Here Are The “Costanza Trades” Of 2020

After an “everything is awesome, nothing will go down” 2019, Mark Orsley – Head of Macro Strategy for Prism, is out with a review of his 2020 “Costanza Trades,” while offering his comprehensive thoughts for next year.

* * *

Long time readers will know that The Macro Scan takes a twist at year end to present next year’s “Costanza Trades” or the “Not Top 10 Trades of 2020.” A kind push back against all the bank “year ahead” pieces that tend to be consensus.

For those of you not familiar with George Costanza, his character on the sitcom Seinfeld could do no right when it came to employment, dating, or life in general. In one episode, George realizes over lunch at the diner with Jerry that if every instinct he has is wrong; then doing the opposite must be right. George resolves to start doing the complete opposite of what he would do normally. He orders the opposite of his normal lunch, and he introduces himself to a beautiful woman that he normally would never have the nerve to talk to: “my name is George,” he says, “I’m unemployed, and I live with my parents.” To his surprise, she is impressed with his honesty and agrees to date him! Doing the opposite was the right thing. Watershed!

Employing the Costanza method to trading is an interesting exercise. Ask yourself what are the trades that make complete rational sense and all your instincts say are right…now consider the opposite. Basically what you end up constructing is an out of consensus portfolio. If you can back those out of consensus views with fundamental and technical justification; there is potentially a high amount alpha in these trades.

It was another successful year for Costanza (though not his best) who fought the idea the world was coming to an end after the December 2018 risk asset massacre. The winners far outpaced the losers.

2019 Costanza Trades:

1) Long FANGs -> + 41%

2) Receive credit protection in IG and HY -> IG 45bps tighter, HY +7.75pts

3) Long Eurodollar spreads (EDZ9/EDZ0) -> -16bps

4) Long Bunds -> German yields 45bps lower

5) Short Gold -> -18%

6) Long WTI crude -> +37%

7) Long AUD/USD -> -0.77%

8) Short EM -> +16% (although in fairness it wildly underperformed the US)

9) Long Bitcoin -> +103%

Costanza Track Record (% of views that were correct):

-

2015 70% correct

-

2016 70% correct

-

2017 83% correct

-

2018 71% correct

-

2019 55% correct

This year is the polar opposite of 2018 which saw massive risk off. Now in December 2019; trade progress between China and the US has developed, risks of a hard Brexit have been reduced, central banks have cut rates and injected liquidity, and fiscal stimulus is being instituted around the world. It’s now full risk on and everything is merry and bright.

That setup makes this year’s Costanza portfolio easy to construct. Costanza is going all in on the idea that reflation is a farce, growth concerns can reemerge, central banks will NOT be on hold in 2020, ranges will be broken, and volatility is too low.

2020 Costanza Trades (in no particular order):

1) Short Rest of World equities vs. long US equities

2) Short US 2s10s steepener (aka: the flattener)

3) Long “green” Euribors

4) Short US 10yr breakevens

5) Long vol: a. “White” Eurodollars b. VIX c. EUR/USD FX

6) Short Gold

7) Short Copper

8) Short Oil

9) Long $Mex

10) Long Bitcoin Bonus: Long initial jobless claims/short the US consumer

As you can see, Costanza thinks the world is NOT reflating as much as the big banks are leading us to believe (recall most of the big banks were calling for 3 HIKES in 2019), and that growth risks still exist in a year with major political uncertainty. Let’s go through each trade and assess the likelihood of Costanza once again beating the street.

1) Short Rest of World equities vs. long US equities

Global growth has bounced on the back of the Fed’s liquidity injection, Phase 1 progress, fiscal stimulus around the world, “yada yada.” That bounce has led to the consensus view across the street to move out of the US equity market (a safer play when global growth is slowing) and into the rest of the world (RoW –higher beta to growth) which has lagged US indices and thus have more upside if growth is picking up again.

When looking at the ratio of US vs. EM, the street is really telling you to fade a multi-year up trend. However, the ratio has gotten quite extended to its trend line so a reversion similar to 2016/2017 is not out of the question…

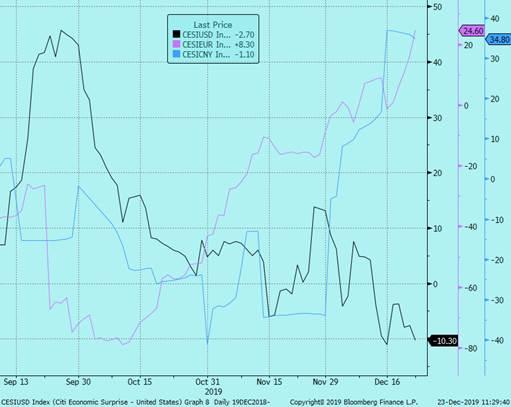

Impressively, the RoW is already economically outperforming the US as seen in economic surprise indices.

US (black), EZ (purple), China (blue)…

Instinct: Fed liquidity injection stimulates global growth as it improves global trade which benefits RoW, countries outside the US are stimulating their economies via fiscal while the US loses its fiscal impulse in 2020, the tariff risk has peaked – therefore the RoW will bounce more than the US from here

Costanza: tariffs have been cut not eliminated, Phase 2 trade talks will be much more difficult, Trump will institute tariffs on the Eurozone, the Fed will end its liquidity injections in 2020 as funding issues calm down past year end, EM growth (led by China) continues to slow – all will keep the trend intact for the US to outperform EM and RoW

Estimated probability of Costanza being right: 35%

Recall the mid-Oct recommendation to buy ESH0 3300/3400 call spread for 5pts which is now worth 33pts (6.5x return). The point is to not pat ourselves on the back but realize it has moved a lot and very fast. Therefore, the crowd is not crazy to sell US and play the catch up trade via RoW longs. I would throw in the risk of margin compressions on US earnings as wages will likely rise more in 2020 as the Fed attempts to further tighten the labor market.

Additionally, the big risk will be the US election which could be the catalyst of US underperformance. The election will be another close call and that could lead to major uncertainty as the policy difference between the Dems and GOP is so vastly different.

Conversely, as long as the Fed keeps pumping Dollars into the global system, that will be positive for RoW growth as Dollars are needed for global trade. Unlike Costanza, we don’t see that spigot getting turned off and in fact we expect that the Fed will eventually move to coupon purchases next year, possibly as early as March. That will be positive for risk assets and accelerate the higher beta plays like EM.

