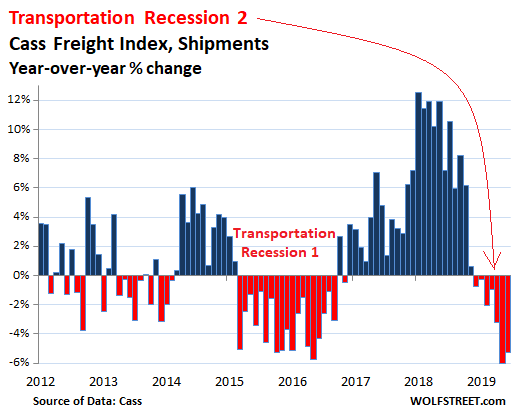

Recent economic reports from the trucking industry show the transportation recession continues to deteriorate through summer, with no end in sight. This is the second transportation recession since the 2008 crash, outlining that freight is a very cyclical business.

Freight companies are dealing with a hangover from last year’s economic sugar high, driven by President Trump debt-fuelled tax cuts and a trade war, that forced importers to build inventory ahead of tariffs. This led to higher demand for big rigs in 2018 as imported items had to be shipped from the port of entries to warehouses.

Freight companies used 2018 profits and the earnings from the 2017 tax cuts to record one of the largest orders for new trucks in some time, resulting in an explosion of overcapacity while cargo volumes started to slide in late 2018, reported The Wall Street Journal.

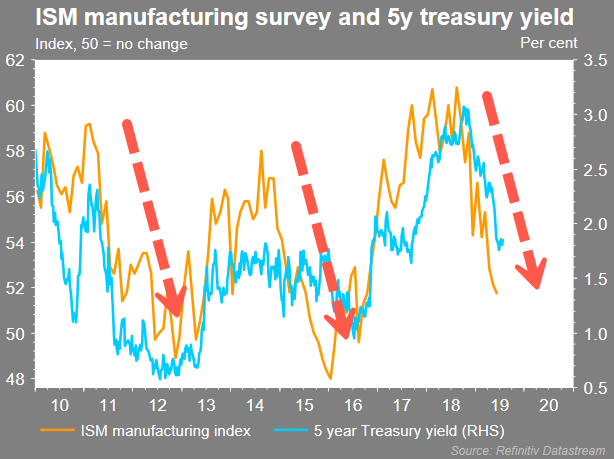

The global economy started slowing in 1Q18, a quarter or so before President Trump launched the first significant punch in the trade war against China. This means an industrial slowdown around the world was structural and unrelated to tit-for-tat tariffs between both countries. By August 2018, ISM manufacturing and UST5Y peaked and had a drastic reversal, due to the start of a domestic industrial slowdown.

Freight executives warn that the industrial slowdown and trade tensions that started last year have reared their ugly heads in the freight industry this year. Companies pulled imports forward late last year ahead of anticipated tariffs are now working through excess inventory piled up in warehouses put a damper on 2019 shipments.

“We’re three months into a freight recession,” said Jack Atkins, a transportation analyst with Stephens Inc.

The spot price to contract a big rig collapsed 18.5% in June on a YoY basis, to $1.89 per mile, according to online freight marketplace DAT Solutions LLC. DAT has recently said there were three loads for every available truck, compared with six loads per vehicle in June 2018.

“The industry bought a lot more trucks than we realized that they did,” Doug Waggoner, chief executive of freight broker Echo Global Logistics Inc., said in a July 24 earnings call. “Relative to last year at this time, there is less demand for capacity and that, coupled with an oversupply of trucks, means there’s little to no spot freight and all truckload prices have come down dramatically.”

Earlier this month, Knight-Swift Transportation, the largest freight carrier in North America, slashed its profit outlook for the second and third quarters, warning “the oversupply of capacity in the truckload freight market” was crushing revenue per loaded mile.

Carrier executives said a credit crunch is headed for the freight industry in the coming quarters, indicating increasing cancellations of truck orders and bankruptcies among smaller regional carriers was adding stress to the industry.

Truck manufacturers like Freightliner, Kenworth, Peterbilt, and International, are still working through order backlogs and fleets continue receiving delivery of new trucks, said Kenny Vieth, president of transportation industry data provider ACT Research, which monitors Class 8 trucks.

“Freight as we measure it is growing at less than 1% in 2019,” Vieth said. “Our modeling suggests that we are adding about 7% to the U.S. Class-8 market capacity…. So the supply-demand equilibrium is tilting away from truckers right now.”

