Proponents of Modern Monetary Theory emphasize that a country that controls its own currency and borrows in its own currency, like the United States, cannot default on its debt. This is because the central bank can, if necessary, “print” the money needed to pay the government’s creditors… – Econofact

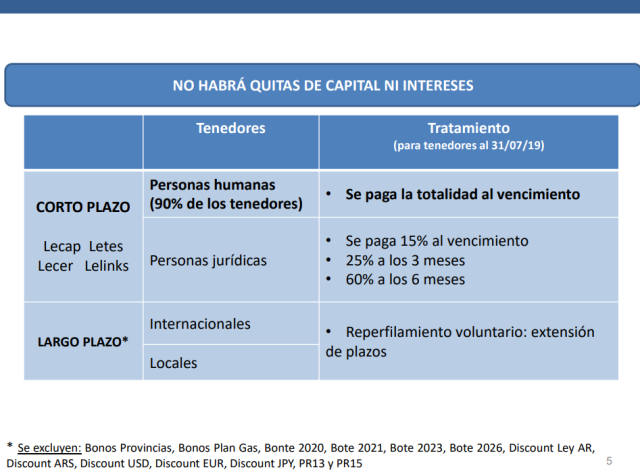

The MMT crowd has some ‘splaining to do after Argentina’s default on local currency Treasury Bills (Lecaps) last week.

We have argued for years with our MMT friends about the dubious assumptions and logic that Modern Monetary Theory is built, most importantly, that a sovereign borrower with an independent central bank and currency, by definition, cannot default. Though the debate has evolved over the years to now what is the true definition of “full monetary sovereignty,” a free floating exchange rate is a big assumption, for example, it would always come down to the case of the 1998 Russian default on ruble Treasury bills known as GKOs. to which the MMT crowd would retort, “special case.” Ironically, the Russians paid their hard currency Eurobonds and defaulted on local currency debt, the complete opposite of what MMT concludes.

Argentina could have monetized the Lecaps last week and let the peso float and collapse as the maturing peso debt would have immediately been converted to dollars. The government chose not to.

We would try to explain to our friends that when a sovereign borrower gets into trouble and experiences “rollover risk” and cannot refinance maturing debt due to a sudden stop of market financing, a policy choice must be made. Either monetize the maturing debt and send the country into hyperinflation as Bulgaria did in late 1996, or default and restructure as Russia did in 1998. We suspect Russia chose the latter because much of their debt was held by foreigners, including hedge funds, such as David Tepper, who said the GKO trade was the worst of his career.

We detect, and we are open to be corrected, from our debates over the years that the MMT crowd believes a reserve currency country, such as the United States, cannot and will never experience rollover risk. We wholeheartedly disagree.

If interest rates significantly increase in the highly indebted DM countries, such as the U.S and even Japan, but especially DMs dependent on foreign financing, public sector finances could enter a doom loop leading them down the road to potential rollover risk.

We saw how the markets fell apart in Q4 when long-term interest rates broke higher in the U.S. to even just above 3 1/4 percent in late September. That is not a very robust debt profile, folks, signaling, at least to us, the interest rate complex cannot normalize because debt is too high. The Fed had to ride to the rescue even as the effective Fed Funds rate was barely positive.

Furthermore, at the end of the day, as the only Joe other than the Yankee Clipper sums it best when it comes to fiat currencies,

As some point, any fiat currency, yes, even reserve currencies, can reach a tipping point into monetary inflation if confidence in its ability to maintain purchasing power is lost and money demand collapses. Even the previous levels of “appropriate” or “normal” levels of money supply then become almost meaningless.

Negative Yielding Debt

Enter the bizarro world of negative yielding debt we now find ourselves, driven by a QE induced structural shortage of long-dated risk-free fixed income instruments, trend following, negative convexity chasing algos with no context that negative rates are a no-no, and traders front running a new round of expected new QE, wrapped in a narrative of a coming deflationary collapse. More market nonsense, in our opinion, but we have trade the hand the market has dealt us. Even if the end game could be a disaster, in our opinion.

Long-term credit risk-free bonds, originally intended to be held to maturity, have been transformed by negative yields into radioactive short-term hot potato trading vehicles that decay your portfolio and P&L the longer they are held. Unless the ECB and BoJ are there to take out the traders at these negative yields, there is going to be a big problem. That is always the case when “the greater fool theory” is the main driver of markets.

We have been writing and debating MMT for years and have been consistent in the solid economic assumption there is no free lunch but MMT keeps evolving, as it should,

We still have ongoing debates with our good friends from the modern monetary theory (MMT) about whether a major sovereign government can default if they have an independent central bank. Yes, they can!

We had the same debate with our Argentine friends several years ago as to whether their government would or could devalue their currency when it was on an effective currency board. Yes, they did! And defaulted to boot.

Just as Russia chose to default on its GKOs (short-term ruble denominated treasury bills) in 1998 with an independent central bank, the same can happen to a G5 country as we approach the upper bound of debt limits and the lower for longer interest rate meme seems to be sunseting in a post-Trump world.

When a highly indebted sovereign crosses the tipping point — and nobody knows where the tipping point is — when the markets lose confidence in its ability to repay or rollover debt coming due and the window shuts on refinancing, they face three choices:

1) bailout – easy for a small country, such as Greece, but Italy or Japan are too big to bail; 2) hyperinflate – print money to pay maturing debt obligations and finance budget deficits. An aside: the Bulgarian central bank did this in 1996 resulting in hyperinflation, which peaked at a monthly inflation rate of 242% in February 1997. I was in the Bulgarian central bank in the fall of 1996, when a senior official looked me in the eye and said, [Gregor], we will not let the government default on its treasury securities.” I knew what was to come; and 3) default and restructure.