In terms of geopolitical risks, the amount of progress made on the US/China trade talks has been impressive including two major sticking points (IP theft and enforcement). So the surprise in 2020 could be a Phase 2 deal. Further on geopol, it would be shocking if Trump went after Europe during the election cycle (isn’t he incentivize to keep the economy going?). So trade war fears should further abate in 2020.

Speaking of progress, the Germans keep inching their way to stimulus with an ever growing acceptance of running a fiscal deficit, something that very few market participants believe will happen. That means EZ equities could be an outperformer next year and prove Costanza wrong.

Overall, Costanza wants to be in low beta, defensive trades in 2020 which makes sense given how much equities have rallied this year and that the street has now fully bought into reflation. The pushbacks to Costanza would be that the best of times are past for the US (especially politically) and the Fed will have to keep injecting liquidity which benefits the RoW. Therefore, we should all consider that perhaps the US is not the best “hiding place” any more, and all that capital flow into the US the past couple years could reverse in 2020. Meaning if there is big risk off, the US could be the worse place to be.

2) Short US 2s10s steepener (aka: the flattener)

The steepener was one of the most popular macro trades this year. The view in the beginning of the year was that the economy was slowing, the Fed would cut, and that back end would sell off on the prospects of future growth due to the Fed easing. That would be a classic end of cycle bull steepener. The prospects for the steepener was further emboldened by the tourist in the equity community who viewed it as a good hedge for equity longs.

But ironically, the 2s10s curve really started to steepen once growth bottomed, fiscal stimulus around the globe began being floated, and the Fed injected liquidity which led to the bear steepener. The bear steepener is a classic reflation trade and as we know from above; the reflation theme makes George very upset!

Instinct: The Fed is on hold in 2020 and has indicated it is “not planning to raise rates for a long time” which will keep front end rates contained whereas the long end can sell off on reflation prospects and coming supply due to fiscal spending around the world.

Costanza: growth will continue to slow (see economic surprise index) which will cause the long end to re-rally and flatten the curve back as the Fed keeps front end rates steady for a least a few meetings. Additionally, per Brainard if growth slows materially, the Fed “might turn to targeting slightly longer-term interest rates” which will certainly flatten the curve. Lastly, George likes carry (+4bps 12m roll down).

Estimated probability of Costanza being right: 50%

hHis could very well be a case where Costanza is wrong at first and right later, thus the 50% assigned probability. The prospects for further bear steepening on the back of reflation looks valid, at least in the near term.

Besides the above mentioned reasons, keep in mind that the beta to foreign curves could also steepen the US curve as central banks like the BOJ and ECB attempt to steepen their curves to aid their banking sector.

Conversely, Costanza isn’t crazy either as if growth fears reemerge, you likely get a period of flattening before the bull steepener as the Fed will be on hold for as long as possible which means the long end will rally more. Further, if the economy really destabilizes, you could then get the Brainard play book where the Fed attempts to bring the entire curve to lower yield levels – thus flattening all curves to essentially zero.

The ironic thing about playing the reflation idea in the steepener is that if the US reflates enough, the Fed could start talking hikes again. The market, who generally does not believe growth is strong enough for hikes, will no doubt bear flatten the curve. This may not be a 2020 story yet but note Evans comments (non-voter in 2020, voter in 2021) from last week where he said he is “quite comfortable with raising rates once in 2021 and again in 2022.” (Insert slapping head emoji – have these guys not learned their lesson yet!)

The technicals jibe with the idea of the curve should continue to steepen over the next couple months as the reflation narrative plays out.

US 2s10s curve have formed a picture perfect inverse head and shoulder pattern. The target is 55bps…

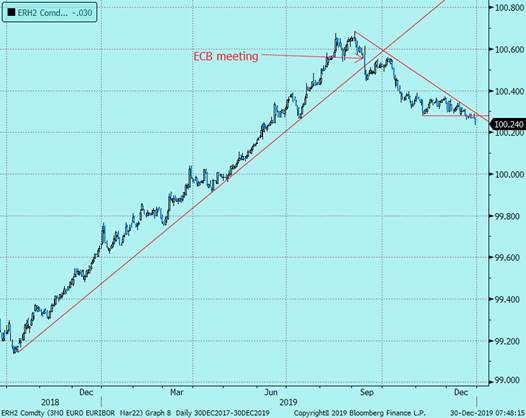

3) Long “green” Euribors (ERH2)

Long Euribors were one of the best trending trades of the year up until the ECB meeting on Sept 12th when we first caught wind that further rate cuts were going to be less likely.

ERH2 broke its uptrend on Sept 12th , now trending to the downside, and just broke pivot support…

Since then, we have gotten further clarification that not only are ECB cuts are becoming less likely, but there is a growing ambition to perhaps move out of negative rates, Riksbank style. ECB officials are now roundly talking about the adverse impact of negative rates, how they are starting to see improved growth prospects, and will consider a monetary policy path.

-

ECB’s De Guindos: side effects of monetary policy is becoming more evident

-

ECB’s de Cos: No conclusive evidence that sub-zero rates were hurting lending but could not rule any negative impact on banking sector

-

ECB’s Holzmann: noted he hopes to see the end of negative interest rates by the time his 6-year term ends – local press

-

ECB’s Holzmann: stated that he saw possible ECB rate changes if the inflation trough passed during 2020

-

ECB Lagarde: downside risks to growth “slightly less pronounced”

-

ECB’s Guindos: low rates create strains on bank profitability

-

ECB’s Knot: In time need to reassess our monetary policy; cannot rule out worrying prospect of current low interest rates lasting another

Additionally, as we spoke about in trade #1, the prospects of German fiscal stimulus are inching their way along and that will keep Euribors under pressure.

Instinct: growth bottoming, the ECB is done cutting and considering moving out of negative rates, prospects for German fiscal stimulus

Costanza: European growth will remain lackluster due to structural reasons, cutting rates further is one of the ECB’s only levers to pull when growth slows, moving rates out of negative will cause the Euro to appreciate which will collapse growth, generally the world has learned that rising rates eventually hurts economic growth and breaks risk assets (due to debt deluge)

Estimated probability of Costanza being right: 60%

The ECB is in a tough spot. It has become en vogue for ECB members to warn about the effects of negative rates but do any of us believe the generally unimpressive growth in Eurozone will be able to sustain rate hikes and an appreciating currency? It’s a tall order.

With the Euribor curve now pricing in hikes in the “greens,” Costanza is buying the dip and playing that at the very least; the ECB will be on perma-hold.

