The IPO of Budweiser Brewing Company APAC Ltd., a subsidiary of Anheuser-Busch InBev NV, was going to be the biggest public offering of the year, even surpassing Uber’s $8.1 billion IPO, but as we reported late on Friday, the company and its bankers shockingly pulled the deal in the last minute blaming “market conditions” (such as the S&P hitting an all time high, perhaps), but the truth is that demand simply never met the sky high valuation expectations.

The hope was that the company’s Asian subsidiary would position it to be the premium beer leader in China and the company’s goal was to raise as much as $9.8 billion for a total valuation of $64 billion. But AB InBev was instead forced to shelve the IPO after tepid investor interest in Hong Kong.

The setback can be blamed on a couple of things, according to Bloomberg: first, younger consumers are moving away from traditional beers and towards craft cocktails. Also, competition in China is robust, especially after Heineken signed a blockbuster deal with a state owned company. This meant the appetite for Budweiser’s IPO was very weak.

Jefferies’ analyst Ed Mundy told Bloomberg Television on July 12 said: “We do feel that there are better places to be invested within beer, such as Carlsberg or Heineken.”

Shares of parent company AB InBev fell as much as 2.8% in early Monday trading in Brussels. The stock is down more than 12% over the past year.

So with the IPO scrapped, instead AB InBev will be looking to sell a minority stake in the Asian business, although there’s no immediate plans for a deal. Banks may have been overly optimistic from the get go. Shortly after the company requested proposals last Christmas one bank even pitched a valuation of $70 billion-$80 billion.

On the back of the S&P 500 hitting new highs and the success of other IPOs in the United States, bankers felt emboldened to offer a larger stake in the business and try to raise $8 billion to $10 billion, which was up from earlier targets of $5 billion to $6 billion. However in the days leading up to the IPO, despite “fake news” reports from numerous news organizations that the deal was oversubscribed, it became clear that demand was not going to meet the bank’s expectations.

Despite guiding investors to a price at the low-end of its marketed range, advisers considered cutting the size of the IPO and re-launching the offer hours before the announcement on Friday afternoon. But several funds pushed the price lower and threatened to pull orders so the company had no choice but to suspend the IPO.

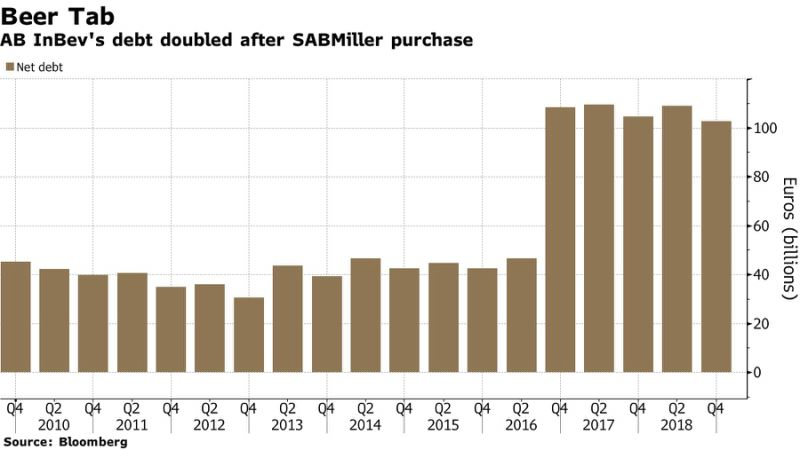

Proceeds from the listing were set to help AB InBev pay down some of its huge debt pile. The company is wrestling with more than $100 billion in debt, with most of it taken on to finance the takeover of rival SABMiller Plc in 2016. Now the company has to deal with its failed IPO while at the same time contending with new pressures in the Chinese market. Despite beer accounting for 30% of China’s total alcohol sales in 2015, that number is expected to fall below 26% by 2023.

Meanwhile, despite its near monopoly status, AB InBev market share continues to slip: the company now commands 43% of the premium market in China, down from 47% in 2014. At the same time, rival company Carlsberg has increased its share from 9% to 14%, with local challengers scrambling to catch up (and do mindboggling IPOs of their own).

via ZeroHedge News https://ift.tt/2NUm813 Tyler Durden