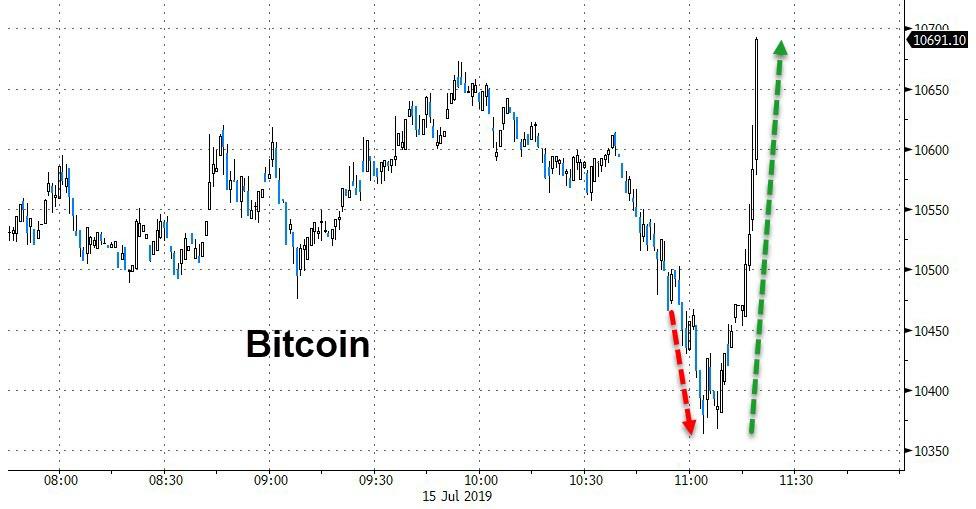

Despite TsySec Mnuchin’s fearmongery, cryptos were actually bid after he spoke (Bitcoin was up 3% on the day after testing $10k overnight)…

But are well down from Friday’s close after the weekend’s crypto carnage (Bitcoin down 10% from Friday)

Oil prices underperformed on the day while copper rallied…

WTI dropped back below $60 as Barry blew itself out…

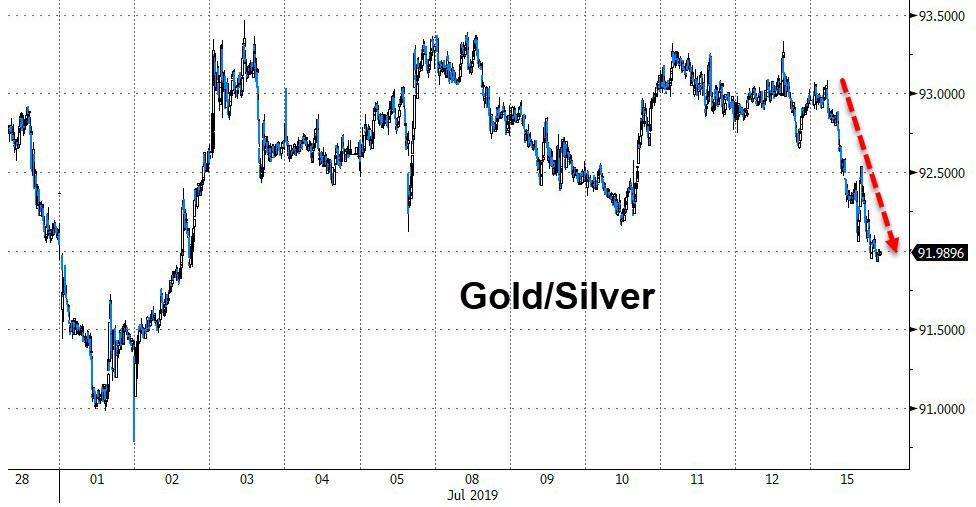

Silver notably outperformed gold on the day…

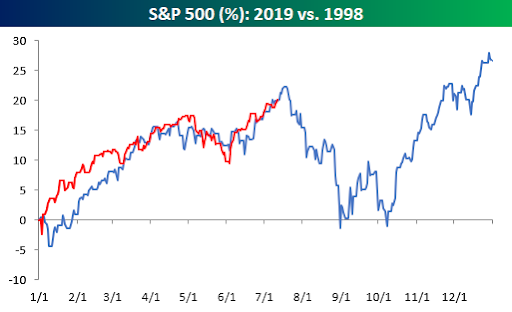

Finally, there’s this…

And this…

It’s the upside-down…

via ZeroHedge News https://ift.tt/30Ak7Zs Tyler Durden