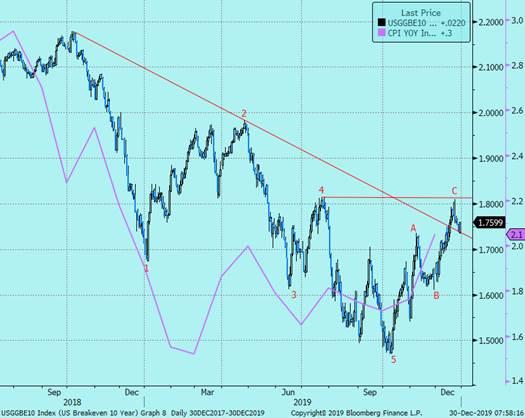

4) Short US 10yr breakevens

You don’t get reflation without the “flation.” This one is another bet against the conventional wisdom of reflation which by definition sees rising inflation.

It has been a good run recently for “breaks” which are now ~30bps off the lows but note that it just failed at a key resistance level, and its Elliott Wave count suggests the recent rally was simply an ABC correction. That at least puts some probability that the reflation narrative is a head fake.

Also note that at 2.1% headline CPI, 10yr breakevens tend to sit in the 1.70%-1.75% range (ie: right here).

10yr breakevens failed at pivot resistance which completes its ABC correction off the 5-wave count down. That would suggest the rally is complete and note that at 2020 consensus forecast of 2.1% CPI, 10yr breaks are “fair” here…

The one big macro positive for inflation was the Fed effectively capping the Dollar this fall with its three rate cuts, but more importantly with the repo operation/liquidity injection/Not QE. Since then, the Dollar has depreciated and that will act as a tailwind for inflation.

However, there are a few macro negatives:

-

The fact that tariffs will get cut in half means the feed through to prices will be negative for inflation.

-

China is still exporting deflation as we can see with its -1.4% PPI

-

No inflation impulse emanating from Europe or Japan

-

Trump is making it his mission to cut prescription drugs prices by increasing competition which will be very negative for medical prices (but good for the economy btw)

-

Oil is potentially topping (see trade #8 below)

Instinct: global growth is picking up, the Fed has eased and provided liquidity, oil has rallied, fiscal stimulus is being instituted around the world – all should feed into higher inflation

Costanza: reflation is a temporary pop that the inflation market already priced in, China is still deflating, oil will cap out soon, the Fed will end its liquidity injection next year which will cause the Dollar to rise again

Estimated probability of Costanza being right: 60%

The potential for higher inflation certainly is viable in the near term as reflation plays out a bit more. The problem is that higher inflation would lead to higher nominal yields. As we saw in 2018, higher yields ultimately tip the economy back towards the downside as the debt overhang, and the rising cost to service that debt with higher yields, will become problematic thus breaking the economy and markets once again. That would send breakevens back down.

Let’s also not forget about the aging demographics problem in the US which will structurally compress inflation over the next decade. Therefore, once the green shoots of reflation fades; Costanza will likely be proven right.

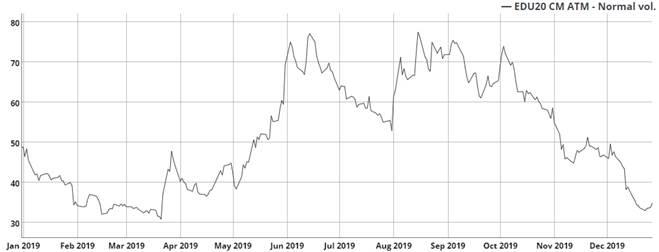

5) Long vol: “white Eurodollar”, VIX, Euro FX

The environment is goldilocks: growth is picking up, the Fed is on hold, the ECB is on hold. What could go wrong?!?!

Since the Fed’s last insurance cut + repo op, fixed income vol has been annihilated. From Costanza’s perspective, it has rarely been cheaper in the past year to bet against the market consensus that the Fed will be on hold. This could mean buying calls, puts, strangles or straddles depending on your view. Point is to own optionality that 2020 won’t be a range.

Using Prism’s constant maturity data, EDU0 at-the-money normal implied vol is back near the 1-year lows…

In other words, if you are playing the range theme in fixed income on the idea that the Fed is on hold in 2020, you are essentially selling vol at the lows. Full pass for Costanza.

