Earlier this morning, JPMorgan hinted at the pain that banks will soon suffer as a result of sharply lower interest rates, when it cuts its Net Interest Income forecast by $500MM to $79.5 billion, sending its stock lower. However, it was Wells Fargo, America’s former mortgage powerhouse, that showed just how ugly the hit to bank net interest income would be, or rather already is, as long-term rates continue to slide.

Wells Reported Q2 EPS of $1.30, beating expectations of $1.15, on revenue of $21.6BN, up 0.1% Y/Y also above the $20.93BN expected.

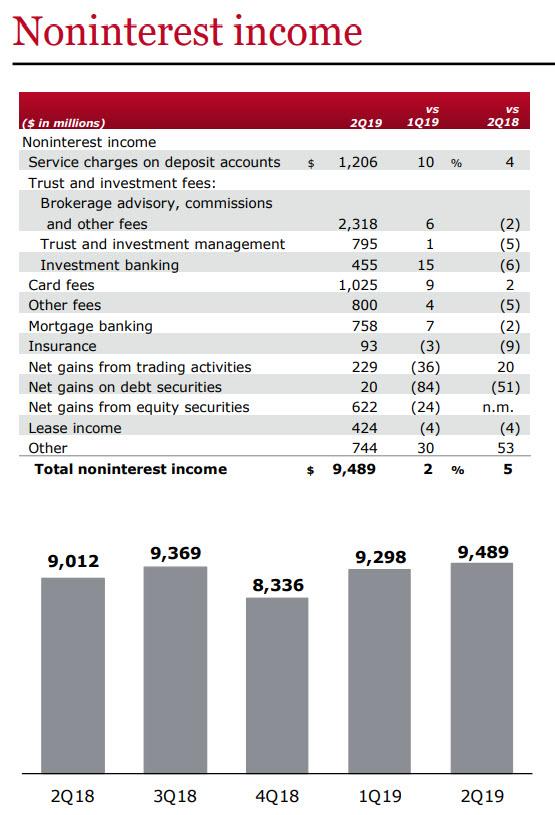

This revenue was made up of the two traditional components: Noninterest Income and, of course, Net Interest Income. Looking at the former first, revealed no major surprises: Noninterest income up $191 million to $1.206 billion due to the following:

- Trust and investment fees up $195 million on higher asset-based fees and investment banking fees

- Card fees up $81 million on higher debit and credit card purchase volumes from a seasonally low 1Q

- Other fees up $30 million largely driven by higher commercial real estate brokerage commissions

- Mortgage banking up $50 million: i) Servicing income down $87 million due to the impact of lower interest rates including higher loan payoffs; ii) Net gains on mortgage loan originations up $137 million on higher origination volumes reflecting seasonality, as well as lower mortgage loan interest rates;

- Trading gains down $128 million driven by lower credit products trading results

- Net gains on debt securities down $105 million from a 1Q19 which included the sale of non-agency residential mortgage-backed securities (RMBS)

- Net gains from equity securities down $192 million and included $258 million lower deferred compensation gains

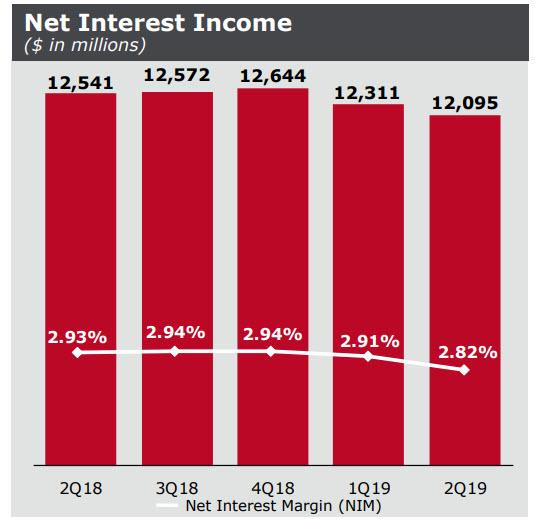

Things were much different in Wells’ other, traditionally greater and far more important, Net Interest Income category, which tumbled to $12.095 billion down $446 million, or 4%, YoY, and $216 million, or 2%, LQ. According to the bank, the decline was due to:

- Balance sheet mix and repricing including the impact of higher deposit costs and a lower interest rate environment

- $73 million higher MBS premium amortization resulting from higher prepays; currently expect 3Q19 MBS premium amortization to be higher than 2Q19

- Partially offset by higher NII from one additional day in the quarter and higher variable income; hedge ineffectiveness accounting results (1) were stable

Average earning assets up $11.4 billion LQ: i) Short-term investments/fed funds sold up $14.8 billion; ii)Mortgage loans held for sale up $4.6 billion; iii) Equity securities up $2.1 billion; iv) Debt securities down $7.6 billion; v) Loans down $2.5 billion

But the punchline was the following: NIM down 9 bps to 2.82% – the lowest in years – “reflecting balance sheet mix and repricing including the impact of higher deposit costs and a lower interest rate environment, as well as higher MBS premium amortization on higher prepayments.”

