Stocks, Bond Yields Tumble As CDC Confirms Coronavirus Case In Seattle

Update (1335ET): The CDC has confirmed that a traveler from China has been diagnosed in Seattle with the Wuhan Coronavirus.

The patient, who was hospitalized with pneumonia last week, recently had traveled to Wuhan, China, where the outbreak appears to have originated, federal officials have found.

Officials declined to identify the patient, who was said to be quite ill.

The outbreak began at a market in China and now has spread to at least four other countries, and has killed at least six people and sickened hundreds more in Asia.

* * *

CNN’s AnneClaire Stapleton (@AnneClaireCNN) tweeted an ominous warning:

“The US Centers for Disease Control and Prevention is expected to announce this afternoon that the first case of Wuhan coronavirus has been reported in the United States, in Washington state, a federal source outside the CDC tells CNN.”

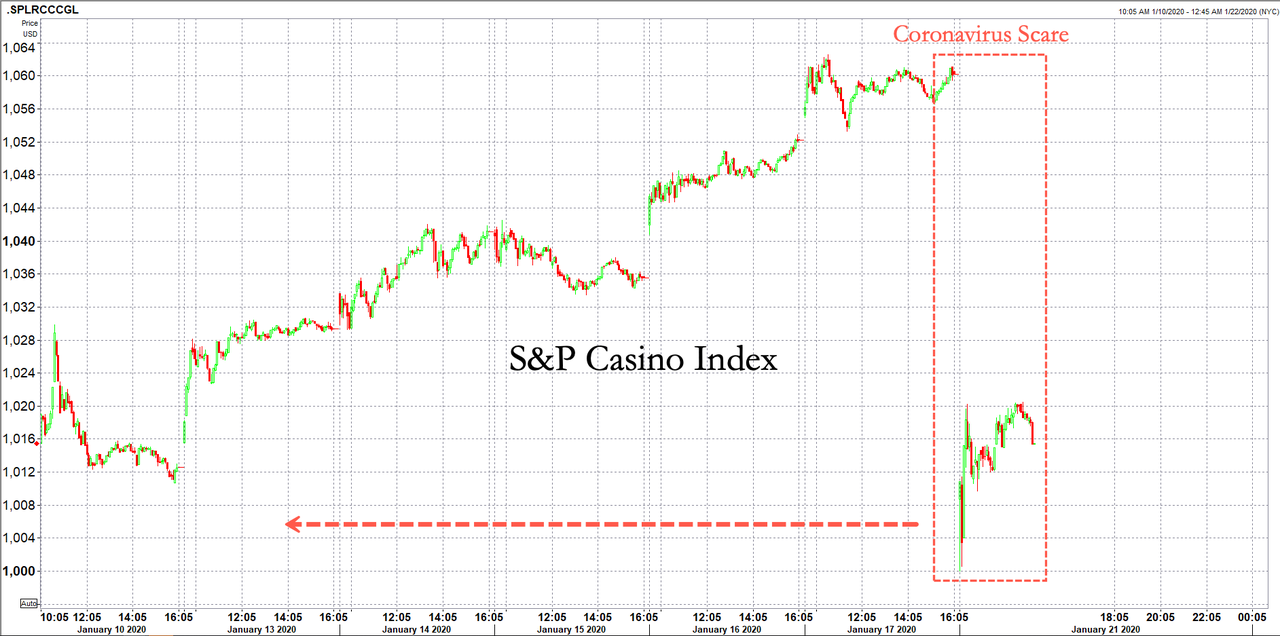

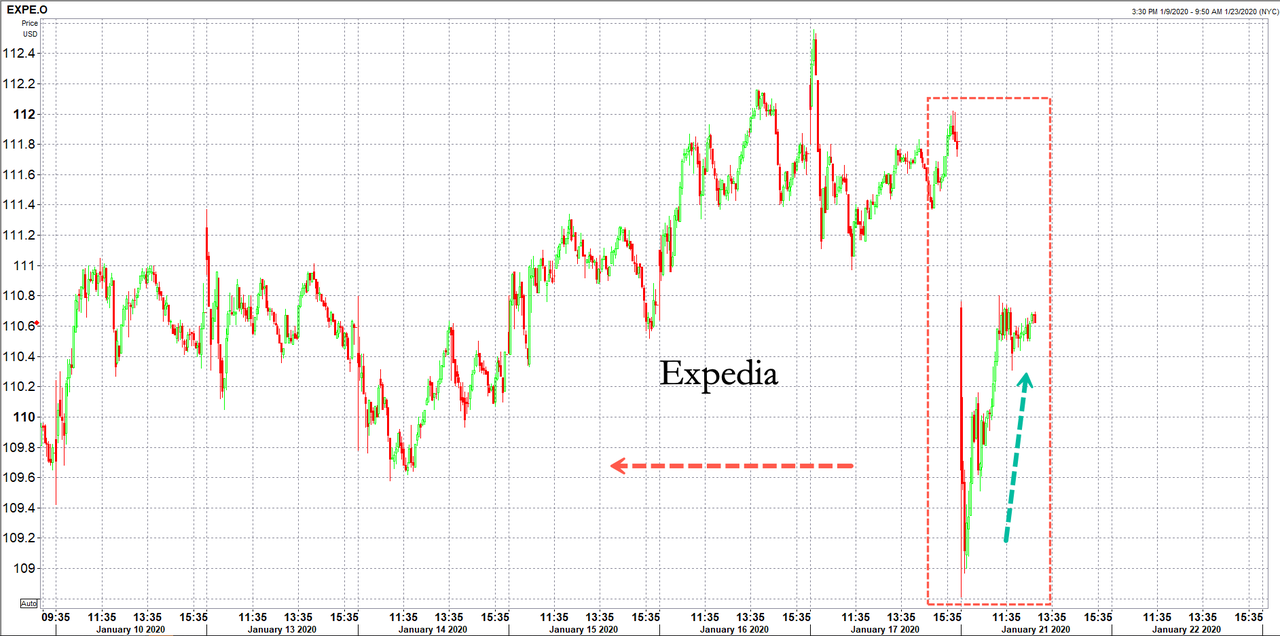

And the market reacted rapidly…

Transports are the worst hit on the day, already suffering from coronavirus fears overnight…

Can The Fed just print up some anti-virus?

As we detailed earlier, the global risk-off wave had started in the overnight hours of Monday as the full extent of the Chinese coronavirus scare became apparent to traders, has rolled into the cash session Tuesday with airline, casino and gaming, hotel, and travel stocks, taking a leg lower.