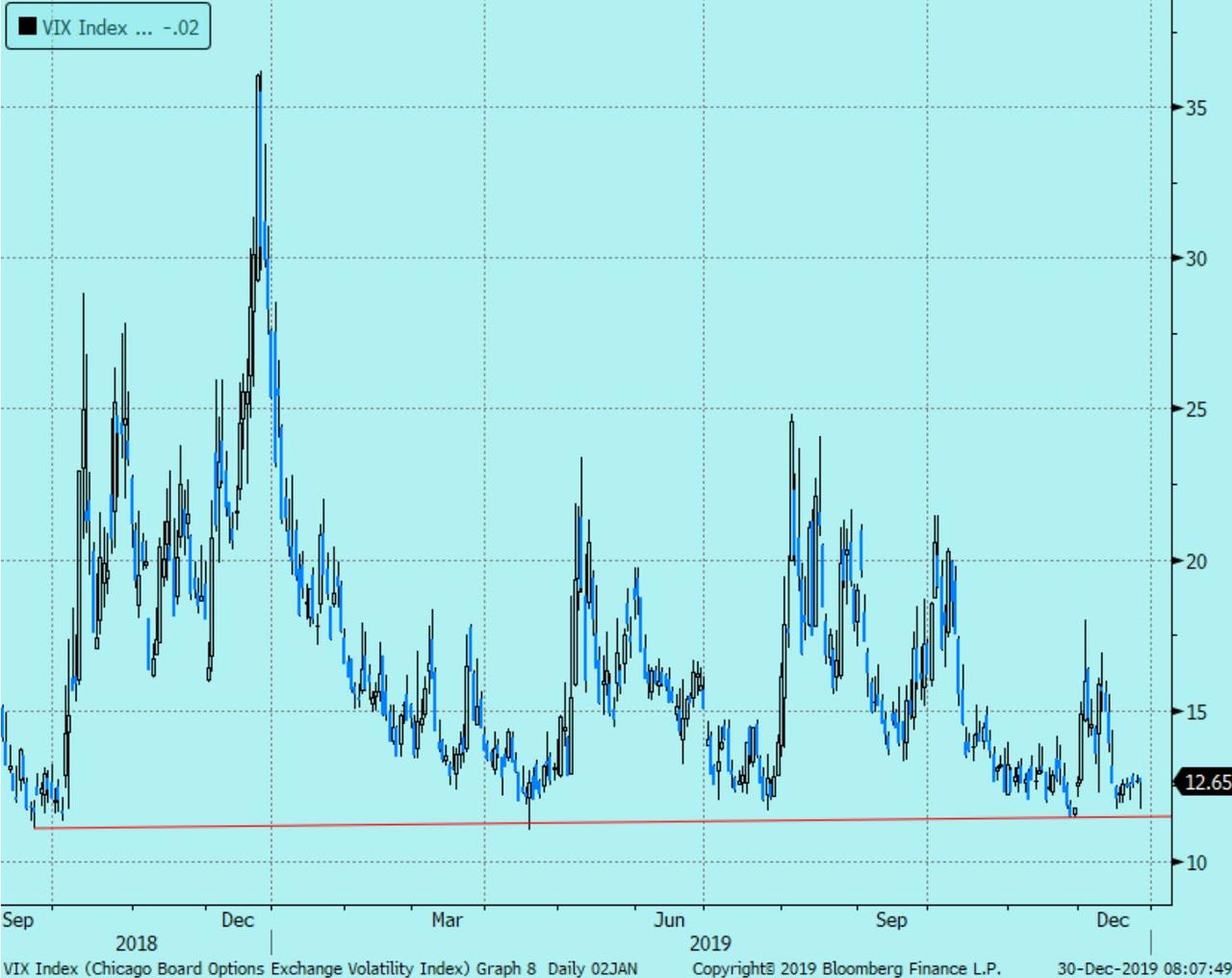

Similar story in equity vol. Obviously with S&P’s making higher highs, VIX has returned to its base where you normally don’t see the index drift any lower. So do you want to sell equity vol here?

And FX vol is just crazy low. All-time lows in 3m EUR/USD vol…

Instinct: absolutely nothing will happen in 2020 (which is what current vol levels are implying)

Costanza: the Fed generally does not make accurate calls on its policy direction so why believe they will remain on hold, the Fed shifts less hawkish/more dovish in 2020, there are still growth concerns, still trade talk uncertainty, US election uncertainty –buy volatility at the lows

Estimated probability of Costanza being right: 99.99%

This idea is made for Costanza. Most commentators right now are talking up a Fed on hold + reflation. You have to be concerned how consensus this is and the building of short vol positions in Q4.

The odds of nothing happening in 2020 and not getting a disturbance in the force is slim to none. Has anyone noticed that US growth has been disappointing recently? Has Phase 1 actually been signed? Is Phase 2 done? Is there a US election this year where policy is so binary its impossible for businesses to make investment decisions? Anyone notice nominal yields are rising to a point compared to growth where risk asset vols tend picks up?

The point is the market is priced for near perfection so playing ranges and selling vol at these levels has become dicey.

Costanza will be proven right in his highest conviction trade of the year. He would much rather buy cheapening tails than sell ATM vol. Ideally, play for higher rates now which breaks the economy/risk assets and then for Fed cuts later.

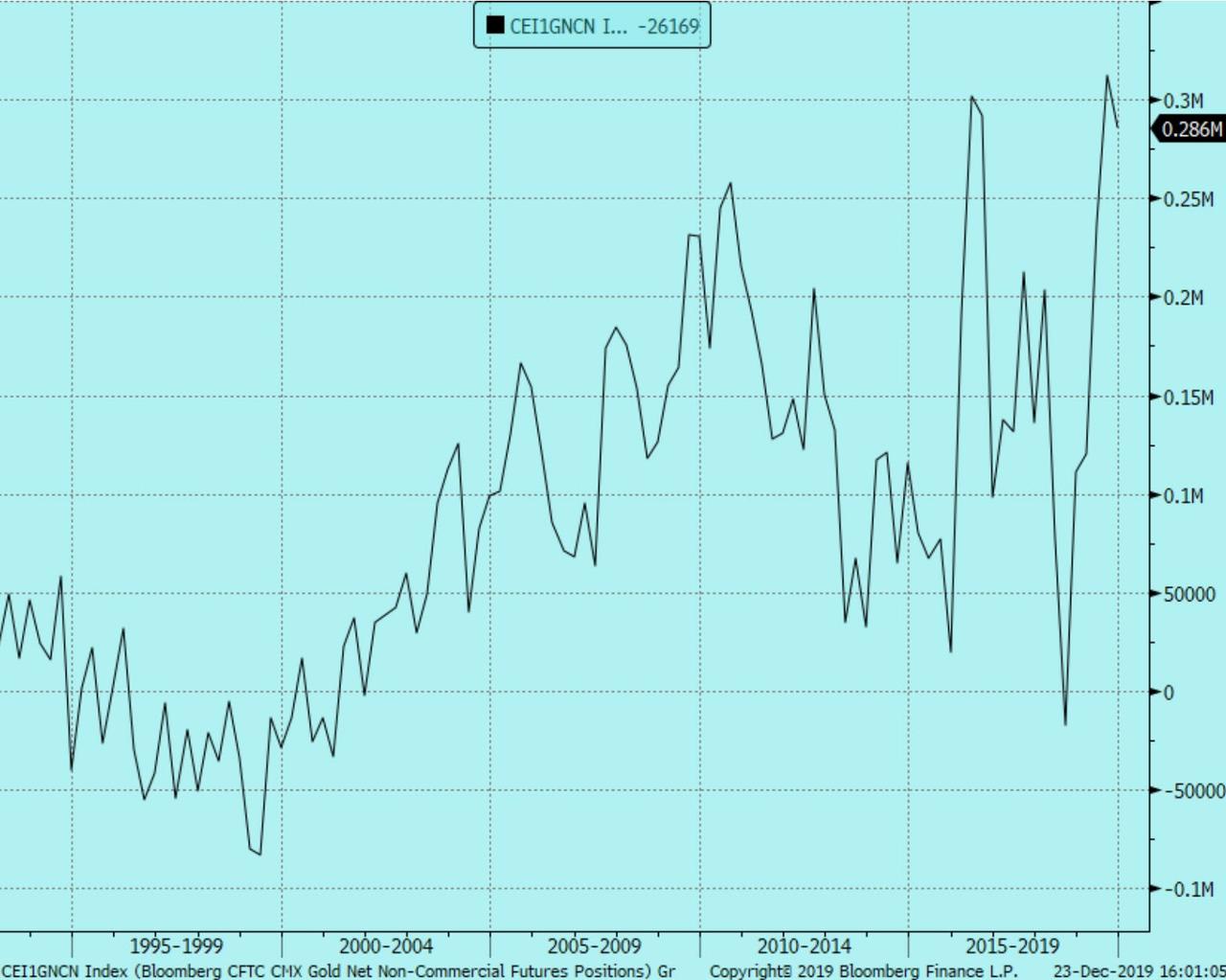

6) Short Gold

Against his long vol position, Costanza wants to sell Gold. Gold has become a widely popular macro trade as central banks are expanding their balance sheets once again, the Dollar has been falling, and the Fed is working to keep real rates low. Therefore, the Gold long is completely intuitive and is breaking out.