Like the Russians, the decision to hyperinflate, default, or go begging to the IMF, is a political one. Russia saw that a high percentage of holders of its local currency debt was held by foreigners, hedge funds such as David Tepper.

Tepper says that losing 29% ($80 million) on Russia when Russia defaulted after an IMF deal “the biggest screw-up in his career”. – Ivanhoff Capital

The Russians made a political choice to default and inflict the pain on foreigners rather their domestic population through hyperinflation. What was interesting is Russia continued to pay their dollar-denominated euro bonds, which had a relatively low debt service burden compared to the maturing GKOs. The Russian government effectively carved out and gave implicit seniority to a specific component of their debt structure. Totally contrary to what MMT predicts will happen, i.e., print money to pay the local debt and default on the hard currency external debt. – GMM, January 2017

So the ball is in your court, MMT friends.

Please explain how Argentina just defaulted on its local currency debt with an independent central bank and currency, which they chose not to float? No special case arguments, no circular logic of defining “monetary sovereignty,” and, yes, it was default and not a “reprofiling” as the government claims,

Just as the law of gravity does not stop at the borders of emerging markets neither should robust economic theories, if they are truly robust. We are more open to kind of a “bounded” MMT under special circumstances and a given timeframe. Universal? NFW.

Upshot?

Deficits do matter.

It is hard to imagine how an MMT advocate would explain away the experience of Argentina. Perhaps the requirement that a country can issue its own currency is, in fact, a requirement that a country can issue debt in its own currency. That would explain why Argentinian outcomes differ from those predicted by MMT. However, it is hard to imagine that a country would be able to issue debt in its own currency for long if it were engaged in deficit spending to the extent MMT advocates propose. In other words, that explanation — while preserving the integrity of the original argument — undermines its practical application.

Alternatively, MMT advocates might fall back on the inflation constraint, which they acknowledge when pressed. If inflation picks up, they say, then countermeasures will be adopted. Again, we have an explanation that undermines the practical application of MMT. But it is even worse than that. Argentina did not adopt countermeasures. In suggesting that countries could just adopt countermeasures when inflation picks up, MMT fails to account for political incentives. Its advocates confuse the possible with the probable.

Argentina’s experience gives us reason to doubt the practical relevance of MMT. In downplaying the costs of deficit spending and monetizing deficits, advocates of MMT enable political actors — even those with the best of intentions — to pursue policies that will ultimately reduce the living standards of the least well off. — AIER, March 2019

Debating these issues are healthy.

As always, we reserve the right to wrong and to be corrected by our MMT friends, who still seem to be developing their theory.

Special thanks to our good friend, Leonardo in Buenos Aires for providing us with the background for this post. Godspeed, our brother, to you and the good people of Argentina, especially the most vulnerable, during these difficult days.

* * *

Appendix

What Should Modern Monetary Theory Learn From Argentina? – AIER

Good background piece on Argentina’s debt and monetary problems

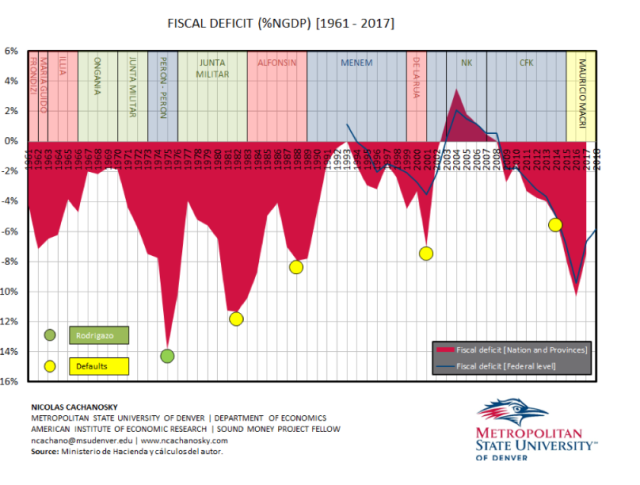

[T]he monetary and fiscal history of Argentina for the period 1960–2017, a time during which the country suffered several balance of payments crises, three periods of hyperinflation, two defaults on government debt, and three banking crises. All told, between 1969 and 1991, after several monetary reforms, thirteen zeros had been removed from its currency. We argue that all these events are the symptom of a recurrent problem: Argentina’s unsuccessful attempts to tame the fiscal deficit. An implication of our analysis is that the future economic evolution of Argentina depends greatly on its ability to develop institutions thatguarantee that the government does not spend more than its genuine tax revenues over reasonable periods of time. – FRB of Minneapolis

Great Twitter thread by Brad Setser

There will be much written on the errors made by Macri (and likely the IMF). But the most obvious one was a simple error of debt management. Borrowing too much in foreign currency early on ….

External bonded debt doubled in a very short period of time.

2/x pic.twitter.com/YKXSuG4SEX

— Brad Setser (@Brad_Setser) September 2, 2019

…Fifteen months later, the giant bailout has become a millstone around Mr Macri’s neck. Voters angry at the continuing recession delivered a stinging rebuke on August 11, handing a big victory to his Peronist rival Alberto Fernández in a primary vote. The contest is regarded as a reliable barometer for the election in October and its result panicked investors because it spelt disaster for Mr Macri’s chances.

Following days of market chaos in the wake of the vote, Mr Macri’s government bowed to the inevitable last week and asked creditors for more time to pay back Argentina’s $101bn of foreign debt, including the IMF money, as Buenos Aires struggled to avoid the country’s ninth sovereign default — and the third this century. Currency controls were imposed on businesses on Sunday after it lost an estimated $3bn in reserves in just two days last week. – FT, Sept 1

via ZeroHedge News https://ift.tt/2Zxt5ud Tyler Durden