As we mentioned earlier, most of the economic weakness originated from an industry slowdown, so trucking related to consumer demand has been somewhat stronger than the rest of the industry.

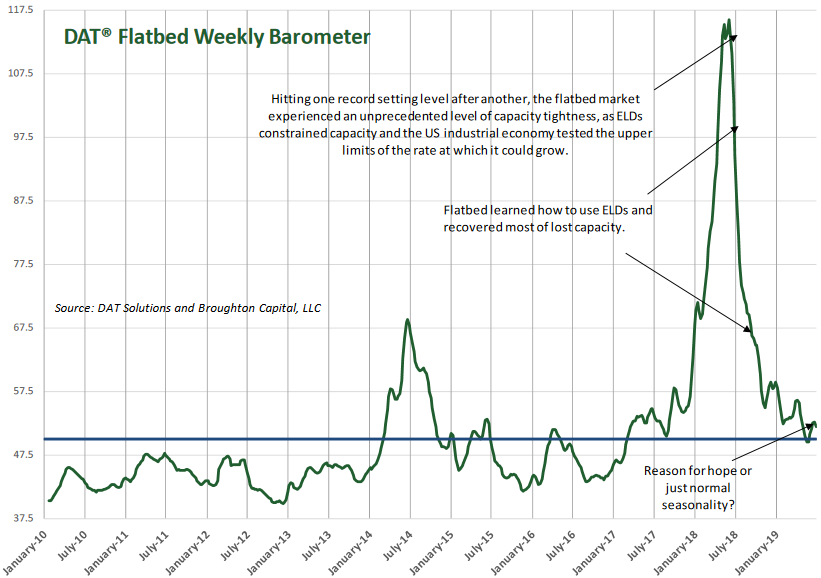

The energy sector has felt the brunt of the industrial slowdown. Rig counts peaked in November 2018, have since declined by 12.5% overall. In the last 50 days, domestic oil production has dropped about 9% from its peak, a violent reverse that is the result of a deteriorating economy. Another industrial sector cycling down is residential construction. With industrial demand waning from big rigs, DAT Flatbed Barometer shows the plunge:

Alternative data, like trucking, serves as a good proxy as to the directional heading of the economy. Freight data overall paints a dire picture for the economic outlook in 2H19.

As Wolf Richter via Wolf Street writes: “The cyclicality in trucking is also based on the classic mismatch in the timing of demand for transportation that creates a capacity crunch because there aren’t enough trucks, as it had done last year, that in turn creates a boom in orders of trucks. And when a few quarters later those trucks are being delivered, this is precisely when demand for transportation is starting to slow down, cycling the industry from capacity crunch to overcapacity in a very short time.”

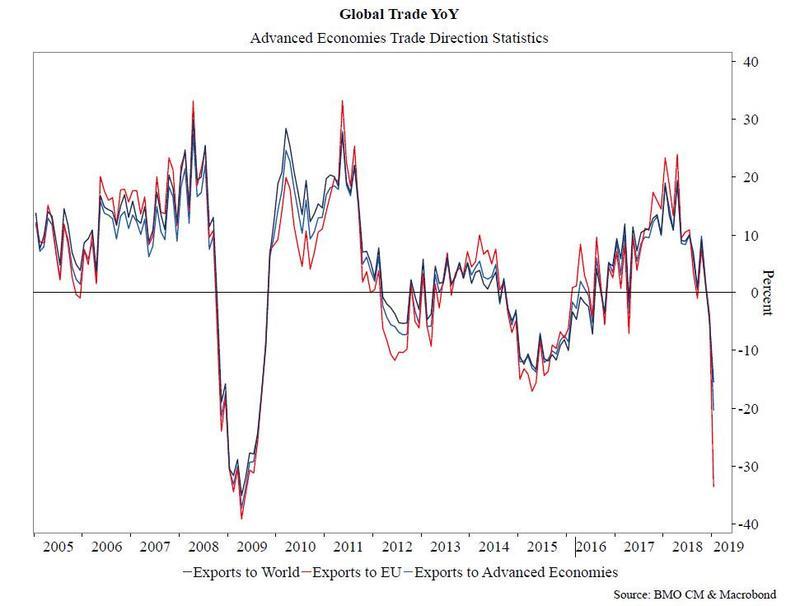

And to summarize the global industrial slowdown in one chart. Here’s Global Trade YoY crashing to levels not seen since the last financial meltdown.

via ZeroHedge News https://ift.tt/3350J8H Tyler Durden