Gold is breaking out of its bull flag pattern. The target is 1700…

The major problem is just how widely own it is.

Gold speculative positioning near all-time high…

Instinct: Fed capped the Dollar and is compressing real rates, good insurance policy for an equity market melt down

Costanza: positioning is very crowded long, Fed will end its liquidity injection in 2020 which will allow the Dollar to rise again, the Fed will indicate rate hikes are once again on the horizon

Estimated probability of Costanza being right: 20%

The gold market at some point will need a positioning cleanse but the bull case is strong and the bear case is weak at best. The consensus will likely be proven right (for once).

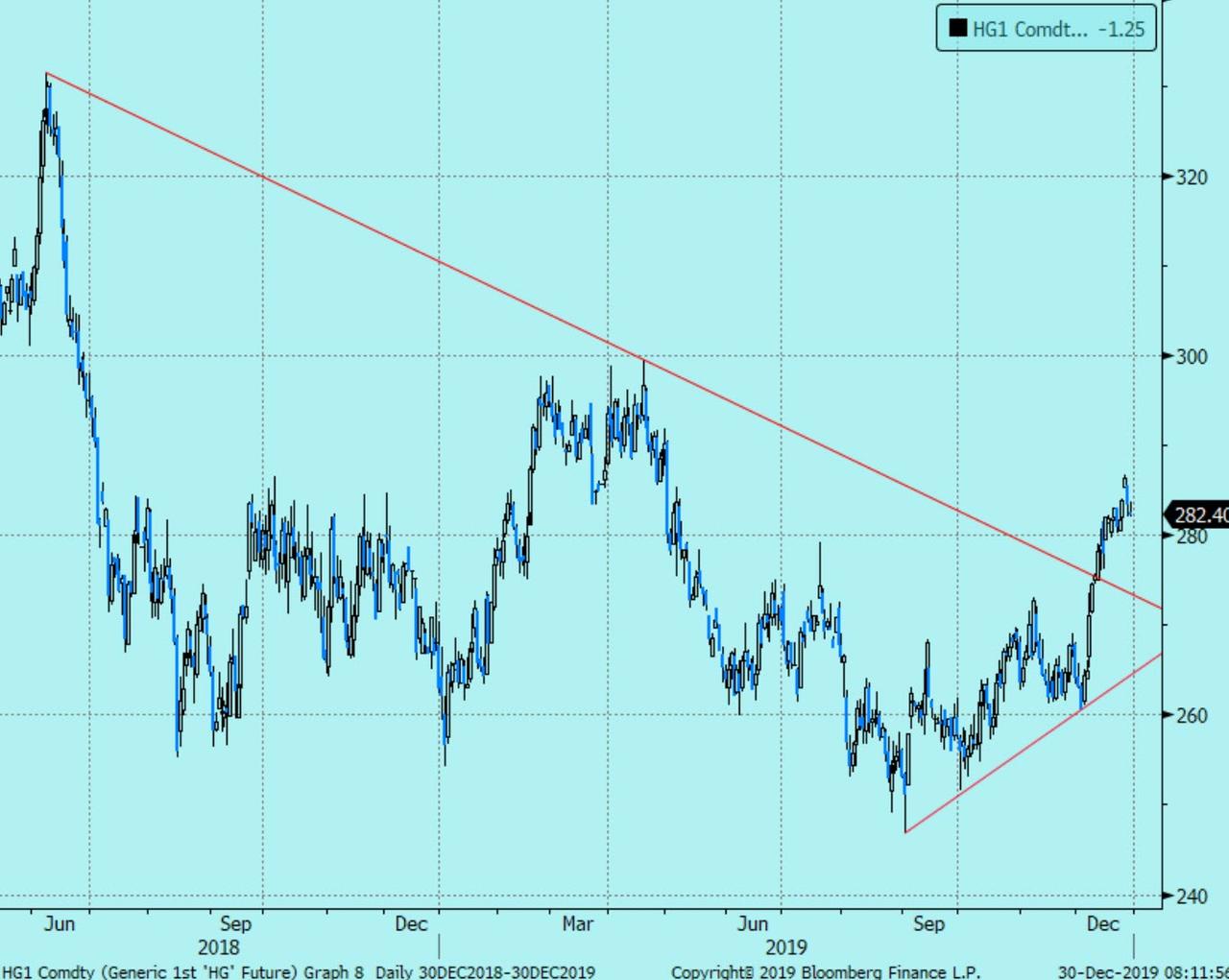

7) Short Copper

Shorting Dr. Copper is a simple play that reflation will be temporary and that trade talks could deteriorate once again.

Costanza will be concerned about the supply issues in Chile which has also provided a bid to copper this year. Longer term, copper demand should remain robust as the US moves to more electronic vehicles of which copper is a major component of.

Copper has broken out of its 1-year downtrend…

Instinct: the trade wars are cooling which will be good for global growth and China, supply disruptions, EV demand

Costanza: the breakout has been mostly uninspiring which could be a signal that reflation is not real, Chilean supply issues could be fixed in 2020, the EV demand theme is very long term and may not be a 2020 story

Estimated probability of Costanza being right: 50%

This is really a pure call on global growth and as stated above in some of the other trades, its likely reflation works for Q1 or so and then fades later in 2H. Therefore, with copper mostly beaten down due to trade wars, its prudent to position long here especially if you think the progress on China-US trade talks are genuine. Compared to some of the other reflation trades, this has a better entry point.

