The litany of orders last summer – both for Class 8 trucks and trailers – has weighed on the freight industry for the better part of 2019, with sales of both collapsing on a year over year basis. But now it looks as though things could be returning to some semblance of normalcy, according to FreightWaves.

The low order count for trailers that we pointed out in early August could actually “suggest a possible return to normal order patterns,” according to the analysis.

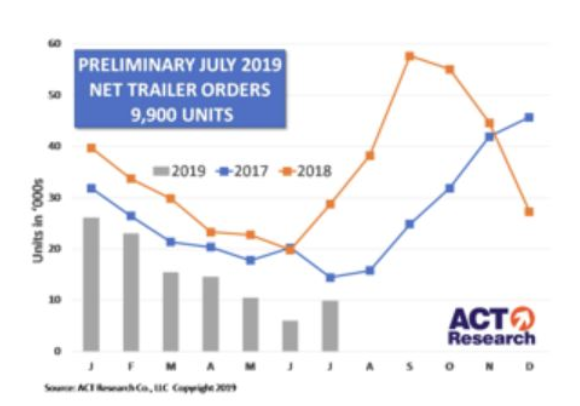

FTR Transportation Intelligence posted preliminary trailer orders for July at 9,000 units, a 68% fall year over year. ACT’s data showed 9,900, down 66%. But there could be a silver lining: sequentially, orders were up, 61% and 65%, respectively. Trailer orders for the last twelve months have come in at 324,000 units.

Don Ake, FTR vice president of commercial vehicles said: “The July order volumes demonstrate a possible return to normalcy in the equipment markets.”

But most fleets (the ones that haven’t shut down) are waiting to take their cues from the overall economy, realizing that the trucking sector is already in recession. Stuart James, chief sales officer at Hyundai Translead said:

“We are experiencing the annual slow-down of orders typical every summer but exacerbated by an undeniable cooling in the market.”

Van production is still at near-record levels for now – at least, until backlogs begin to fall to early 2018 levels. Then, build rates will cool down. The U.S./China trade war and 10% tariffs on $300 billion in Chinese goods has also acted as a headwind for the industry.

Frank Maly, ACT director of commercial vehicle transportation analysis and research said: “A few months ago, there was strong interest to push commitments into next year, but uncertainty over the economy, freight volumes and capacity have now caused many fleets to move to the sidelines as they reassess their true needs.”

“There will be a few months of tough going for anyone that doesn’t have a healthy backlog, but I’d say hang in there because 2020 order activity should start soon,” James concluded. “The fact that there have been virtually no cancellations at all this year until June makes June look especially bad. But looking at the actual volume for the year, there is really very little to complain about.”

via ZeroHedge News https://ift.tt/2z8Dc98 Tyler Durden