Via Monday Morning Macro blog,

As August comes to a close, one can’t help but wonder just how dependent risk assets have become on everything from tweets to rebalancing. The biggest form of life-support, however, still comes from the Fed: equities are in a world of total dependency.

At a minimum, the S&P will require more than 2 rate cuts by the end of the year just to maintain current valuations.

Here’s a rough idea – some numbers behind the “Fed put”.

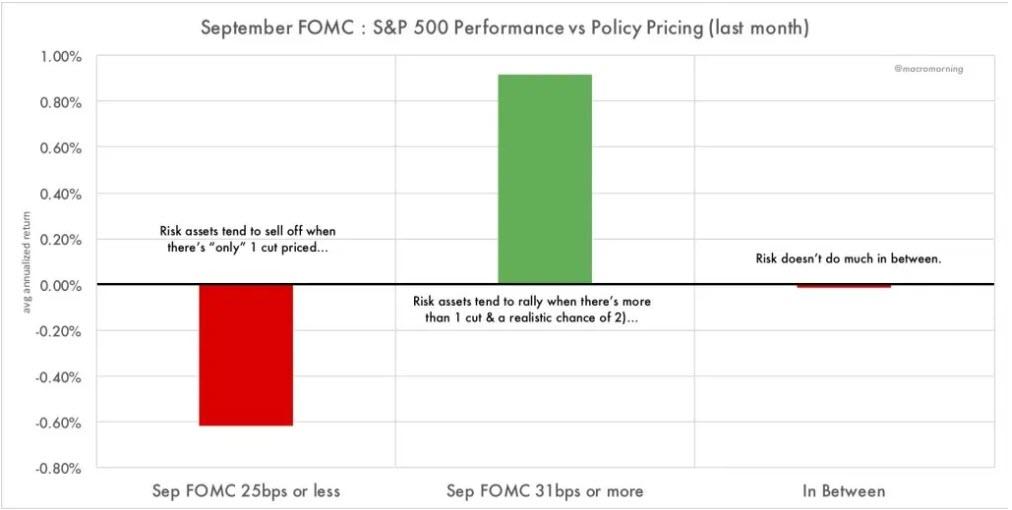

Over the past month, here’s the performance of the S&P over 3 different time slices (avg annualized returns, 10-min windows).

-

When the September FOMC is priced for 25bps or less (1 cut or less): the S&P avgs a -0.62% annlzd return.

-

When the September FOMC is priced for more than 31bps cuts (at least 1 cut & chance of more): the S&P avgs a +0.92% annlzd return.

-

When there is something in between: the S&P is essentially unchd.

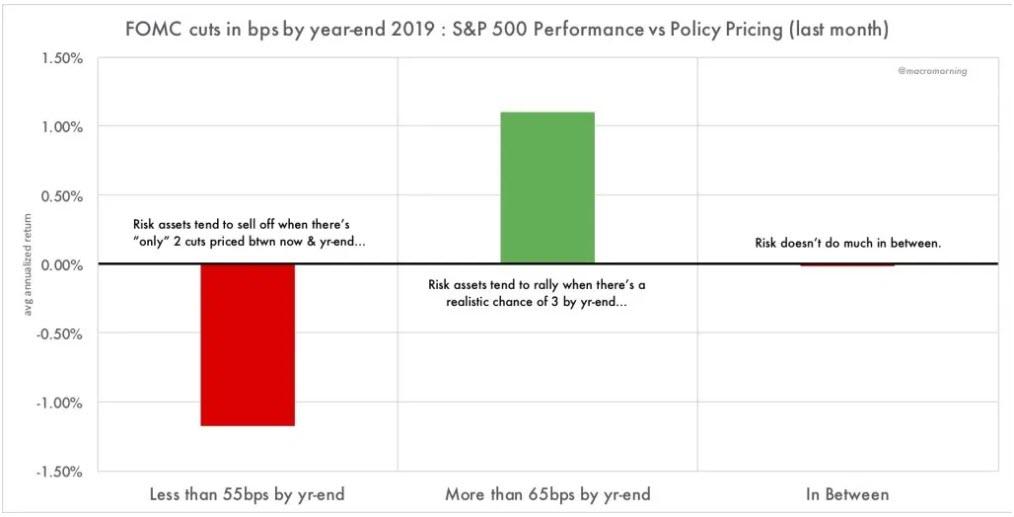

Similarly, for pricing between now & yr-end it’s clear that the S&P would very much like at least 3 cuts from the Federal Reserve.

-

When less than 55bps is priced between now & yr-end: the S&P avgs a -1.17% annlzd return.

-

When more than 65bps is priced between now & yr-end: the S&P avgs a +1.10% annlzd return.

-

When there is something in between: the S&P is essentially unchd.

For more discussion on this dynamic, see here & here. Prices from CME website, Bloomberg.

via ZeroHedge News https://ift.tt/2NBOWts Tyler Durden