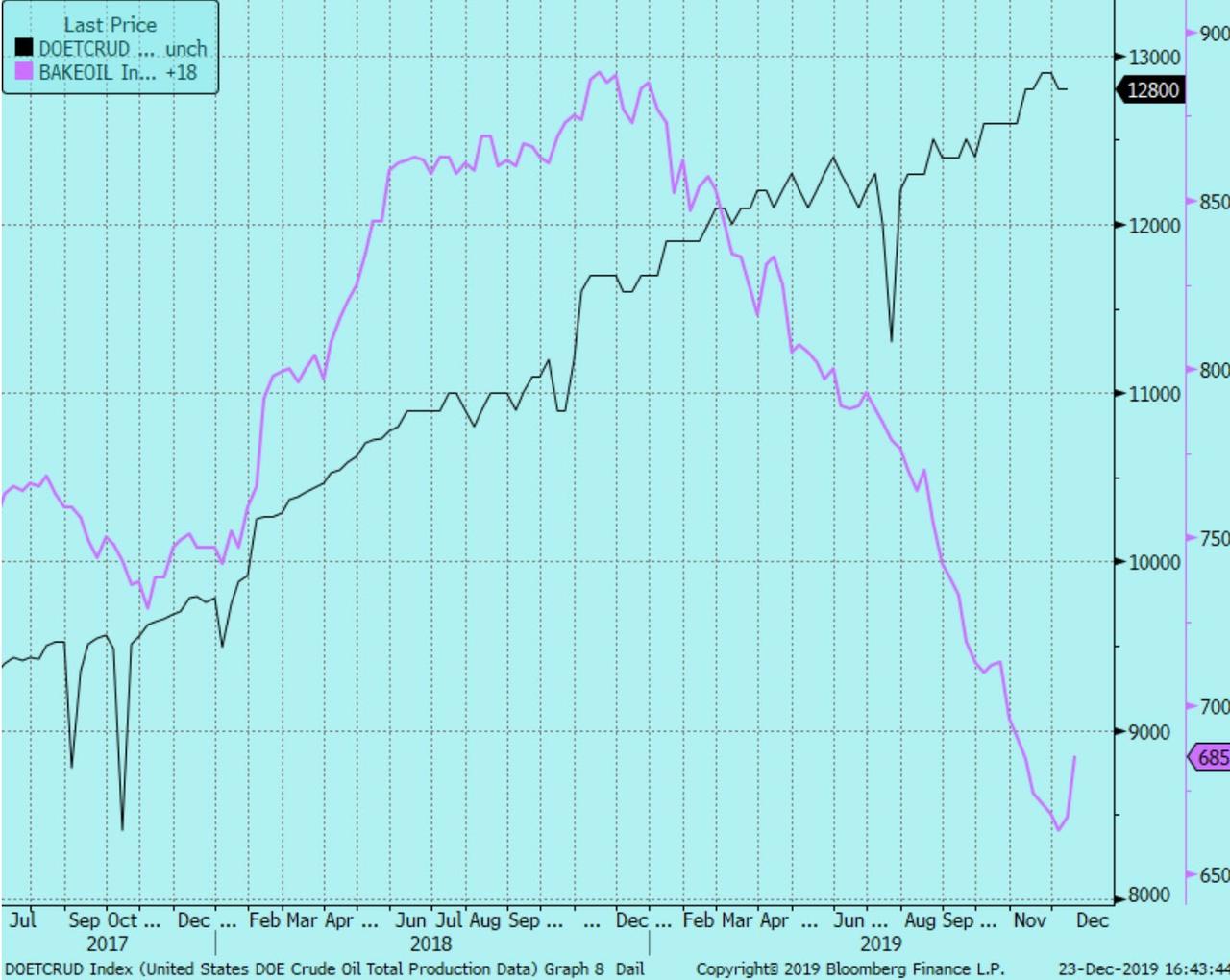

8) Short Oil

Costanza is really beating a dead horse now. Many factors drive crude oil prices but more than anything, global growth concerns kept WTI under $60 for most of the year. With the growth picture more robust, WTI has recaptured $60.

Besides the possible reemergence of growth concerns, Costanza will hang his hat on US production continuing to grow. What’s been impressive this year is US production has risen from 11.5m barrels/day to almost 13m barrels/day despite rig counts declining all year (mostly due to DUC’s being completed). But note that the rig count is starting to turn higher again which is typical when prices start to rise and producing oil becomes economically attractive again. That could keep supply pressures going.

US total crude production (black) vs. rig counts (purple)…

The bull case rests on the idea that US production will start to fall as production issues have reemerged (wells producing less oil than expected), capex has been low, and funding has become more difficult. Additionally, OPEC has made it clear they will keep prices firm with output cuts for the time being.

It’s also time to see if IMO 2020 (curtailing sulfur output on cargo ships which requires a heavy blend of crude) will cause a price spike or not as shippers could stockpile the necessary crude to turn it into product that would lower their sulfur emissions.

Costanza knows that WTI, at the end of the day, generally maintains a range around its “fair value.” In this case, over the past 5 years, WTI has an average price of $53. You can see from the below chart, 72% of the time, it stays within 1 standard deviation of that average (there has only been two periods where it traveled outside that zone). Therefore, better to fade at the top of the range than chase…

Instinct: growth is picking up, IMO 2020 rules take effect now, US production will slow due to well issues

Costanza: global growth concerns still exist, shippers can use scrubbers to manage the new IMO 2020 rules, rig count is picking up which will mean US production will keep rising, DUC’s are being completed which will bring new supply with or without increasing rig count, OPEC+ ends or reduces the supply cuts now that Aramco has IPO’d (note recent Russian comments that cuts are not indefinite), getting to the top of its normal range

Estimated probability of Costanza being right: 65%

In The Macro Scan on September 30th, we discussed how oil would bottom out in the low $50s with a target range of $60-$65. That micro call played out and here we are back at the top end of the range. Statistically speaking, Costanza looks wise to play that range with the market betting on reflation.

9) Long USD/MXN (Long US Dollar vs. short Mexican Peso)

Costanza’s call here has a few different drivers:

-

A play that global growth convergence will not occur in 2020 (see trade #1)

-

A play that the USMCA deal will not spur the Mexican economy which has seen two consecutive quarters of negative GDP growth

-

A play that the Fed will not continue its repo operations well into 2020 which is working to suppress the USD, or will re-lose control over funding markets bringing back the Dollar shortage theme

-

A play against all those trying to collect carry, short vol, etc. (Mex is the highest yielding major currency)

So this encompasses many of Costanza’s view of short risk assets, short EM, short nothing is going to happen, and long Dollar.

Instinct: growth is recovering, Fed is on hold for 2020, Fed is injecting liquidity, Mexico will benefit from USMCA deal, long EM and collect carry

Costanza: global growth is still murky and the Mexican economy has slowed hard (-0.3% GDP YoY), Banxico will have to cut rates further hurting its currency carry, the Fed will end the liquidity injections in 2020, risk asset vol will emerge which will hurt carry trades

Estimated probability of Costanza being right: 60%

This is a popular street idea and when EM trades get crowded, Costanza gets worried. It appears to him that the Mexican economic slowdown will outweigh the benefits of USMCA passage. Probably another example of not working first but bouncing in 2H.

Correction down to its long-term trend line with a 2H rally?