Delta Air -3.50%, United Airlines Holdings -3.20%, Southwest Airlines -1.5%, and American Airlines Group -2.50%, were all sold as the outbreak may crimp global air travel during the upcoming Lunar New Year holiday period.

Investors dumped Wynn Resorts -4.45%, Las Vegas Sands Corp -4%, and MGM Resorts International -3%, as the virus threatens to decrease foot traffic.

Hotels were also sold, Wyndham Hotels and Resorts -1%, Choice Hotels International -1%, and Extended Stay America -1%.

Travel stocks were dumped, Expedia Group -1%, Booking Holdings -2.20%, TripAdvisor Inc -1%, and Trip.com -10%.

Investors are unloading sensitive travel stocks because confirmed cases of coronavirus have tripled since Monday and spread to other countries around China with the risk of spreading across the world.

Fears of a 2002-03 outbreak of SARs has been on everyone’s mind to start the week – and with a Lunar New Year holiday fast approaching – the spread of the virus could broaden in the days ahead.

Travel sensitive stocks have taken a beating in Asia, Europe, and the US – basically across the world on Tuesday, as investors brace for new cases of the virus that is quickly spreading.

Could this mean world stocks are due for a pullback?

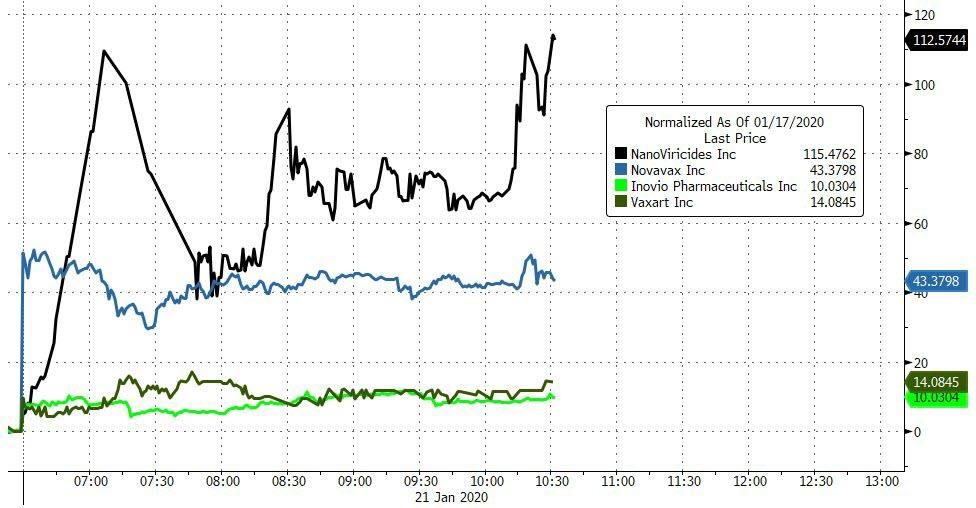

There is one silver lining however, prices for flu-shot manufacturers are soaring: Nanovaricides +75%, Novavax +44%, Inovio Pharma +11%, and Vaxart +11%.

Tyler Durden

Tue, 01/21/2020 – 13:22

via ZeroHedge News https://ift.tt/2sJt8ny Tyler Durden