Translated to English, this means that Wells’ Net Interest Margin of 2.82% tumbled from 2.91% in Q1, and not only missed the consensus print of 2.85%, but also the lowest Wall Street estimate.

And visually:

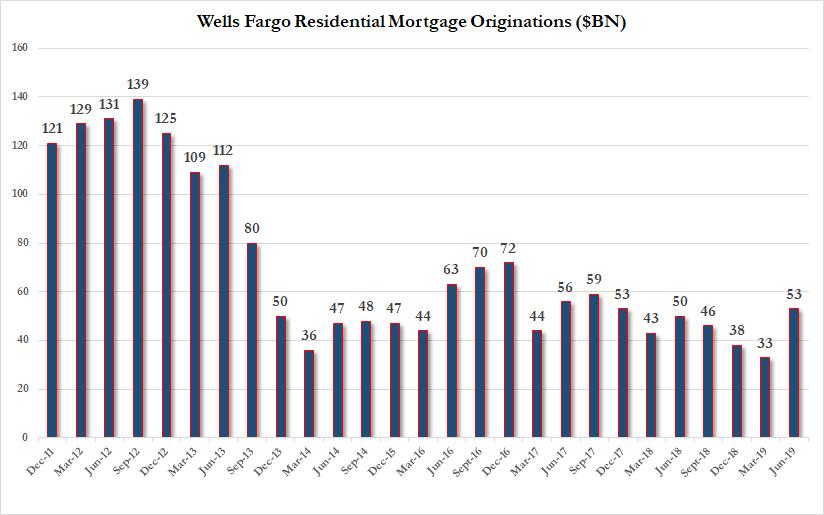

What is bizarre, is that the company’s NII dropped even though Wells actually managed to stage a recovery in its mortgage pipeline, with Mortgage Origination staging an impressive comeback from post-crisis lows, rising to $53 billion largely thanks to much lower rates…

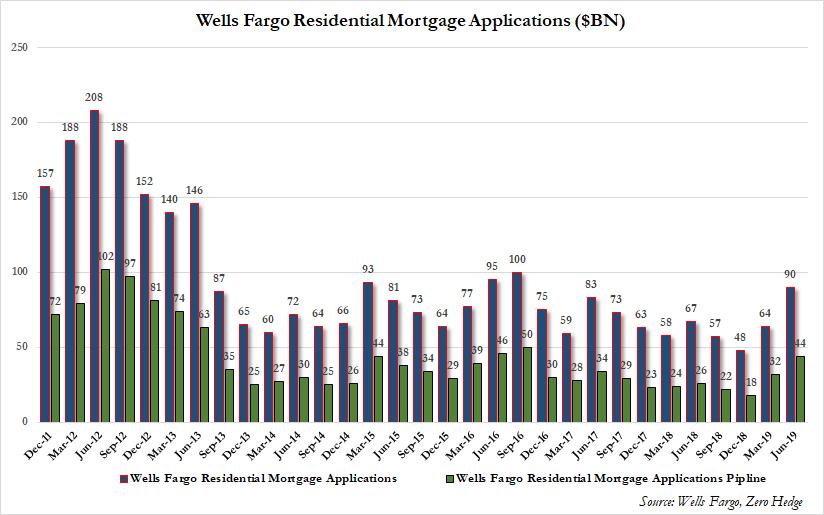

… as well as Mortgage Applications and associated pipeline, with the former surging from $64BN to $90Bn, the highest in three years!

So what is going on?

Well, for the best answer ask Deutsche Bank which has been suffering a nightmarish environment of a flat yield curve, which has destroyed the bank’s Net Interest Income as a result of a collapsing NIM.

Unfortunately for US banks, it is this environment that is coming to the US, with the Fed now set to launch a new rate cut cycle, which in turn will cripple bank interest income, sending NIMs even lower, and forcing banks like JPM to guide even lower on this key bank revenue category, while banks such as Wells that have traditionally been over-reliant on mortgage issuance and origination, will find themselves scrambling how to find alternative revenue pathways.

Alas, as the tragic case of Deutsche Bank shows, such pathways are virtually impossible to come by, and should the Fed cut rates too low, it will be US banks that will be crushed first. What happens after that? Just look at Japan and Europe which are the gunniea pigs for this final central bank experiment.

via ZeroHedge News https://ift.tt/2lv63Rx Tyler Durden