10) Long Bitcoin

Since adding Bitcoin to his repertoire two years ago, Costanza is two for two in his Bitcoin calls (short vol in 2018, outright long Bitcoin in 2019). Luckily enough the long trade in 2019 worked brilliantly in 1H but has since given up much of those games. Thus entering the decade, the sentiment has flipped bearish mainly due to:

1) As trade war fears abate, the demand from the Chinese to move wealth offshore via Bitcoin decreases. And with the common belief that tariffs have peaked, there will be less demand for Bitcoin going forward.

2) Government sponsored cryptocurrencies which will lower Bitcoin demand. China is expanding is blockchain study and Japan is pushing for an international network of cryptocurrency payments as examples.

3) Libra/Stablecoins – full of controversy, but Facebook intends to move ahead with plans to bring a stable medium of currency exchange to 1.7b “unbanked” people to allow money to more easily flow around the world.

As you can see, there has been plenty of fundamental reasons to sell Bitcoin in 2H, but Costanza is betting there is still a store of value price that the market will place on it. His bet is that store of value price is around 6k. Notice the fractals that have formed since July which are “W” shaped corrections. All those “W’s” have worked to fill the various “gaps” that formed during the 1H rally. There is one last gap to fill down at 6078. Note that coincides with the all-important pivot support around 6,000. Also take notice that the MACD (bottom graph) is starting to make higher lows which is an indication that momentum is starting to turn higher…

Instinct: improved China-US trade talks means less demand from the Chinese, governments continue to work to introduce legitimate crypto, the private sector as well is attempting to bring a more stable form of crypto

Costanza: there will always be demand for a non-legitimate crypto, spec traders will buy just above 6,000 once the last 1H gap is filled and at key pivot support

Estimated probability of Costanza being right: 75%

Whether you believe Bitcoin is the IPhone or the Treo of cryptocurrencies is neither here nor there going into 2020. It remains the most liquid way to transfer money globally without real government supervision.

Further, it is still the best speculative asset in the macro landscape due to its high volatility which simply does not exist in the developed markets due to central banks compressing volatility. Those specs will take their shots at long in 2020, and Costanza has to imagine the whales come in just ahead of 6k.

Bonus: Long Initial Jobless Claims (higher claims), short the consumer

Record low unemployment and strong consumer. That has been the story in 2019 despite an economic slowdown and three Fed rate cuts. The street widely expects claims and UER to remain low in 2020.

The labor market is tight and the Fed intends on “letting it run hot” as per Kaplan’s comments that “inflation is not running away from us, so we might have the luxury of trying to do more to get more people into this workforce on a sustainable basis.”

The problem is tight labor markets can end a cycle. Wages rise which compresses margins which then leads to layoffs as companies cut costs to improve profitability (at a time when corp. earnings are now negative on a YoY basis).

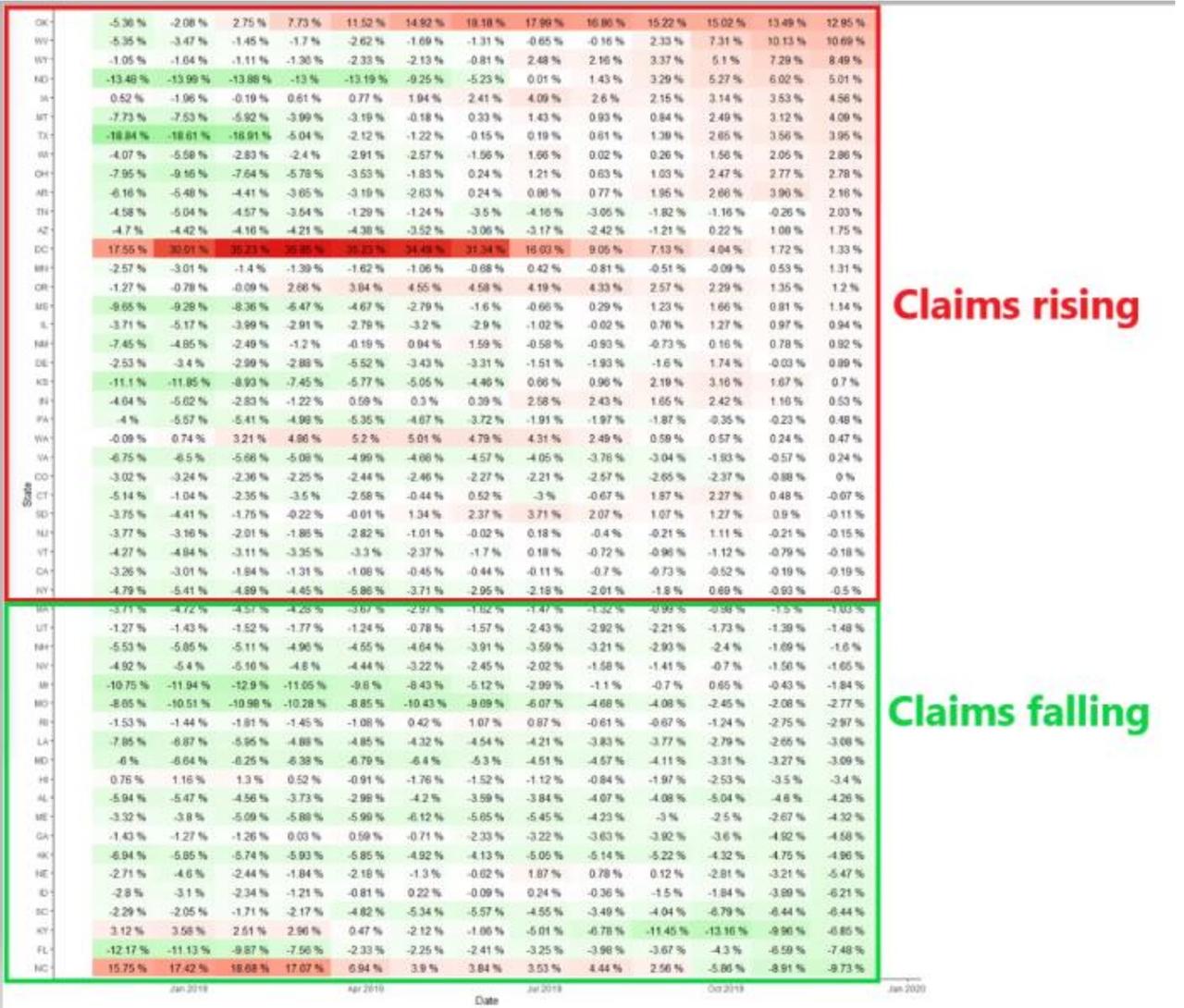

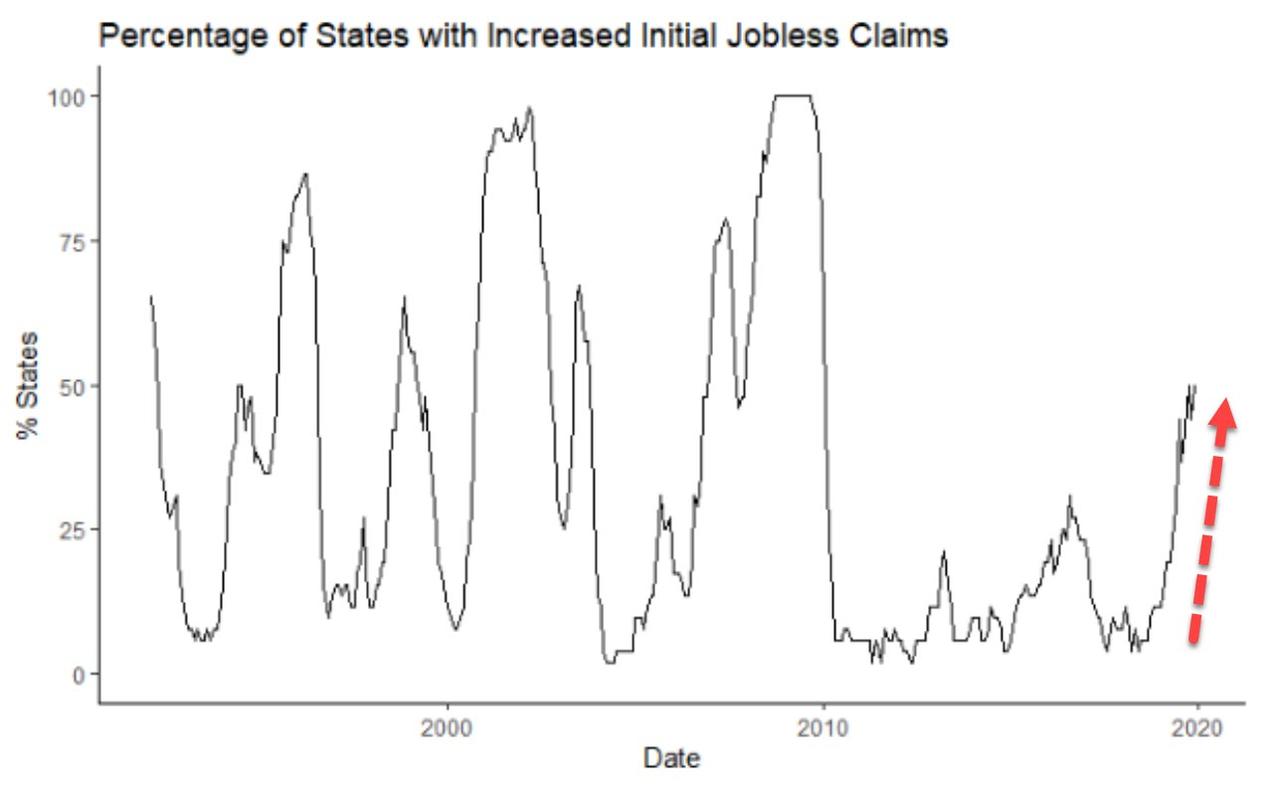

That puts wages in a tough spot entering 2020. Either they rise to an unsustainable level which would end the cycle, or wages fall telling us the cycle has already ended. The only “goldilocks” scenario from Costanza’s estimation would be a stable 3% average hourly earnings (i.e.: right here, no big movements). While claims are still low on an absolute basis, the scene “under the hood” is less robust. The 4-week moving average has moved from 212k three months ago to 228k now. Not exactly troublesome yet by any means but ticking higher nonetheless. Additionally, when looking at a heat map of claims on a state-to-state basis, you can see that the rate of change is worsening more than the headline number suggests. 6m change of claims by state…

Notice how in the beginning of the year, there were only five states in the red (seeing rising claims). Now 50% of states are in the red (seeing rising claims compared to 6m ago).

If claims breakout, that would kill the other consensus economic thought of a strong consumer. Not to say this would send the US into a deep recession (it won’t because consumers have savings right now), but this would reinvigorate the US slowdown theme and cause many of Costanza’s theme to play out and squash the reflation narrative.

Summary:

Costanza’s view is straight forward once again this year: fade the reflation narrative and the idea that nothing will happen in 2020 which has led the crowd to play the range and sell vol. Costanza wants to own vol, own tails for range breaks, and generally be short reflation assets.

What are some of the potential, reasonable catalyst for Costanza to be profitable?

-

US growth slowdown (its already been disappointing) led by a weakening labor market that hurts the “strong consumer” narrative forcing the Fed back into a cutting cycle (thus lifting fixed income vol)

-

Central banks start talking rate hikes and/or market pricing for hikes increase which leads to higher rates which once again cracks risk assets

-

US election cycle turns 2016 Charlottesville ugly in addition to policies being so uncertain that business retrench which will hurt consumer and business sentiment

-

Inability for China-US to complete a Phase 2 deal which disproves the “peak tariff” idea

-

EM growth continues to weaken due to supply chain disruptions and still enacted tariffs

-

US oil production breaks above 13m barrels/day which brings down oil prices serving as not only a poor reflation signal but hurts energy equities (now becoming a popular long) and breakeven/inflation expectations

What are the glaring issues that could lead to Costanza being more wrong than right for the first time in history?

-

The prospects for German fiscal stimulus continues to improve

-

The Fed, having learned their lesson in 2018, continues to talk down rate hikes (they better censor Evans then), especially with the 2020 Fed becoming less hawkish/more dovish

-

The Fed continues to inject liquidity in order to control funding markets with the potential to shift purchases out the curve (i.e.: into coupons)

-

Companies begin to restock inventories lifting manufacturing PMI’s and, as per prior history, service PMI’s bounce 6-months later

-

A Biden vs. Trump outcome would reduce political risks as policies are less binary

-

IMO 2020 causes a demand spike for heavy crude lifting oil prices at the same time as spurring economically positive drilling activity that helps the economy

Wishing everyone a very Happy New Year and a successful 2020!

Thank you for your continued support, and I look forward to many thought-provoking market discussions in 2020. I doubt it will be a dull year.

Tyler Durden

Tue, 12/31/2019 – 16:30

via ZeroHedge News https://ift.tt/2MLjZSb Tyler Durden